Torsten Asmus

The real yield to maturity on the iShares TIPS Bond ETF (NYSEARCA:NYSEARCA:TIP) has risen to new multi-year highs and now sits at an impressive 2.1%. Actual returns are likely to far exceed this as real yields decline under the weakening economy and high debt levels. Over the past two decades of data, a real yield of 2.1% has been consistent with annual nominal returns of 8% over the following 5 years. A deflationary credit crunch presents the main risk, but it is difficult to imagine negative total returns over the coming years even under a worst-case scenario.

The TIP ETF

The TIP tracks the performance of US Treasury inflation-protected securities, with a weighted average maturity of 7.2 years and an effective duration of 6.6 years. This puts the TIP in the mid-range in terms of duration and volatility across the inflation-linked bond universe. The current real yield on the TIP of 2.1% is what investors should expect to receive per year over the long term after inflation, less the fund’s expense fee of 0.19%.

I have written a number of articles on the TIP over the past year, most recently arguing “De-Dollarization Should Help Drive Real Yields Lower”. High coupon payments have helped the ETF post positive returns over this time, yet the real yield has continued to rise, making it an even more attractive investment. In fact, the outlook for the TIP is stronger now than at any time since the height of the Global Financial Crisis.

High Yield Plus Capital Gains Should See TIP Return 8% Annually Over Next 5 Years

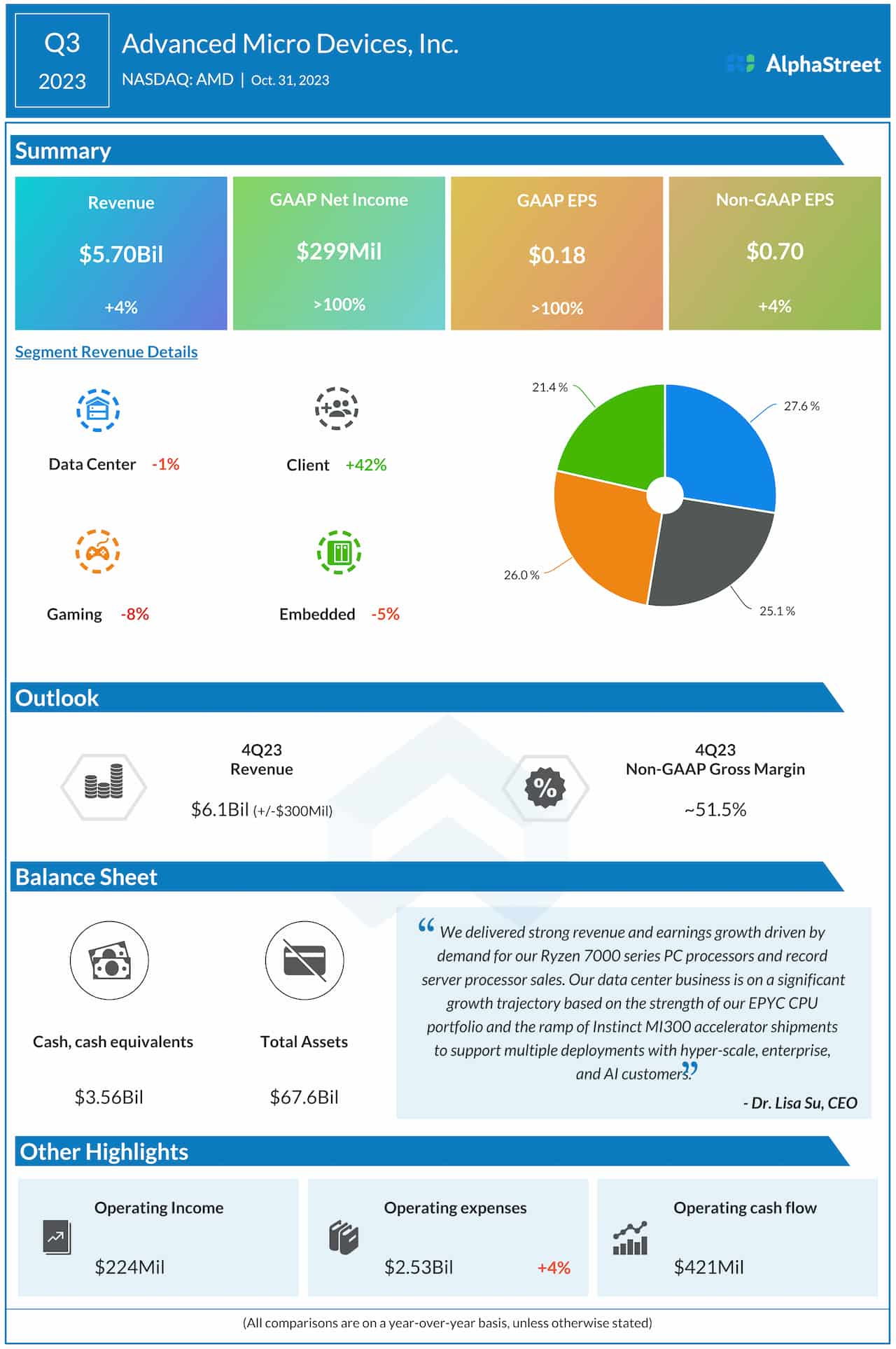

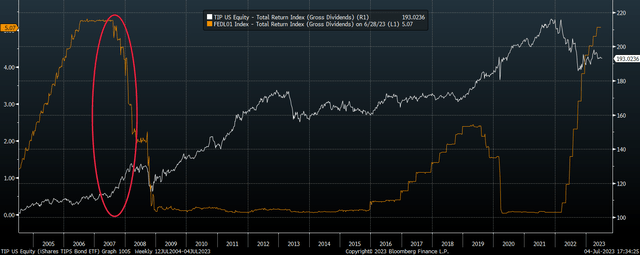

The following chart shows the real yield to maturity on the TIP ETF alongside historical 5-year annual subsequent returns. The first thing to note is that real yield on the TIP is extremely closely correlated with subsequent returns. This should not be surprising as the yield is the key factor driving multi-year returns.

Bloomberg, Author’s calculation

The second point to note is that historically elevated real yields tend to result in outsized nominal returns due to the impact of capital gains. When real yields are high, reflecting either low inflation expectations or high nominal rates, this creates contractionary conditions for the real economy, which eventually give way to monetary easing and lower real yields. This mean reversion in real yields suggests that the TIP should be expected to return 8% annually over the next 5 years.

Rising Real Yields At Odds With Economic Reality

While there is of course no guarantee that real yields decline and contribute positively to returns over the coming years, the macro environment suggests history will repeat, perhaps with a vengeance. The heavily indebted and slow-growing US economy simply cannot withstand sustained periods of elevated real yields.

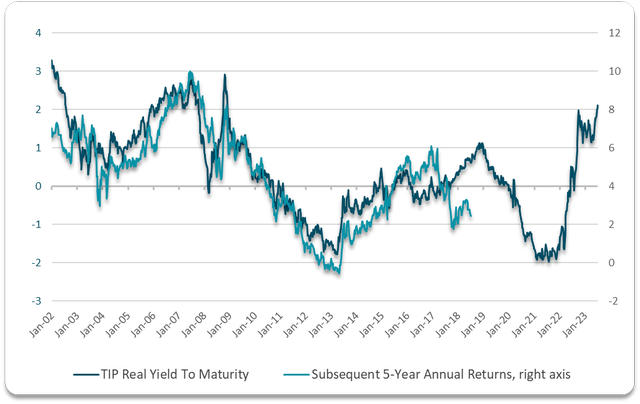

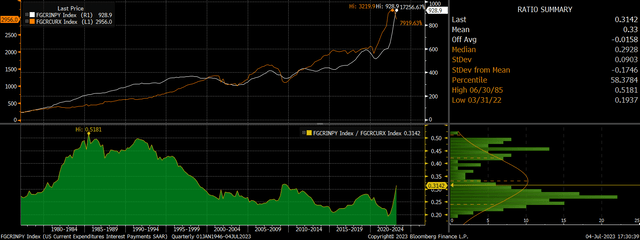

On the government side we have already seen interest payments on the national debt rise to 31% of current tax revenues and the latest figures are for Q1 when interest rates were significantly lower. The average interest rate on US Treasury debt has risen 110bps since its low in early-2021 yet remains at just 2.7%, far below the yield on 7-year USTs of 4.0% (the average maturity on US Treasury debt is around 7 years). Further increases in debt servicing costs are inevitable and may well rise back up to the 50% level seen in the 1980s.

Debt Interest Payment Versus Current Tax Receipts (Bloomberg)

In the private sector, the surge in mortgage rates and still-elevated house prices have seen the NAR housing affordability index fall to its lowest level since the index begun in 1989. The Bankrate.com 30-year fixed mortgage rate is now 7.2%, having risen more than 4pp over the past 18 months. Meanwhile, the 1-3 year investment grade corporate bond index now yields 5.7%, while inflation expectations over this period have fallen back to 2.0%, meaning even the most secure companies in the economy are paying almost 4% in real terms on their borrowing. With leading economic indicators pointing towards an outright contraction in real GDP by year-end, something has to give, and that thing is likely to be real bond yields.

Spikes in real borrowing costs typically only occur during recessions as investors shun credit risk amid default concerns, but the recent spike has been almost entirely driven by the Fed’s hiking cycle while the economy is still near full capacity with unemployment remaining near record lows. While there is no telling how much higher real yields can go before a financial crisis occurs, pressure in mounting on the Fed to bring rates back down to levels commensurate with the real economy.

The TIP May Even Post Positive Returns In A Financial Crisis

The key question for the TIP is whether the Fed will be able to manage to engineer a soft landing of the US economy. If the Fed begins to ease rates as headline inflation continues to fall, we could see nominal bond yields fall and inflation expectations rise as liquidity conditions improve, which would be highly supportive of the TIP. For example, when the rate hiking cycle ended in mid-2007 and the Fed began to ease, the TIP rose by almost 20% in total return terms over the following 9 months.

TIP Total Return Vs Fed Funds Rate (Bloomberg)

These gains were given back rapidly once the financial crisis began in earnest as the demand for inflation protection collapsed amid deflation fears amid the global banking crisis. As inflation expectations fell faster than the Fed could cut rates, the TIP saw heavy losses. While these losses were quickly reversed, with the ETF going on to produce returns of 55% over the next four years, a repeat of such a crash would be painful for TIP investors.

That said, a deflationary collapse of the magnitude seen during the Global Financial Crisis seems highly unlikely. US policymakers will be keen to prevent another over another debilitating financial crisis by allowing a systemically important bank to fail and have a lot more support tools available. More importantly, the real yield on the TIP is already near the highs seen at the height of the GFC. Given the relatively low duration of the TIP, even a rise in yields back to 2008 highs would result in losses of just 7%. Considering the impact of the high nominal yield, it is difficult to imagine the TIP posting losses over the coming years even under a worst-case scenario. In a best-case scenario of Fed easing and a recovery in inflation expectations, the TIP could easily return 20% over the next 12 months.