sodafish

I assign a Purchase funding score to Tokio Marine Holdings, Inc. (OTCPK:TKOMY) (OTCPK:TKOMF) [8766:JP] inventory.

My opinion is that Tokio Marine can enhance its ROE to justify the next P/B a number of with ROE growth drivers just like the sale of cross-shareholdings, and the rise in buybacks and dividends. As such, I’ve a bullish view of TKOMY which helps a Purchase score.

The corporate’s shares are traded on each the Tokyo Inventory Alternate and the Over-The-Counter market. The imply each day buying and selling values for Tokio Marine’s OTC shares and Japan-listed shares had been $2 million and $200 million (S&P Capital IQ), respectively, for the previous three months. Readers can select to commerce in Tokio Marine’s comparatively extra liquid Japanese shares with US brokerages like Interactive Brokers.

Firm Description

TKOMY is “Japan’s largest normal insurance coverage group” based on Hennessy Funds’ Could 2024 article. As per MS&AD Insurance coverage Group Holdings’ Japanese insurance coverage business analysis report, Tokio Marine and its friends, MS&AD Insurance coverage and Sompo Group, in mixture boast a “90% market share” of the nation’s non-life insurance coverage phase.

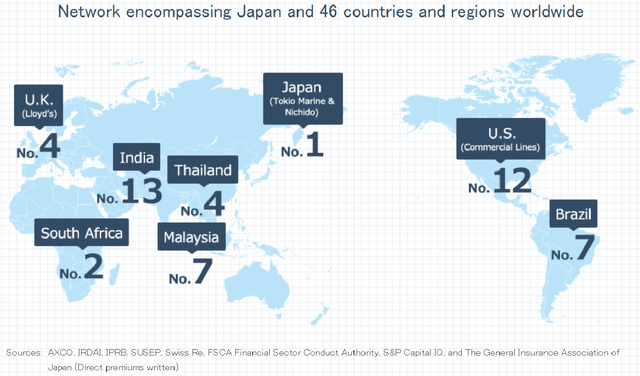

Tokio Marine can be among the many main insurance coverage firms in key worldwide markets, as per the chart introduced beneath.

Tokio Marine’s Market Share Rating In Particular Abroad Markets

Tokio Marine’s Company Web site

In its FY 2023 built-in report, TKOMY highlighted that it’s the ninth largest non-life insurance coverage firm worldwide when it comes to earnings contribution. Wanting forward, the corporate is guiding for a 75:25 revenue break up between its international and home enterprise operations for FY 2024 (April 1, 2024 to March 31, 2025).

Be aware that Tokio Marine refers to fiscal 2023 because the 12 months ended March 31, 2024, and I can be utilizing the corporate’s definition for the aim of this text.

Tokio Marine Is Buying and selling At A Low cost To Friends

The market presently values Tokio Marine at 2.4 occasions trailing P/B as per S&P Capital IQ. As a comparability, TKOMY’s friends Zurich Insurance coverage Group AG (OTCQX:ZURVY) (OTCQX:ZFSVF) [ZURN:SW] and The Progressive Company (PGR) at the moment are buying and selling at comparatively larger trailing P/B multiples of three.1 occasions and 5.5 occasions, respectively.

Tokio Marine’s important valuation low cost vis-a-vis the corporate’s friends is probably going attributable to the previous’s comparatively decrease ROE. In its July 2024 investor presentation slides, TKOMY disclosed that its newest fiscal 12 months or FY 2023 ROE was 15.0%.

TKOMY additionally famous in its July investor presentation that different non-life insurance coverage firms have set ROE objectives within the high-teens to high-twenties share vary, primarily based on its benchmarking research. As one other comparability, the consensus FY 2024 ROE estimates for Zurich Insurance coverage Group and The Progressive Company are 22.8% and 29.6% (supply: S&P Capital IQ), respectively.

A good P/B valuation a number of is the same as [ROE minus Perpetuity Growth Rate] divided by [Cost of Equity minus Perpetuity Growth Rate] as per the Gordon Development Mannequin valuation components. Assuming a 15% ROE (TKOMY’s FY 2023 ROE), an 8% Price of Fairness in step with the business common, and a 3% Perpetuity Development Price, Tokio Marine warrants a good P/B valuation metric of two.4 occasions. In different phrases, the inventory’s present valuations are affordable, making an allowance for its ROE metric.

Within the subsequent part, I contact on Tokio Marine’s valuation re-rating potential, making an allowance for an growth of its ROE within the years forward.

Achievement Of 20% ROE Goal Will Justify A Larger P/B A number of

As indicated in its July 2024 investor presentation, Tokio Marine has set a purpose of bettering the corporate’s ROE to twenty% in fiscal 2026 or in three years’ time.

I take the view that TKOMY will have the ability to increase its ROE from 15% in FY 2023 to twenty% for FY 2026, as there are a number of ROE enchancment levers.

One key ROE growth driver is the discount of cross-shareholdings, which Tokio Marine refers to as “the sale of business-related equities” in its company disclosures.

“Strategic crossholdings between conglomerates” and different firms are a standard phenomenon in Japan, as talked about in Looking for Alpha Information’ earlier February 22, 2024 article. Usually, these non-core investments are usually a drag on Japanese firms’ ROEs.

In an investor relations convention held on Could 24, 2024, TKOMY disclosed that it had cross-shareholdings or “business-related equities” with a guide worth of JPY0.4 trillion and a market worth of JPY3.5 trillion as of end-FY 2023. This additionally translated right into a business-related equities-to-net belongings ratio of above 0.6 occasions.

Shifting ahead, Tokio Marine’s goal is to promote half of its business-related equities by FY 2026 and utterly get rid of its cross-shareholders earlier than the top of FY 2029. This means that TKOMY’s business-related equities-to-net belongings metric might be lowered to round 0.2 occasions in three years’ time, primarily based on the corporate’s inside projections.

The opposite key ROE enchancment lever is the enhancement of shareholder capital return.

At its FY 2023 (firm’s definition of fiscal 12 months) analyst briefing on Could 20, 2024, Tokio Marine shared that it plans to hike its dividend per share distribution by +29% to JPY159 in FY 2024 and allocate JPY200 billion to share repurchases for the brand new fiscal 12 months. Which means that the inventory boasts fairly respectable ahead FY 2024 dividend and buyback yields of two.6% and 1.7%, respectively.

In abstract, the lower in cross-shareholdings and the rise in capital returned to shareholders will shrink TKOMY’s fairness base (denominator of ROE equation) and enhance its possibilities of assembly its 20% ROE purpose. If I assume a 20% ROE, an 8% Price of Fairness and a 3% Perpetuity Development Price, Tokio Marine’s goal P/B a number of as per the Gordon Development Mannequin is 3.4 occasions, or 42% above its present P/B ratio of two.4 occasions.

Variant View

Tokio Marine’s shares won’t expertise a constructive valuation re-rating if its ROE would not enhance.

One state of affairs is that Tokio Marine’s fairness base would not shrink that a lot attributable to a lower-than-expected stage of buybacks and a smaller-than-expected quantity of cross-shareholdings discount.

One other state of affairs is that TKOMY’s future earnings (numerator for ROE equation) decline considerably, which greater than offsets the shrinkage of the fairness base (denominator for ROE equation) by means of capital return and the sale of enterprise equities.

Remaining Ideas

Tokio Marine is presently buying and selling at a reduction to its friends primarily based on the P/B valuation metric. My view is that the inventory’s P/B ratio can increase from the present 2.4 occasions to three.4 occasions sooner or later, with a rise in its ROE from 15% in FY 2023 to twenty% in FY 2026. This explains why I’ve rated TKOMY as a Purchase.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.