Sakorn Sukkasemsakorn

SandRidge Energy’s (NYSE:SD) stock price has underperformed recently despite a growing cash balance, stable cash flow, low required rates of re-investment, and growing oil production. SandRidge recently posted strong Q1 2023 results, generating $30MM in free cash flow despite lower commodity prices. More on this below.

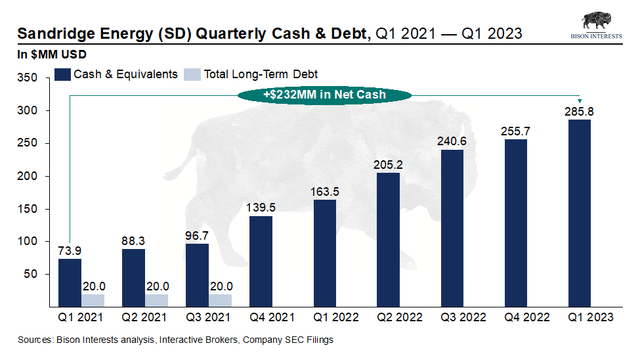

Considering SandRidge’s strong fundamentals, the likely reason for their share price underperformance is not an asset quality concern, but rather, a capital allocation concern. Specifically, SandRidge has been completely debt-free and has been hoarding its growing cash pile for some time now, while management has provided limited go-forward guidance for the use of this cash:

Bison Interests

Several SandRidge analysts and investors, including us, have been asking for clarity for some time now on how SandRidge might return its growing cash balance. In fact, we asked about a potential return of capital as early as SandRidge’s Q4 2021 public conference call, to which SandRidge’s CFO responded:

I think that the view of management and the process that we go through and how we think about this is that all options are on the table. I think that if we do not find a highly accretive strategic option, within the energy space or otherwise, to deploy this capital and again, to use the same a highly accretive way for our investors that’s both prudent and highly profitable.”

At the time, the prospect of SandRidge using its cash to do an accretive deal placated many concerned investors. Since then, however, 5 quarters have elapsed and SandRidge has not bought any material assets. The time to do a deal has clearly passed, and surely, management is feeling mounting pressure from investors to return capital via buybacks or dividends.

Trouble for Carl Icahn

Recently, Hindenburg Research published a short report on Icahn Enterprises (IEP), controlled by legendary investor Carl Icahn. Hindenburg claims that IEP trades at an unjustifiably high premium to its net asset value, and that it had been aggressively marking up both private and public investments to support abnormally high dividend payments to IEP investors and to prop up IEP’s unit price.

Carl Icahn, who owns 85% of IEP, has been taking IEP dividends in the form of units, allowing IEP to limit cash outflow in a period where investment losses were allegedly mounting, and IEP was burning cash. It also appears that Icahn has taken personal margin loan (a risky form of debt) collateralized by 60% of his IEP holdings.

We take no view on these allegations and note Icahn’s reputation and long track record. However, this controversy is relevant for SandRidge, which is effectively controlled by Icahn. Icahn Associates is the largest shareholder, with 13% of outstanding SandRidge shares, and Icahn was the winner of a proxy battle that resulted in the appointment of most of the current board of directors. A dividend paid out by SandRidge would not be material in the scope of the IEP / Hindenburg controversy, but it could be a start. Alternatively, repurchasing Icahn Associates’ 4.82 million shares could alleviate some of the return of capital overhang while providing a potentially more relevant ~$82 million to Icahn.

In our view, SandRidge’s lack of transparency with respect to capital allocation is the main driver of the underperformance of its shares, which should trade at a premium to peers due to operational outperformance and a fortress balance sheet. SandRidge investors have been anticipating a dividend or buyback for some time now, and rightfully so. This IEP situation may finally get SandRidge’s board to return the shareholders money, unlocking material value.

SandRidge Q1 2023 Results

SandRidge recently announced its Q1 2023 results, having reported Adjusted EBITDA, Net Income and FCF of $31.2MM, $23.8MM and $30.4MM, respectively. Despite lower revenues due to lower realized pricing (oil and gas prices have fallen significantly over the past year), cash flow came in higher this quarter due to the positive effects of working capital changes and a realized cash hedging gain of $6.2MM.

Considering SandRidge’s strong free cash flow generation in the current commodity price environment and operational outperformance, this could be an optimal time for SandRidge to initiate a large regular dividend and/or to act on the approved share repurchase plan.

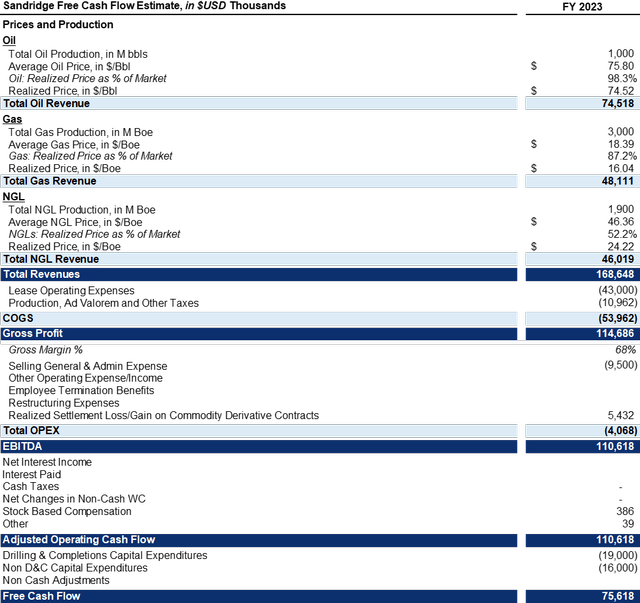

SandRidge FY 2023 Free Cash Flow Forecast

In the context of a potential dividend payment, it is helpful to review our estimate for SandRidge’s 2023 cash flow. We modelled cash flow assuming reasonable mid-cycle energy prices ($75/bbl WTI, $3.50/MMBtu Henry Hub Natural Gas & $8MMBtu NGL Composite) and using the midpoint of SandRidge’s management’s guidance for production and costs. We also assumed the high end of management’s guidance for capital expenditures. Under conservative commodity price, production, cost and capital expenditure assumptions, we estimate SandRidge will produce ∼ $76MM in free cash flow in 2023, on the low end:

Bison Interests

It is worth noting that SandRidge has historically re-invested ∼20% of free cash flow to grow production, however, production appears to be declining a bit in 2023 as indicated by lower production (16,100 Boe/d in 2023 vs. 17,400 Boe/d in 2022) and capex ($35MM in 2023 vs. $49MM in 2022) guidance. Without any plans to allocate capital expenditures to growth, SandRidge should have at least $76MM in FCF to pay a dividend in 2023, or roughly $2.05 per share, excluding it’s $255MM net cash position! With a share price of $13.82 at the time of writing, this implies a forward dividend yield of 14.8%, among the highest of peers, with a cash cushion to continue to pay dividends for years regardless of commodity prices.

Implications for SandRidge Energy

SandRidge’s prospects are improving: it has almost $8 in net cash per share, a low re-investment requirement to keep overall production nearly flat and growing oil production. And while there have been talks of a potential dividend for more than a year now, the chances of one being paid out have never been higher given the ongoing situation at IEP.

In our view, SandRidge is likely to generate sufficient free cash flow this year to support a hefty 14.8% dividend, not accounting for its large cash balance which could still be used to acquire assets or provide a cushion to continue to pay the dividend in the case of a prolonged oil & gas downturn. Potential initiation of dividend payments from SandRidge may attract a new wave of dividend-focused investors and galvanize a re-rate higher.