Up to date on Could eleventh, 2022 by Bob Ciura

Earnings traders could generally tend to concentrate on shares with the very best dividend yields. However dividend development can also be an essential consideration when setting up an income-focused portfolio.

Whereas high-yield shares are interesting for the revenue they supply right this moment, dividend development shares are equally interesting as a result of potential for even increased dividends down the street.

For instance, the Dividend Aristocrats are an unique group of high-quality dividend development shares. The Dividend Aristocrats signify 65 firms within the S&P 500 Index, which have every raised their dividends for at the least 25 consecutive years.

You possibly can obtain an Excel spreadsheet of all 65 (with metrics that matter) by clicking the hyperlink under:

The Dividend Aristocrats are broadly thought to be among the many finest dividend development shares an investor should purchase. However they didn’t begin out as Dividend Aristocrats. It’s also helpful for traders to contemplate shares that will not have as lengthy of a dividend historical past proper now, however have the potential to grow to be the subsequent Dividend Aristocrats.

Traders ought to concentrate on high-quality firms with sturdy aggressive benefits, constant development, and the flexibility to lift their dividends over the long run.

These 10 dividend development shares aren’t all on the listing of Dividend Aristocrats. However in any case, they’ve the potential to lift their dividends at a excessive fee every year, and maybe be among the many future Dividend Aristocrats.

Desk Of Contents

The highest 10 listing is comprised of shares with dividend yields at or above the S&P 500 common (at the moment 1.5%), in addition to ahead payout ratios under 25%. All the shares have Dividend Danger scores of ‘C’ or higher.

Lastly, all 10 shares have constructive anticipated EPS development over the subsequent 5 years of at the least 5% per 12 months.

You possibly can immediately soar to a particular inventory by clicking on the hyperlinks under:

Dividend Development Inventory #10: Microchip Applied sciences (MCHP)

Microchip Know-how develops, manufactures, and sells good, linked and safe embedded management options used for all kinds of functions. These embrace disruptive development traits similar to 5G, synthetic intelligence, Web of Issues (IoT), and autonomous driving, amongst others, in key finish markets similar to automotive, aerospace and protection, communications.

The corporate’s strategic focus is that these options are cost-effective, supply excessive efficiency, with a large voltage vary operation, at extraordinarily low energy utilization. Microchip Know-how generates round $6 billion in annual revenues.

On February third, 2022, Microchip Know-how reported its Q3-2022 outcomes for the quarter ending December thirty first, 2021. Web gross sales have been a file $1.79 billion, up 30% from the comparable interval final 12 months and 6.8% increased sequentially. Larger revenues have been once more powered by distinctive execution on delivering Microchip’s backlog and robust underlying demand regardless of the continued manufacturing capability constraints amid provide chain constraints.

On a non-GAAP foundation, EPS was $1.20 versus $0.81 in Q3-2021. Microchip as soon as once more hiked its quarterly dividend 9.1% sequentially, or 29.7% year-over-year, to $0.253.

Click on right here to obtain our most up-to-date Certain Evaluation report on MCHP (preview of web page 1 of three proven under):

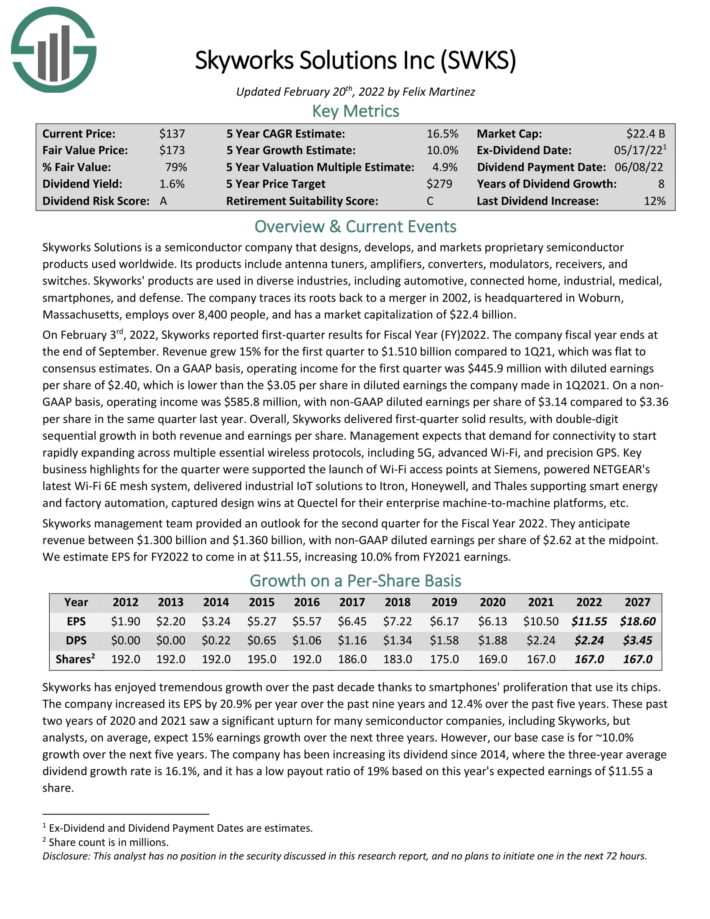

Dividend Development Inventory #9: Skyworks Options (SWKS)

Skyworks Options is a semiconductor firm that designs, develops, and markets proprietary semiconductor merchandise used worldwide. Its merchandise embrace antenna tuners, amplifiers, converters, modulators, receivers, and switches.

In the latest quarter, income grew 15% year-over-year. Adjusted diluted earnings per share of $3.14 in comparison with $3.36 per share in the identical quarter final 12 months. Total, Skyworks delivered first-quarter strong outcomes, with double-digit sequential development in each income and earnings per share.

Skyworks has a robust steadiness sheet with over $1 billion in money and money equivalents and no debt. This offers the corporate great flexibility and resiliency to offset a few of its concentrated buyer base dangers and transfer ahead with its development plans. The dividend could be very nicely lined by earnings, and we think about it very protected.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWKS (preview of web page 1 of three proven under):

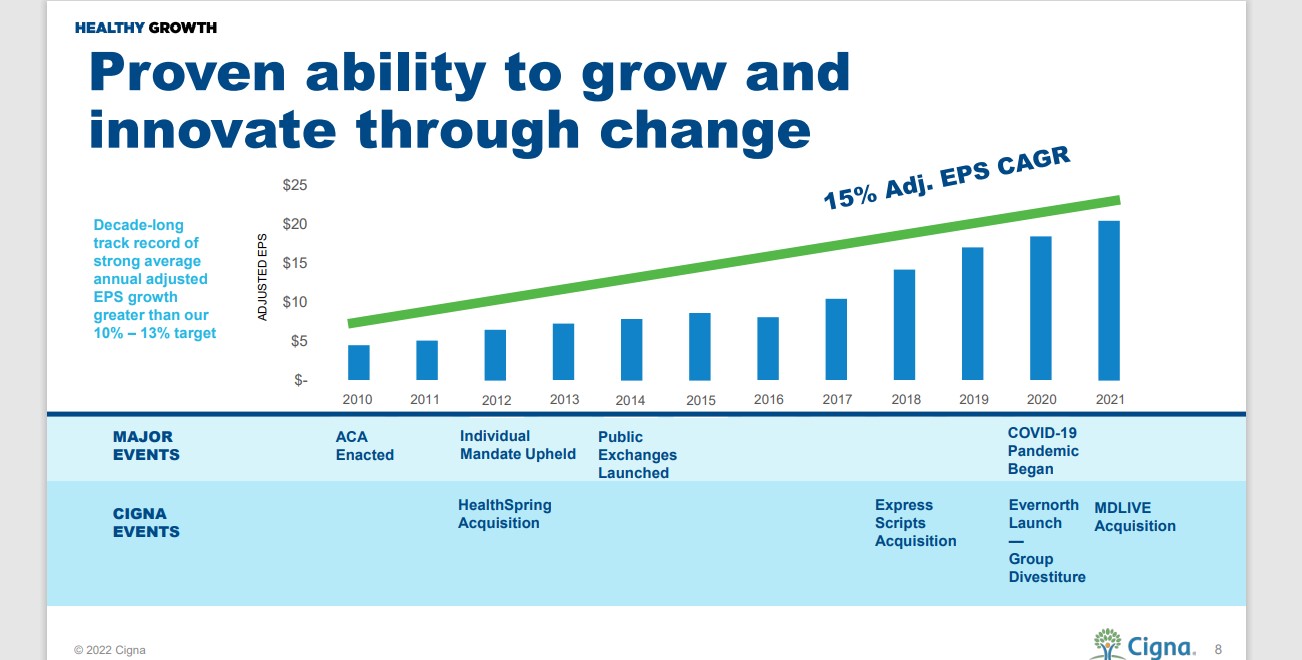

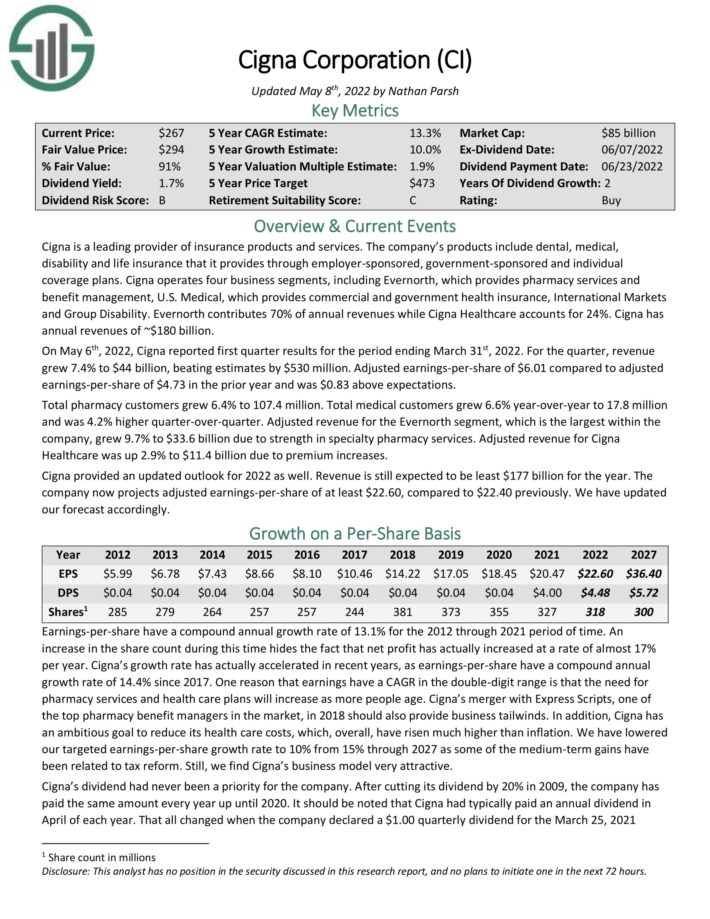

Dividend Development Inventory #8: Cigna Company (CI)

Cigna is a number one supplier of insurance coverage services and products. The corporate’s merchandise embrace dental, medical, incapacity and life insurance coverage that it supplies by way of employer-sponsored, government-sponsored and particular person protection plans.

The corporate has generated double-digit EPS development over the previous a number of years, even throughout recessions and the coronavirus pandemic.

Supply: Investor Presentation

Cigna operates 4 enterprise segments, together with Evernorth, which supplies pharmacy providers and profit administration, U.S. Medical, which supplies business and authorities medical health insurance, Worldwide Markets and Group Incapacity. Evernorth contributes 70% of annual revenues whereas Cigna Healthcare accounts for twenty-four%. Cigna has annual revenues of ~$180 billion.

On Could sixth, 2022, Cigna reported first quarter outcomes for the interval ending March thirty first, 2022. For the quarter, income grew 7.4% to $44 billion, beating estimates by $530 million. Adjusted earnings-per-share of $6.01 in comparison with adjusted earnings-per-share of $4.73 within the prior 12 months and was $0.83 above expectations.

Complete pharmacy prospects grew 6.4% to 107.4 million. Complete medical prospects grew 6.6% year-over-year to 17.8 million and was 4.2% increased quarter-over-quarter.

Cigna supplied an up to date outlook for 2022 as nicely. Income remains to be anticipated to be least $177 billion for the 12 months. The corporate now tasks adjusted earnings-per-share of at the least $22.60, in comparison with $22.40 beforehand.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cigna (preview of web page 1 of three proven under):

Dividend Development Inventory #7: Jack within the Field (JACK)

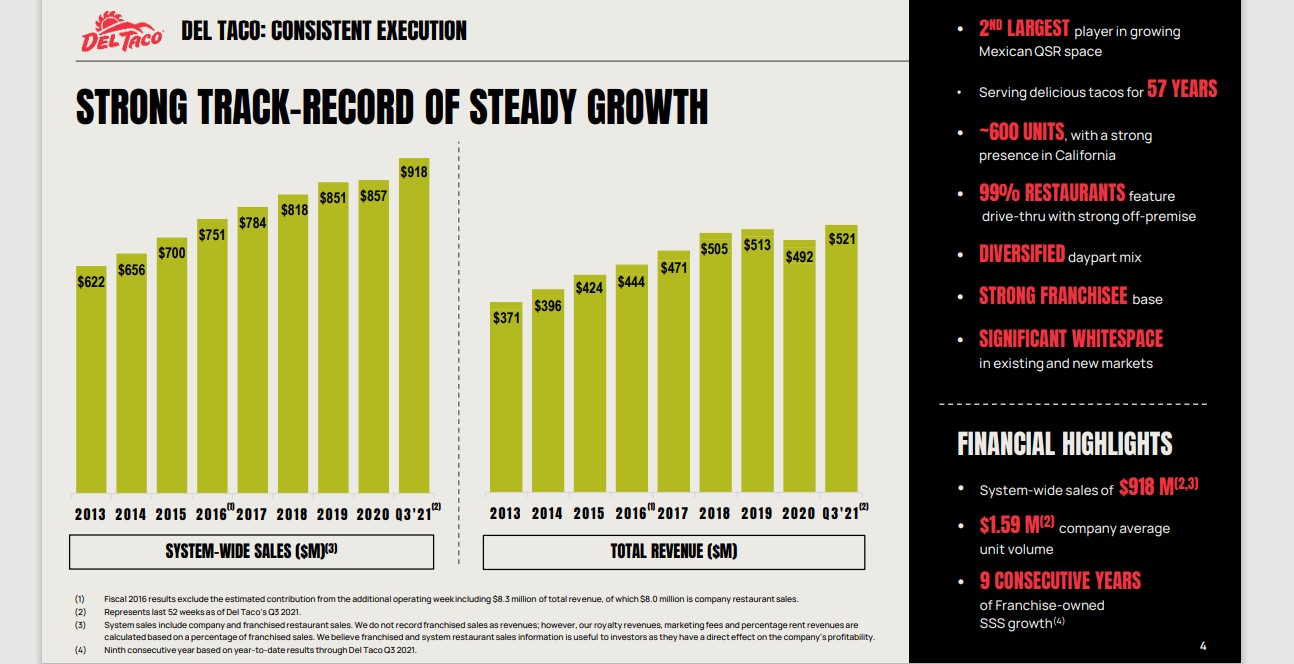

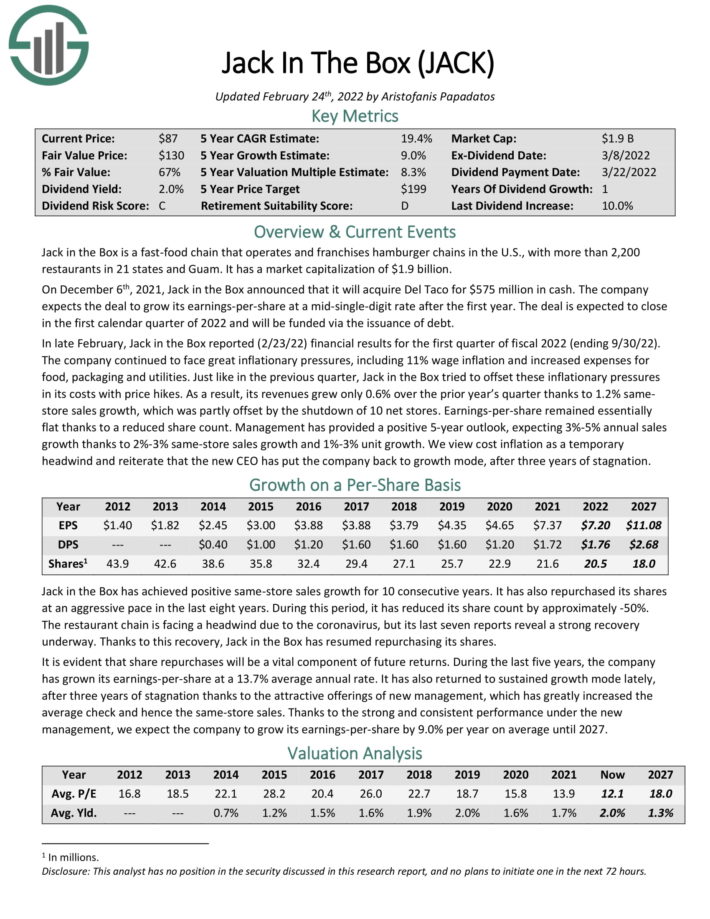

Jack within the Field is a fast-food chain that operates and franchises hamburger chains within the U.S., with greater than 2,200

eating places in 21 states and Guam.

On December sixth, 2021, Jack within the Field introduced that it’s going to purchase Del Taco for $575 million in money. The corporate expects the deal to develop its earnings-per-share at a mid-single-digit fee after the primary 12 months.

Supply: Investor Presentation

The deal is predicted to shut within the first calendar quarter of 2022 and will probably be funded through the issuance of debt.

In late February, Jack within the Field reported (2/23/22) monetary outcomes for the primary quarter of fiscal 2022 (ending 9/30/22). The corporate continued to face nice inflationary pressures, together with 11% wage inflation and elevated bills for meals, packaging and utilities.

Administration has supplied a constructive 5-year outlook, anticipating 3%-5% annual gross sales development because of 2%-3% same-store gross sales development and 1%-3% unit development.

In 2021, the corporate elevated its dividend by 10%. The inventory has a 2022 projected dividend payout ratio of 24.4%.

Click on right here to obtain our most up-to-date Certain Evaluation report on JACK (preview of web page 1 of three proven under):

Dividend Development Inventory #6: Tennant Co. (TNC)

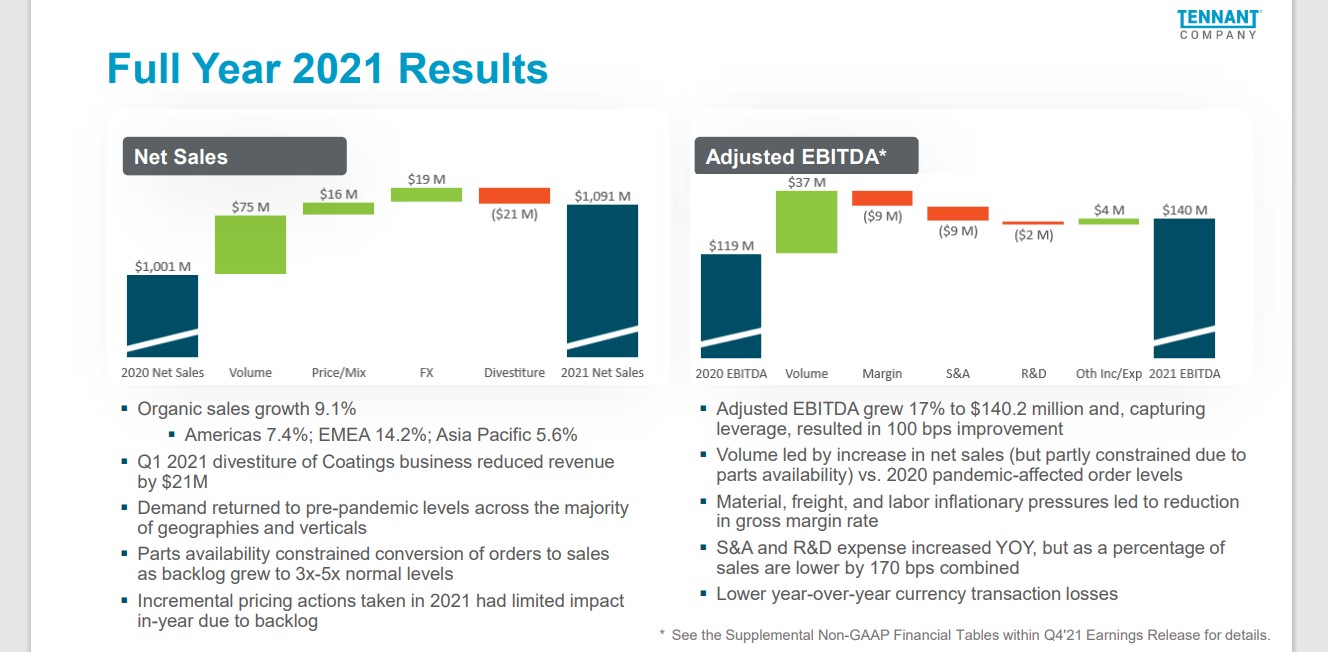

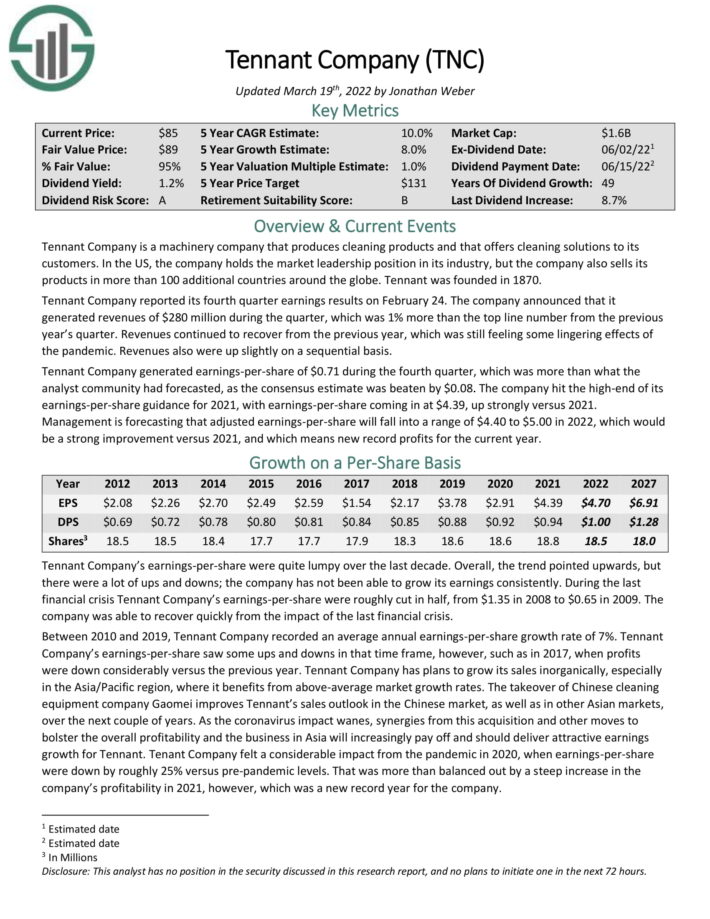

Tennant Firm is a equipment firm that produces cleansing merchandise and that gives cleansing options to its prospects. Within the US, the corporate holds the market management place in its trade, however the firm additionally sells its merchandise in additional than 100 further international locations across the globe. Tennant was based in 1870.

Tennant Firm reported its fourth quarter earnings outcomes on February 24. The corporate introduced that it generated revenues of $280 million throughout the quarter, which was 1% greater than the highest line quantity from the earlier 12 months’s quarter. Revenues continued to get well from the earlier 12 months, which was nonetheless feeling some lingering results of the pandemic. Revenues additionally have been up barely on a sequential foundation.

Supply: Investor Presentation

Tennant Firm generated earnings-per-share of $0.71 throughout the fourth quarter, which was greater than what the analyst group had forecasted, because the consensus estimate was crushed by $0.08. The corporate hit the high-end of its earnings-per-share steering for 2021, with earnings-per-share coming in at $4.39, up strongly versus 2021.

Administration is forecasting that adjusted earnings-per-share will fall into a spread of $4.40 to $5.00 in 2022, which might be a robust enchancment versus 2021, and which implies new file earnings for the present 12 months.

Tennant final elevated its dividend by 9% in 2021.

Click on right here to obtain our most up-to-date Certain Evaluation report on Tennant (preview of web page 1 of three proven under):

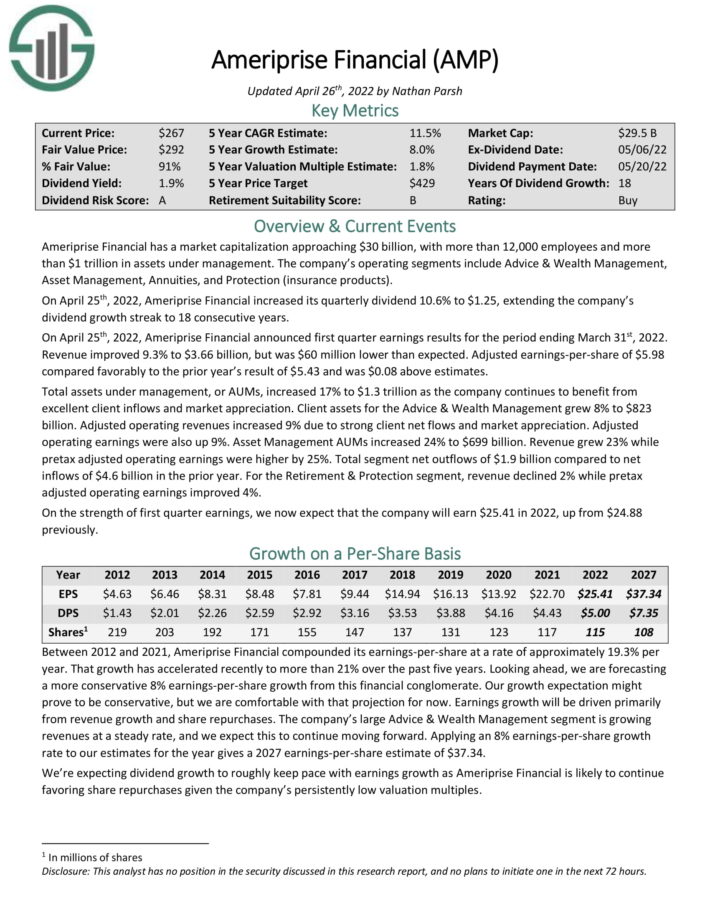

Dividend Development Inventory #5: Ameriprise Monetary (AMP)

Ameriprise Monetary has greater than $1 trillion in property below administration. The corporate’s working segments embrace Recommendation & Wealth Administration, Asset Administration, Annuities, and Safety (insurance coverage merchandise).

On April twenty fifth, 2022, Ameriprise Monetary elevated its quarterly dividend 10.6% to $1.25, extending the corporate’s dividend development streak to 18 consecutive years.

On April twenty fifth, 2022, Ameriprise Monetary introduced first quarter earnings outcomes for the interval ending March thirty first, 2022. Income improved 9.3% to $3.66 billion, however was $60 million decrease than anticipated. Adjusted earnings-per-share of $5.98 in contrast favorably to the prior 12 months’s results of $5.43 and was $0.08 above estimates. Complete property below administration, or AUMs, elevated 17% to $1.3 trillion.

Click on right here to obtain our most up-to-date Certain Evaluation report on Ameriprise (preview of web page 1 of three proven under):

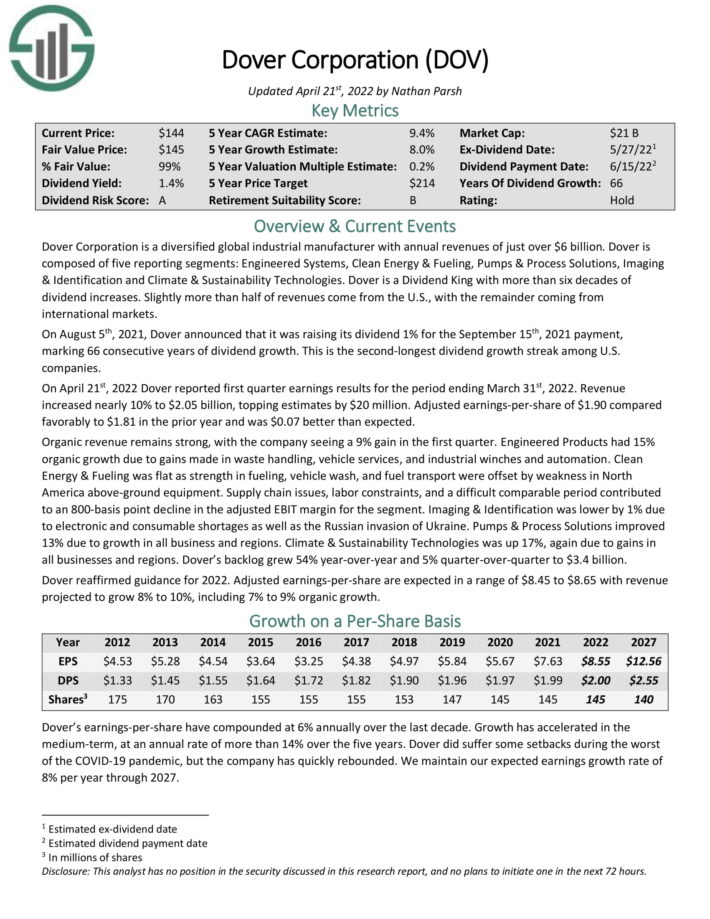

Dividend Development Inventory #4: Dover Company (DOV)

Dover Company is a diversified world industrial producer with annual revenues of simply over $6 billion. Dover consists of 5 reporting segments: Engineered Techniques, Clear Vitality & Fueling, Pumps & Course of Options, Imaging & Identification and Local weather & Sustainability Applied sciences. Barely greater than half of revenues come from the U.S., with the rest coming from worldwide markets.

On August fifth, 2021, Dover introduced that it was elevating its dividend 1% for the September fifteenth, 2021 fee, marking 66 consecutive years of dividend development. That is the second-longest dividend development streak amongst U.S. firms.

On April twenty first, 2022 Dover reported first quarter earnings outcomes for the interval ending March thirty first, 2022. Income elevated almost 10% to $2.05 billion, topping estimates by $20 million. Adjusted earnings-per-share of $1.90 in contrast favorably to $1.81 within the prior 12 months and was $0.07 higher than anticipated.

Natural income stays robust, with the corporate seeing a 9% achieve within the first quarter. Dover’s backlog grew 54% year-over-year and 5% quarter-over-quarter to $3.4 billion.

Dover reaffirmed steering for 2022. Adjusted earnings-per-share are anticipated in a spread of $8.45 to $8.65 with income projected to develop 8% to 10%, together with 7% to 9% natural development.

Click on right here to obtain our most up-to-date Certain Evaluation report on Dover (preview of web page 1 of three proven under):

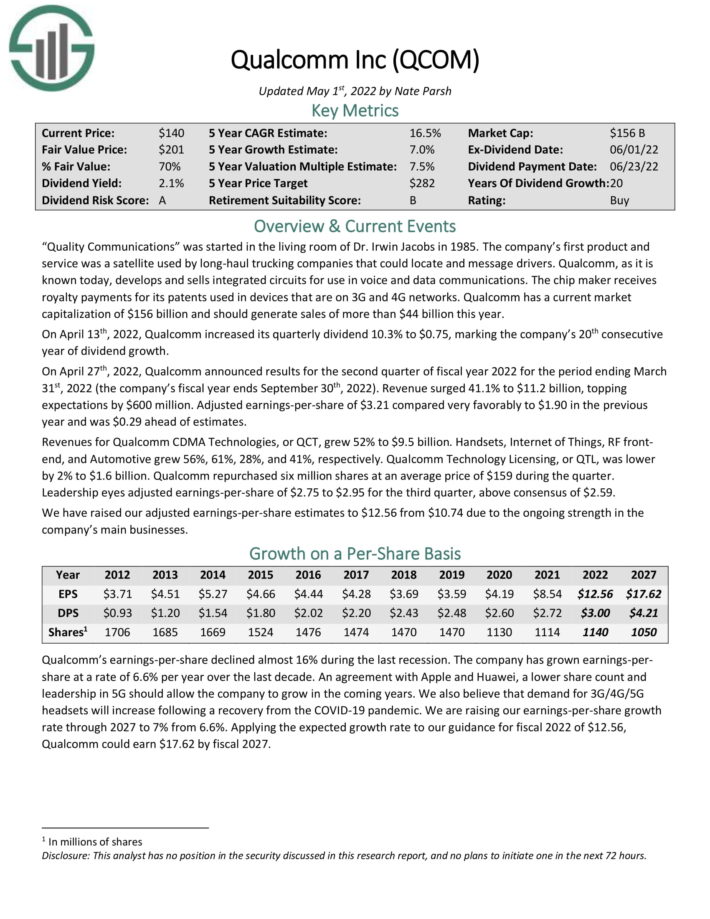

Dividend Development Inventory #3: Qualcomm Inc. (QCOM)

Qualcomm, as it’s recognized right this moment, develops and sells built-in circuits to be used in voice and knowledge communications. The chip maker receives royalty funds for its patents utilized in units which might be on 3G and 4G networks.

On April twenty seventh, 2022, Qualcomm introduced outcomes for the second quarter of fiscal 12 months 2022 for the interval ending March thirty first, 2022 (the corporate’s fiscal 12 months ends September thirtieth, 2022). Income surged 41.1% to $11.2 billion, topping expectations by $600 million. Adjusted earnings-per-share of $3.21 in contrast very favorably to $1.90 within the earlier 12 months and was $0.29 forward of estimates.

Qualcomm just lately elevated its dividend by 10%, and the inventory now yields 2.2%. The corporate has elevated its dividend for 20 consecutive years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Qualcomm (preview of web page 1 of three proven under):

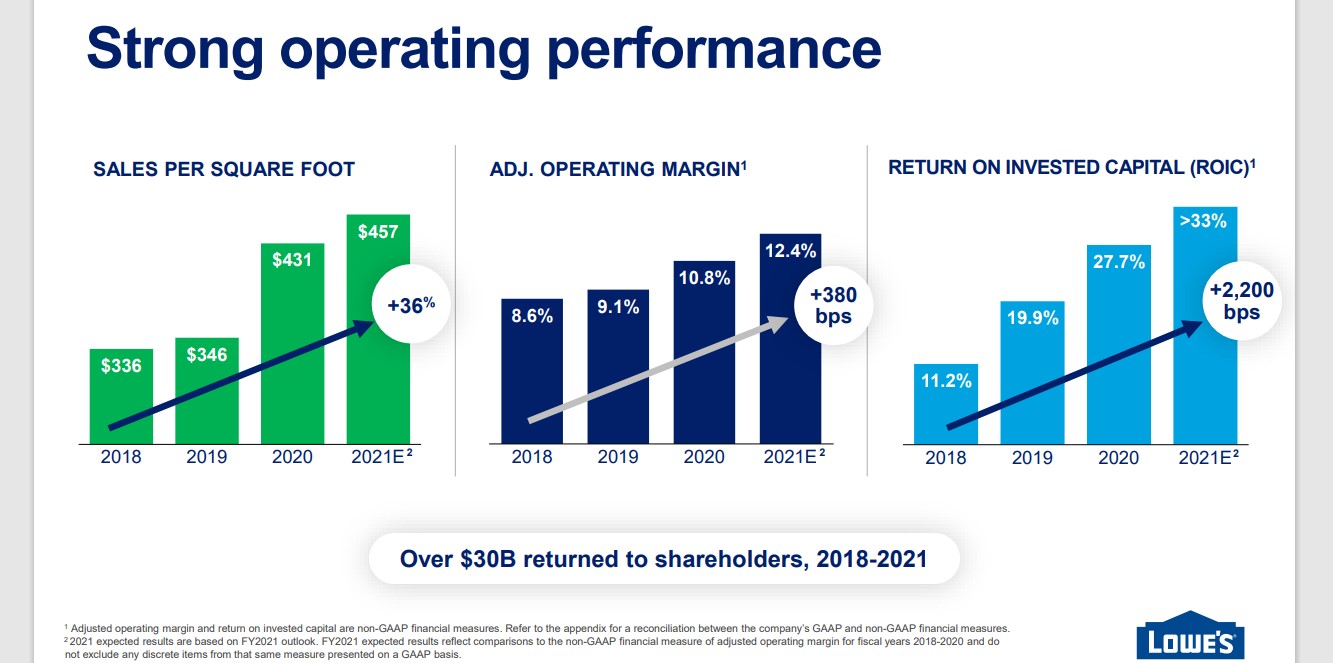

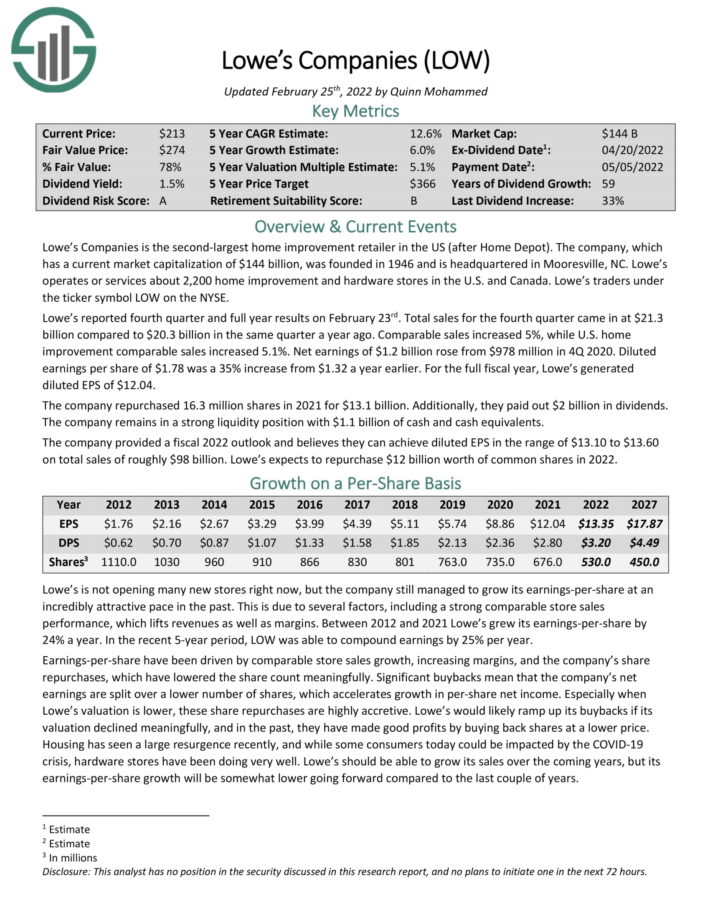

Dividend Development Inventory #2: Lowe’s Corporations (LOW)

Lowe’s Corporations is the second-largest dwelling enchancment retailer within the US (after House Depot). Lowe’s operates or services greater than 2,200 dwelling enchancment and {hardware} shops within the U.S. and Canada.

The corporate has generated robust development prior to now few years, fueled by the robust U.S. economic system and housing market.

Supply: Investor Presentation

Lowe’s reported fourth quarter and full 12 months outcomes on February 23rd . Total gross sales for the fourth quarter got here in at $21.3 billion in comparison with $20.3 billion in the identical quarter a 12 months in the past. Comparable gross sales elevated 5%, whereas U.S. dwelling enchancment comparable gross sales elevated 5.1%. Web earnings of $1.2 billion rose from $978 million in 4Q 2020. Diluted earnings per share of $1.78 was a 35% improve from $1.32 a 12 months earlier.

For the total fiscal 12 months, Lowe’s generated diluted EPS of $12.04. The corporate repurchased 16.3 million shares in 2021 for $13.1 billion. Moreover, they paid out $2 billion in dividends. The corporate stays in a robust liquidity place with $1.1 billion of money and money equivalents.

The corporate supplied a fiscal 2022 outlook and believes they will obtain diluted EPS within the vary of $13.10 to $13.60 on whole gross sales of roughly $98 billion. Lowe’s expects to repurchase $12 billion value of frequent shares in 2022.

In 2021, Lowe’s elevated its dividend by 33%.

Click on right here to obtain our most up-to-date Certain Evaluation report on Lowe’s (preview of web page 1 of three proven under):

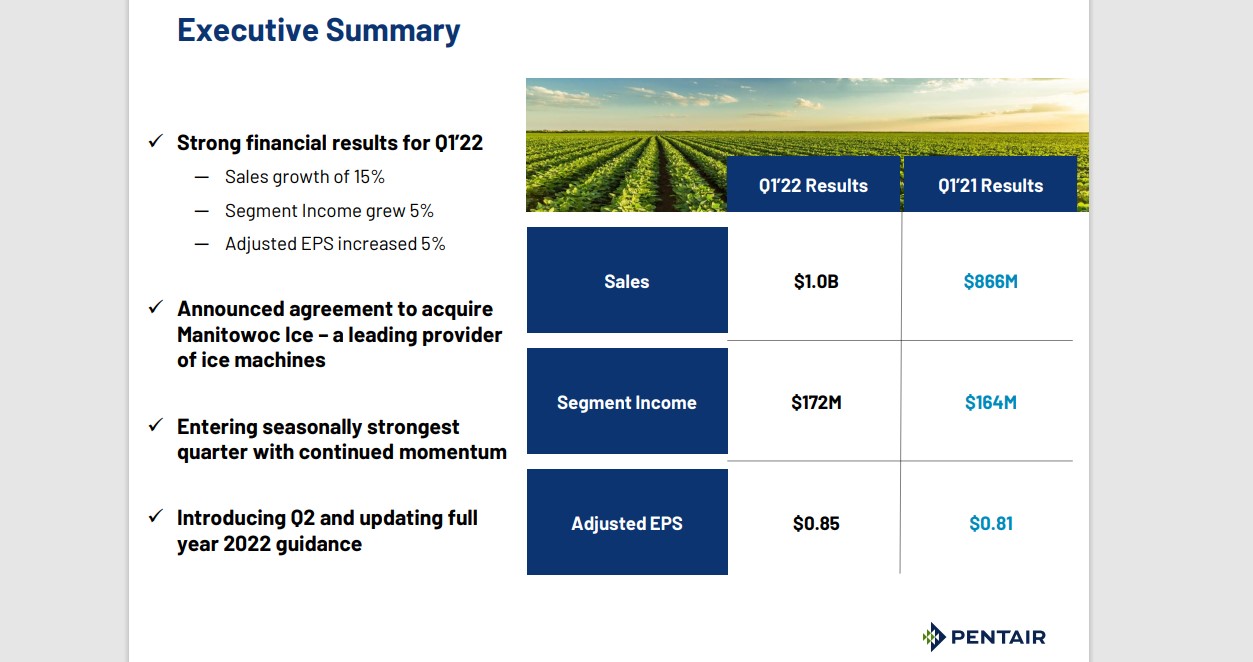

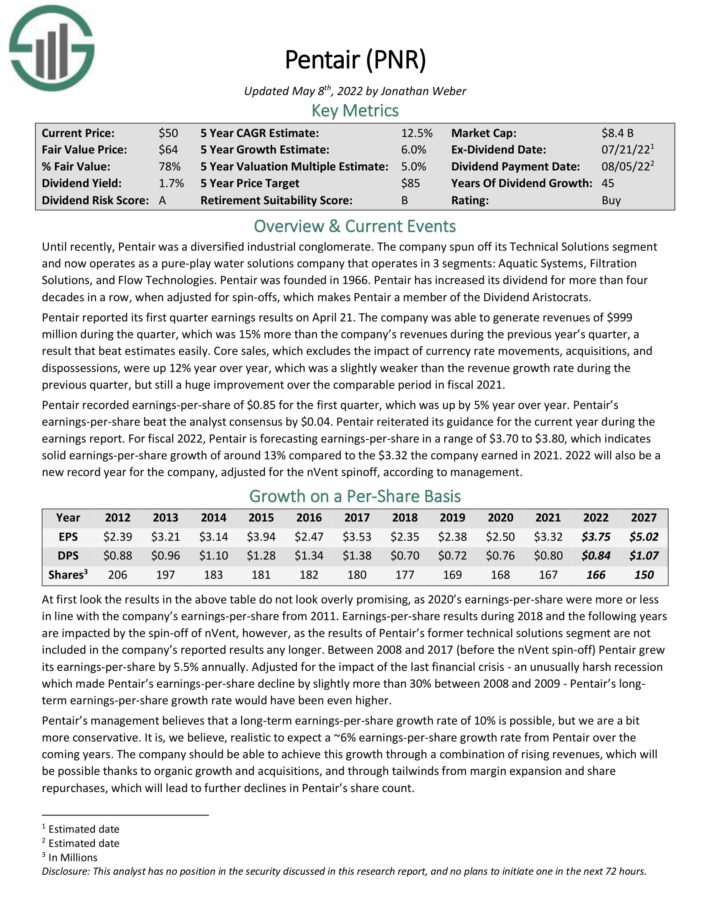

Dividend Development Inventory #1: Pentair plc (PNR)

Pentair operates as a pure–play water options firm with 3 segments: Aquatic Techniques, Filtration Options, and Circulate Applied sciences. Pentair was based in 1966. Pentair has elevated its dividend for greater than 4 many years in a row, when adjusted for spin–offs.

Pentair reported its first quarter earnings outcomes on April 21. Core gross sales, which excludes the affect of forex fee actions, acquisitions, and dispossessions, have been up 12% 12 months over 12 months.

Pentair recorded earnings-per-share of $0.85 for the primary quarter, which was up by 5% 12 months over 12 months.

You possibly can see a snapshot of the corporate’s fiscal first-quarter leads to the picture under:

Supply: Investor Presentation

For fiscal 2022, Pentair is forecasting earnings-per-share in a spread of $3.70 to $3.80, which signifies strong earnings-per-share development of round 13% in comparison with the $3.32 the corporate earned in 2021.

Click on right here to obtain our most up-to-date Certain Evaluation report on Pentair (preview of web page 1 of three proven under):

Ultimate Ideas

Traders mustn’t ignore dividend development shares just because many have low present dividend yields. Corporations with robust enterprise fashions, aggressive benefits, and development potential are engaging no matter their beginning yields. In reality, shares with decrease dividend yields right this moment might really outperform high-yield shares if they will develop their earnings and dividends at a excessive fee over the long-term.

Dividend development unleashes the ability of compounding curiosity. There are a lot of instances by which dividend development shares might produce the next yield on value over time than a inventory with the next present yield however little or no dividend development. These 10 dividend development shares have the potential to lift their dividends by 10% per 12 months or extra for the foreseeable future, which makes them a pretty mixture of dividend yield and development.

Different Dividend Lists

The Dividend Aristocrats listing just isn’t the one option to shortly display for shares that usually pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].