Khosrork/iStock through Getty Photos

Most buyers prefer it when shares go up. That is comprehensible since all of us make investments with the objective of being profitable and rising our revenue streams.

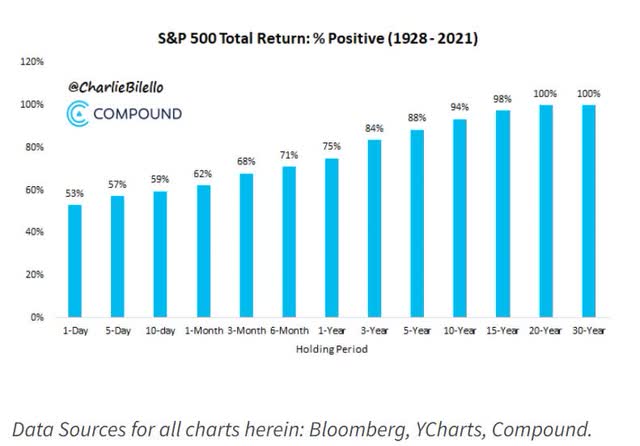

The excellent news is that shares go up 76% of all years.

Charlie Bilello

There are few ensures on Wall Avenue. In truth, research present that simply two issues are a long-term certainty.

- Shares go up over time

- Diversification will increase risk-adjusted returns over time

At present many buyers are terrified on the prospect of stagflation, excessive inflation, and gradual development, inflicting the Fed to boost charges to the sky and leading to a possible misplaced decade for shares.

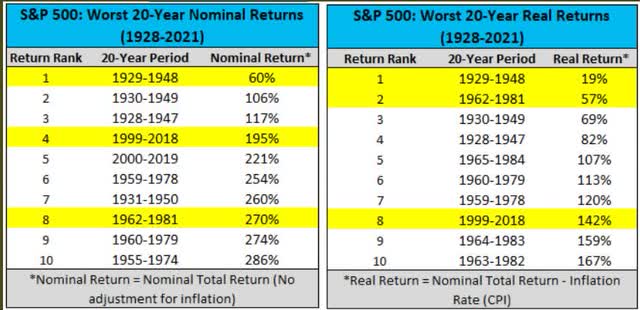

Stagflation does certainly harm market returns, however the excellent news is that not even 20 years of excessive inflation has precipitated the US market to fail to ship optimistic returns.

Charlie Bilello

Throughout the late Nineteen Forties, we had 20% inflation after WWII, the very best in US historical past.

From 1929 (an epic bubble prime) by way of 1949 we had the Nice Melancholy, 4 recessions, WWII, and 20% inflation.

And shares nonetheless delivered optimistic actual returns. Except you suppose we’re dealing with an apocalypse or that the long run can be bleaker than 1929 to 1949, staying invested for the long run is the sensible name.

And let’s not neglect that bear markets are the perfect time to purchase the world’s finest corporations and lock in Buffett-like returns from blue-chip bargains hiding in plain sight.

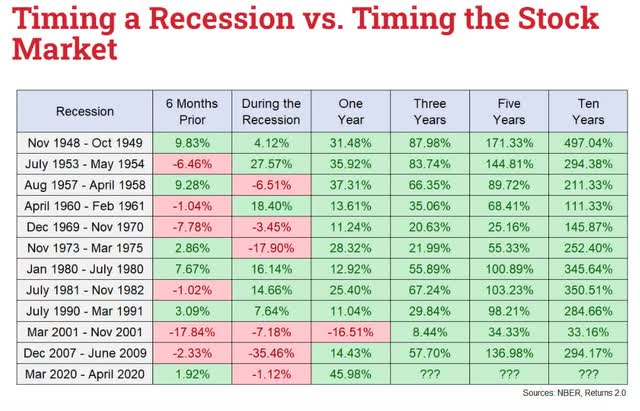

Ben Carlson

Are we headed for a recession in 2023?

- 70% of economists suppose so

- 75% of Fortune 500 CEOs suppose so

- 85% of buyers (based on JPMorgan) suppose so

- About 50% of Individuals suppose we’re already in a recession (the financial information clearly exhibits we’re not)

However guess what? Even when we get a recession in 2023, it is more likely to be delicate.

- No blue-chip economist group (the 16 most correct on the earth) thinks the US will expertise a extreme recession

How delicate?

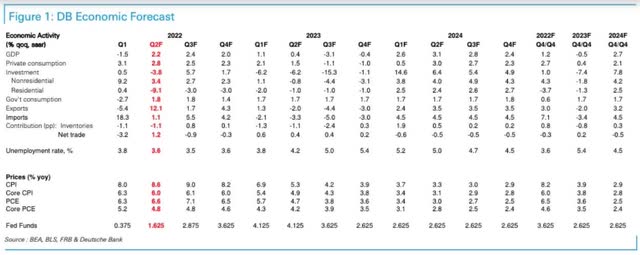

Deutsche Financial institution

Deutsche Financial institution was the primary blue-chip economist group to forecast a recession in 2023.

- They initially thought the Fed would elevate charges to five% to six%

- Now they count on a 4% terminal Fed funds price

- And -3.1% GDP development in Q3 2023

- And -0.4% development in This autumn 2023

- Adopted by optimistic development beginning in Q1 2024

Deutsche Financial institution calls this a “extreme” recession, however in 2023 they count on -0.5% development.

- The 2nd mildest recession in historical past behind 2001’s -0.4%

In different phrases, the recession that seems probably (although the bond market disagrees for the time being) subsequent yr is more likely to be one of many softest “laborious landings” in historical past.

And but…

- 11% of US shares are down 80+%

- The S&P 500 has fallen 24.5% thus far (peak decline)

- The Nasdaq has been down 31%

And guess what? The bluest of blue-chips, the dividend aristocrats, are additionally buying and selling at bargain-basement costs if you understand the place to look.

Some are already priced at valuations you solely see on the backside of extreme recessionary bear market lows.

Besides that the economic system remains to be robust for now and the recession of 2023 that most individuals count on could be very more likely to be one of many mildest in historical past.

The clever investor is a realist who buys from pessimists and sells to optimists.” – Ben Graham, The Clever Investor

Or to place it one other method, Mr. Market has turn into so pessimistic that most of the world’s finest corporations are loopy, silly, low cost.

Await a fats pitch after which swing for the fences.” – Warren Buffett

So at present I need to share with you 5 unbelievable high-yield dividend aristocrat bear market bargains.

These are a number of the world’s most secure and most reliable dividend development blue-chips which might be so undervalued analysts suppose they’ll ship:

- 42% complete returns within the subsequent 12 months

- Fundamentals justify a median 12-month complete return of 72%

- They might doubtlessly double within the subsequent three years

It is Time To Again Up The Truck On These 5 Excessive-Yield Dividend Aristocrat Bargains

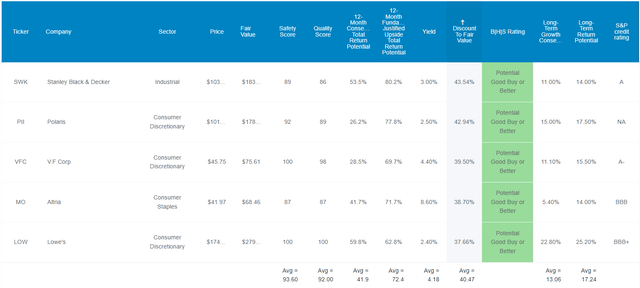

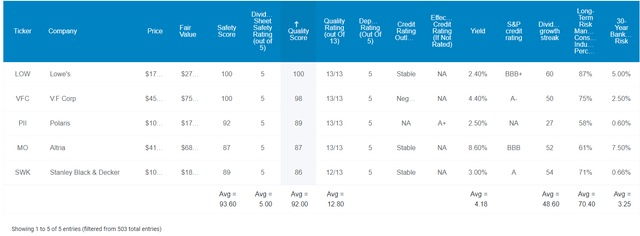

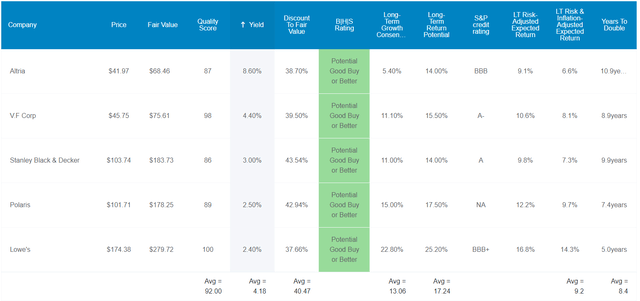

(Supply: Dividend Kings Zen Analysis Terminal)

I’ve linked to deep-dive articles absolutely analyzing every firm’s funding thesis, development outlook, threat profile, valuation, and complete return profile.

In a second I am going to summarize why these are a number of the finest bear market aristocrat bargains, however this is the bottom-line up entrance.

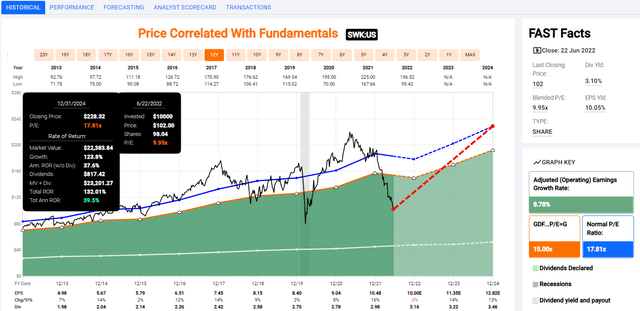

Stanley Black & Decker 2024 Consensus Complete Return Potential

(Supply: FAST Graphs, FactSet)

If SWK grows as anticipated and returns to historic honest worth, essentially the most undervalued dividend aristocrat may ship:

- 132% complete returns by 2024

- 40% annual returns

- Buffett and Joel Greenblatt-like return potential from a blue-chip discount hiding in plain sight

- And buying and selling at a P/E solely seen in extreme recessionary bear markets

- Nice Recession… Pandemic… at present

- One in all these is not like the opposite

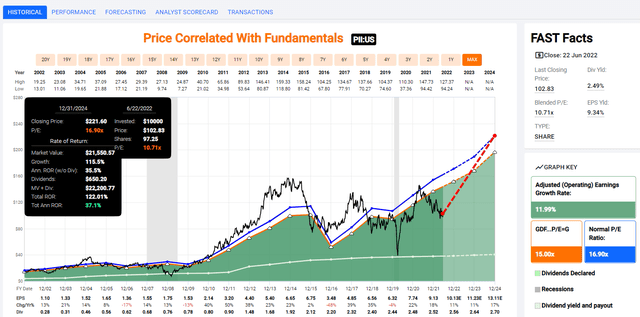

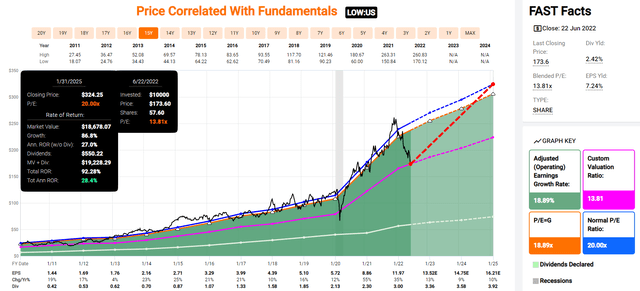

Polaris 2024 Consensus Complete Return Potential

(Supply: FAST Graphs, FactSet)

If PII grows as anticipated and returns to historic market-determined honest worth, it may ship:

- 122% complete returns by 2024

- 37% annual returns

- Buffett and Joel Greenblatt-like return potential from a blue-chip discount hiding in plain sight

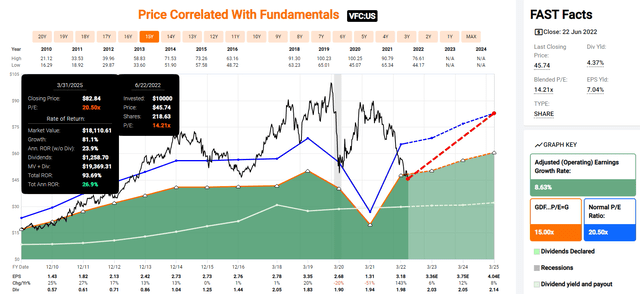

V.F. Corp 2024 Consensus Complete Return Potential

(Supply: FAST Graphs, FactSet)

If VFC grows as anticipated and returns to historic market-determined honest worth, it may ship:

- 94% complete returns by 2024

- 27% annual returns

- Buffett and Peter Lynch-like return potential from a blue-chip discount hiding in plain sight

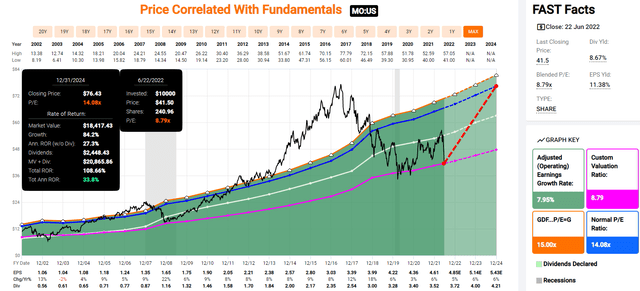

Altria 2024 Consensus Complete Return Potential

(Supply: FAST Graphs, FactSet)

If MO grows as anticipated and returns to historic market-determined honest worth, it may ship:

- 109% complete returns by 2024

- 34% annual returns

- Buffett and Peter Lynch-like return potential from a blue-chip discount hiding in plain sight

- The final occasions’ MO was buying and selling on the present P/E of beneath 9… Grasp Settlement interval, Nice Recession low, Pandemic… now

- Even bearish analysts count on a 30% complete return inside a yr

Lowe’s 2024 Consensus Complete Return Potential

(Supply: FAST Graphs, FactSet)

If LOW grows as anticipated and returns to historic market-determined honest worth, it may ship:

- 92% complete returns by 2024

- 28% annual returns

- Buffett and Peter Lynch-like return potential from a blue-chip discount hiding in plain sight

- LOW’s has solely traded at a decrease P/E within the Pandemic low and the Nice Recession low

- Already pricing in a recession that is more likely to be one of many mildest in historical past

Why I Belief These Aristocrats And So Can You

These aren’t simply blue-chips; they collectively are Extremely SWANs, as near excellent high quality corporations as exist on Wall Avenue.

(Supply: Dividend Kings Zen Analysis Terminal)

How can we verify that? By evaluating their high quality to the aristocrats themselves.

A lot Greater High quality Than The Dividend Aristocrats

| Metric | Dividend Aristocrats | 5 Aristocrat Bargains | Winner Aristocrats | Winner 5 Aristocrat Bargains |

| High quality | 87% | 92% | 1 | |

| Security | 89% | 94% | 1 | |

| Dependability | 84% | 91% | 1 | |

| Lengthy-Time period Danger Administration Business Percentile | 67%- Above-Common | 70% Good | 1 | |

| Common Credit score Score | A- Steady | A- Steady | 1 | 1 |

| Common 30-12 months Chapter Danger | 3.01% | 3.25% | 1 | |

| Common Dividend Progress Streak (Years) | 44.3 | 48.6 | 1 | |

| Common Return On Capital | 100% | 173% | 1 | |

| Common ROC Business Percentile | 83% | 89% | 1 | |

| 13-12 months Median ROC | 89% | 121% | 1 | |

| Complete | 2 | 9 |

(Supply: Dividend Kings Zen Analysis Terminal)

Ben Graham thought-about a 20+ yr dividend development streak to be an essential signal of wonderful high quality. These aristocrats common nearly 50 years, almost a dividend king portfolio.

Joel Greenblatt is likely one of the best buyers in historical past.

- 40% annual returns for 21 years

He considers return on capital to be his gold commonplace proxy for high quality and moatiness.

- S&P 500 ROC in 2021 14.6%

- Aristocrats 100%

- These aristocrats 173% (12X higher than the S&P 500)

- These aristocrats’ ROC is within the prime 11% of their friends (broad moat)

- Their 13-year median ROC is 121% (steady or enhancing moat)

S&P estimates the typical chapter threat over the following 30 years at 3.25% principally matching the aristocrat’s A- steady credit standing.

And 6 ranking businesses estimate these aristocrats’ long-term risk-management is within the prime 30% of their friends.

Lengthy-Time period Danger Administration That You Can Belief

| Classification | Common Consensus LT Danger-Administration Business Percentile | Danger-Administration Score |

| S&P International (SPGI) #1 Danger Administration In The Grasp Record | 94 | Distinctive |

| Robust ESG Shares | 78 | Good – Bordering On Very Good |

| Overseas Dividend Shares | 75 | Good |

| Extremely SWANs | 71 | Good |

| 5 Aristocrat Bargains | 70 | Good |

| Low Volatility Shares | 68 | Above-Common |

| Dividend Aristocrats | 67 | Above-Common |

| Dividend Kings | 63 | Above-Common |

| Grasp Record common | 62 | Above-Common |

| Hyper-Progress shares | 61 | Above-Common |

| Month-to-month Dividend Shares | 60 | Above-Common |

| Dividend Champions | 57 | Common |

(Supply: DK Zen Analysis Terminal)

The 4.2% yield these aristocrats provide is not simply very secure, it is a number of the most secure high-yield on earth.

| Score | Dividend Kings Security Rating (162 Level Security Mannequin) | Approximate Dividend Minimize Danger (Common Recession) | Approximate Dividend Minimize Danger In Pandemic Stage Recession |

| 1 – unsafe | 0% to twenty% | over 4% | 16+% |

| 2- under common | 21% to 40% | over 2% | 8% to 16% |

| 3 – common | 41% to 60% | 2% | 4% to eight% |

| 4 – secure | 61% to 80% | 1% | 2% to 4% |

| 5- very secure | 81% to 100% | 0.5% | 1% to 2% |

| 5 Aristocrat Bargains | 94% | 0.5% | 1.3% |

| Danger Score | Low-Danger (seventieth trade percentile risk-management consensus) | A- Steady outlook credit standing 3.25% 30-year chapter threat | 20% OR LESS Max Danger Cap Advice (Every) |

(Supply: DK Analysis Terminal)

The common likelihood of those aristocrats chopping their dividends in a traditionally common recession since WWII is roughly 0.5%. The likelihood in a extreme recession (Pandemic or Nice Recession stage) is roughly 1.3%.

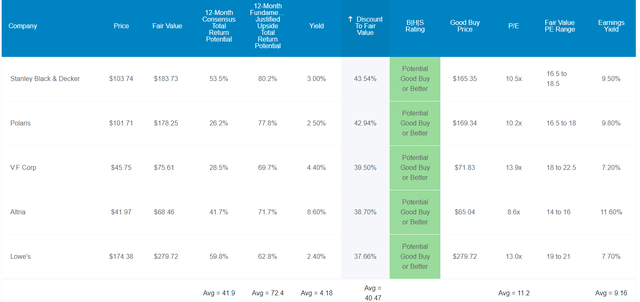

Okay, so now that you just perceive why I personal all of those aristocrats, this is why you would possibly need to purchase them at present.

The Finest Dividend Aristocrat Bargains On Wall Avenue

(Supply: Dividend Kings Zen Analysis Terminal)

The S&P 500 trades at 15.9X ahead earnings, a 6% historic low cost.

These aristocrats commerce at 11.2X ahead earnings, a 41% historic low cost to honest worth.

- The final time the S&P traded at 11.2X earnings was 2008, the height of the Nice Recession

Analysts count on 42% complete returns in simply the following 12 months, and they’re so undervalued {that a} 72% complete return can be justified by fundamentals.

Or to place it one other method, if these aristocrats develop as anticipated and return to honest worth, they might soar 72% and never turn into overvalued.

That is the facility of deep worth aristocrat discount searching in a bear market.

In order that’s why it is doubtlessly price shopping for these aristocrats at present. However this is why they’re price proudly owning for the long run.

Lengthy-Time period Return Fundamentals That Can Assist You Retire In Security And Splendor

(Supply: Dividend Kings Zen Analysis Terminal)

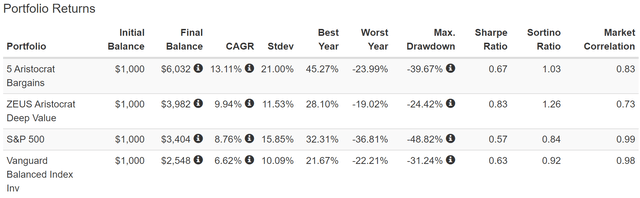

For context, non-public fairness and Cathie Wooden at ARK try to realize 15+% long-term returns.

To do this, they purchase extremely speculative tech corporations or lock up investor cash for 7 to fifteen years with complicated illiquid investments.

OR… you should buy these 5 aristocrats, a number of the world’s finest and 100% liquid corporations.

Not solely do they yield one of many most secure 4.2% yields on earth (2.5X greater than the S&P 500), however they’re rising at 13.1% and analysts count on 17.2% long-term returns.

- On par with the best buyers in historical past

Adjusting the chance of those corporations not rising as anticipated, going bankrupt, and inflation, you’ll be able to realistically count on them to double your cash each 8.4 years.

- vs. 15 years for the S&P 500

| Funding Technique | Yield | LT Consensus Progress | LT Consensus Complete Return Potential | Lengthy-Time period Danger-Adjusted Anticipated Return | Lengthy-Time period Inflation And Danger-Adjusted Anticipated Returns | Years To Double Your Inflation & Danger-Adjusted Wealth | 10-12 months Inflation And Danger-Adjusted Anticipated Return |

| 5 Aristocrat Bargains | 4.2% | 13.06% | 17.2% | 12.1% | 9.6% | 7.5 | 2.50 |

| Nasdaq | 0.9% | 15.9% | 16.8% | 11.8% | 9.3% | 7.8 | 2.43 |

| Worth | 2.7% | 13.3% | 16.0% | 11.2% | 8.7% | 8.2 | 2.31 |

| Excessive-Yield | 3.1% | 12.7% | 15.8% | 11.1% | 8.6% | 8.4 | 2.28 |

| Dividend Progress | 2.0% | 11.5% | 13.5% | 9.5% | 7.0% | 10.3 | 1.96 |

| Dividend Aristocrats | 2.4% | 8.5% | 10.9% | 7.6% | 5.2% | 14.0 | 1.65 |

| REITs | 3.0% | 7.8% | 10.8% | 7.6% | 5.1% | 14.1 | 1.64 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 4.7% | 15.2 | 1.59 |

(Sources: Morningstar, FactSet, YCharts)

Analysts count on these high-yield aristocrats to outperform not simply the S&P and aristocrats over time however each main funding technique, together with the Nasdaq.

What does that doubtlessly imply for you?

Inflation-Adjusted Consensus Complete Return Potential: $1,000 Preliminary Funding

| Time Body (Years) | 7.6% CAGR Inflation-Adjusted S&P Consensus | 8.4% Inflation-Adjusted Aristocrats Consensus | 14.7% CAGR Inflation-Adjusted 5 Aristocrat Discount Consensus | Distinction Between Inflation-Adjusted 5 Aristocrat Discount Consensus Vs S&P Consensus |

| 5 | $1,445.67 | $1,493.29 | $1,987.86 | $542.18 |

| 10 | $2,089.97 | $2,229.92 | $3,951.57 | $1,861.60 |

| 15 | $3,021.42 | $3,329.92 | $7,855.16 | $4,833.74 |

| 20 | $4,367.98 | $4,972.54 | $15,614.92 | $11,246.94 |

| 25 | $6,314.67 | $7,425.45 | $31,040.22 | $24,725.55 |

| 30 | $9,128.95 | $11,088.36 | $61,703.50 | $52,574.55 |

(Supply: DK Analysis Terminal, FactSet)

Analysts and the bond market count on these aristocrats to doubtlessly double the market’s annual inflation-adjusted returns over time.

Meaning a doubtlessly life-changing quantity of wealth compounding.

| Time Body (Years) | Ratio Aristocrats/S&P Consensus | Ratio Inflation-Adjusted 5 Aristocrat Discount Consensus vs S&P consensus |

| 5 | 1.03 | 1.38 |

| 10 | 1.07 | 1.89 |

| 15 | 1.10 | 2.60 |

| 20 | 1.14 | 3.57 |

| 25 | 1.18 | 4.92 |

| 30 | 1.21 | 6.76 |

(Supply: DK Analysis Terminal, FactSet)

These aristocrats are anticipated to doubtlessly outperform the S&P and Nasdaq by 2X over the following 10 years, nearly 4X over the following 20, and presumably as a lot as 7X over the following 30 years.

OK, so the world’s finest corporations, buying and selling at a 40% low cost and 11X earnings, and the potential to double the market’s actual returns for years and even a long time.

Sounds nice in principle. However what proof do we now have that these aristocrats can ship something near 17% long-term returns?

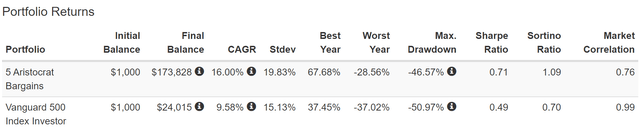

Historic Returns Since October 1987 (Annual Rebalancing)

The longer term would not repeat, but it surely usually rhymes – Mark Twain

Previous efficiency isn’t any assure of future outcomes, however research present that blue-chips with comparatively steady fundamentals over time provide predictable returns based mostly on yield, development, and valuation imply reversion.

Financial institution of America

So how did these aristocrats do over the past 35 years, when 97% of the returns have been the outcomes of fundamentals, not luck?

(Supply: Portfolio Visualizer Premium)

(Supply: Portfolio Visualizer Premium)

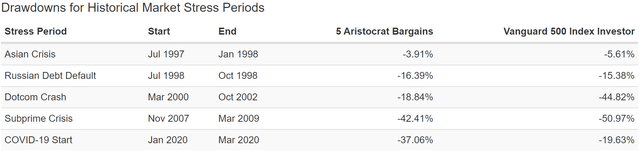

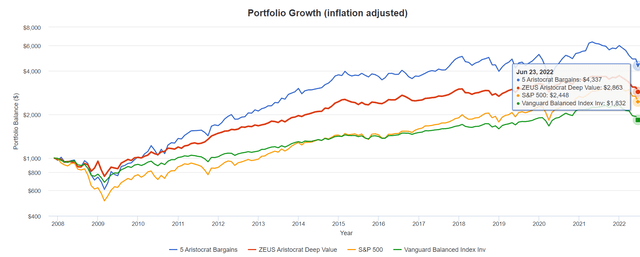

Together with the 24% decline in 2022 (the rationale these aristocrats are such bargains at present) these Extremely SWANs have delivered 16% annual returns over the past 35 years.

- 174X returns

- 69X inflation-adjusted returns

- 7X higher than the S&P 500

- What analysts count on sooner or later

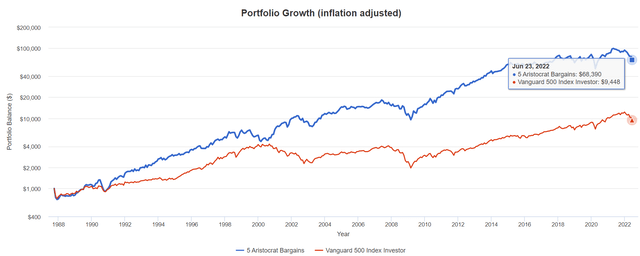

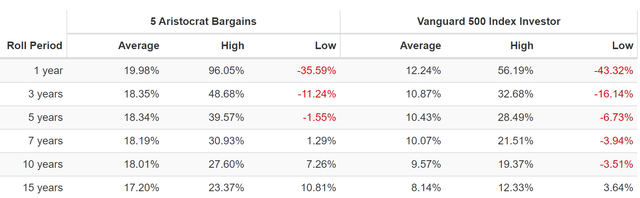

What if we clean out for bear markets?

(Supply: Portfolio Visualizer Premium)

What do analysts count on sooner or later? 17.2% annual returns. What did these aristocrats ship over the past 35 years? Common 15-year rolling returns of 17.2%.

That is double the S&P 500’s 8.1% return. Analysts count on 2X the market’s returns sooner or later, similar to they’ve delivered for the final 35 years.

From bear market lows, they’re able to as a lot as 23% annual returns for the following 15 years.

- 23.3X return in 15 years

- vs. the S&P 500’s finest 15-year return from bear market lows of 5.7X

And what about revenue development?

| Portfolio | 1988 Earnings Per $1,000 Funding | 2022 Earnings Per $1,000 Funding | Annual Earnings Progress | Beginning Yield | 2021 Yield On Price |

| 5 Aristocrat Bargains | $27 | $6,952 | 17.73% | 2.7% | 695.2% |

(Supply: Portfolio Visualizer Premium)

How does 18% annual revenue development sound? That is on par with what the Nasdaq has delivered over the past 20 years however from a bunch of corporations that yields 4X as a lot.

What in regards to the future? Here is what analysts count on.

| Analyst Consensus Earnings Progress Forecast | Danger-Adjusted Anticipated Earnings Progress | Danger And Tax-Adjusted Anticipated Earnings Progress | Danger, Inflation, And Tax Adjusted Earnings Progress Consensus |

| 19.1% | 13.3% | 11.3% | 8.8% |

(Supply: DK Analysis Terminal, FactSet)

Analysts count on 19% annual revenue development. Adjusting for the chance of those corporations not rising as anticipated, inflation, and taxes you’ll be able to fairly count on 8.8% long-term actual revenue development.

Now examine that to what they count on from the S&P 500.

| Time Body | S&P Inflation-Adjusted Dividend Progress | S&P Inflation-Adjusted Earnings Progress |

| 1871-2021 | 1.6% | 2.1% |

| 1945-2021 | 2.4% | 3.5% |

| 1981-2021 (Trendy Falling Price Period) | 2.8% | 3.8% |

| 2008-2021 (Trendy Low Price Period) | 3.5% | 6.2% |

| FactSet Future Consensus | 2.0% | 5.2% |

(Sources: S&P, FactSet, Multipl.com)

What a couple of 60/40 retirement portfolio?

- 0.5% consensus inflation, threat, and tax-adjusted revenue development.

In different phrases, these 5 dividend aristocrat bargains provide:

- Nearly 2.5X the market’s yield (and a a lot safer yield at that)

- Nearly 4.5X its long-term inflation-adjusted consensus revenue development potential

- 17X higher long-term inflation-adjusted revenue development than a 60/40 retirement portfolio

That is the facility of dividend aristocrat discount searching in a bear market.

Backside Line: It is Time To Again Up The Truck On These 5 Dividend Aristocrat Bargains

Do not get me fallacious, I am not saying that if shares hold falling, these 5 aristocrat bargains cannot get cheaper.

Dividend security and elementary high quality have zero to do with short-term worth volatility.

(Supply: Portfolio Visualizer Premium)

In periods of market turmoil, the world’s most secure dividend blue-chips continue to grow their dividends however they’ll fall rather a lot.

(Supply: Portfolio Visualizer Premium)

(Supply: Portfolio Visualizer Premium)

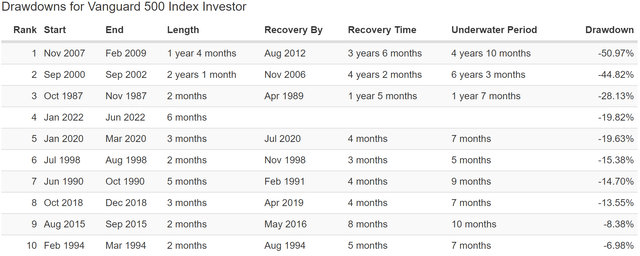

However whereas they are often extremely unstable at occasions, additionally they are likely to get better quicker.

After the Nice Recession, once they fell 47%, they recovered to new file 2 years sooner than the S&P 500.

How To Flip These 5 Aristocrat Bargains Into An Extremely Sleep Properly At Evening Retirement Portfolio

- 33% aristocrat bargains (6.67% every)

- 33% Vanguard high-yield ETF (VYM)

- 28.33% lengthy bonds (EDV)

- 5% money (VGSH)

Via a prudent allocation to money and bonds, you’ll be able to flip these 5 Extremely SWAN aristocrat bargains right into a recession-optimized extremely sleep nicely at evening retirement portfolio.

- The Zen Extraordinary Extremely SWAN Deep Worth Aristocrat retirement portfolio

- ZEUS Deep Worth Aristocrat

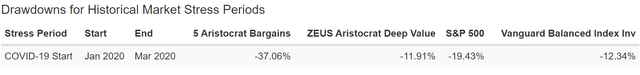

Historic Returns Since December 2007 (Annual Rebalancing)

(Supply: Portfolio Visualizer Premium)

One which traditionally has crushed the market with double-digit returns, however with 30% much less annual volatility, and half the height decline of the S&P in the course of the 2nd larger market crash in US historical past.

- 7% smaller decline than a 60/40 retirement portfolio in the course of the Nice Recession

- However with 3.4% increased annual returns

- 22% higher unfavorable volatility-adjusted returns than the aristocrats alone

- 37% higher unfavorable volatility-adjusted returns than a 60/40

- 50% higher negative-volatility adjusted returns than the S&P 500

(Supply: Portfolio Visualizer Premium)

This ZEUS deep worth aristocrat portfolio delivered 56% higher inflation-adjusted returns than a 60/40 and with smaller peak declines in even essentially the most excessive market crashes.

Market and 60/40 beating returns with a lot increased and safer yield and decrease volatility? Now we’re cooking with gasoline.

(Supply: Portfolio Visualizer Premium)

By including money and bonds and a high-yield ETF, we constructed a splendidly diversified and prudently risk-managed Extremely SWAN portfolio. One which lower the height pandemic decline by 66%.

- Decrease declines than a 60/40, the Nasdaq (-13%), the S&P and the aristocrats alone

What about future volatility?

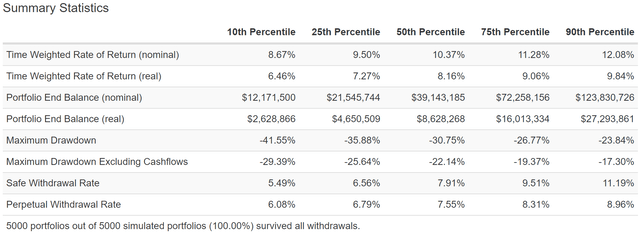

75-12 months Monte Carlo Simulation: Stress Testing The Future

- 4% annual withdrawal price

- Submit-tax returns, prime tax bracket (for conservatism)

- $510K beginning worth (common retired couple’s financial savings)

(Supply: Portfolio Visualizer Premium)

Together with a 4% annual withdrawal price (2.6% is the secure withdrawal price for the 60/40 based on FactSet), this portfolio is 80% statistically more likely to ship 6.5% to 9.8% long-term inflation-adjusted returns.

- 80% more likely to undergo 17% to 29% bear markets sooner or later (not together with withdrawals)

- 24% to 42% bear markets together with withdrawals

- A secure withdrawal price of 5.5% to 11.2%

Are you frightened about rising rates of interest, inflation, recession, and one of the unstable inventory markets we have ever seen?

Do not you want you would belief your hard-earned financial savings to consultants who’ve an impeccable observe file of rising very secure dividends in all financial and market situations, for over 35 years?

Properly then LOW, SWK, PII, VFC, and MO is perhaps simply what you are on the lookout for.

- Very secure 4.2% yield

- A- common credit standing

- seventieth percentile long-term threat administration

- Greater high quality and safer than the dividend aristocrats

- 13% consensus long-term development

- 17% consensus long-term complete return potential vs. 17% returns since 1987

- 41% undervalued

- 11.2X earnings

- Analysts count on 42% complete return inside a yr

- 72% complete return can be justified by fundamentals

Whether or not you purchase these aristocrats individually, collectively, or mixed with a prudent allocation to different ETFs, money, and bonds, the purpose is obvious.

Fortunes are made in bear markets.” – Todd Sullivan

“Be grasping when others are fearful.” – Warren Buffett

“Luck is what occurs when preparation meets alternative.” – Seneca

If you wish to retire wealthy and keep wealthy in retirement, you must take cost of your monetary future and make your individual luck on Wall Avenue.

And by specializing in security and high quality first, and prudent valuation and sound threat administration all the time, retiring in security and splendor turns into a perform of time, persistence, and self-discipline… not luck.