For the primary time, Northern Virginia will not be the preeminent location for information heart absorption, based on a brand new report from CBRE.

Atlanta is the brand new chief within the quantity of area leased in comparison with the quantity vacated, reaching 705.8 megawatts of constructive internet absorption in 2024, based on the agency’s North American information heart developments report.

Final yr, Atlanta absorbed practically 39 occasions extra space than at year-end 2023 (18 MW). The market recorded the best quantity of colocation leasing exercise ever, spurred by GPU-as-a-Service tenants.

GPUaaS is a cloud-based service that enables on-demand entry to high-performance graphics processing models, or GPUs.

A colocation information heart facility permits companies to lease area to accommodate their servers, networking tools and storage units. It would allow them to position their {hardware} in a third-party information heart whereas sustaining possession and management over their tools, in contrast to a cloud service the place the supplier owns the infrastructure.

Astounding numbers

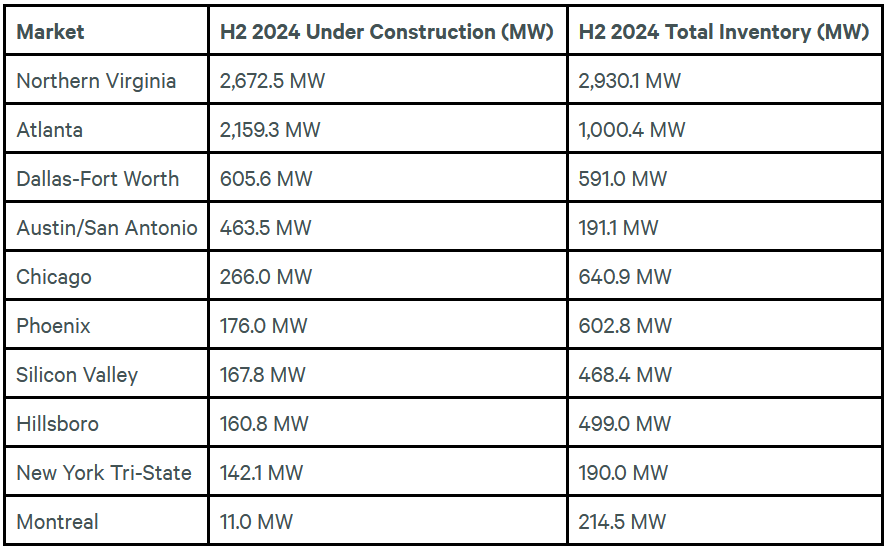

The information heart stock numbers within the Atlanta market are astounding. Final yr, it elevated by 222 % to 1,000.4 MW because the market accommodated demand by ramping up information heart area below building.

Within the yr’s second half, the market noticed 2,159.3 MW below building, representing a 195 % annual improve in under-construction totals. That tops the eight main North American information heart markets in CBRE’s report.

As for brand spanking new developments out there, AWS plans to speculate $11 billion in new information heart growth. In the meantime, Lincoln Property Co.’s acquisition of a DXC information heart reveals it plans to redevelop it right into a 30 MW colocation facility.

Ryan Mallory, Flexential’s COO, advised Business Property Government that Atlanta is rising as the brand new “information heart alley.”

GA Energy/Southern Co. not too long ago introduced the Vogtle reactors on-line, delivering roughly 4GW of energy capability and unlocking important growth potential, Mallory stated.

READ ALSO: Information Middle Demand Retains Surging Regardless of Challenges

“Moreover, Georgia has carried out strong gross sales tax incentives to draw high-paying jobs to communities internet hosting information facilities,” he added. “This highly effective mixture of ample energy, out there land and supportive communities has firmly positioned Georgia on the know-how map.”

Nonetheless, Georgia will not be the one market experiencing this surge.

In Texas, markets equivalent to Dallas-Fort Value, Austin and San Antonio have grown remarkably previously 24 months, based on Mallory.

“These cities profit from dependable energy, a positive tax atmosphere, a high-quality workforce and communities that welcome the information heart trade—a sector recognized for its high-paying, low-impact nature,” he stated.

Total, the distinctive high quality of the product and the provision of land and energy differentiate the U.S. market, Mallory added. “With traditionally high-growth areas slowing or pausing information heart growth, there has by no means been a greater time to be within the information heart enterprise in North America.”

CBRE stated tax incentives, out there land and better energy accessibility make markets equivalent to Charlotte, Northern Louisiana and Indiana potential progress areas for hyperscale and colocation suppliers.

This, regardless of some saying that Deep Search may curb information heart demand.

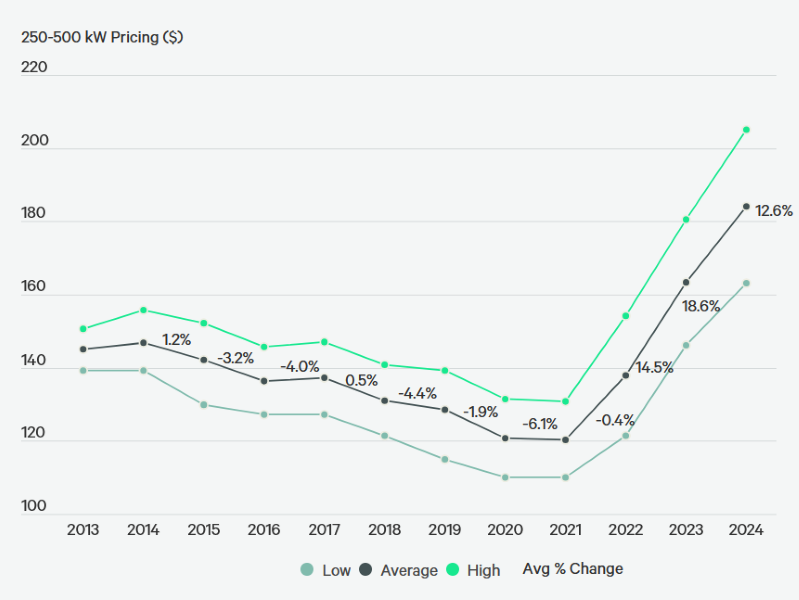

As for funding, CBRE reported that the common sale worth elevated year-over-year. Eleven asset sale transactions exceeded $90 million, whereas 5 surpassed $400 million.

AI impacts information heart venture places

“Because the demand for information facilities has elevated considerably, we now have seen a shift in the place these tasks are being developed,” Todd Johnson, director of actual property growth at Ryan Cos., advised CPE.

“Historically, information facilities had been located close to metropolitan areas to reduce latency, however newer AI fashions have diminished the necessity for this proximity. Now, information facilities are being developed in additional distant places the place there may be ample energy provide.”

In search of extra power

Avison Younger’s information heart market report for the fourth quarter of 2024 signifies that information heart stock continues to hit file highs within the U.S., with commissioned colocation energy increasing practically 50 % over the earlier 12 months. But, emptiness charges stay at historic lows, at simply 1.6 %.

In 2024, CBRE said that North America doubled the information heart provide below building in comparison with the earlier yr to a file 6,350.1 megawatts. This can be a 12-fold improve from the 456.8 MW below building in 2020.

Given this progress, the power wanted to energy these belongings has develop into a spotlight.

As energy era and transmission timelines proceed to stretch with rising demand, extra information heart builders are contemplating self-generation as a short lived complement or a long-term answer, based on Howard Huang, a market intelligence analyst with Avison Younger.

“Pure fuel is gaining traction attributable to its abundance, affordability and sooner deployment in comparison with ready on grid transmission whereas sidestepping lots of the limitations of photo voltaic and wind.”

Andrew Batson, head of U.S. Information Middle Analysis for JLL, advised CPE that the North American information heart market reached unprecedented demand ranges in 2024, with emptiness charges plummeting to file lows amid insatiable tenant demand and restricted provide.

JLL’s analysis discovered that almost all markets have doubled or tripled since 2020.

“Energy availability stays the first problem, with common wait occasions for grid connections extending to 4 years in most markets,” Batson stated.

“Consequently, information heart growth is increasing into new territories searching for energy, with rising markets seeing elevated exercise. In 2024, AI represented about 15 % of knowledge heart workloads; by 2030, it may develop to 40 %. AI can be a key supply of progress for the sector.”