Authored by Peter Earle by way of TheDailyEconomy.org,

In a exceptional feat of recent physics, scientists on the Giant Hadron Collider have managed to recreate one in every of humanity’s oldest fantasies: turning lead into gold. By smashing lead atoms collectively at near-light speeds, the ensuing collisions generate immense warmth and vitality — circumstances so excessive that they momentarily produce a flurry of unique particles and even atoms with the identical variety of protons as gold. Might it’s that the alchemists’ long-elusive dream — transmuting the nugatory into the chic — has ultimately been realized? And never in cluttered stone laboratories thick with incense and delusion, however within the glossy, buzzing vacuum tubes of a particle collider hidden miles underneath the Swiss Alps?

However there’s a catch: these gold-like nuclei exist for less than the tiniest sliver of time — lower than a millionth of a second — earlier than they decay or rework into one thing else. They don’t final lengthy sufficient to type secure atoms, a lot much less shiny gold bars. That’s as a result of what’s being created in these collisions isn’t atypical, secure gold. As a substitute, these are unstable isotopes — nuclei which will include 79 protons (which defines gold) however usually the flawed variety of neutrons, or an excessive amount of inside vitality to carry themselves collectively. Missing the mandatory stability, and with no time to seize electrons and type full atoms, these proto-gold particles shortly disintegrate into different parts or radiation. It’s an awe-inspiring show of physics on the fringe of chance, however it’s a far cry from the sensible transformation of lead into gold dreamed of by historical alchemists.

However what if that limitation may by some means be overcome? What if science unlocked a approach to create gold that didn’t vanish — gold that was secure, persistent, and reproducible? 1000’s of years of mystical craving, from Egyptian monks to Renaissance alchemists, may abruptly be realized in a laboratory. Let’s conduct a gedankenexperiment — a thought experiment — to discover what may occur if the traditional dream lastly got here true.

The Bodily Limitations

Step one in our thought experiment should be a sober take a look at the prices and logistics of synthetic gold creation. Producing an oz. of gold via nuclear transmutation — whether or not in particle accelerators or hypothetical future reactors — would at present require astronomical vitality enter. Excessive-speed collisions between heavy nuclei demand immense energy, cryogenic cooling methods, uncommon supplies, and extremely specialised infrastructure. Even when science finds a approach to stabilize the gold nuclei created in such collisions, the method stays extremely inefficient: billions of collisions may yield only some atoms of usable gold. Time is one other issue — every collision and its byproducts should be exactly managed and monitored, which implies even producing milligrams of gold may take days or perhaps weeks underneath fixed operation.

In distinction, trendy gold mining — whereas environmentally and socially fraught — is comparatively low-cost per ounce when unfold over large-scale operations. Open-pit mines and chemical leaching processes can yield ounces of gold at a price starting from tons of to low hundreds of {dollars}, relying on geology and placement. Synthetic synthesis, by comparability, may run into the tens of hundreds of thousands of {dollars} per ounce at present know-how ranges. Moreover, there are security issues: working with high-energy particle beams, radioactive decay merchandise, and precision instrumentation carries severe bodily and radiological dangers. Earlier than the fantasy of lab-made gold may be handled as a sensible various to mining, these profound variations in price, time, vitality, and hazard should be reconciled — or radically improved.

A crucial problem in our thought experiment is scalability. Even when secure gold could possibly be produced artificially, the infrastructure wanted to take action at significant volumes could be staggering. In contrast to mining operations — which have developed over centuries to use wealthy deposits effectively — nuclear synthesis requires extremely specialised amenities, huge quantities of vitality, and delicate precision. Producing even just a few ounces would possible contain a number of synchronized particle accelerators or superior reactors, none of which at present exist for that goal, and whose development and upkeep would carry prohibitive prices.

Equally vital is the problem of purity and isotopic composition. Naturally occurring gold is made virtually completely of one secure isotope, Au-197, prized for its inertness and consistency. Lab-synthesized gold, however, may include unstable isotopes or hint ranges of radiation, making it unsuitable to be used in jewellery, electronics, or central financial institution reserves with out in depth and costly purification. If synthetic gold couldn’t meet the identical metallurgical requirements as mined gold, it will stay a scientific novelty slightly than an financial competitor.

Taken collectively, these tradeoffs recommend that whereas synthetic gold creation is likely to be scientifically fascinating, it’s at present removed from commercially viable. The promise of alchemical transformation nonetheless faces large sensible, technical, and financial limitations earlier than it may rival — and even complement — the traditional follow of pulling gold from the earth.

Clues from the Previous

With these parameters in place, let’s now flip our consideration to historic analogies that may present a template for this form of change. There are just a few previous examples the place commodities as soon as thought-about valuable, strategic, or culturally important grew to become abruptly plentiful, out of date, or economically irrelevant as a consequence of scientific or technological breakthroughs. These instances assist construct a psychological mannequin for the potential disruption of gold — however in addition they include limitations. Most lacked the deep financial, psychological, and geopolitical entrenchment that gold possesses at present.

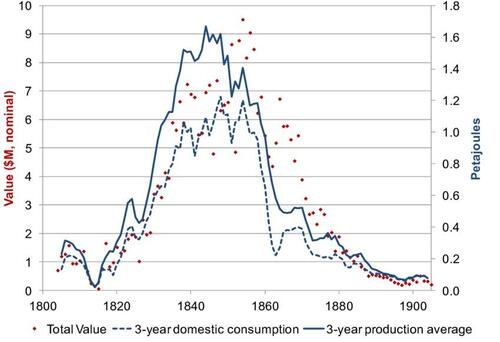

Whale Oil → Kerosene & Petroleum

Within the 18th and early nineteenth centuries, whale oil was a prized commodity, used primarily for lighting. Whole coastal economies, significantly in New England, relied on the harmful and labor-intensive whaling business. This modified quickly with the invention of kerosene and the invention of petroleum in Pennsylvania in 1859. These options had been cheaper, extra scalable, and didn’t depend on dwindling whale populations. As demand plummeted, the whaling business collapsed, resulting in financial decline in cities that had thrived on maritime oil. In the meantime, petroleum-rich areas noticed a surge in financial exercise, and synthetic lighting grew to become vastly extra accessible, democratizing productiveness after darkish.

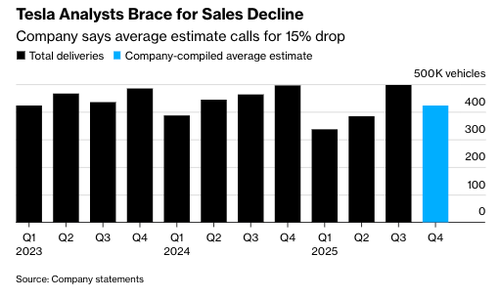

https://www.businessinsider.com/prices-and-quantity-for-whale-oil-and-w…

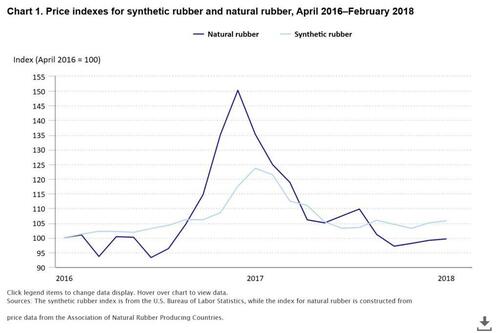

Pure Rubber → Artificial Rubber

Pure rubber was as soon as a strategic useful resource, important to industrialization and trendy warfare. It got here virtually completely from Amazonian and Southeast Asian plantations, giving colonial powers immense leverage. Throughout World Conflict II, artificial rubber was developed utilizing petrochemicals to satisfy army calls for when entry to pure rubber was lower off. Postwar, artificial rubber manufacturing continued to increase, regularly displacing pure rubber in lots of makes use of. Whereas not rendered out of date, pure rubber misplaced its monopoly and strategic cachet. Its pricing and geopolitical significance diminished, changed by versatile international manufacturing chains centered round chemistry, not timber. Each, nonetheless, are nonetheless in use, with the worth of artificial rubber extra carefully correlated with world oil costs than the pure selection.

https://www.bls.gov/opub/btn/volume-9/why-the-prices-of-natural-and-syn…

Diamonds → Lab-Grown Disruption

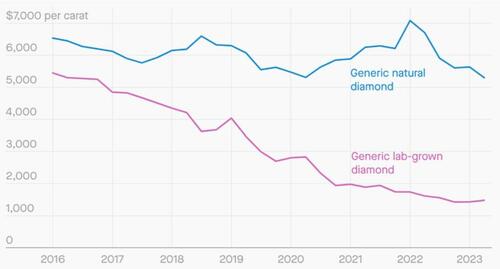

Although diamonds had been by no means a standardized financial asset like gold, they carried immense cultural, emotional, and typically monetary weight. The commercialization of lab-grown diamonds via HPHT and CVD processes has led to a pointy divergence in worth: lab-created stones have dropped 60–90% in worth since 2016. Conventional gamers like De Beers initially resisted however now promote lab diamonds at decrease costs to protect the premium of pure stones. Gen Z shoppers more and more favor lab-grown choices for his or her affordability and moral benefits, undermining the mystique of “actual” diamonds. Industrially, lab-grown diamonds dominate — over 99% of the market — as a consequence of price and flexibility. Because of this, funding demand has practically vanished, and resale worth is very unsure. In distinction to gold, diamonds had no common customary or function in reserves, however their destiny suggests that when shortage is replicable, long-term worth erodes — particularly if emotional or cultural ties are weak.

https://www.crmjewelers.com/blogs/information/dabeers-vs-lab-grown-diamonds

Let’s assume all of the financial hurdles are overcome — and sure, pun gently put aside, atom-smashing gold pans out: Let’s additional suppose that our historic paradigms are typically consultant. What would among the knock-on results be if secure, plentiful lab-made gold grew to become a actuality?

Quick-Time period Implications (0–6 months)

If secure, artificially created gold had been abruptly viable, the speedy affect could be monetary chaos. Gold costs would collapse virtually in a single day — probably falling 50 to 80 % — as buyers and establishments dumped bodily holdings and gold-backed ETFs in a panic. The psychological shock alone would set off a rush for various shops of worth, briefly sending silver, platinum, and palladium hovering. Nonetheless, these rallies could be risky and short-lived: if gold may be synthesized in a hadron collider, then silver, platinum, and palladium — every only a handful of protons and neutrons away in atomic mass — are nicely inside placing distance within the nuclear transmutation panorama. Change charges would shift as nicely: gold-exporting nations like Ghana and Russia would see their currencies depreciate sharply, whereas commodities priced in gold would turn into erratic. Cryptocurrencies — significantly Bitcoin — may rally as narratives of engineered shortage and digital permanence gained new urgency. Central banks with massive gold reserves would endure paper losses and steadiness sheet misery, whereas economies reliant on gold exports would expertise swift and painful present account shocks.

Medium-Time period Implications (6 months–2 years)

Inside a yr or two, the gold worth would stabilize at a brand new, dramatically decrease stage — possible simply above the marginal price of synthetic manufacturing until its output had been by some means tightly regulated. Gold’s historic financial premium would vanish, and it will lose a lot of its funding attract. In the meantime, industrial and luxurious demand would shift: if artificial gold proved unsuitable for high-end jewellery or electronics, demand for purer pure metals like platinum or rhodium may get better. The broader financial panorama would start to alter, with central banks rethinking reserve methods and searching past gold for hedging functions. Property like actual property, artwork, or crypto would possible soak up capital previously allotted to gold. The mining sector could be reshaped: gold mining operations would collapse, equities in main gold producers would plummet, and funding would flood into different extractive industries with development potential, comparable to lithium and uncommon earths.

Lengthy-Time period Implications (2 years and past)

Over time, gold could be reclassified as an industrial or luxurious commodity slightly than a financial asset. Like copper or nickel, it will be valued for its bodily properties however not function a hedge or retailer of worth. Its function in central financial institution vaults would fade, changed by various property — doubtlessly crypto, digital commodities, and even algorithmically scarce devices designed for financial roles. International locations that had hoarded gold, like China or Germany, would lose strategic leverage, whereas these pioneering and controlling artificial gold applied sciences may quickly see geopolitical ascendance. Extra broadly, the occasion would pressure a philosophical and financial reckoning: shortage, as soon as tied to the pure world, would turn into a query of code, governance, and confidence. Belief in tangible wealth would erode, prompting a shift towards engineered types of shortage, completely altering how worth and stability are perceived in international finance.

Different Results Over Various Time Frames

Past monetary markets and central financial institution insurance policies, the synthetic creation of secure gold would ripple outward into practically each nook of the worldwide financial and geopolitical order. Gold-backed financial frameworks — together with symbolic or partially collateralized methods promoted by BRICS or envisioned in various commerce settlements — would unravel in a single day. Even proposals for gold-linked stablecoins or a brand new Bretton Woods-style regime would turn into immediately out of date, stripping credibility from financial methods premised on pure shortage. The psychological blow could be simply as profound: gold has lengthy symbolized permanence and intrinsic worth. If it abruptly grew to become artificial and plentiful, it may shake confidence not solely in gold however in different bodily shops of worth, prompting a cultural pivot towards digital property, mental capital, or algorithmically enforced shortage.

The political and societal penalties could be no much less destabilizing. Many growing nations rely closely on gold exports to fund authorities budgets and keep social cohesion. A collapse in gold’s worth may drive unemployment, fiscal crises, and even regime change in politically fragile states. In the meantime, cultural norms could be disrupted: in nations like India, the place gold is deeply tied to weddings, dowries, and social standing, plentiful artificial gold may democratize jewellery entry but additionally undermine centuries-old traditions. On the similar time, nations that management or lead in synthetic gold manufacturing would acquire a brand new form of strategic leverage — akin to mastering uranium enrichment or dominating semiconductor provide chains. Industries that revolve round gold’s physicality — vaulting, bullion transport, and gold-backed lending — would face obsolescence or radical transformation. And inevitably, such a paradigm shift would provoke a wave of conspiracy theories and populist backlash, with claims that international elites orchestrated the disruption to destroy sovereignty, wealth preservation, or conventional financial values.

Though we’ve taken a small step nearer, true alchemy — whether or not within the historic sense of chemical transmutation or the Star Trek-style replicator fantasy — continues to be a great distance off. But as historical past exhibits, when shortage collapses, so can also the methods constructed upon it — financial, political, and cultural alike. From whale oil to diamonds, once-prized commodities have been dethroned by technological advances, usually with far-reaching penalties. If gold is subsequent, the ripple results may redefine our ideas of worth, belief, and stability. Whether or not this transformation brings prosperity or disruption will rely not simply on science, however on how properly we reply. As with all Schumpeterian inventive destruction, disruption on the elemental stage on this planet of commodities will convey each upheaval and alternative.