Updated on May 2nd, 2023 by Bob Ciura

Monthly dividend stocks can be a profitable investment option for those seeking stable income since they provide a regular and continuous stream of cash flow. Monthly dividends, as opposed to quarterly or yearly dividends, allow investors to receive payments more often, which can assist to fund living costs or complement other sources of income.

Monthly dividend stocks can also be excellent for compounding returns because investors can reinvest dividends more frequently to increase their wealth over time. Monthly dividend stocks, in general, can help to mitigate market volatility and support long-term financial goals.

There are just 86 companies that currently offer a monthly dividend payment. You can see all 86 monthly dividend paying names here.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

In this article, we look at the ten monthly dividend stocks from our Sure Analysis Research Database, which we believe rank best in terms of 5-year expected total returns. The stocks have been arranged in ascending order based on their 5-Year Expected Total Return rates, and if there is a tie, their ranking is determined by their dividend yield.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Monthly Dividend Stock #10: Whitestone REIT (WSR)

- 5-Year Expected Total Return: 12.4%

- Dividend Yield: 5.5%

Whitestone is a retail REIT that owns about 57 properties with about 5.1 million square feet of gross leasable area primarily in top U.S. markets in Texas and Arizona. Its tenant base is very diversified with about 1,477 tenants with no tenant exceeding 2.2% of total revenue.

Its strategy is prioritize renting to strong tenants and service-oriented businesses, including grocery, restaurant, health and fitness, financial services, logistics services, education and entertainment, etc. in neighborhoods with high disposable income.

Whitestone reported its fourth-quarter 2022 results on 2/28/23 for which it witnessed an all-time high occupancy rate of 93.7% versus 91.3% in Q4 2021. For the quarter, revenue growth was 4.8% to $34.9 million versus Q4 2021. Funds from operations per share (“FFOPS”) growth was 9.5% to $0.23. Same-store net operating income (“SSNOI”) rose 7.1% to $23.4 million.

Rental rate growth was 23.5%, up from 14.9% a year ago, driven by a jump in rental rate growth in renewal leases (to 23.2% vs. 15.7% a year ago) and new leases (to 24.3% vs. 11.2% a year ago).

For 2022, Whitestone increased revenues by 11% to $139.4 million. FFO per share climbed 20% to $1.03. As well, its SSNOI growth was 7.9%. Whitestone provided its 2023 guidance, including SSNOI growth of 2.5%-4.5% and FFOPS of $0.95-0.99. It forecasts an ending occupancy of about 94%.

Click here to download our most recent Sure Analysis report on WSR (preview of page 1 of 3 shown below):

Monthly Dividend Stock #9: LTC Properties, Inc (LTC)

- 5-Year Expected Total Return: 12.9%

- Dividend Yield: 6.8%

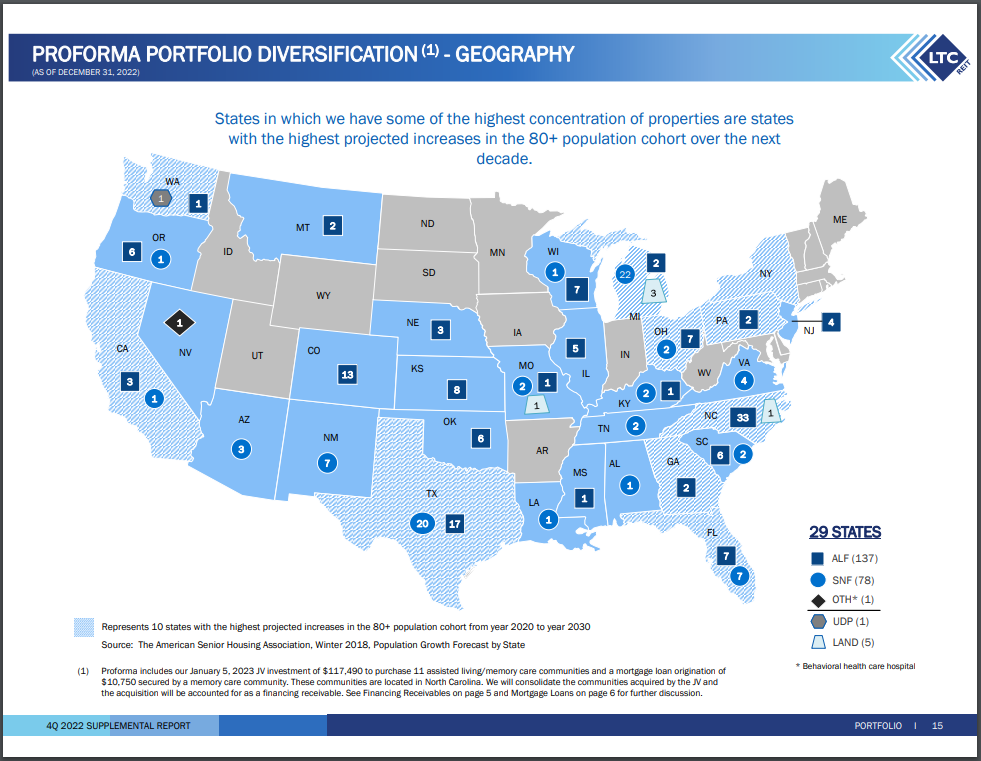

LTC Properties is a real estate investment trust that invests in senior housing and skilled nursing facilities. Its portfolio includes approximately 52% assisted living properties and 47% skilled nursing properties. The REIT owns 216 investments in 29 states with 32 operating partners.

Source: Investor Presentation

The bankruptcy of Senior Care Centers, Texas’ largest skilled nursing operator, has harmed LTC Properties. In December 2018, Senior Care filed for Chapter 11 bankruptcy. Until 2018, it accounted for 9.7% of LTC Properties’ annual revenues and was the trust’s fifth largest customer.

The fact that LTC Properties has the majority of its assets in states with the highest projected increases in the 80+ age cohort over the next decade is a driving force for future growth.

LTC Properties is currently paying a 6.8% dividend yield. Over the last decade, the REIT has increased its dividend at an annual rate of 1.2% on average. Yet, due to a lack of underlying growth, it has frozen its dividend for the last six years. As a result, it is wise not to anticipate dividend growth anytime soon.

The payout ratio is 84%, and the balance sheet is leveraged, with a debt-to-adjusted EBITDA ratio of 5.0 and an interest coverage ratio of 3.5. As a result, if LTC Properties faces a significant headwind, such as a recession, the dividend may be jeopardized. Thankfully, the REIT has no significant debt maturities over the next five years.

Click here to download our most recent Sure Analysis report on LTC Properties, Inc (LTC) (preview of page 1 of 3 shown below):

Monthly Dividend Stock #8: Gladstone Commercial (GOOD)

- 5-Year Expected Total Return: 13.1%

- Dividend Yield: 10.2%

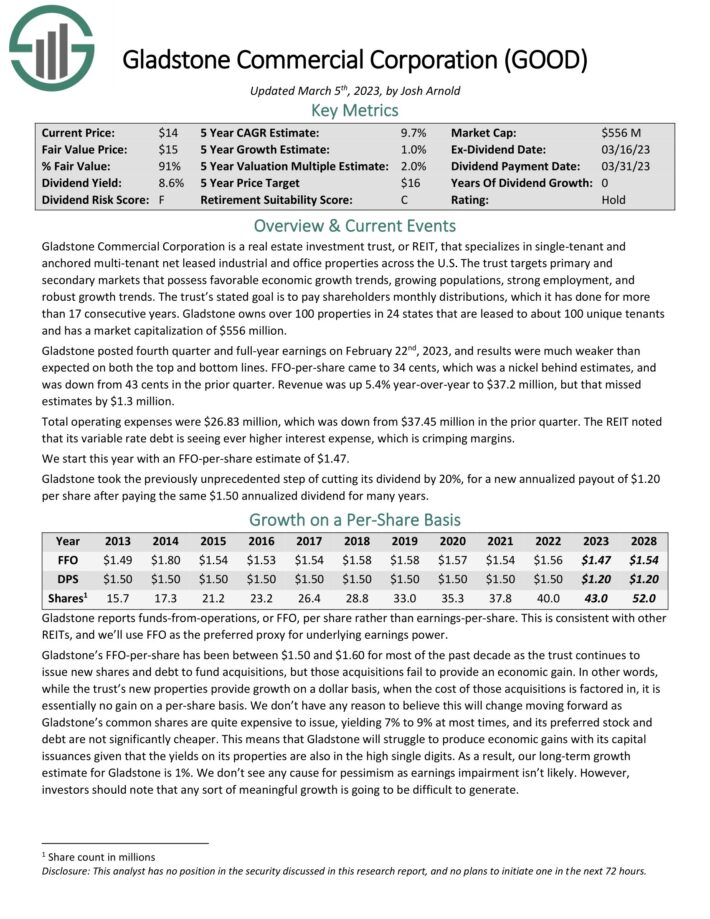

Gladstone Commercial Corporation is a REIT that specializes in single-tenant and anchored multi-tenant net leased industrial and office properties across the U.S. The trust targets primary and secondary markets that possess favorable economic growth trends, growing populations, strong employment, and robust growth trends.

The trust’s stated goal is to pay shareholders monthly distributions, which it has done for more than 17 consecutive years. Gladstone owns over 100 properties in 24 states that are leased to about 100 unique tenants and has a market capitalization of $556 million.

Gladstone posted fourth quarter and full-year earnings on February 22nd, 2023, and results were much weaker than expected on both the top and bottom lines. FFO-per-share came to 34 cents, which was a nickel behind estimates, and was down from 43 cents in the prior quarter.

Revenue was up 5.4% year-over-year to $37.2 million, but that missed estimates by $1.3 million. Total operating expenses were $26.83 million, which was down from $37.45 million in the prior quarter. The REIT noted that its variable rate debt is seeing ever higher interest expense, which is crimping margins.

Click here to download our most recent Sure Analysis report on GOOD (preview of page 1 of 3 shown below):

Monthly Dividend Stock #7: Itaú Unibanco (ITUB)

- 5-Year Expected Total Return: 13.8%

- Dividend Yield: 4.1%

Itaú Unibanco is a large bank headquartered in Brazil. ITUB is a large-cap stock with a market cap of $42 billion.

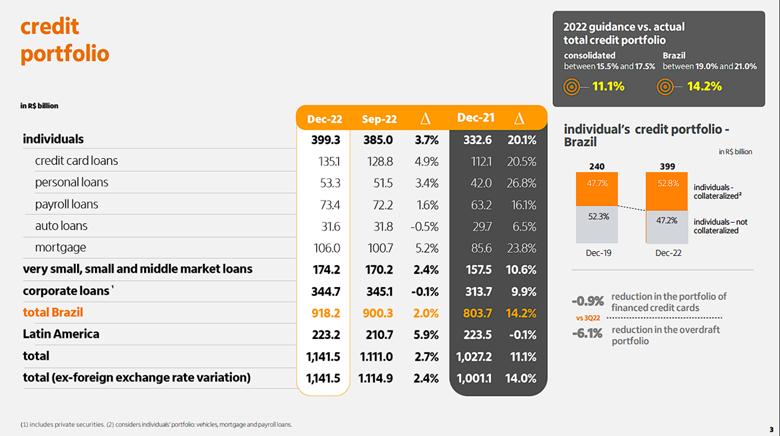

Itaú Unibanco operates in more than a dozen countries worldwide, but its headquarters are in Brazil. It has large operations in several Latin American nations, as well as select operations in Europe and the United States.

In comparison to other Latin American banks, its size is enormous. Itaú is the Southern Hemisphere’s largest financial conglomerate, the world’s tenth-largest bank by market value, and the largest Latin American bank by assets and market capitalization.

Source: Investor Presentation

In order to attract consumers, banks like Itaú Unibanco aim to cater to every sort of consumer and business, much as large US banks have done by offering a variety of services such as deposits, loans, insurance products, equity investing, and more.

What distinguishes Itaú Unibanco is its emphasis on emerging economies such as Brazil. However, emerging markets have been struggling. This is a cause for concern since economic growth is critical for a bank’s expansion, and without it, Itaú Unibanco may have difficulties in increasing profits.

Itaú Unibanco maintains a conservative dividend policy. Dividends are paid to shareholders based on the bank’s predicted earnings and losses, with the aim of continuing to pay the dividend under varied economic conditions. Along with reporting its most recent quarterly results, the company increased its monthly dividend from $0.0033 to $0.0034 per share.

Click here to download our most recent Sure Analysis report on Itaú Unibanco (ITUB) (preview of page 1 of 3 shown below):

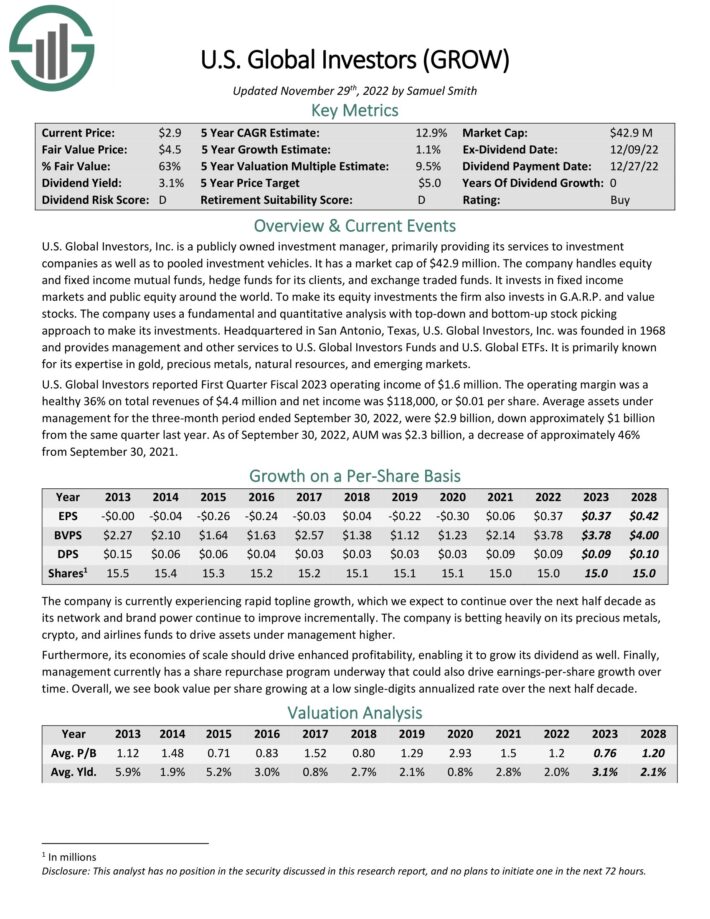

Monthly Dividend Stock #6: U.S. Global Investors (GROW)

- 5-Year Expected Total Return: 14.2%

- Dividend Yield: 3.4%

U.S. Global Investors, Inc. is a publicly owned investment manager, primarily providing its services to investment companies as well as to pooled investment vehicles. The company handles equity and fixed income mutual funds, hedge funds for its clients, and exchange traded funds.

It invests in fixed income markets and public equity around the world. To make its equity investments the firm also invests in G.A.R.P. and value stocks. The company uses a fundamental and quantitative analysis with top-down and bottom-up stock picking approach to make its investments.

Headquartered in San Antonio, Texas, U.S. Global Investors, Inc. was founded in 1968 and provides management and other services to U.S. Global Investors Funds and U.S. Global ETFs. It is primarily known for its expertise in gold, precious metals, natural resources, and emerging markets.

Click here to download our most recent Sure Analysis report on GROW (preview of page 1 of 3 shown below):

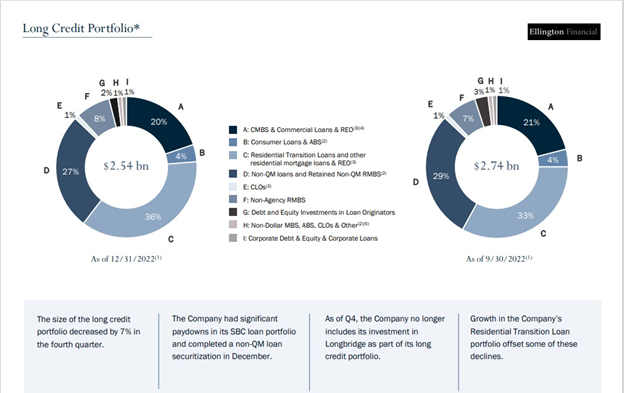

Monthly Dividend Stock #5: Ellington Financial Inc (EFC)

- 5-Year Expected Total Return: 14.5%

- Dividend Yield: 14.4%

Ellington Financial Inc. acquires and manages mortgage, consumer, corporate, and other related financial assets in the United States. The company acquires and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Additionally, it manages RMBS, for which the U.S. government guarantees the principal and interest payments. It also provides collateralized loan obligations, mortgage–related and non–mortgage–related derivatives, equity investments in mortgage originators and other strategic investments.

Source: Investor Presentation

Mortgage REITs are appealing to investors because they give exceptionally high dividend yields to shareholders and are required by law to distribute the bulk of their income. As a result, the company’s dividend yield has averaged 10.2% over the last decade.

While management has already restored its monthly dividend rate following the most recent dividend drop, the dividend is barely covered. Based on the dividend’s historical downward trend, slight declines in the future are possible if profits fail to rise significantly in the coming years.

Click here to download our most recent Sure Analysis report on Ellington Financial Inc (EFC) (preview of page 1 of 3 shown below):

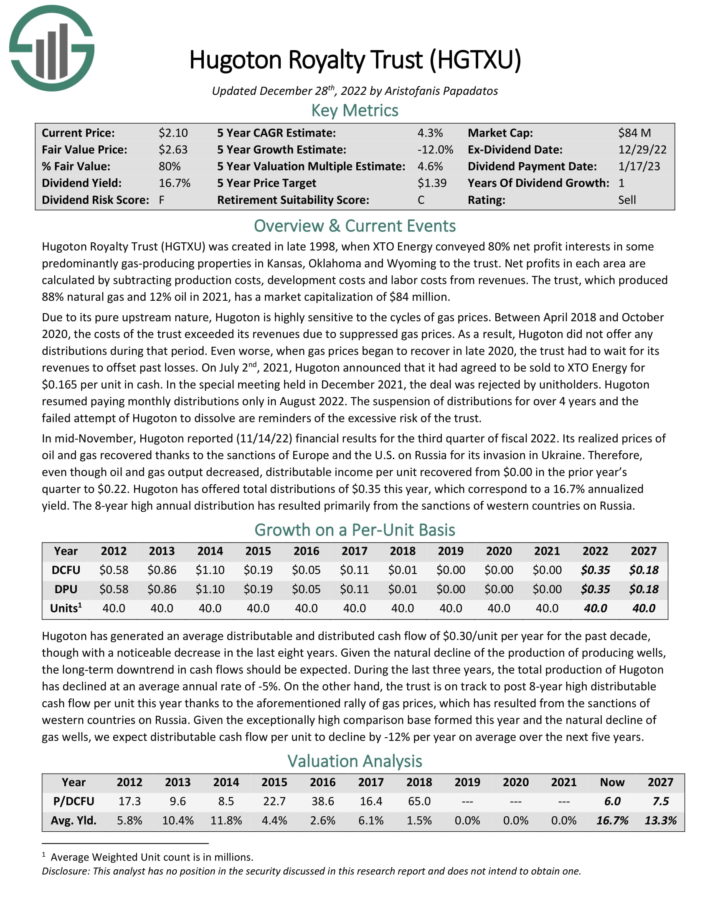

Monthly Dividend Stock #4: Hugoton Royalty Trust (HGTXU)

- 5-Year Expected Total Return: 15.5%

- Dividend Yield: 10.3%

Hugoton Royalty Trust was created in late 1998, when XTO Energy conveyed 80% net profit interests in some predominantly gas-producing properties in Kansas, Oklahoma and Wyoming to the trust. Net profits in each area are calculated by subtracting production costs, development costs and labor costs from revenues. The trust, which produced 88% natural gas and 12% oil in 2021, has a market capitalization of $84 million.

Due to its pure upstream nature, Hugoton is highly sensitive to the cycles of gas prices. Between April 2018 and October 2020, the costs of the trust exceeded its revenues due to suppressed gas prices. As a result, Hugoton did not offer any distributions during that period. Even worse, when gas prices began to recover in late 2020, the trust had to wait for its revenues to offset past losses. Hugoton resumed paying monthly distributions only in August 2022.

Click here to download our most recent Sure Analysis report on HGTXU (preview of page 1 of 3 shown below):

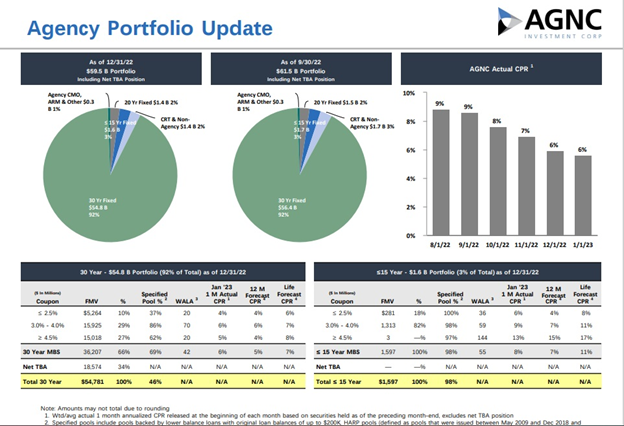

Monthly Dividend Stock #3: AGNC Investment Corp (AGNC)

- 5-Year Expected Total Return: 19.0%

- Dividend Yield: 15.0%

AGNC is an internally managed REIT that was founded in 2008. Unlike most REITs, which own physical properties that are leased to tenants, AGNC operates on a different business model. It is a REIT that specializes in mortgage securities.

AGNC invests in agency mortgage-backed securities. It generates income by collecting interest on its invested assets less borrowing costs. It also records gains and losses from its investments and hedging practices. Agency securities are those whose principal and interest payments are guaranteed by a government-sponsored entity or the government itself. They are generally less risky than private mortgages.

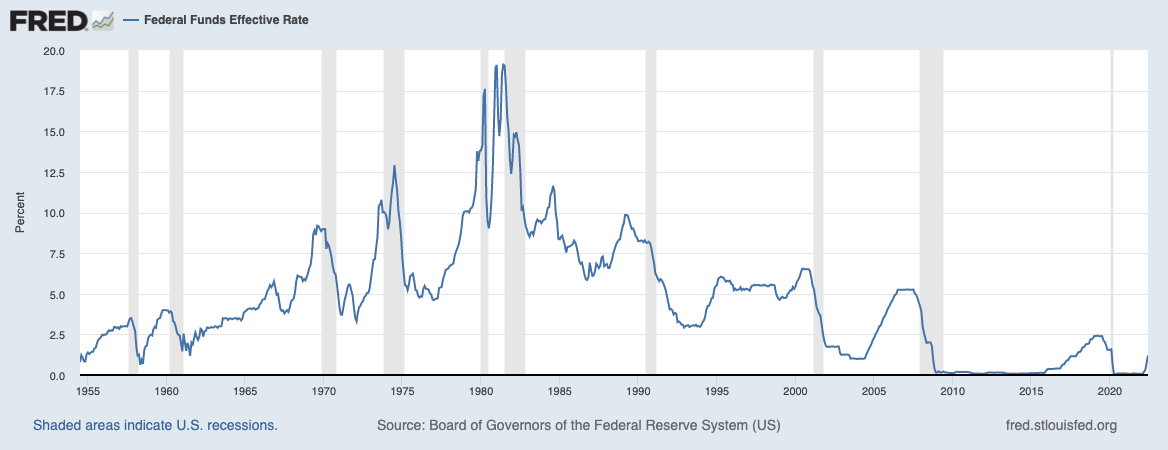

The main disadvantage of mortgage REITs is that rising interest rates have a negative impact on the business model. AGNC profits by borrowing at short-term interest rates, lending at long-term interest rates, and pocketing the difference. Mortgage REITs are also highly leveraged to boost returns. Despite this, AGNC has been able to expand its net interest spreads as its average yield on assets has grown faster than its average cost of funds.

Source: Investor Presentation

AGNC has paid monthly dividends of $0.12 per share since April 2020, following a dividend decrease in 2020. This equates to an annualized distribution of $1.44 per share, pushing AGNC’s dividend yield to an astounding 14.6% at the current stock price.

A high yield can indicate a high level of risk. Furthermore, AGNC’s dividend is highly uncertain. AGNC cut its dividend many times in the last decade and, most recently, two years ago. While we do not consider a dividend cut as an urgent risk at this time, given that the payout ratio has slightly improved, we do not rule it out if AGNC’s investment returns take a sudden cut.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

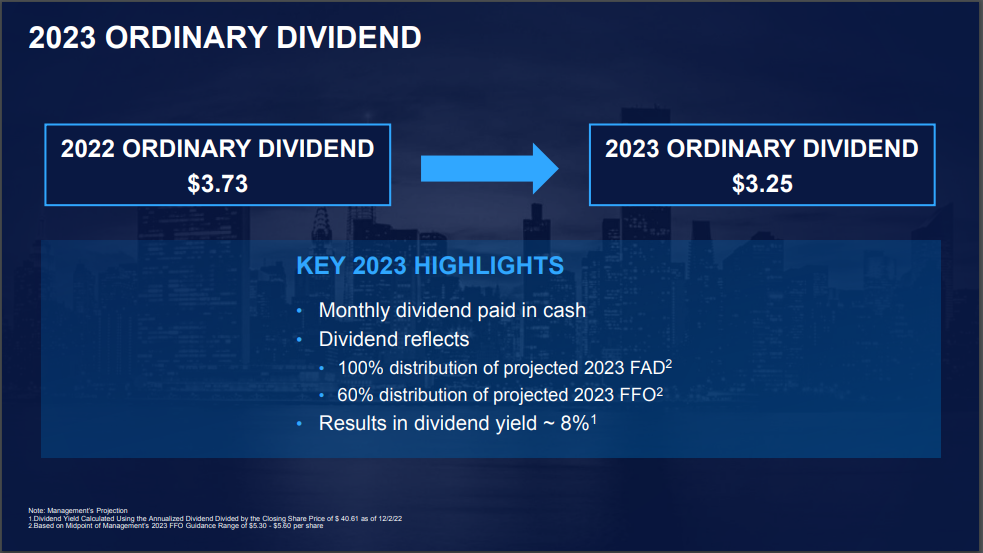

Monthly Dividend Stock #2: ARMOUR Residential REIT Inc (ARR)

- 5-Year Expected Total Return: 21.1%

- Dividend Yield: 19.0%

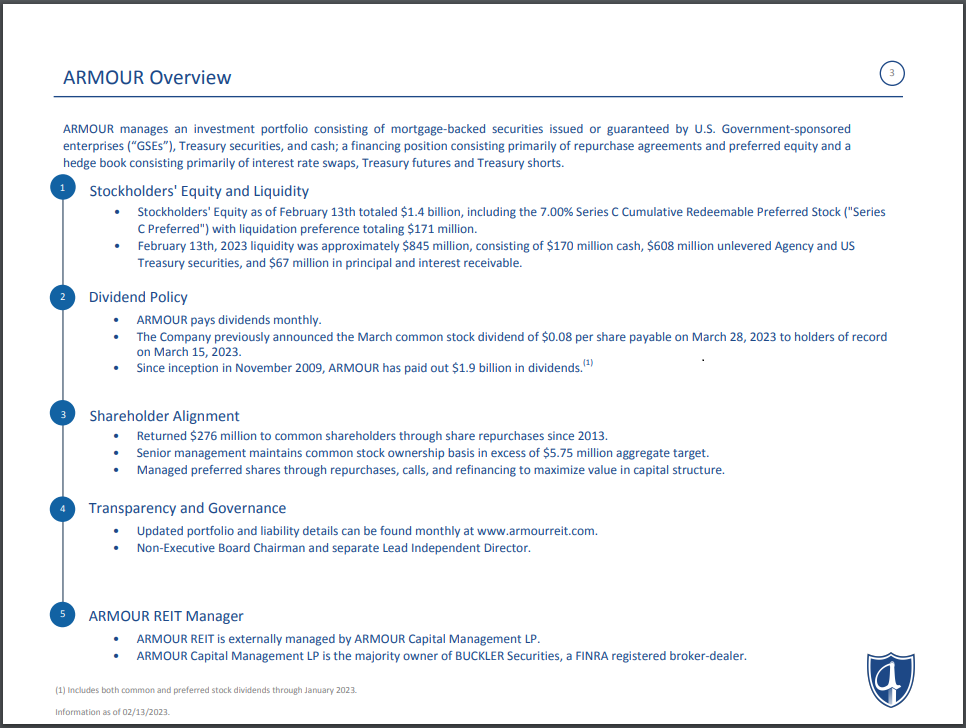

As an mREIT, ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac. It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

The trust generates revenue by issuing debt, preferred and common equity, and then reinvesting the proceeds in higher-yielding debt instruments. The spread (the difference between the cost of capital and the return on capital) is then largely returned to common shareholders in the form of dividend payments, though the trust commonly keeps a portion of the profits to reinvest in the business.

Source: Investor Presentation

Since its inception in 2008, ARMOUR’s cash flow has been volatile, but this is to be expected with all mREITs. Declining spreads have recently harmed earnings, while the economic disruption caused by the coronavirus outbreak disrupted the business model, resulting in a sharp decline in cash flow per share and a steep dividend cut in 2020.

ARMOUR is beginning to show signs of recovery and should continue to do so in the next quarters and years. Looking forward, we anticipate that the company will grow slowly and that it will take a long time to return to past levels of book value and earnings power.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

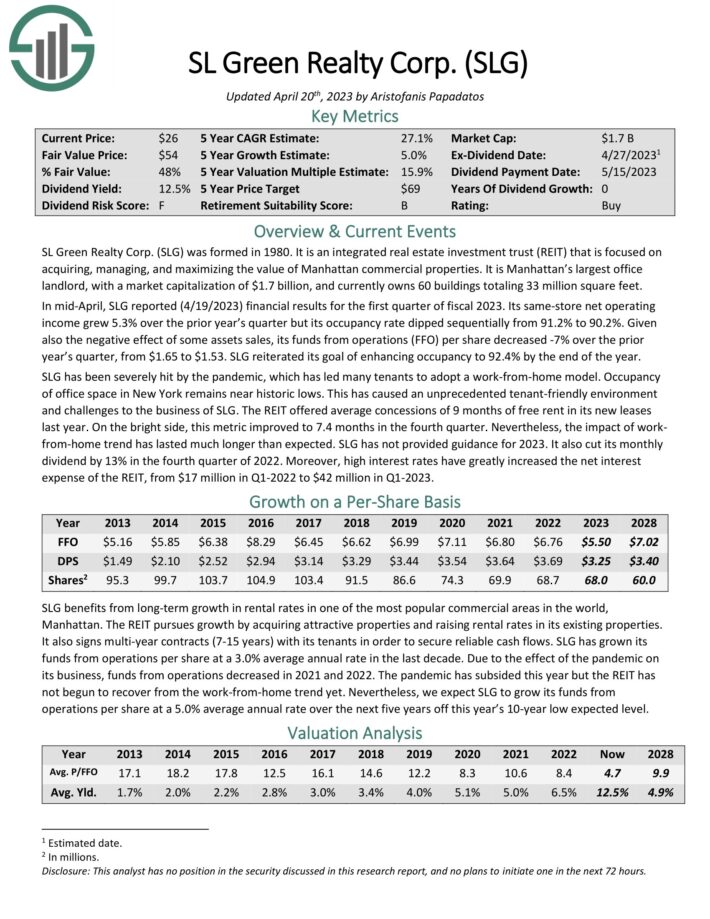

Monthly Dividend Stock #1: SL Green Realty Corp. (SLG)

- 5-Year Expected Total Return: 29.5%

- Dividend Yield: 13.8%

SL Green is a self-managed REIT that manages, acquires, develops, and leases New York City Metropolitan office properties. In fact, the trust is the largest owner of office real estate in New York City, with the majority of its properties located in midtown Manhattan. The trust has a market capitalization of ~$1.5 billion and is Manhattan’s largest office landlord, with more than 40 buildings totaling nearly 30 million square feet.

The coronavirus crisis, which has harmed several SLG tenants, has significantly impacted SL Green. Office space occupancy in New York is near historic lows, as demand has waned, at least in part, due to increased working from home. However, with New York City’s employment rates steadily improving, the company anticipates increased demand for office space in the future.

SL Green also benefits from its trophy assets, such as 450 Park Avenue and 245 Park Avenue, where the company can command high rents from tenants and where demand remains high. The company’s regular asset sales of non-core assets aim to further strengthen the portfolio, which should help with demand and occupancy rates in the long run.

Source: Investor Presentation

In December 2022, SL Green reduced its dividend by 12.9% to $0.2708 per month. Despite ongoing interest rate challenges, the current payout appears to be manageable. We expect SL Green to generate $5.40 in FFO per share in 2023, resulting in a dividend payout ratio of ~60%.

Click here to download our most recent Sure Analysis report on SL Green Realty Corp. (SLG) (preview of page 1 of 3 shown below):

Final Thoughts

Monthly dividend stocks might be an appealing option for investors looking for a consistent income stream, whether for meeting daily needs or regular compounding. While no investment is risk-free, some monthly dividend stocks have a track record of financial stability, steady profitability, and consistent dividend payments.

Our list of the ten best monthly dividend stocks presented in this article includes companies from a variety of industries that rank high based on our 5-year expected total return forecasts.

While all the companies on this list have strong expected total returns, some of them have previously cut their dividend or pay distributions based only on how much they generate annually. Almost all of them have a dividend risk score of F in our Sure Analysis Research Database. As a result, individual investors must perform their due diligence before making investment decisions.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].