Published on September 5th, 2023 by Bob Ciura

The Dividend Aristocrats are among the best dividend growth stocks to buy and hold for the long-run. Dividend Aristocrats have excellent business models that have produced annual dividend increases, even during recessions.

With this in mind, we have created a downloadable list of all the Dividend Aristocrats.

There are currently 67 Dividend Aristocrats. You can download an Excel spreadsheet of all 67 (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

This article will discuss the 10 best Dividend Aristocrats now, based on 5-year expected annual returns according to the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Dividend Aristocrat #10: Lowe’s Companies (LOW)

- 5-Year Expected Annual Returns: 11.1%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). Lowe’s operates or services more than 1,700 home improvement and hardware stores in the U.S.

Lowe’s reported first quarter 2023 results on May 23rd, 2023. Total sales for the first quarter came in at $22.3 billion compared to $23.7 billion in the same quarter a year ago. Comparable sales decreased 4.3%. Adjusted net earnings, which excludes the gain associated with the 2022 sale of the Canadian retail business, rose 5% year-over-year to $3.67 per share.

The company repurchased 10.6 million shares in the first quarter for $2.1 billion. Additionally, they paid out $633 million in dividends.

Click here to download our most recent Sure Analysis report on LOW (preview of page 1 of 3 shown below):

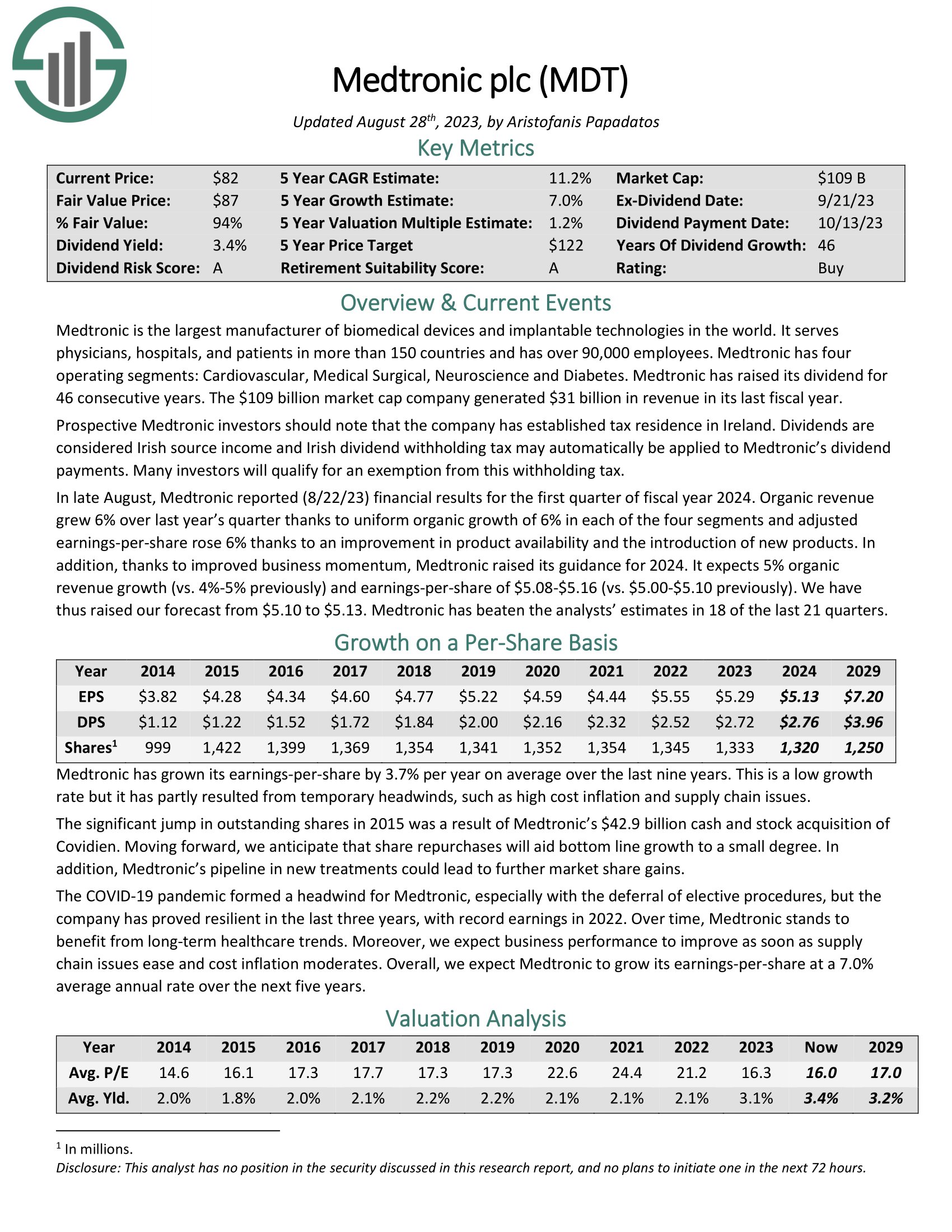

Dividend Aristocrat #9: Medtronic plc (MDT)

- 5-year Expected Annual Returns: 11.3%

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. It serves physicians, hospitals, and patients in more than 150 countries and has over 90,000 employees.

It has four operating segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. The company generated $31 billion in revenue in its last fiscal year.

In late August, Medtronic reported (8/22/23) financial results for the first quarter of fiscal year 2024.

Source: Investor Presentation

Organic revenue grew 6% over last year’s quarter thanks to uniform organic growth of 6% in each of the four segments and adjusted earnings-per-share rose 6% thanks to an improvement in product availability and the introduction of new products.

Medtronic has raised its dividend for 46 consecutive years.

Click here to download our most recent Sure Analysis report on MDT (preview of page 1 of 3 shown below):

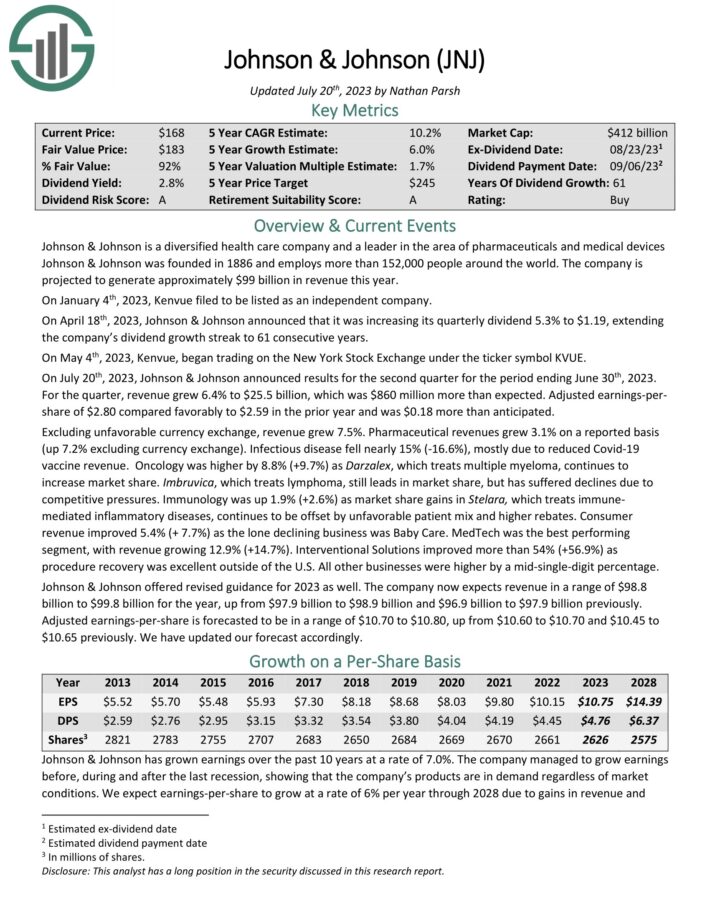

Dividend Aristocrat #8: Johnson & Johnson (JNJ)

- 5-year Expected Annual Returns: 11.2%

Johnson & Johnson is a global healthcare giant. The company currently operates three segments: Consumer, Pharmaceutical, and Medical Devices & Diagnostics. The corporation includes some 250 subsidiary companies with operations in 60 countries and products sold in over 175 countries.

On July 20th, 2023, Johnson & Johnson announced results for the second quarter for the period ending June 30th, 2023.

Source: Investor Presentation

For the quarter, revenue grew 6.4% to $25.5 billion, which was $860 million more than expected. Adjusted earnings-pershare of $2.80 compared favorably to $2.59 in the prior year and was $0.18 more than anticipated. Excluding unfavorable currency exchange, revenue grew 7.5%. Pharmaceutical revenues grew 3.1% on a reported basis (up 7.2% excluding currency exchange).

The company has increased its dividend for over 60 consecutive years, making it a Dividend King.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

Dividend Aristocrat #7: NextEra Energy (NEE)

- 5-year Expected Annual Returns: 11.3%

NextEra Energy is an electric utility with two operating segments, Florida Power & Light (“FPL”) and NextEra Energy Resources (“NEER”). FPL is the largest U.S. electric utility by retail megawatt hour sales and customer numbers.

The rate-regulated electric utility serves about 5.8 million customer accounts in Florida. NEER is the largest generator of wind and solar energy in the world. NEE generates roughly 80% of its revenues from FPL.

NextEra Energy reported its Q2 2023 financial results on 7/25/23.

Source: Investor Presentation

On a per-share basis, adjusted earnings climbed 8.6% to $0.88. Particularly, FPL continued to execute on capital investments in solar and transmission and distribution infrastructure, while NEER placed ~1.8 GW into service. Additionally, NEER added ~1.7 GW of new renewables and storage projects to its backlog that totals ~20 GW.

Click here to download our most recent Sure Analysis report on NEE (preview of page 1 of 3 shown below):

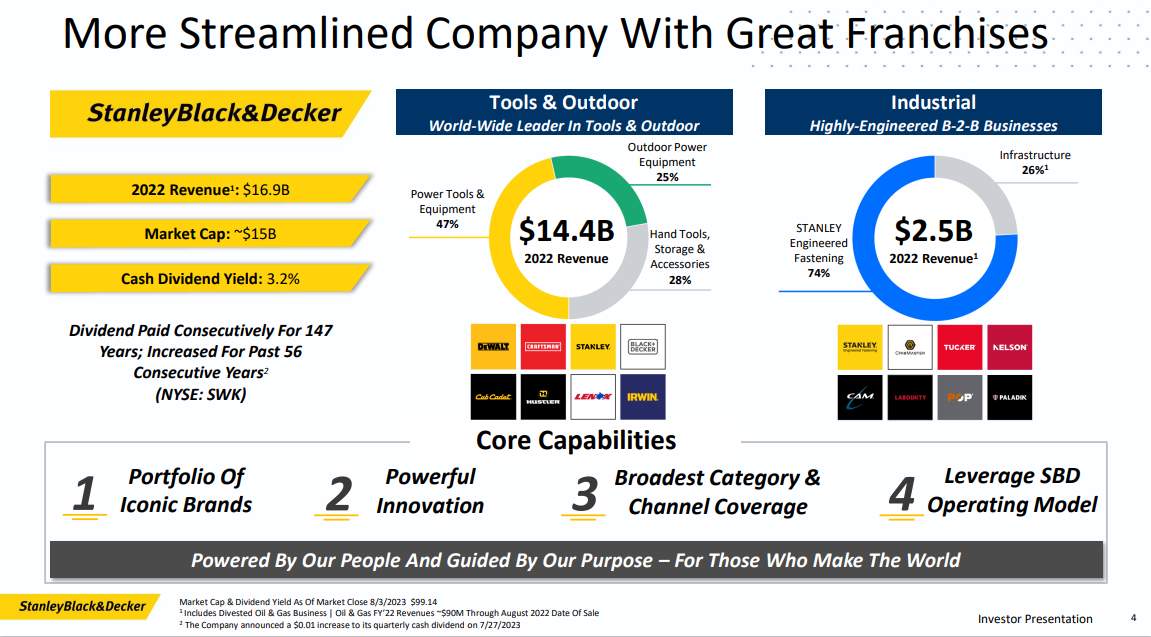

Dividend Aristocrat #6: Stanley Black & Decker (SWK)

- 5-year Expected Annual Returns: 11.9%

Stanley Black & Decker is a world leader in power tools, hand tools, and related items. The company holds the top global position in tools and storage sales. Stanley Black & Decker is second in the world in the areas of commercial electronic security and engineered fastening.

Source: Investor Presentation

Stanley Works and Black & Decker merged in 2010 to form the current company, thought the company can trace its history back to 1843. Black & Decker was founded in Baltimore, MD in 1910 and manufactured the world’s first portable power tool.

On August 1st, 2023, Stanley Black & Decker announced second quarter results for the period ending June 30th, 2023. For the quarter, revenue fell 5.3% to $4.2 billion, but this was $70 million more than expected. Adjusted earnings-per-share of -$0.11 compared very unfavorably to $1.77 in the prior year, but was $0.25 above expectations.

Click here to download our most recent Sure Analysis report on SWK (preview of page 1 of 3 shown below):

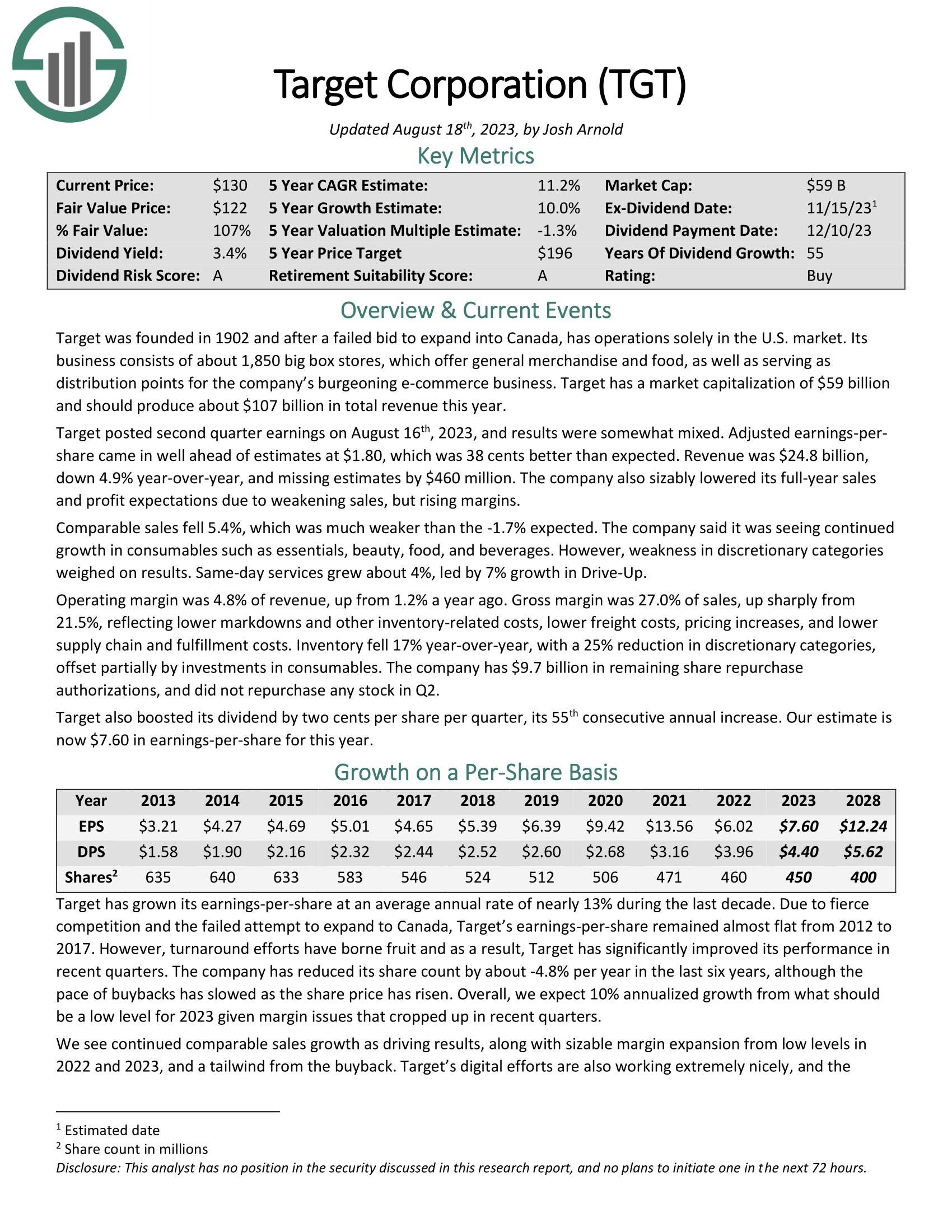

Dividend Aristocrat #5: Target Corporation (TGT)

- 5-year Expected Annual Returns: 12.1%

Target is a discount retail operations solely in the U.S. market. Its business consists of about 2,000 big box stores offering general merchandise and food and serving as distribution points for its burgeoning e-commerce business. Target should produce about $110 billion in total revenue this year.

Target posted second quarter earnings on August 16th, 2023, and results were somewhat mixed. Adjusted earnings-per-share came in well ahead of estimates at $1.80, which was 38 cents better than expected. Revenue was $24.8 billion, down 4.9% year-over-year, and missing estimates by $460 million. The company also sizably lowered its full-year sales and profit expectations due to weakening sales, but rising margins.

Click here to download our most recent Sure Analysis report on Target Corporation (preview of page 1 of 3 shown below):

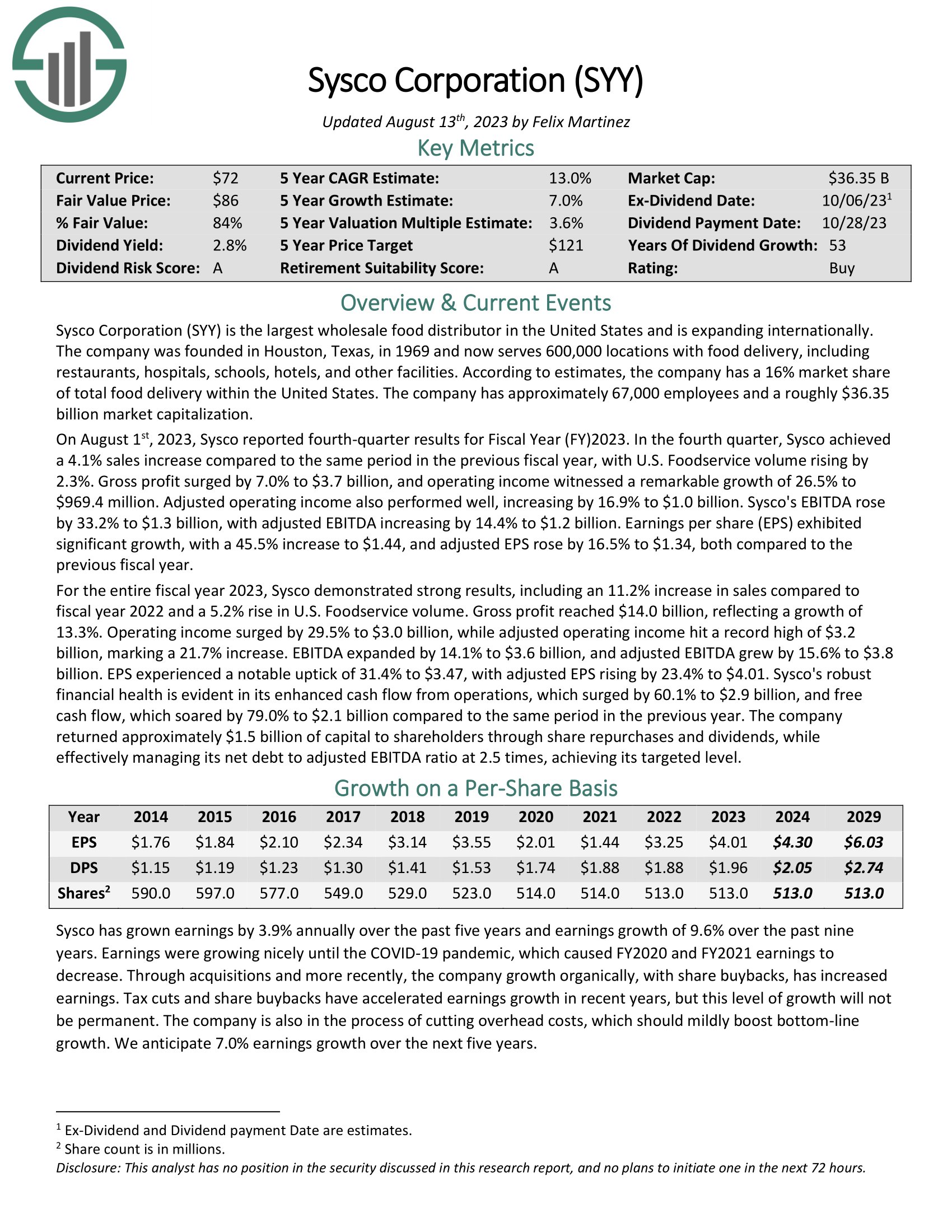

Dividend Aristocrat #4: Sysco Corporation (SYY)

- 5-year Expected Annual Returns: 13.6%

Sysco Corporation is the largest wholesale food distributor in the United States. The company serves 600,000 locations with food delivery, including restaurants, hospitals, schools, hotels, and other facilities. According to estimates, the company has a 16% market share of total food delivery within the United States.

On August 1st, 2023, Sysco reported fourth-quarter results for Fiscal Year (FY) 2023. In the fourth quarter, Sysco achieved a 4.1% sales increase compared to the same period in the previous fiscal year, with U.S. Foodservice volume rising by 2.3%. Adjusted EPS rose by 16.5% to $1.34, compared to the previous fiscal year.

For the entire fiscal year 2023, Sysco grew revenue by 11% with a 5.2% rise in U.S. Foodservice volume. Adjusted earnings-per-share increased 23% to $4.01.

Click here to download our most recent Sure Analysis report on SYY (preview of page 1 of 3 shown below):

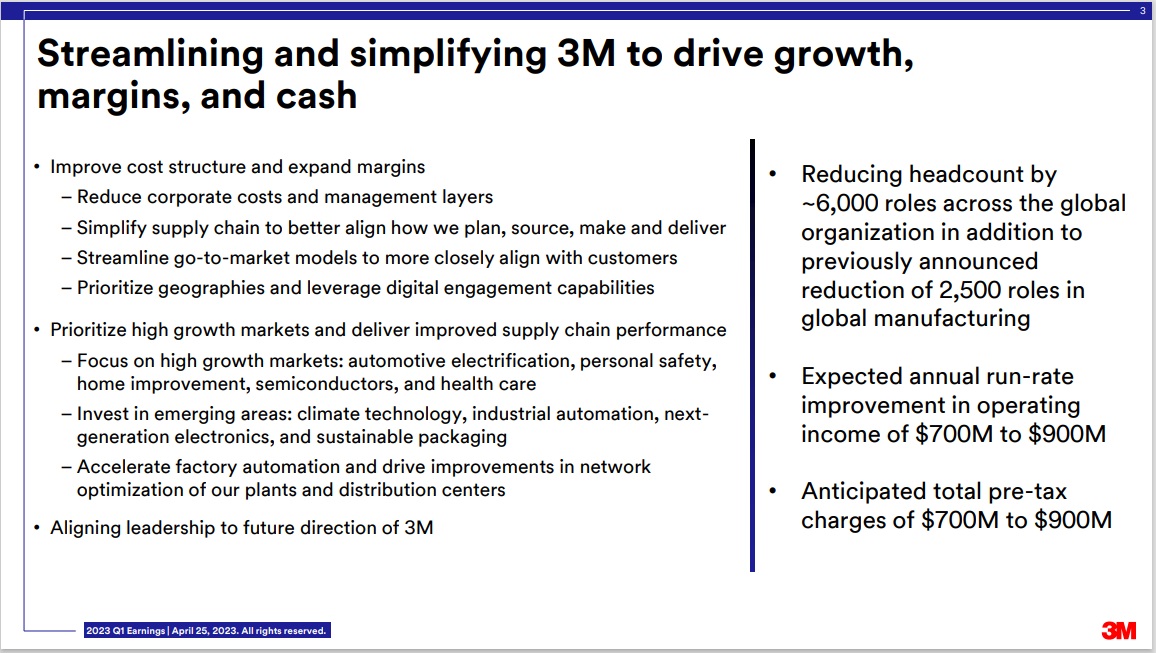

Dividend Aristocrat #3: 3M Company (MMM)

- 5-year Expected Annual Returns: 15.9%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000 employees and serves customers in more than 200 countries.

3M is now composed of four separate divisions: Safety & Industrial, Healthcare, Transportation & Electronics, and Consumer.

The company also announced that it would be spinning off its Health Care segment into a standalone entity.

Source: Investor Presentation

3M’s innovation is one of the company’s greatest competitive advantages. The company targets R&D spending equivalent to 6% of sales (~$2 billion annually) in order to create new products to meet consumer demand.

This spending has proven to be very beneficial to the company as 30% of sales during the last fiscal year were from products that didn’t exist five years ago. 3M’s commitment to developing innovative products has led to a portfolio of more than 100,000 patents.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

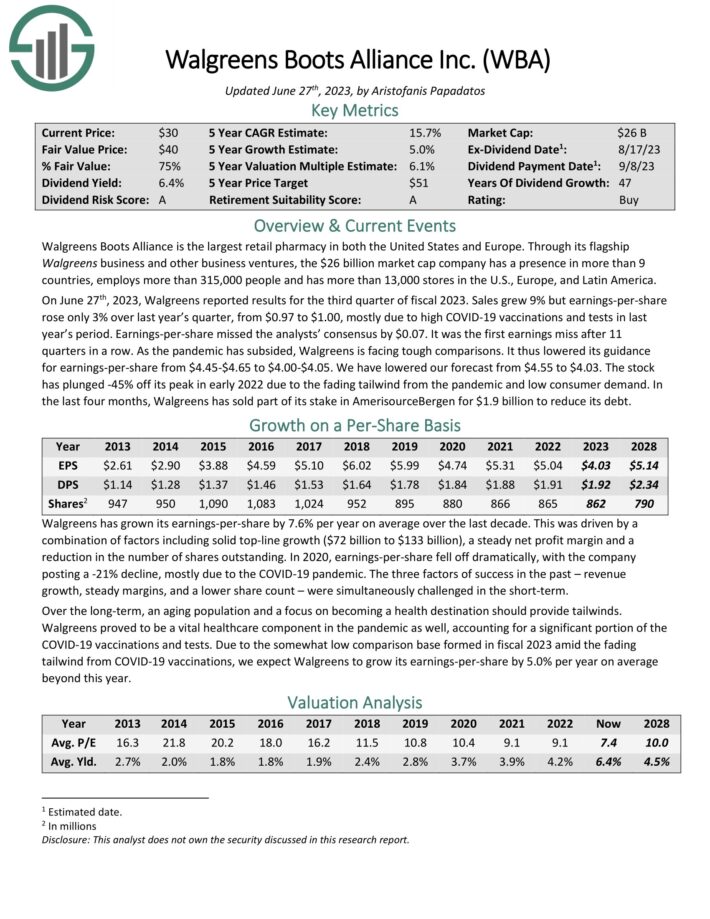

Dividend Aristocrat #2: Walgreens Boots Alliance (WBA)

- 5-year Expected Annual Returns: 19.6%

Walgreens Boots Alliance is the largest retail pharmacy in the United States and Europe. The company has a presence in more than nine countries through its flagship Walgreens business and other business ventures.

Source: Investor Presentation

On June 27th, 2023, Walgreens reported results for the third quarter of fiscal 2023. Sales grew 9% but earnings-per-share rose only 3% over last year’s quarter, from $0.97 to $1.00, mostly due to high COVID-19 vaccinations and tests in last year’s period. Earnings-per-share missed the analysts’ consensus by $0.07.

It was the first earnings miss after 11 quarters in a row. As the pandemic has subsided, Walgreens is facing tough comparisons. It lowered its guidance for earnings-per-share from $4.45-$4.65 to $4.00-$4.05.

Click here to download our most recent Sure Analysis report on Walgreens Boots Alliance (preview of page 1 of 3 shown below):

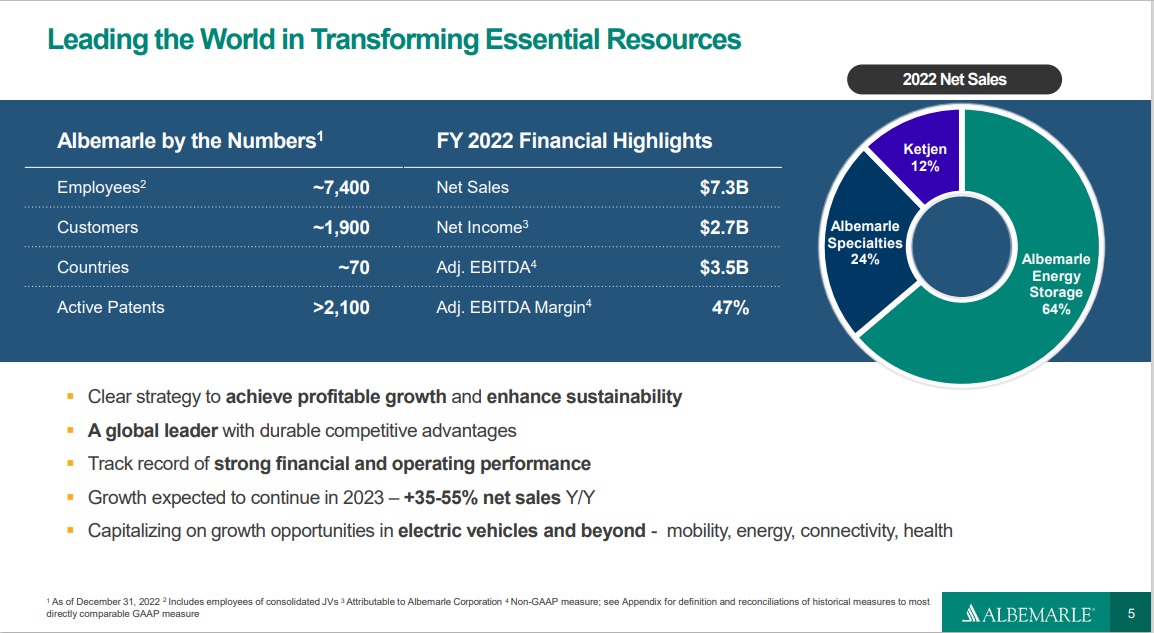

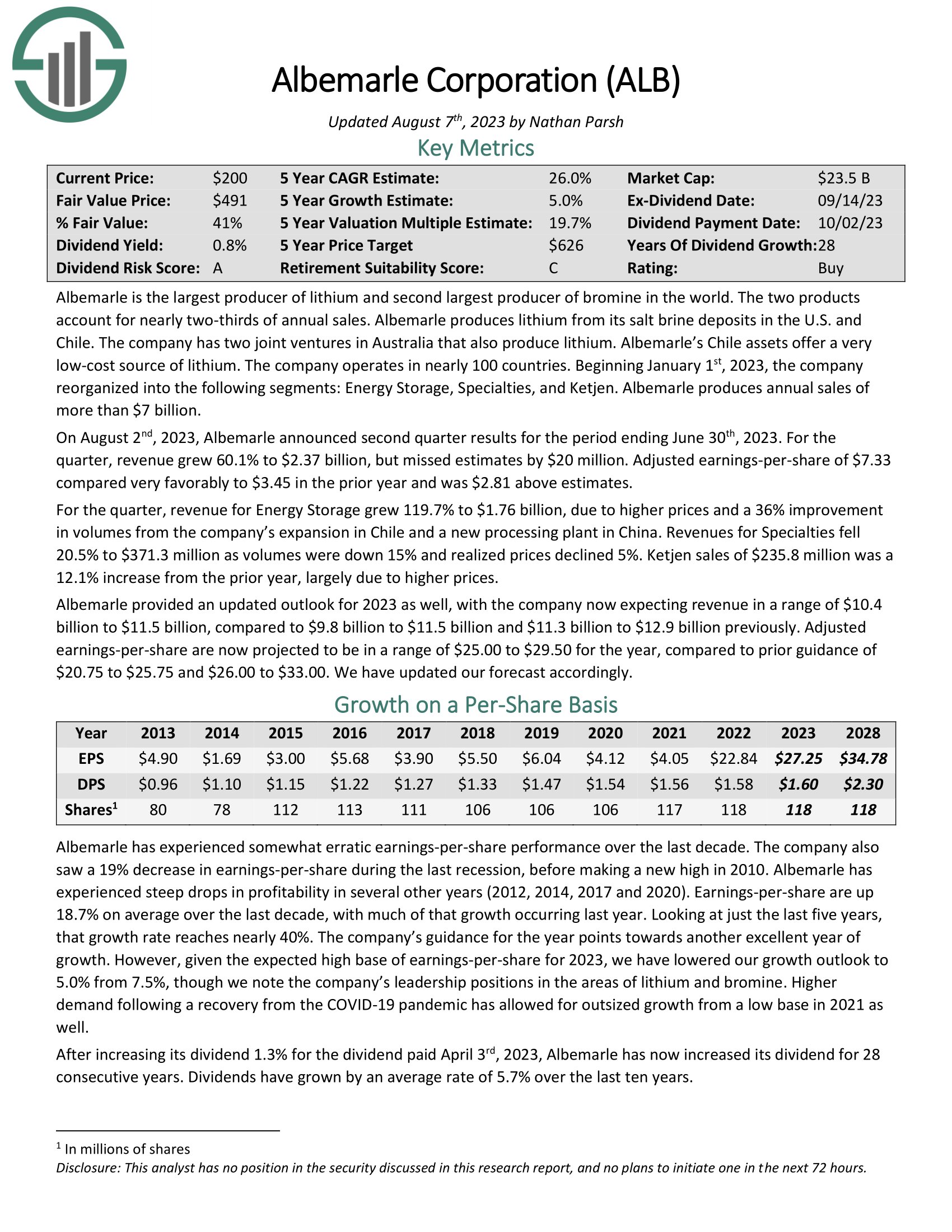

Dividend Aristocrat #1: Albemarle Corporation (ALB)

- 5-year Expected Annual Returns: 26.0%

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile. The company has two joint ventures in Australia that also produce lithium.

Related: 2023 Lithium Stocks List

Source: Investor Presentation

In the second quarter, revenue grew 60.1% to $2.37 billion, but missed estimates by $20 million. Adjusted earnings-per-share of $7.33 compared very favorably to $3.45 in the prior year and was $2.81 above estimates.

For the quarter, revenue for Energy Storage grew 119.7% to $1.76 billion, due to higher prices and a 36% improvement in volumes from the company’s expansion in Chile and a new processing plant in China.

Click here to download our most recent Sure Analysis report on Albemarle (preview of page 1 of 3 shown below):

Final Thoughts

The Dividend Aristocrats are excellent options for investors looking for a consistent income stream, along with annual dividend increases.

Our list of the 10 best Dividend Aristocrats includes companies from a variety of industries that rank highly based on our 5-year expected total return forecasts.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

Monthly Dividend Stock Individual Security Research

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].