The overwhelming majority of actual property traders get into the business to pursue passive money stream. Sadly, over the past a number of years, discovering offers with sturdy money stream has turn out to be a problem. Nevertheless, there are nonetheless loads of markets within the U.S. that proceed to supply money stream potential.

Beneath, I present what I consider to be the highest 10 markets in the USA for money stream and provide a free excel spreadsheet you’ll be able to obtain right here that has key cashflow metrics for the biggest 100 markets within the nation.

Cashflow Traits

There’s been quite a lot of anecdotal chatter about how troublesome money stream is to seek out lately, so I seemed on the information to see if that is true.

Some of the frequent metrics used to estimate money stream potential and the one I’ll use for the rest of this text, is named the rent-to-price ratio (RTP). The upper the RTP, the higher potential for money stream.

RTP is a straightforward calculation—you divide median month-to-month lease by median gross sales value. In accordance with an evaluation I did in 2020, there’s a correlation of .85 (1 being the strongest correlation) between RTP and money stream. It’s not good, but it surely’s fairly good for the broad evaluation that we’re doing right here.

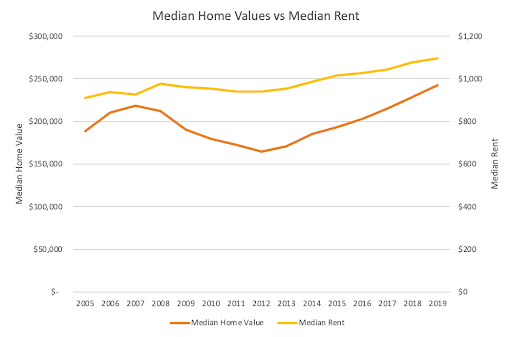

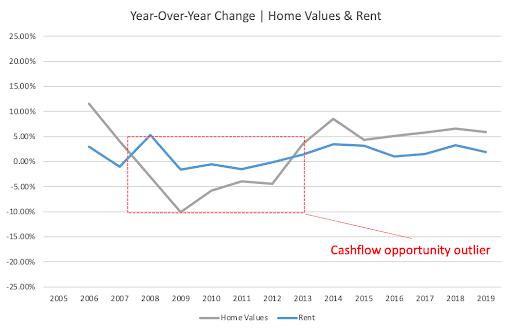

As you’ll be able to see, in line with U.S. Census information, RTP has been on the decline since 2012. The chatter about money stream turning into tougher to seek out is correct!

NOTE: U.S. Census information will not be probably the most present, but it surely gives a constant methodology over an extended interval and is subsequently most well-liked for taking a look at historic information like this. For my evaluation of what markets at present provide one of the best money stream, I exploit BiggerPockets’ proprietary information, which is up to date weekly.

This graph tells a vital story in regards to the Nice Recession’s impression and its subsequent fallout when housing costs dropped considerably greater than lease costs.

Typically talking, throughout recessions, lease values don’t fall very a lot. Demand from renters doesn’t fluctuate a lot primarily based on financial cycles. Individuals will at all times want a spot to dwell. Actually, residence costs don’t often dip an excessive amount of throughout recessions both – with the Nice Recession being a notable exception.

From 2008-2012, residence costs declined extra dramatically and for longer than lease.

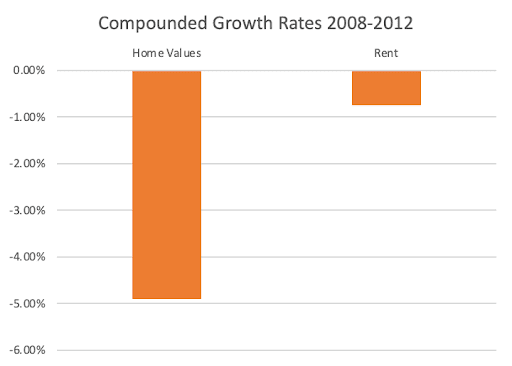

You possibly can see this very clearly should you have a look at the compounded progress charges for the years 2008-2012. House values averaged a decline of almost 5% per yr for 4 years whereas lease was unfavourable, however barely.

This created the perfect state of affairs for the money stream we noticed within the aftermath of the Nice Recession. Houses grew to become cheaper, and bills declined, however incomes stayed comparatively flat. Since 2012, residence values began rising quicker than lease, and RTP began to lower.

So, whereas it’s true that money stream has been, on a nationwide stage, more and more troublesome to seek out, it’s vital to do not forget that the Nice Recession and its aftermath was a uniquely constructive alternative to seek out money stream. It’s not the norm.

That mentioned, there are nonetheless good alternatives to seek out money stream! Sure markets nonetheless provide glorious money stream prospects throughout the board, and most markets can nonetheless produce cashflow should you pursue value-add methods, short-term rental, or different inventive methods.

For this evaluation, I checked out which markets provide sturdy cashflow potential no matter technique, as measured by the rent-to-price ratio.

Prime 10 Marketplace for Cashflow in 2022

Broadly talking, one of the best cashflow alternatives in the USA are concentrated within the Midwest and Southeast. In case you have a look at the interactive map under, you’ll be able to see not one of the markets are west of Louisiana. Once more, that doesn’t imply you’ll be able to’t discover money stream in different cities. However usually talking, the western half of the county has much less money stream alternative than the japanese half.

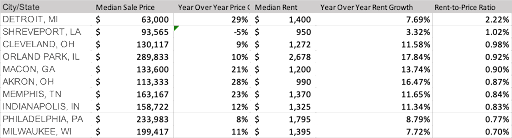

Right here’s the info for the highest 10 cashflow markets:

As you’ll be able to see, Detroit stands by itself by way of money stream, with an RTP greater than double the subsequent highest metropolis on our lists. Regardless, the entire cities on this record provide sturdy money stream potential.

You need to be aware that I didn’t simply choose the ten cities with the best RTP. I didn’t wish to think about all of the fascinating markets close to one another, so I attempted to create some geographic and financial range amongst the cities (I nonetheless couldn’t discover something within the west). I additionally solely selected cities which have sufficient information for evaluation and enormous sufficient economies to warrant investing consideration.

You possibly can obtain my abstract information right here to see the info for the biggest 100 cities within the U.S.

How To Interpret This Knowledge

In case you’re taking a look at this record or the spreadsheet pondering, “what is an efficient RTP?” That is a fantastic query! That could be a private selection for traders, however I’ll share my ideas.

For a few years quite a lot of traders subscribed to one thing referred to as the 1% rule. It mainly acknowledged that any deal you pursue ought to have an RTP above 1%. Moreover, some folks solely wish to put money into markets the place the typical RTP is 1%. Personally, I don’t subscribe to this rule for a couple of causes.

- It was developed over a decade in the past through the cashflow outlier interval I discussed above. It was lifelike again then to seek out loads of offers with an RTP over 1%. Now, it’s not a helpful rule of thumb. It is advisable to modify to current-day market circumstances, and religiously following the 1% rule goes to stop you from getting in on offers which are very sturdy by at the moment’s requirements. A few of my finest offers, even my highest cash-flowing offers, didn’t meet the 1% rule on the time of buy.

- RTP is only a proxy for money stream—not a exact measurement. You shouldn’t resolve to pursue or abandon any deal till you’ve totally run the numbers. RTP alone shouldn’t be used to make investing selections. It is advisable to account for taxes, insurance coverage, and different bills. Moreover, it is advisable consider lease progress. If lease grows in your market, the RTP will enhance over time.

- I really like utilizing RTP to display screen markets for cashflow potential however keep in mind the info above is simply the common. Which means, by rule, there are offers with higher RTPs than town’s common and offers with worse RTPs than town’s common. For instance, in Milwaukee, the typical RTP is 0.7%, however I assure dedicated traders can discover offers with a a lot larger RTP than 0.7%, and certain even above the 1% rule. Typically talking, any market with an RTP above .6% has the potential for cashflow offers.

Conclusion

Though money stream potential, as measured by RTP, has declined over the past a number of years, many markets within the U.S. nonetheless provide sturdy money stream potential throughout the board. As my evaluation reveals, they’re largely concentrated within the Midwest and Southeast. However that being mentioned, loads of different markets provide money stream potential. I encourage you to obtain the spreadsheet accompanying this text and conduct your individual evaluation.

And keep in mind, this information is simply averages! It doesn’t replicate the absolute best deal in every metropolis, it doesn’t consider lease progress or worth add both. These are broad metrics meant that can assist you slim down cities for funding consideration. They aren’t meant to judge the potential of any particular person deal or sub-market.

On The Market is offered by Fundrise

Fundrise is revolutionizing the way you put money into actual property.

With direct-access to high-quality actual property investments, Fundrise lets you construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has shortly turn out to be America’s largest direct-to-investor actual property investing platform.

Be taught extra about Fundrise

How are you discovering money stream in at the moment’s market? Tell us within the feedback under.

Notice By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.