Vertigo3d

What if I was to tell you an unregulated industry was met with a high volume of inexperienced “investors”? Doesn’t sound like the dream matchup does it? I documented stories in previous articles a number of months ago about meeting people from all walks of life who had mentioned they had got into crypto but in reality, I have no facts of how things ended for them so I can only hope well, but generally, in these situations, history has told us that is not the case.

On the other hand, when Bitcoin (BTC-USD) was circling around the $17-$23K region for a long period of time, I did say it was going lower. This also may not have been the case as I do not own a crystal ball but I do know my technicals. And the region it had potentially bottomed off technically didn’t add up. In bearish cases, it can be slightly more complex to exactly decipher the outcome of a wave pattern as they can at times, work differently to bullish wave patterns. Buy low sell high comes to mind and therein lies one reason, a financial product can be bought up at any stage if the buyer with enough buying power and insight or courage can essentially turn a market around where others follow.

Bullish waves have generally been bought low and without coining a phrase like “Let the winners run”, there is some truth to the aforementioned cheesy line. As prices are going up investors want to stay for the long term and traders may see no need to sell in a calm market so bullish waves have generally more of a chance of completing than their bearish counterparts.

In Bitcoin’s case, I was technically forced to make a call as where it had appeared to be “bottoming” just didn’t make technical sense. A bearish wave will normally at least see the Fibonacci 161 after breaking through support and in Bitcoin’s case that level is 10k.

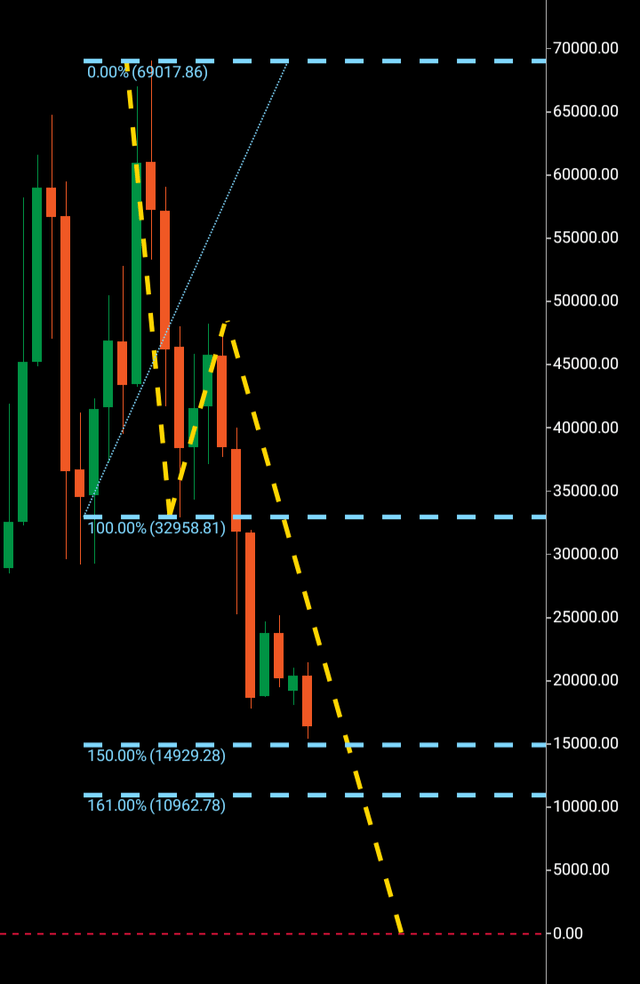

Bit firstly, let’s look at the current monthly chart. My previous Bitcoin article was published at circa the price region $19K. So large was the bearish wave one that if wave three completes a numerical copy of it, Bitcoin will end up at zero. The first level we can see is the Fibonacci 150 at $14.9K which isn’t a popular Fibonacci level, given the scale of the wave one, the 150 level came within heightened probability of being hit before the 161 level at $10K. So far Bitcoin has come near and dropped into the low $15K region.

Bitcoin Monthly (C Trader )

We can see the wave one $69K – $32K with the wave two topping out near the $50K region before breaking support at $32K.

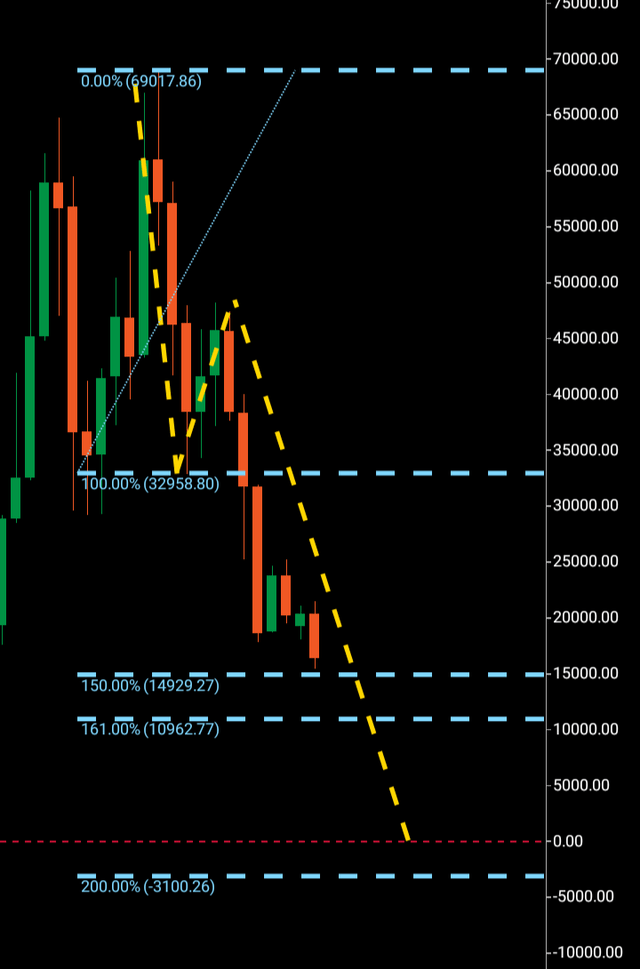

So what’s next and is the just the start of a steep demise for this digital currency? Possibly is the answer. In the chart below we can see that if Bitcoin does numerically replicate its wave one it will drop to zero.

Bitcoin Monthly (C Trader )

To summarize, I would expect Bitcoin to drop to the $10K region within the next 30-120 days. If there are signs of a macro turnaround by way of a three wave bullish pattern on the monthly chart that develops it may signal a bottoming. Without that three wave pattern being formed the probability that the wave may look to complete by heading to zero will be heightened.

About the Three Wave Theory

The three wave theory was designed to be able to identify exact probable price action of a financial instrument. A financial market cannot navigate its way significantly higher or lower without making waves. Waves are essentially a mismatch between buyers and sellers and print a picture of a probable direction and target for a financial instrument. When waves one and two have been formed, it is the point of higher high/lower low that gives the technical indication of the future direction. A wave one will continue from a low to a high point before it finds significant enough rejection to then form the wave two. When a third wave breaks into a higher high/lower low the only probable numerical target bearing available on a financial chart is the equivalent of the wave one low to high point. It is highly probable that the wave three will look to numerically replicate wave one before it makes its future directional decision. It may continue past its third wave target but it is only the wave one evidence that a price was able to continue before rejection that is available to look to as a probable target for a third wave.