Prime 10 Crypto Startup VCs to Watch in 2022

Over the previous couple of years, the worldwide crypto market has been on an upward observe, with 2021 marking the trade’s pinnacle. Notably, the rising market hit $3 trillion in market valuation to attain a brand new all-time excessive, whereas signaling a serious present of energy for an trade that had gone ignored for a really very long time.

Because of the explosion of cryptocurrencies on the worldwide monetary panorama right now, many individuals at the moment are reevaluating their stance about investing in them. Nevertheless, whereas the primary cryptocurrency was born in 2009, this sensational adoption didn’t begin till 2017.

Apparently, and opposite to the favored false impression, crypto startup enterprise capital companies have been in existence lengthy earlier than the digital asset class’s meteoric rise to prominence again in 2017. That is evidenced by the truth that sure crypto VCs had been based as early as 2011, as within the occasion of Digital Foreign money Group, and in 2012 within the case of Winklevoss Capital and Increase VC.

The variety of these VCs continued to rise with the increase within the crypto market, offering much-needed funding throughout numerous sectors at completely different funding levels. In right now’s article, we’ll think about the highest 10 crypto VCs we predict it’s best to regulate in 2022. However first, let’s shortly check out how VC companies function throughout the crypto area of interest.

How do VC companies work within the crypto trade?

It’s not information that the cryptocurrency sector continues to be in its early levels, with loads of prospects and room for growth. Many VC companies see that crypto is the wave of the long run, and they’d not need to lose out on what would be the most profitable funding alternative of our time, by merely watching from the sideline.

Even supposing the crypto market stays unpredictable, VC companies who imagine in blockchain and cryptocurrency startups are keen to take the bull by its horn.

Apart from a number of variations inherent within the underlying infrastructure of most initiatives, enterprise capital fundraising within the crypto realm is just like conventional VC funding. Notably, the startups, the vast majority of that are based mostly on blockchain, function throughout the cryptocurrency market, versus the normal market.

Right this moment, VC buyers are more and more flocking to crypto for numerous causes together with noteworthy moments similar to Coinbase’s IPO, El Salvador’s acceptance of as a authorized tender, and the incorporation of crypto tax laws in nations just like the US, the UK, Canada, and so forth.

That mentioned, under are the highest 10 crypto enterprise capital companies (in descending order) to regulate in 2022.

10. ConsenSys Ventures

Beginning at quantity ten, we’ve ConsenSys Ventures based mostly in San Francisco, California. Based in 2016, ConsenSys Ventures is the funding arm of the blockchain software program expertise firm, ConsenSys, the identical firm that developed the favored Ethereum-based MetaMask pockets.

ConsenSys’s funding arm funds a lot of blockchain and cryptocurrency startups. Since its inception in 2016, the enterprise capital firm has maintained a single funding fund, which it has utilized to make 32 investments in blockchain startups. The company has solely exited one among these 32 investments to this point.

9. 8 Decimal Capital

Established in 2017, 8 Decimal Capital is a enterprise capital agency located in San Francisco, California. It’s identified for offering crypto startup funding throughout a spread of funding levels and strategies, together with preliminary coin choices (ICOs) and outright shareholdings (i.e. fairness).

Additionally, due to the unpredictable nature of most crypto initiatives, 8 Decimal Capital leverages its expert advisory community, which ensures that the funded startups have the best potential likelihood of succeeding.

Since its inception 5 years in the past, the agency has managed a single funding fund. The agency has made a complete of 43 investments with the newest amongst them being Parallel Finance again in June 2021. As of now, the company is but to liquidate any of its holdings, making it a terrific deal for funded startups, particularly these in search of long-term funding.

8. Fenbushi Capital

Fenbushi Capital is a Chinese language enterprise capital agency headquartered in Shanghai, China. Launched in 2015, the agency claims to be Asia’s most lively blockchain-focused enterprise capital agency. The company desires to leverage its monetary energy and industrial information to assist the worldwide blockchain ecosystem to thrive.

Since its inception seven years in the past, the group has overseen a complete of 88 investments in blockchain-related expertise startups, 4 of which the VC has exited from.

Notable startups by which Fenbushi Capital has invested embrace Fold, a present card platform designed to assist spend Bitcoin in the true world. Multiverse Labs, which leverages blockchain to enhance resource-sharing, is one other beneficiary of FC funding.

7. Winklevoss Capital

Maybe one of many oldest within the recreation, Winklevoss Capital is an American VC agency birthed by the Winklevoss brothers in 2012. Whereas the agency primarily operates from its New York workplace within the US, it gives seed funding and infrastructure to early-stage startups.

Though the staff didn’t begin initially as a crypto-focused VC, it has since made important investments within the crypto house that qualifies them as a crypto start-up VC agency. Since its inception 9 years in the past, the group has made a complete of 123 investments in new enterprises. Within the firm’s buying and selling historical past, it has withdrawn from 23 of those positions.

In its most up-to-date endeavor, Winklevoss Capital joined Soros Fund Administration and others to take a position $359 million within the NFT-focused firm, Animoca, whose valuation subsequently ballooned from $1 billion to $5 billion.

6. Coinbase (NASDAQ:) Ventures

Coinbase Ventures is an American VC agency located in San Francisco, California. It was integrated in 2018 because the investing arm of the digital asset trade, Coinbase. Understanding its involvement within the crypto house way back to 2012, there’s little or no surprise that the enterprise chooses to actively put money into the crypto startup house.

Based initiatives obtain early-stage funding from the VC, permitting them to carry their concepts to actuality. Whereas it makes a speciality of early-stage funding, Coinbase Ventures strictly focuses on blockchain and cryptocurrency-related initiatives.

Notable examples of initiatives that Coinbase Ventures has backed embrace crypto trade platforms like CoinDCX and blockchain-based video distribution like Livepeer based mostly on their actions inside these sectors.

Since inception in 2018, Coinbase Ventures has made 130 investments in rising blockchain and cryptocurrency companies. Extra so, regardless of its giant variety of funding portfolios, the company has solely exited from 4 initiatives thus far.

5. Pantera Capital

Pantera Capital was initially based in 2003 as an asset administration firm based mostly in Menlo Park, California. Nevertheless, it subsequently launched what it claimed to be the primary funding fund targeted on Bitcoin in 2013.

Ever since, Pantera has been identified for specializing in digital forex and blockchain expertise investments. As such, its funding is primarily focused at early-stage VC and seed-stage rounds with a median spherical quantity of $9.8 million.

Notable beneficiaries of Pantera Capital embrace Pintu and Vauld, two of the agency’s most up-to-date additions, each of which attempt to make buying and selling digital belongings simpler.

Since its founding by Dan Morehead, Pantera Capital has managed not less than 5 funding funds. In whole, the VC has been in a position to construct an funding portfolio of no fewer than145 startups, 15 of which it has pulled out from.

4. Craft Ventures

Craft Ventures is an American enterprise capital agency located in San Francisco, California. It was created 5 years in the past by Invoice Lee, David Sacks, and Jeff Fluhr. The group gives early-stage enterprise capital funding to a spread of technological startups, together with crypto enterprise capital.

Since its inception in 2017, the VC firm has overseen the administration of 5 funding funds. With this cash, the group has been in a position to make 158 investments in rising companies. The corporate has efficiently exited 15 of those investments as of now.

3. Digital Foreign money Group

Based in 2011 by Barry Silbert, Digital Foreign money Group is an American enterprise capital agency based mostly in New York. Though it invests in fintech initiatives that aren’t based mostly on blockchain, the corporate’s standing as a crypto startup VC is plain, because it contributes considerably as a lot as assist firms within the cryptocurrency and blockchain house.

DCG’s huge community and entry to wealth makes it extremely sought-after, and as such, many startups have turned to them for funding and with correct presentation, have obtained it in good measure.

Since its inception a decade in the past, the agency has made a complete of 235 investments and bought two extra enterprises alongside the best way. Likewise, the Group has pulled out of 28 of its investments to this point.

2. Increase VC

Proclaimed to be the “pre-seed fund making Sci-Fi a actuality,” Increase VC is an American enterprise capital agency that makes a speciality of crypto startup VC, digital actuality, augmented actuality, AI, open tech, house tech, and human augmentation, which seems to be a brand new love.

The 2012-founded American VC agency is predicated in San Mateo, and is led by Adam Draper and Brayton Williams, each of whom function founders and managing administrators. Not like the vast majority of their friends, Increase VC solely invests in new initiatives twice a 12 months and affords prolonged providers similar to teaching and workplace house to assist them broaden.

Since its inception a decade in the past, the crypto VC agency has managed quite a lot of funding funds totaling $2 billion in accordance with its official web site. Moreover, it has been in a position to develop an funding portfolio that features not less than 253 startups, 25 of which it has exited from.

1. RRE Ventures

RRE Ventures takes the place of primary on this listing for a lot of causes, one among which incorporates having probably the most initiatives in its portfolio.

Based by Jim Robinson and Stuart Ellman in 1994, lengthy earlier than the launch of Bitcoin (the primary mainstream cryptocurrency), RRE Ventures is an American VC agency headquartered in New York.

Previous to its foray into crypto asset courses and startup funding, the American VC agency was identified for investing in a big selection of firms working throughout numerous rising sectors together with software program, web, communications, aerospace, robotics, 3D printing, and monetary providers amongst others.

Additionally, being a prime canine within the VC enterprise, RRE invests on the early seed stage, Collection A, and Collection B rounds. Extra just lately, the agency has made a major funding within the crypto house that classifies it as a crypto startup enterprise capital.

Since inception, RRE Ventures has managed a complete of 9 funding funds and has backed a complete of 567 initiatives throughout completely different phases. At present, the virtually three-decades previous VC agency has efficiently exited a complete of 111 initiatives.

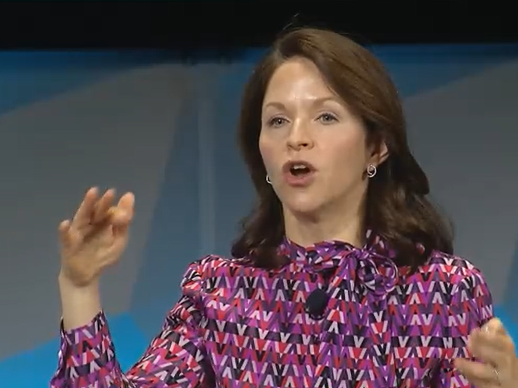

Particular Point out: Haun Ventures

Haun Ventures, the most recent member to the listing, just lately made headlines after acquiring its first and largest spherical of funding. Following her departure from Andreessen Horowitz, the place she beforehand labored, the brand new VC founder and investor, Katie Haun, reportedly raised $1.5 billion.

In response to Haun, the newly established enterprise capital agency will initially operate as two funds: a $500 million early-stage fund and a $1 billion acceleration fund. And by operating a pair of enterprise capital funds, Haun Ventures would turn into the primary of its sort, and as it’s, probably the most properly endowed startup VC agency of all time.

Proceed studying on DailyCoin