In a bid to reply the query of the place does massive enterprise capital cash go to, a brand new evaluation checked out the newest knowledge on unicorns.

The general variety of firms that exceed $1 billion in valuation has doubled previously 12 months alone, with enterprise capital cash accountable for most of that development.

The basic adjustments in societal fashions, workflows, and industries the market has seen led lots of the largest VC companies to spend money on the identical set of unicorns, most of that are both fintech or web service firms.

Huge VC companies all spend money on the identical unicorns

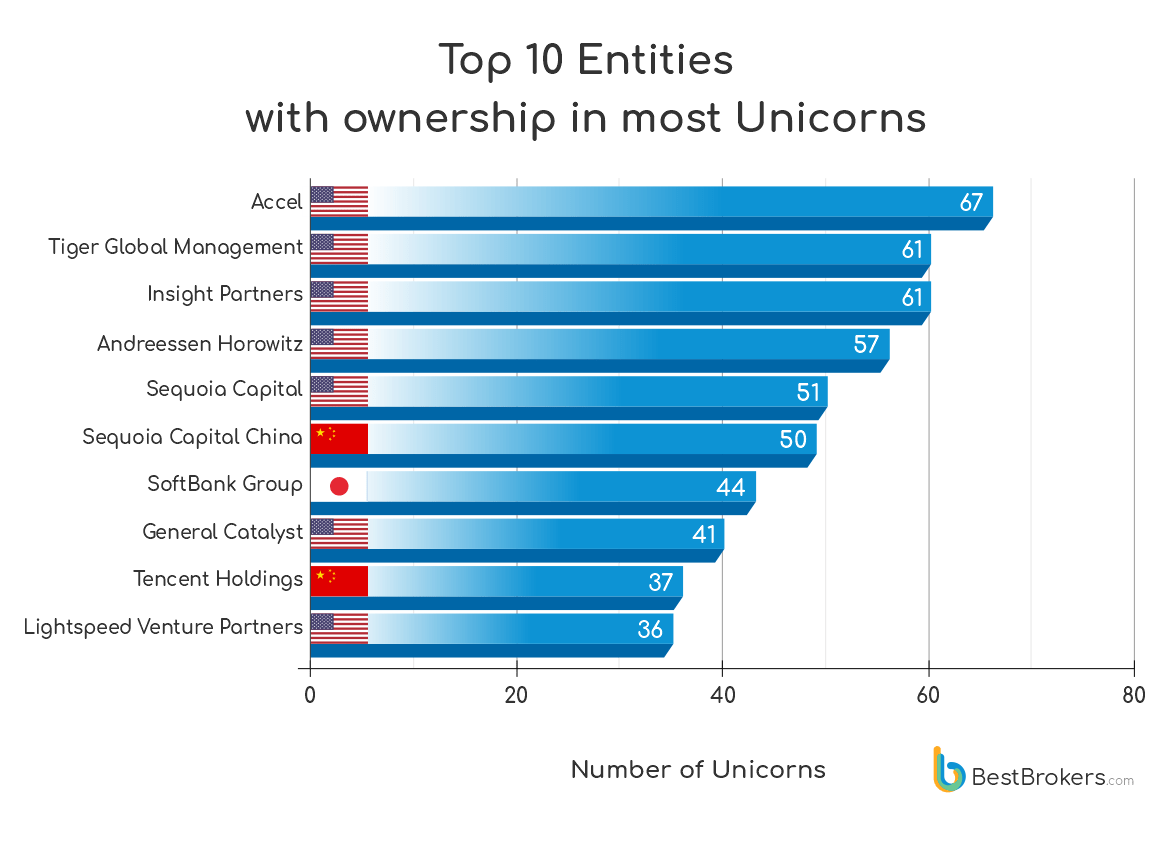

To search out out extra about what most enterprise capital companies spend money on, BestBrokers analyzed the not too long ago printed analysis from CB Insights. CB Insights offered an inventory of the entire world’s unicorns and matched it with knowledge on their buyers and industries.

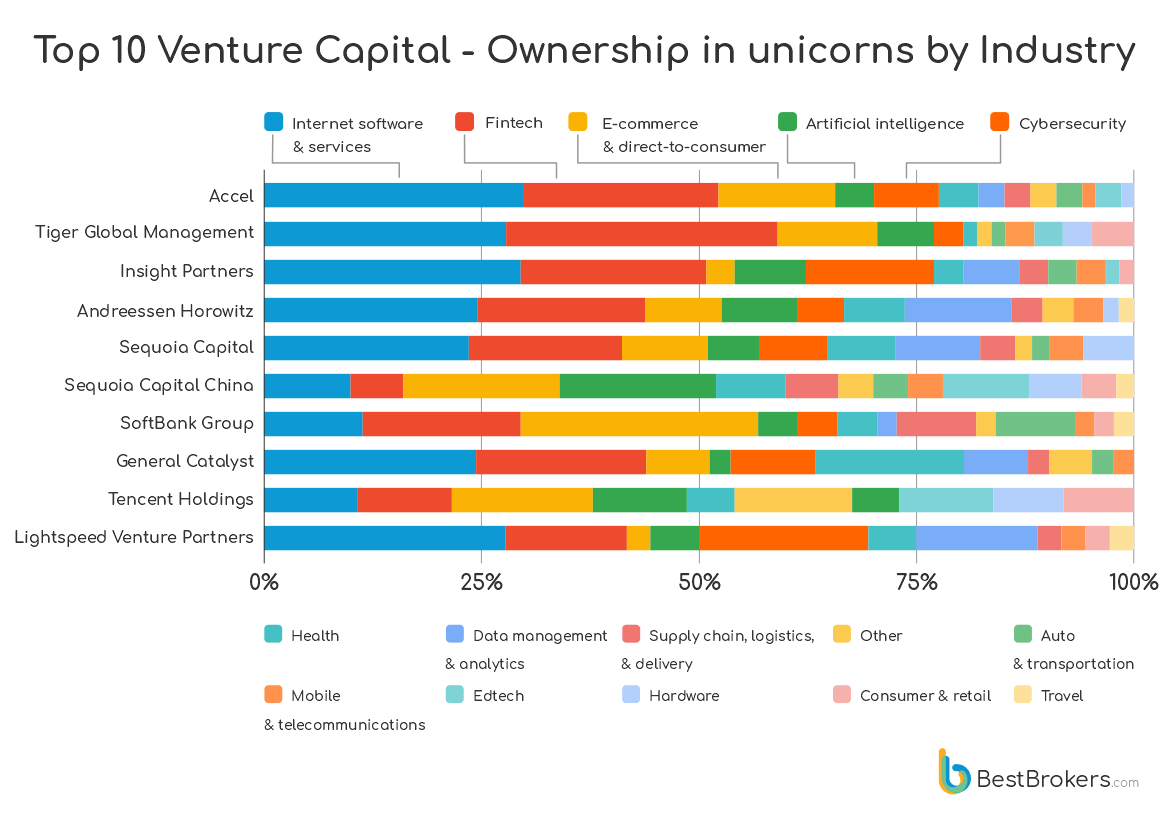

BestBroker’s report recognized the highest 10 entities which have invested within the largest variety of unicorns. In accordance with the information, simply ten companies personal 38% of all 1143 unicorns presently available on the market. Accel leads the way in which with possession in a staggering 67 firms valued at over $1 billion, whereas Tiger World Administration and Perception Companions each invested in 61 unicorns.

Andreessen Horowitz, one of the vital well-known names within the VC world, has possession in 57 unicorns.

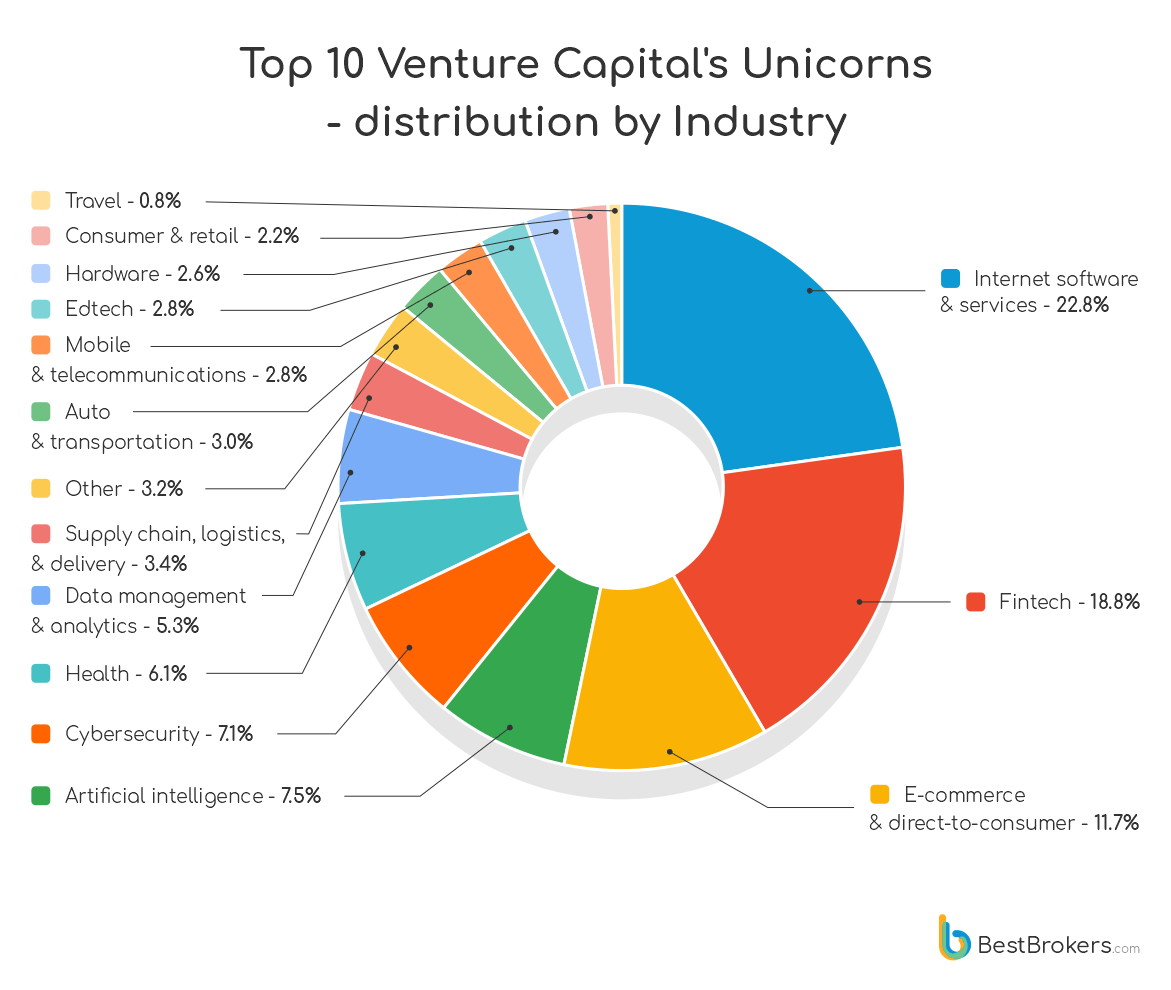

Grouping these unicorns by trade reveals an simple pattern — nearly all of VC cash appears to be going to software program and fintech firms.

Web software program and providers, fintech, and e-commerce account for over half of the full variety of unicorns. The following 4 industries — AI, cybersecurity, well being, and knowledge administration — quantity to only over 1 / 4 of the unicorns.

“Because the starting of 2021 fintech unicorns grew by a staggering 330%, adopted by web software program and providers with 274% and cybersecurity with 267%. Subsequent within the record are well being, knowledge analytics, logistics, and AI. We are able to clearly see how the trending industries are influenced strongly by the pandemic and the adjustments it caused,” stated Alan Goldberg, an analyst at BestBrokers.

The adjustments introduced on by the pandemic are most evident within the development we’ve seen in e-commerce. E-commerce and direct-to-consumer firms are strongly represented within the portfolios of all Asian entities on the record, with the trade taking first place in all three Asian companies.

Goldberg stated that this comes as no shock, on condition that e-commerce revenues in Asia are anticipated to achieve $2 trillion by 2024.

Nonetheless, the 2 main industries VC companies invested in are software program and fintech. And whereas CB Perception’s report teams crypto firms with legacy fintech companies, it’s secure to imagine that crypto and blockchain firms additionally make up a notable portion of those VCs’ portfolios.

As reported by CryptoSlate, a big variety of new unicorns that had been added all through final 12 months got here from the crypto market. These firms embody FTX, Ripple, OpenSea, Bitmain, Alchemy, Chainlysis, and others.