Stock market news, share market today: Of late, several analysts and market experts have turned cautious and even bearish on small- and mid-cap stocks, given their frothy valuations, and have been suggesting investors park money in large-cap stocks.

ICICI Direct, in its report issued in late November, said that with a significant move in midcap in CY23, it expects large caps to start catching up as they provide favourable risk-reward as Nifty is emerging from a two-year consolidation phase.

Echoing similar views, analysts at Kotak Institutional Equities, in their report dated December 4, 2023, wrote they continue to favour the mega-caps and a few large-caps and quality mid-caps. They further said that FPIs are likely to prefer investment in large-caps and are unlikely to look at mid-caps and small-caps for both liquidity and valuation reasons.

Given this scenario, one large-cap stock that investors may consider is Siemens. Although the stock has already rallied 40 per cent in the past 12 months, it is expected to fly more in the coming days. Arafat Saiyed, a research analyst with InCred Equities, and Anirvan Divakera, also a research analyst at the brokerage, wrote in their report dated December 22, that Siemens is the most diversified industrial play in India, which is set to benefit because of its exposure to a wide range of sectors.

“During FY18–23, the company’s order inflow clocked a strong 28 per cent compound annual growth rate (CAGR) led by the mobility segment, which is on a solid footing and has gained visibility by winning a new order for electric locomotives. We expect the momentum to continue in digital, factories, and building technologies, which will boost growth and operating margins given the high growth potential and value addition by Siemens,” the report said.

It is the key beneficiary of the capex upcycle in railway, power T&D, decarbonisation initiatives, data centres, automation, and digitalisation. The integration of C&S Electric further strengthens the company’s position in the global LV & MV switchgear market, the report added.

Motilal Oswal Securities believes that the company’s near-term order inflows may be affected by the general election schedule; however, in the long term, order inflow prospects remain strong from transmission, railways, data centres, industrial automation, etc.

A potential demerger and listing of Siemens’s India Energy segment should open avenues for value-unlocking over the next 2–3 years.

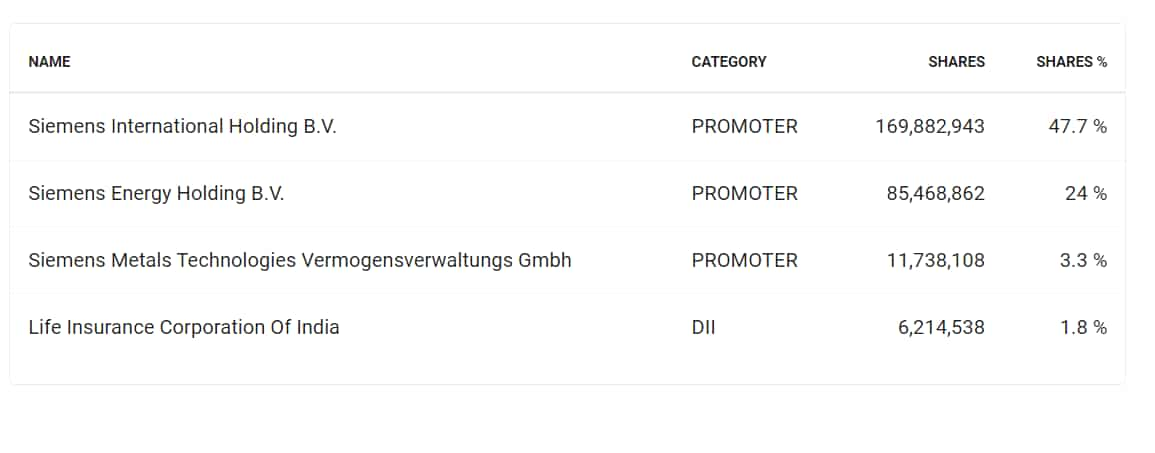

It must be noted here that Siemens AG is set to acquire an 18 per cent stake from Siemens Energy in Siemens India for EUR 2.1 billion. The promoters of the company have also proposed a demerger of its energy arm, and the deal is expected to close by FY25F.

“We marginally revise our estimates to bake in slightly better margins and expect the company to clock revenue/EBITDA/PAT/CAGRs of 16 per cent / 18 per cent / 19 per cent over FY23–26. We continue to value it at 55X P/E on two-year forward earnings and maintain our buy rating with a TP of Rs 4,600,” the report said.

Foreign brokerage Jefferies, too, has maintained a ‘buy’ rating on the stock and raised the target price to Rs 5,000 from Rs 4,520 earlier.

InCred Equities, on the other hand, maintains its ADD rating on the stock with a target price of Rs 4,400 (from Rs 4,255 earlier), valuing it at 60x Sep 2025F EPS.

EPS stands for earnings per share.

Siemens’ earnings

The company—which follows an October-September financial year—registered 24.2 per cent growth in revenue to Rs 5,381.5 crore for the three months to September 30 while maintaining a double-digit quarterly margin. Its standalone net profit from continuing operations increased 36.2 per cent on a year-on-year basis to Rs 534 crore, in line with Street estimates, according to a regulatory filing.

The company’s quarterly earnings before interest, taxes, depreciation, and amortisation (EBITDA) increased 34.4 per cent to Rs 631.2 crore.

The technology firm’s margin, a key measure of a business’s profitability, improved by 90 basis points (bps) to 11.7 per cent for the quarter under review. Zee Business analysts, however, had expected Siemens to clock a margin of 12 per cent.

While revenue from its energy segment increased 13.2 per cent to Rs 1,846.7 crore, that from its smart infrastructure unit expanded 24.8 per cent to Rs 1,728.6 crore. Its digital industries revenue increased 26 per cent to Rs 1,190.3 crore and mobility revenue jumped 68 per cent to Rs 667 crore. READ MORE

Siemens Ltd. Shareholding Pattern/ Ownership

FPI holding

Source: Trendlyne