Klaus Vedfelt/DigitalVision via Getty Images

In my writing, I tend to focus on dividend-paying ETFs with strong yields, returns, and buy ratings. I sometimes write about weaker ETFs, to warn investors about their shortcomings and provide suitable alternatives. In this article, I’ll give a quick overview of three such ETFs.

HYG – Expensive High-Yield Bond ETF

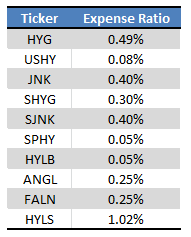

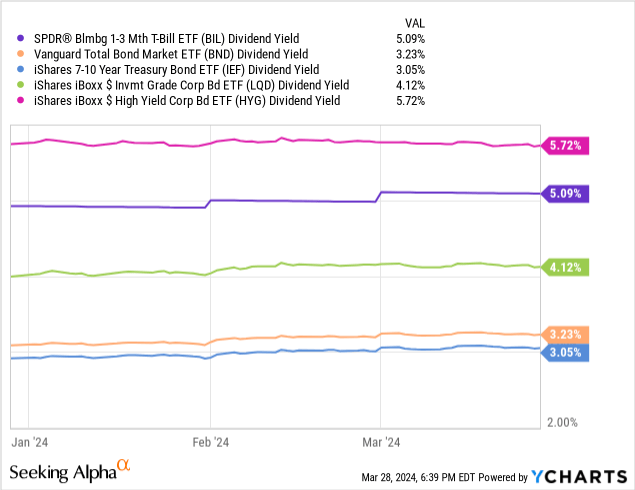

The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) is the largest high-yield bond ETF in the market, with $16.5B in assets. HYG is also one of the most expensive high-yield bond ETFs, with a 0.49% expense ratio. It is around twice the industry average, with several ETFs offering sub 0.10% expenses. Of the top ten ETFs in this sector, only the First Trust Tactical High Yield ETF (HYLS) is more expensive, with a 1.02% expense ratio.

Seeking Alpha – Table by Author

Expenses directly reduce HYG’s dividend yield and returns, two significant, straightforward negatives for the fund and its shareholders.

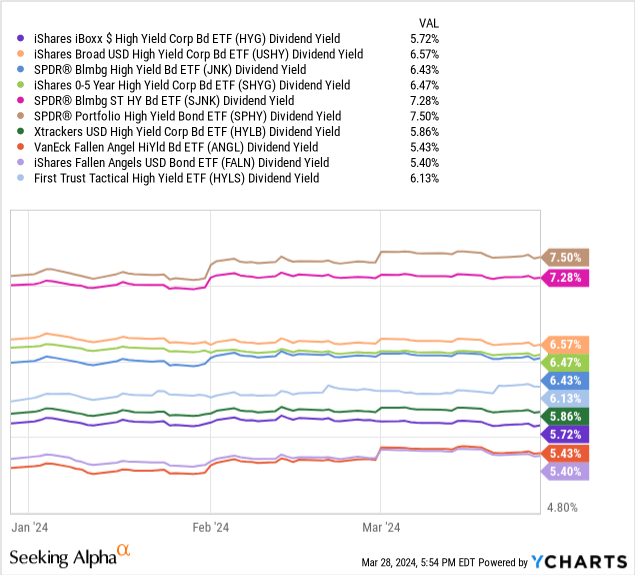

Specifically, HYG’s current 5.7% yield is quite a bit lower than average. Only the iShares Fallen Angels USD Bond ETF (FALN) and the VanEck Fallen Angel High Yield Bond ETF (ANGL) yield less than HYG, but the strategies employed by those funds, and their returns, are much stronger.

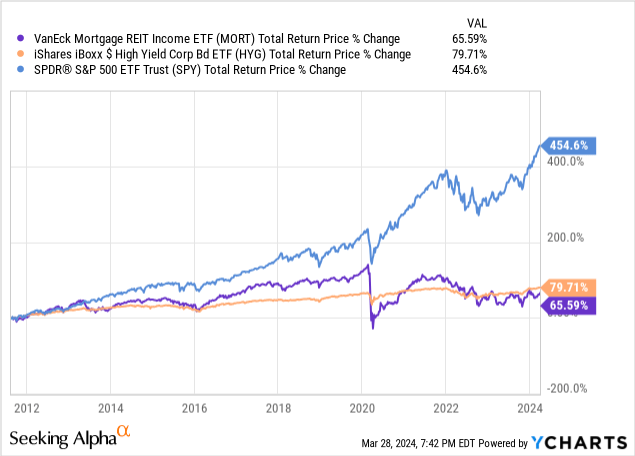

Data by YCharts

HYG’s total returns are much weaker than average too, although a couple of other funds have broadly comparable performance. HYG’s high expenses are responsible for a significant portion of the fund’s underperformance.

Data by YCharts

As HYG is a simple index ETF, it provides no other meaningful benefit or advantage that could counteract its expenses. Leveraged funds might generate excess income, for instance, but HYG does not. Actively-managed funds might generate alpha or excess returns, but HYG cannot. Some more targeted index funds might focus on best-performing securities, such as ANGL and FALN, but HYG does not.

Considering the above, I believe there is basically no reason to choose the expensive HYG over its cheaper peers. Instead of HYG, investors could buy the SPDR Portfolio High Yield Bond ETF (SPHY), with a much lower 0.05% expense ratio, and a much higher 7.5% dividend yield. Returns are stronger too, as expected. Investors also have the choice of ANLG and FALN. Both are somewhat cheaper, with 0.25% expense ratios. Both have slightly lower 5.4% dividend yields, but much stronger returns.

BIL – Simple T-Bills ETF

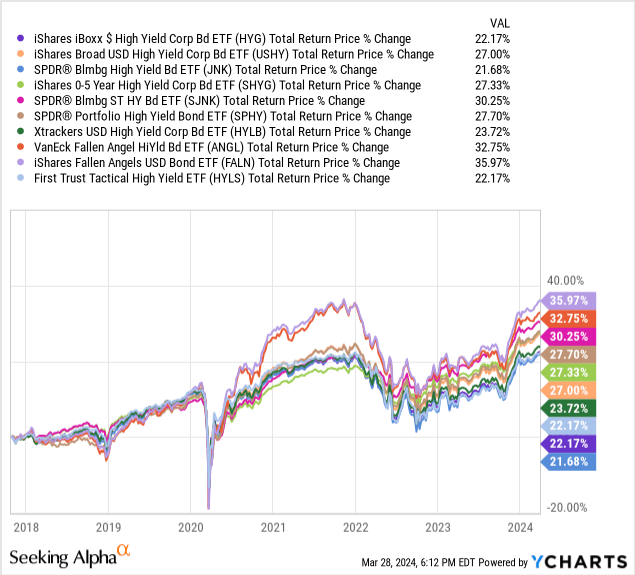

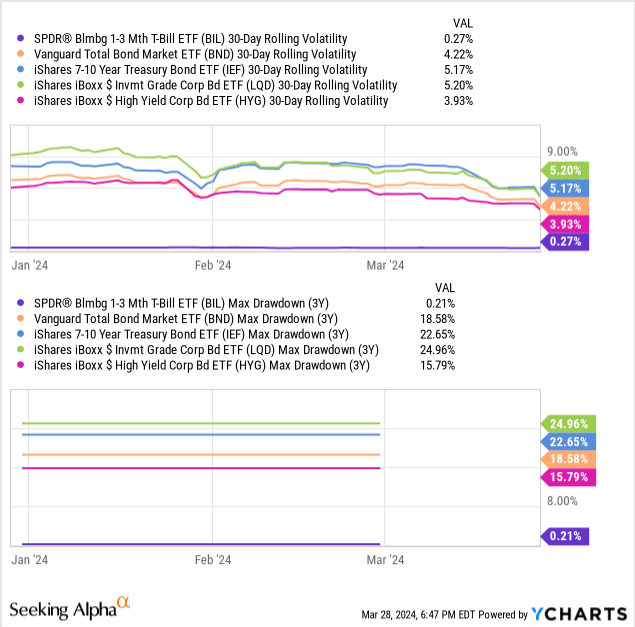

The SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) is a simple index ETF, with all the characteristics and benefits that entails. Specifically, Fed hikes have caused t-bill yields to spike, with the fund itself yielding 5.1%, more than most other bonds with the exception of high-yield bonds.

Data by YCharts

Risk, volatility, and drawdowns are quite minimal too. In practice, most of the fund’s (tiny) volatility is due to temporarily retaining income within the fund, and then distributing it to shareholders.

Data by YCharts

BIL’s 0.14% expense ratio is about average for a simple fixed-income ETF. Some investors might prefer to build their own personal t-bill portfolio to avoid these expenses, but these do not seem terribly expensive either way.

In my opinion, BIL has no significant risks or negatives. I still think investors should avoid the fund for a simple reason: the Alpha Architect 1-3 Month Box ETF (BOXX) does everything BIL does, but better.

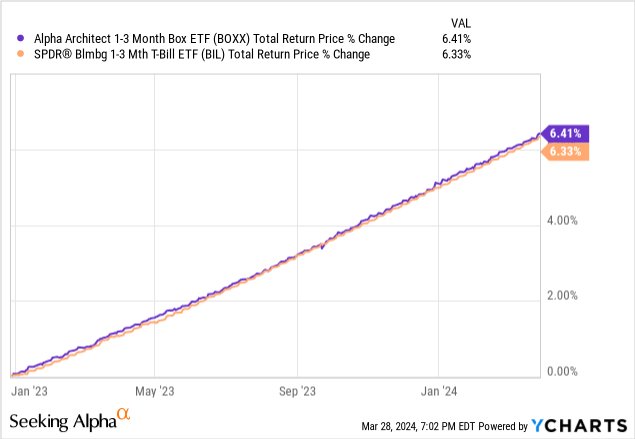

BOXX achieves comparable returns to t-bills through equity options. An in-depth explanation of these is outside the scope of this article but see here for one. BOXX’s returns have almost identical to those of BIL since inception, as expected.

Data by YCharts

BOXX does have two advantages relative to BIL.

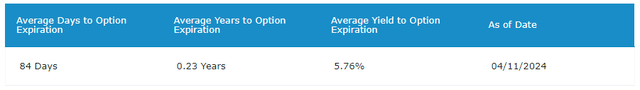

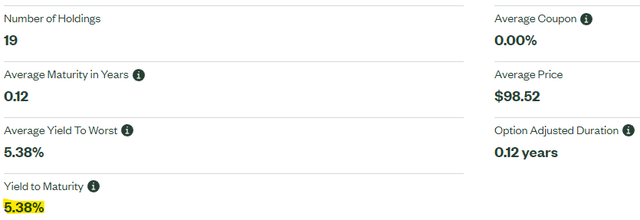

First, BOXX tends to have a marginally higher yield and return. Right now, the fund sports a yield to option expiration of 5.8%, compared to BIL’s 5.4% yield to maturity. Spreads are generally tighter, but positive.

BOXX BIL

Second, the fund has some potential tax benefits. Specifically, strategy should not generate taxable events for either the fund or its shareholders, with the fund retaining any income and returns within itself, and with no dividend payments.

Seeking Alpha

Investors in BOXX can choose to hold the fund long-term, deferring taxes until a moment of their choosing. Doing so could, potentially, result in tax savings.

BOXX’s marginally higher, tax-deferred 5.8% yield seems strictly superior to BIL’s. As such, I would much sooner invest in BOXX over BIL.

MORT – Risky mREIT ETF

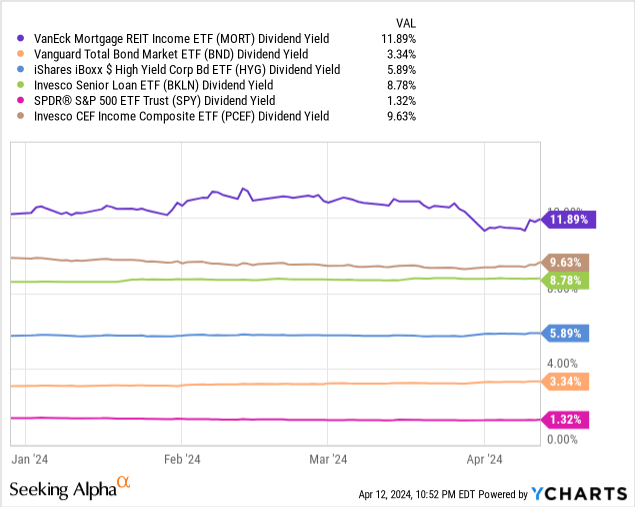

The VanEck Mortgage REIT Income ETF (MORT) invests in mREITs, financial institutions focusing on leveraged mortgage investments. These institutions tend to sport strong dividend yields, with the fund itself yielding a whopping 11.9%. MORT yields more than most bonds, high-yield bonds, senior loans, equities, even CEFs, and by very healthy margins.

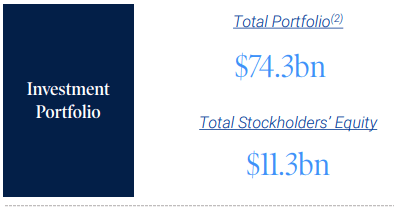

mREIT leverage ratios are also generally quite high, with Annaly Capital Management (NLY) managing a $74.3B portfolio with only $11.3B in equity. In other words, for every dollar of equity, the company has six dollars of debt, a staggering amount.

Annaly

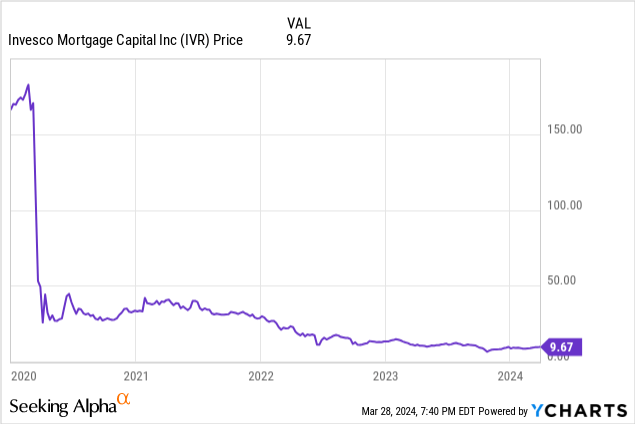

Annaly’s massive debt load boosts the company’s dividends, but also its risk. Default rates of 10% would cause significant issues for the fund, default rates a bit higher would mean immediate insolvency, and likely bankruptcy. These are not idle threats, with mREITs do occasionally imploding, much more so than average. As an example, the Invesco Mortgage Capital (IVR) saw massive losses during early 2020. Due to their magnitude, losses were effectively irrecoverable, with share prices still massively down from pre-pandemic trends.

Data by YCharts

In my opinion, mREITs are sometimes excessively leveraged, so significant investments in these, especially as an asset class, are unwise. Smaller, targeted investments in the best of these might make more sense. MORT focuses on the latter, making the fund a broadly sup-par investment. MORT has seen weaker returns than equities and high-yield corporate bonds since inception, and with significantly greater risk and volatility, in-line with expectations.

Data by YCharts

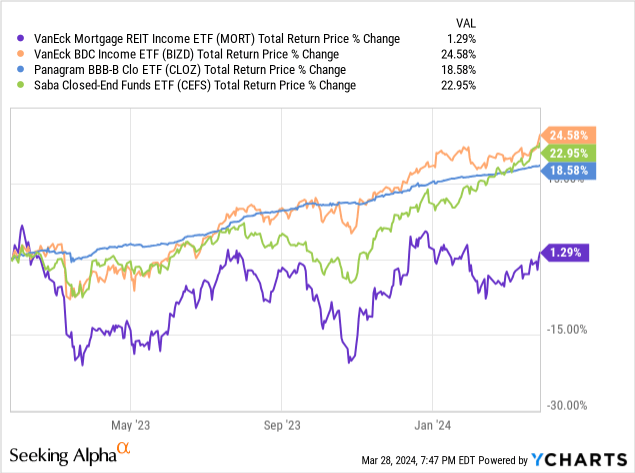

In my opinion, investors looking for particularly strong yields have much better alternatives to MORT.

The VanEck BDC Income ETF (BIZD), focusing on BDCs, offers a growing 10.9% yield. Although it yields a bit less than MORT, returns are much stronger.

The Panagram BBB-B Clo ETF (CLOZ), focusing on BBB-BB CLO tranches, offers a lower 9.4% yield. Returns are higher, too.

Finally, the Saba Closed-End Funds ETF (CEFS), holding a diversified portfolio of CEFs, has a somewhat lower 8.3% yield, but also higher returns.

The funds above have lower yields, but much stronger performance and dividend growth track-records.

Data by YCharts

Conclusion

HYG, BIL, and MORT are three dividend-paying ETFs. Although each fund has its advantages, each has stronger alternatives, and so I would not be investing in any of these funds.