Michael Fischer

Medical cannabis firm Tilray Brands, Inc. (NASDAQ:TLRY) has just reported its fiscal Q2 earnings results, as Seeking Alpha has reported here. Although pre-market price actions can be fickle, the stock is up substantially as of this writing, suggesting that the market likes the report. But let’s take a deeper dive in the latest edition of The Good, The Bad, and The Ugly.

The Good

- Tilray highlighted its cost savings program in the fiscal Q2 earnings report, and this showed up in the profit margin and improvement in cash position. Overall, the company is on track to save $30 to $35 million annually, as the HEXO integration matures.

- It is a common trend for the “sin” companies to get into other “sin” products. For many years, we’ve seen Tobacco companies trying to get into beverages and reduced-nicotine products. Similarly, Tilray has made a variety of beverage acquisitions so far, and the company is beginning to reap the benefits. In Q2, Tilray’s beverage revenues more than double YoY as highlighted here by Seeking Alpha. More importantly, the company is now positioned to become a top 15 player in the alcohol and beverage market in the U.S.

- Tilray is spreading its revenue stream nicely across 4 different segments. In Q2 2024, Cannabis, Distribution, Beverage, and Wellness brought in 34%, 35%, 24%, and 7% of the total revenue respectively. In Q2 2023, these numbers were 34%, 42%, 15%, and 9%, respectively, indicating a more spread out revenue stream is likely to be in place as the company matures.

The Bad

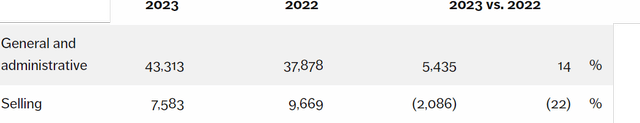

- Despite touting cost savings, Tilray’s Q2 saw a 14% jump in general and administrative expenses. The fact that selling expense went down nearly 1/4th YoY could be interpreted alternatively as a good sign or bad. It may be good if the synergies from acquisition is leading the company to spend less on selling, but bad if it indicates the company is slowing down on efforts to sell.

TRLY Expenses (ir.tilray.com)

- Tilray has almost quadrupled its shares outstanding in the last 5 years, and it doesn’t appear to be slowing anytime soon. Shares outstanding according to the Q2 report stands at about 733 million and that means investors have been further diluted away given the 691 million shares at the end of the previous quarter.

The Ugly

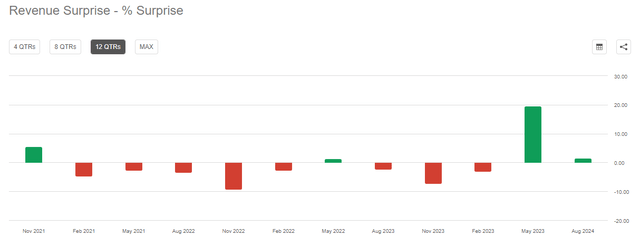

- The revenue miss by $1.03 million marks the 9th quarter in the last 12 where the company has missed expectations. A company in a growth spurt is generally expected to be erratic when it comes to EPS, but revenue is always the stronger suit at this stage of a company’s life. This brings into question whether the acquisitions made by the company are bringing on the expected results and if expectations should be tempered going forward.

TLRY Rev Surprise (Seekingalpha.com)

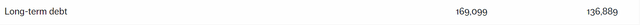

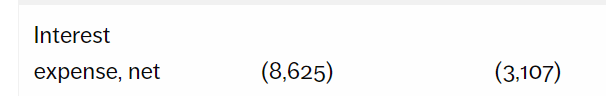

- Tilray has increased its long-term debt by nearly 25% in the last 6 months, as the number has ballooned from about $137 million at the end of May 2023 to nearly $170 million at the end of November 2023. This is not the best of times to be increasing or refinancing the debt and the impact is immediate. Tilray’s interest expense in Q2 more than doubled on a YoY basis, as shown below.

TLRY Debt (ir.tilray.com) Interest Expense (ir.tlry.com)

- Tilray guided for a high-range of $78 million in FY 2024 EBITDA. That means the stock is trading at more than 22 times forward EBITDA with the company’s market cap of $1.73 billion. That’s egregious overvaluation, to put it mildly.

Conclusion

“If you can’t find the sucker at the table, you’re it.”

“If you are not paying for it, you become the product.”

Those two adages apply to many stocks as well, but with a slight change to read “If you don’t who/what is making your company stay afloat, you’re it.” Tilray has been diluting away like there is no tomorrow, and the exponential increase in revenue has not really reflected on the bottom line yet. I doubt they will reflect any time soon.

While Tilray Brands, Inc.’s fiscal Q2 has some strings that bulls could hang on to, like the impressive beverage revenue and some discipline in cost-cutting, the negatives stand out as well. These include the enormous increase in debt recently and dilution history. I suggest the average investor to stay out of this stock. I am rating Tilray Brands, Inc. stock a “Hold” just because I don’t have a “no action” option.

Disclosure: In interest of full disclosure, I own a few shares in SNDL Inc. (SNDL) as a gamble.