visualspace/E+ through Getty Photographs

Funding Thesis

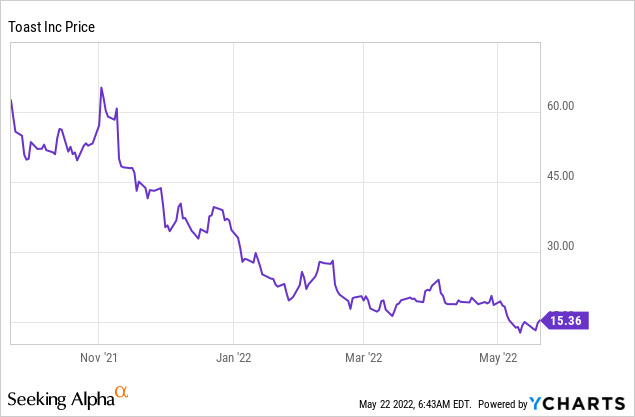

Toast (NYSE:TOST) is an organization that gives POS (level of sale) and software program options for eating places of all sizes. The corporate went public final September at an IPO worth of $55.78 however has been dropping continuous since. It’s presently buying and selling at $15.36, representing a 76% drop from its all-time excessive. In contrast to most SaaS (software program as a service) corporations that function horizontally, Toast is a vertical SaaS firm. This implies it focuses solely on one trade, and on this case, it’s the restaurant trade, which is without doubt one of the largest and under-penetrated vertical markets. This presents an enormous TAM (whole addressable market) for Toast to develop into with its full suite of choices. After the massive drop, the present valuation appears honest in comparison with friends and different SaaS corporations. The corporate has robust potential and excessive income progress; nonetheless, margins and profitability stay an enormous subject. Due to this fact, I imagine the corporate is a maintain till it is ready to present a transparent path to profitability.

Why Toast?

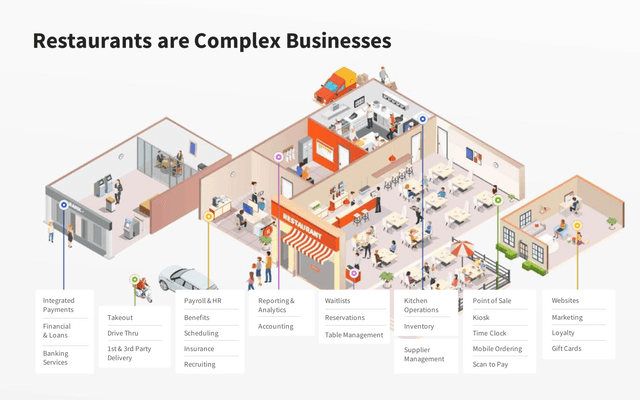

Toast is a cloud-based restaurant software program firm based within the US in 2011. The corporate gives an end-to-end platform for eating places to effectively function and handle their enterprise. The restaurant trade is without doubt one of the largest vertical markets as there are lots of layers to it. This ranges from POS, web sites, advertising and marketing, funds, Payroll, Stock, analytics, Take out, and much more. In consequence, loads of eating places are utilizing a number of merchandise from completely different corporations which makes their operation very complicated. That is the place Toast is available in and tries to disrupt the market by offering a platform with completely different merchandise that fulfill all wants.

Toast’s principal three merchandise are POS, Toast {Hardware}, and Fee Processing. These three merchandise are the center of the corporate as each restaurant wants them. The corporate then gives 15+ elective merchandise that eating places can select to deploy in keeping with their particular wants. This contains merchandise akin to on-line ordering, payroll administration, reporting & analytics, e mail advertising and marketing, loyalty program, buyer financing, and extra. Extra eating places are deciding to make use of Toast because it is ready to simplify their operation by lowering the distributors they should use. Apart from, as Toast is just centered on the restaurant trade, it is ready to provide merchandise with higher high quality and functionality in comparison with different opponents.

Toast

The Potential

The TAM (whole addressable market) for Toast is large because the restaurant trade is without doubt one of the largest vertical markets within the US and globally. In response to Toast, the annual gross sales for the US restaurant trade are $800 billion, representing 3% of GDP. The US TAM is estimated to be 50 billion whereas the worldwide TAM is estimated to be $110+ billion. That is enormous in comparison with its quarterly ARR (annual recurring income) of $0.6 billion. Apart from, the corporate has a robust land and develop technique. Most corporations begin off solely utilizing the bottom merchandise from Toast. As they develop and get extra comfy with its resolution, they’ll begin deploying extra merchandise. This creates a robust community impact for the corporate permitting them to speed up progress in a short time. As an illustration, in Q1 20, 40% of its buyer makes use of 4+ elective merchandise, the proportion elevated by 200 foundation factors to 60% in Q1 22.

The corporate has just a few opponents which embody Sq. (SQ), Lightspeed (LSPD), and PAR (PAR). All of those corporations provide a POS system however none of them has the identical product breadth that Toast has. Sq. and Lightspeed should not hyper-focused on eating places as their POS system are made for all sorts of customer-facing industries together with attire, sports activities, and so on. Whereas additionally they provide options like funds, supply, and analytics, they’re lacking some necessary options akin to Kitchen show programs or self-ordering kiosks, that are tailored for eating places. PAR’s Brink POS is one other platform that focuses solely on eating places; nonetheless, it’s inferior in comparison with Toast. Toast is ready to provide a free starter plan for small eating places whereas PAR’s least expensive plan prices $90 USD per thirty days. It additionally gives a tailor-made plan for enterprise prospects with customized pricing in keeping with their wants. This ends in Toast profitable market share within the enterprise restaurant market.

Financials And Valuations

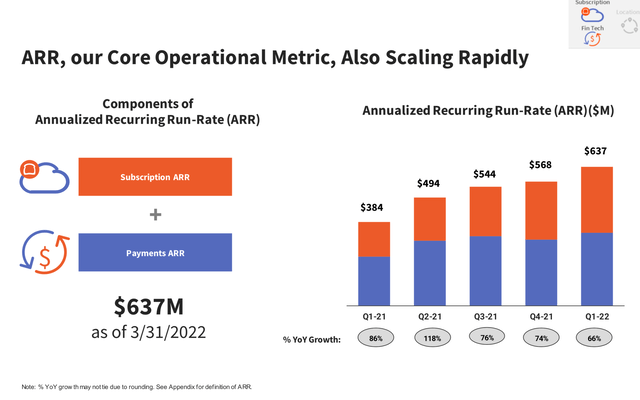

The corporate is continuous its robust progress throughout the board. For the primary quarter of 2022, the corporate reported a income of $535 million a 90% enhance in comparison with $282 million a yr in the past. Subscription service income elevated 103% from $31 million to $63 million whereas monetary know-how options elevated 93% from $227 million to $438 million. GPV (gross cost quantity) elevated 98% YoY (year-over-year) to $17.8 billion. ARR grew 66% YoY to $637 million and whole areas elevated 45% YoY to roughly 62,000. Prime-line progress is robust however the backside line remains to be struggling considerably.

Gross revenue solely elevated 29% YoY from $69 million to $89 million, a lot decrease than the income progress of 90% talked about above. That is largely because of the gross margin dropping from 24.5% to 16.6%. Apart from, adjusted EBITDA went from a optimistic $4 million final yr to a detrimental $(45) million this quarter, and loss from operation widened from a detrimental $(5) million to $(101) million. Free Money Circulate additionally widened from detrimental $(13) million to detrimental $(50) million.

The gross margin drop just isn’t my largest concern as that is largely because of the present income combine. Monetary know-how options, {hardware}, {and professional} service mixed presently account for 88% of Toast’s income. These income streams all have very low margins, monetary know-how resolution accounts for 81.9% of whole income with a margin of solely 20.8%. If we have a look at the margin of subscription companies it’s presently standing at 60.3%. I imagine the portion of subscription companies income will enhance over time as the corporate converts free customers into paying customers whereas current customers are beginning to deploy extra merchandise as nicely. Because of the financial system of scale and income combine bettering margins ought to enhance over time.

Toast

Nevertheless, working expense appears uncontrolled. The corporate’s gross revenue is just $89 million however already has an working expense of $190 million, greater than 2x its gross revenue. The corporate’s gross sales and advertising and marketing bills elevated by over 120%, increased than the income progress of 90%. G&A and R&D elevated by over 200% which is unreasonable even for a high-growth firm. Inventory-based compensation can also be abnormally excessive growing over 10-fold from $5 million to $53 million, leading to working money stream lowering from detrimental $(5) million to detrimental $(47) million. The corporate presently has round $1.1 billion of money in hand after debt which permits it to afford the present money burn however in the long term, it should get its expense in line and enhance profitability.

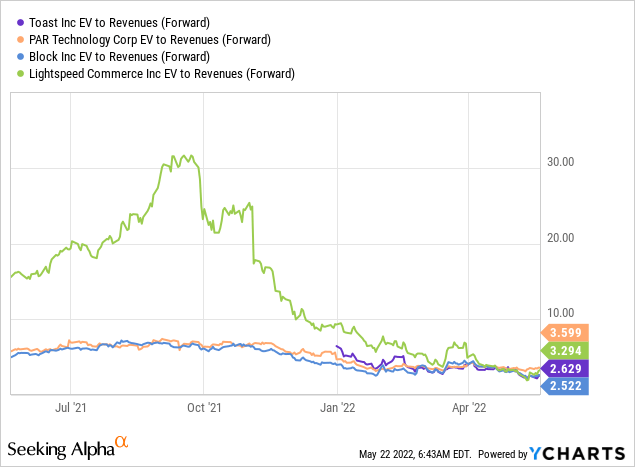

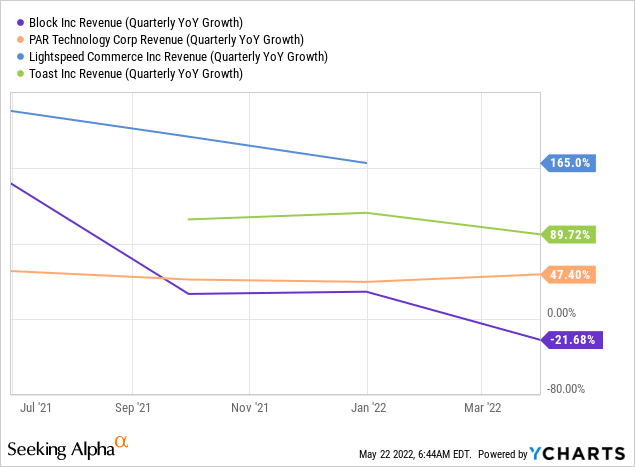

The corporate is presently buying and selling at an EV/gross sales of two.63, which is according to its friends. From the chart under, you possibly can see that different corporations are additionally buying and selling at the same EV/gross sales ratio of round 2.5–3.5. Toast has the best income progress amongst all corporations, Lightspeed’s income progress for the newest quarter is 78% (the second chart under hasn’t been up to date but). Each Sq. and Lightspeed function in different industries akin to crypto and retail due to this fact I imagine PAR needs to be the perfect comparability out of all. PAR is buying and selling at an EV/gross sales ratio of three.6 which is nearly 40% increased than Toast. It’s also rising a lot slower at 47.4% in comparison with Toast’s 90% (additionally it is value noting a portion of PAR’s income progress is because of its acquisition of Punchh). I imagine the present valuation is sort of honest when in comparison with its friends and factoring in its robust progress and SaaS enterprise mannequin.

Conclusion

Toast is working in a big vertical market with an enormous TAM. The present cloud penetration for the restaurant trade remains to be very low and eating places are additionally in search of a one-in-all platform that permits them to attenuate the variety of distributors used. This gives a robust tailwind and marketplace for Toast and it has been rising quickly. Its land and develop technique is working nicely with income growing by 90% YoY and subscription service income growing by 103%. After the 70%+ drop in inventory worth, the corporate can also be now buying and selling at a good degree and is barely discounted when in comparison with its friends. Nevertheless, profitability stays an enormous subject. The corporate’s detrimental money stream and web loss hold widening whereas bills and stock-based compensations are growing considerably. The corporate can also be more likely to see some headwinds from the macro setting as prospects might spend much less time consuming out (which reduces their GPV) and eating places could also be extra reluctant to improve their plans. Due to this fact, I imagine the inventory is a maintain for now and can improve it to a purchase as soon as the corporate is ready to management its expense and enhance its profitability.