JHVEPhoto

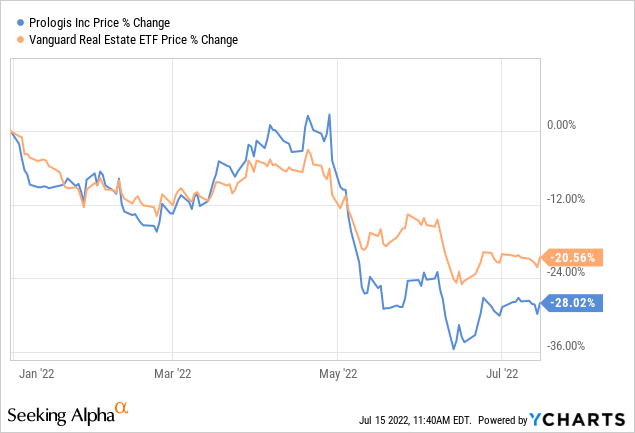

To date 2022 has been a troublesome yr for shares of Prologis (NYSE:PLD), down by virtually a 3rd. Traders shouldn’t get overly involved in our opinion, on condition that a lot of the drop may be defined by normal weak spot in the true property sectors, as evidenced by the sharp drop within the Vanguard Actual Property ETF (VNQ). After all, it didn’t assist that Prologis acquired slightly forward of itself when it comes to valuation, and that it paid prime greenback for Duke Realty (DRE). In any case we consider shares at the moment are much more enticing, and we’ll analyze the valuation and the basics of the corporate.

DukeRealty Acquisition

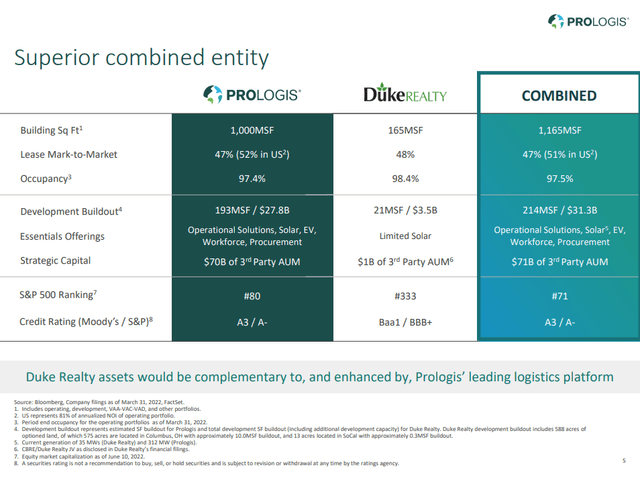

Was the DukeRealty acquisition a catastrophe? We don’t suppose so. In our opinion Prologis purchased good property at a full-price, probably not producing a lot worth even supposing the mixed entity ought to profit from Prologis’ decrease value of capital, because of its superior credit standing, and that there are some G&A financial savings and working leverage advantages.

Prologis Investor Presentation

Financials

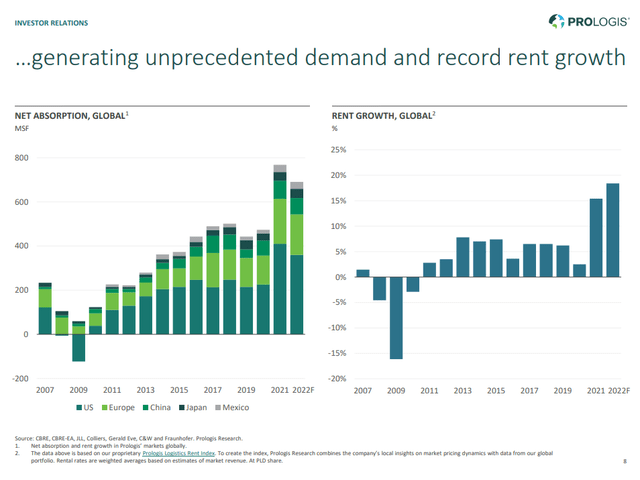

One cause why we don’t suppose Prologis traders ought to get too involved in regards to the share value drop is that fundamentals stay very stable. Web absorption in Prologis’ markets stays very excessive, leading to spectacular hire development. Such ranges of hire development bode properly for NOI development and occupancy ranges.

Prologis Investor Presentation

In truth demand is so sturdy that on the present absorption price, accessible area within the U.S. would dry up in 16 months.

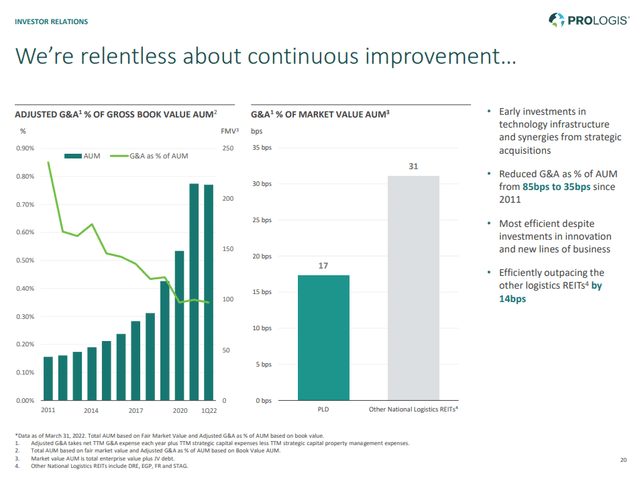

On the identical time, Prologis continues to search out methods to enhance its effectivity, driving G&A as a proportion of property below administration to document lows. Prologis is sort of 2x as environment friendly as its common peer.

Prologis Investor Presentation

Progress

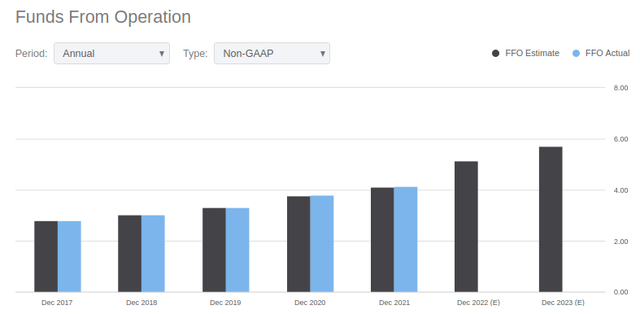

Progress in funds from operation per share has been spectacular, rising virtually 50% within the final 4 years. That may be a CAGR of ~10%, which explains why Prologis has delivered such excellent returns to its shareholders over the previous couple of years. For 2022 Prologis is anticipated to ship one other large bounce in FFO per share to ~$5.15.

Searching for Alpha

Stability Sheet

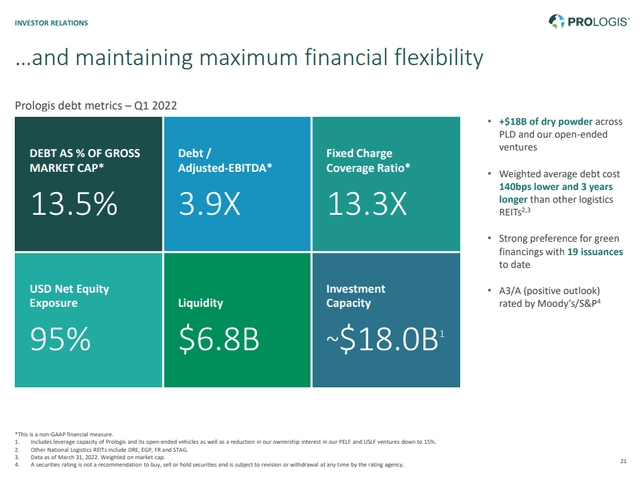

Because of its sturdy credit standing of A3/A- (constructive outlook) and robust ESG practices that permit the corporate to entry inexperienced financings, Prologis has a a lot decrease weighted common debt value than most of its different logistics opponents. Its stability sheet metrics are fairly sturdy, for instance debt/EBITDA stays comparatively low at 3.9x, Mounted Cost Protection Ratio is kind of excessive at 13.3x, and liquidity is a wholesome $6.8 billion.

Prologis Investor Presentation

Capital Returns

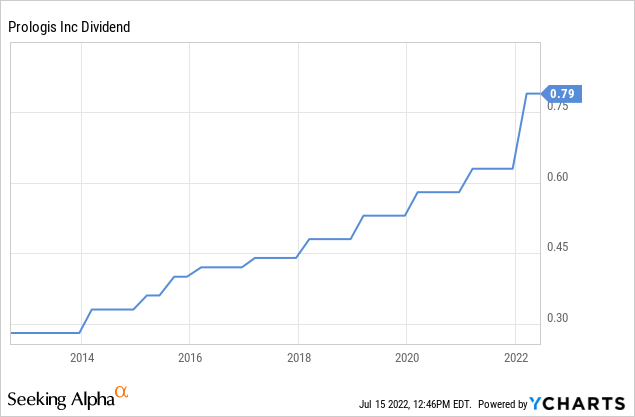

Reflecting the sturdy fundamentals, Prologis just lately made an enormous improve to its quarterly dividend to $0.79 per share. At present costs of ~$120 this implies a yield of ~2.6%. This isn’t even near the very best dividend an investor can at present get in a stable REIT, however it is very important do not forget that Prologis has been elevating its dividend by ~10% CAGR. If it could possibly proceed to take action for a lot of extra years, traders may very well be enticing complete returns.

Valuation

We estimate a web current worth per share of $115, utilizing a ten% low cost price, common analyst earnings estimates for the subsequent three years, and an 11% earnings development thereafter till 2032, after which we use a terminal development price of three%. Our estimated honest worth may be very near the present share value. This leads us to consider that shares are at present pretty valued, and priced to ship complete returns for shareholders within the excessive single digits to low double digits.

| EPS | Discounted @ 10% | |

| FY 22E | 5.15 | 4.68 |

| FY 23E | 5.73 | 4.74 |

| FY 24E | 6.07 | 4.56 |

| FY 25E | 6.74 | 4.60 |

| FY 26E | 7.48 | 4.64 |

| FY 27E | 8.30 | 4.69 |

| FY 28E | 9.21 | 4.73 |

| FY 29E | 10.23 | 4.77 |

| FY 30E | 11.35 | 4.81 |

| FY 31E | 12.60 | 4.86 |

| FY 32 E | 13.99 | 4.90 |

| Terminal Worth @ 3% terminal development | 199.84 | 63.67 |

| NPV | $115.66 |

Dangers

The principle danger we see with Prologis is that of an overbuilding of logistics amenities by the trade, in the event that they over estimate demand that fails to materialize. Prologis has been capable of develop funds from operation in a short time partly because of rising rents, which may reverse ought to the trade overbuild capability.

Conclusion

Shares of Prologis have misplaced a couple of third of their worth for just a few causes, none of which we discover significantly worrisome. One is that actual property generally has gone down as evidenced by the Vanguard Actual Property ETF VNQ. One other particular cause for Prologis is that it acquired slightly overvalued, however we now consider shares are pretty valued once more. Lastly, some analysts disliked the DukeRealty acquisition. We don’t consider it was significantly enticing, however we don’t consider that worth was destroyed for Prologis shareholders both. All in all we see the worth decline as a wholesome correction that has now priced shares to ship excessive single digits to low double digits returns, so long as the trade doesn’t overbuild logistics capability.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.