Dilok Klaisataporn/iStock via Getty Images

When I wrote “Wild Cards for September” over the weekend, 9 or 10 days ago – I write these commentaries over the weekend, while most of you read them on Tuesdays – I didn’t expect that one of them would immediately begin to move global markets.

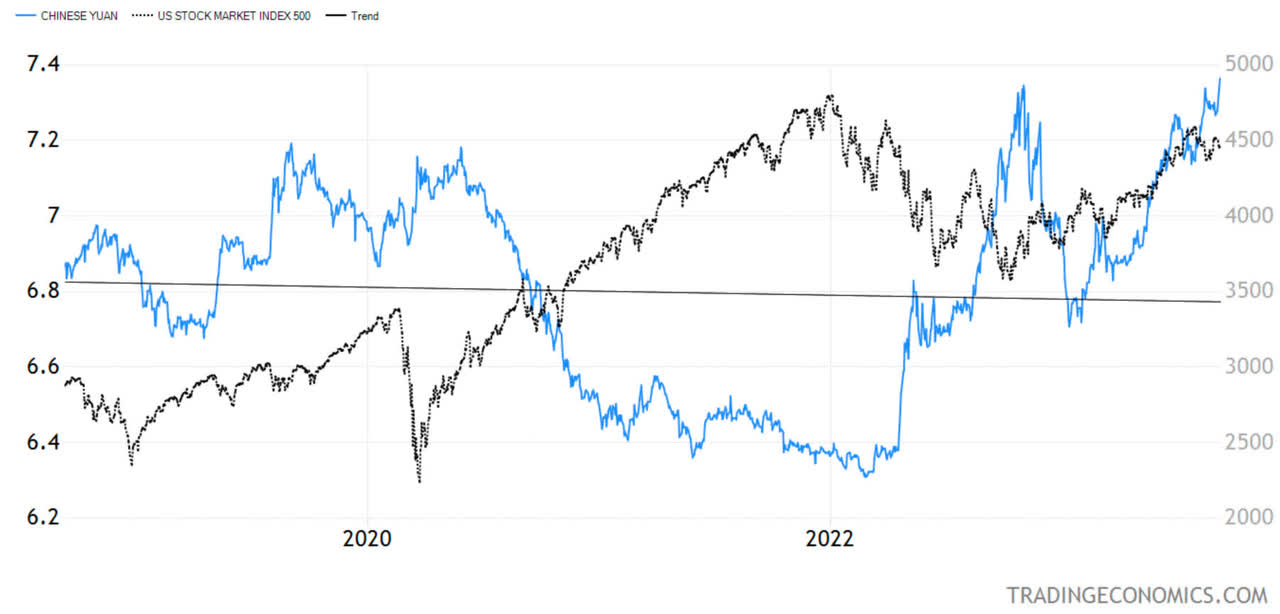

As of last Friday, the Chinese yuan depreciated to a 15-year low against the dollar, to close last week at 7.3640 ($0.1358) on the USDCNY exchange rate.

As it was sliding throughout the week, with U.S. Treasury yields on the firm side, so did U.S. stocks.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As this chart shows, the U.S. stock market generally has a negative correlation with the yuan, albeit not a perfect one. Still, the sharper the depreciation of the yuan, the more pressure there is on U.S. stocks prices. If the yuan keeps sliding this week, I expect to see further weakness in stock markets, globally.

Former Chinese Premier Li Keqiang used to say, “We’d never use the currency” in a bid to help the Chinese economy. Well, he is no longer the premier, and they are using it, since it is a managed currency and China does have $3.16 trillion in forex reserves to support the yuan, if it wanted to.

Nearly 30 years ago, it was the massive 33% devaluation of the Chinese yuan in January 1994 that ultimately sowed the seeds of the Asian Financial Crisis in 1997. In that respect, it came at a very high cost to the region and the world. Could the same sort of event happen again?

Global markets still remember 1997 well, and they won’t like seeing any sharp yuan devaluation, which is why the People’s Bank of China (PBOC) is devaluing it slowly at the moment.

In this case, the issue is the large Chinese economy, as there are problems in the real estate market, as well as with the payment of clients of any fixed-income wealth management products tied to mortgages.

I am not sure if these signs are real evidence of an onset of a Chinese hard landing, as the Chinese government has managed to delay a recession for 30 years with its clever grip on the economy and the financial system with its infamous lending quotas, which do not exist anywhere else in the world.

Whatever it is, it is a situation worth our attention, as a weaker yuan may mean weaker U.S. stock prices, particularly if devaluation happens fast.

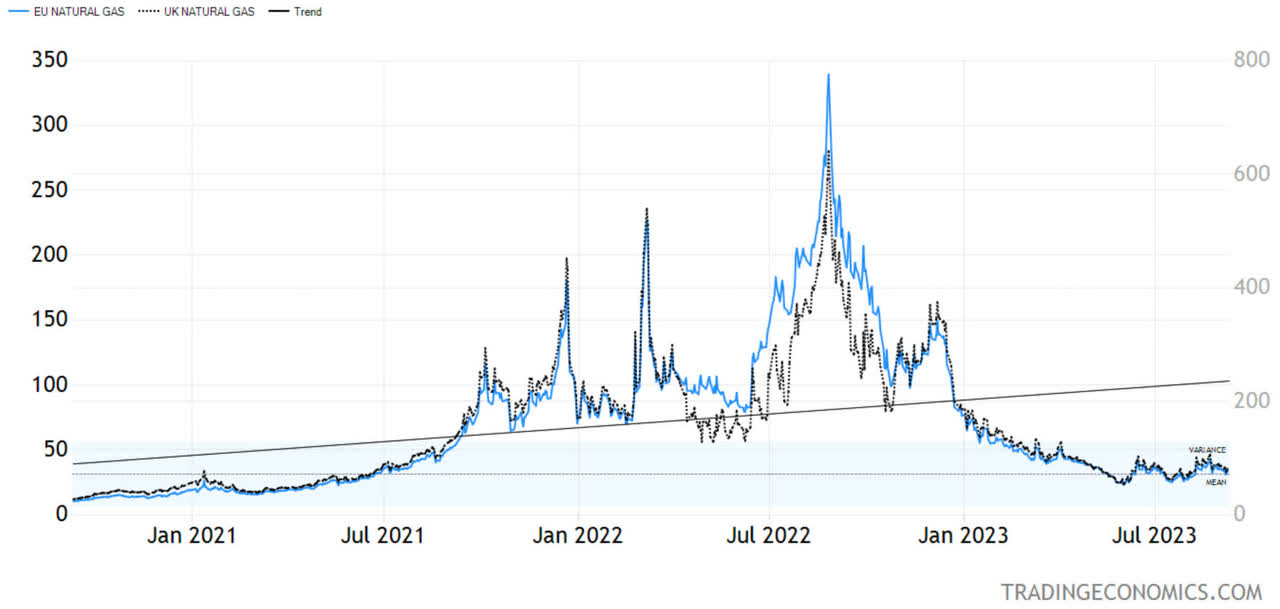

The EU Natural Gas Saga is Not Over

I spoke at length with a former energy minister of a small EU country embroiled in Europe’s natural gas pipeline issues. Since the man is actively involved in politics, I won’t mention his name, but I can share what he said, which he believes is common knowledge in the EU.

First, he does not think the EU natural gas problem is fixed. The primary reason the EU survived last winter relatively unscathed is because last winter was mild. If the coming winter is severe, we are likely to see natural gas and electricity price spike.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

LNG gas is more expensive and even though there is quite a bit of new capacity, there is not enough to substitute pipeline gas. Since three of the four main pipelines going to Germany have been blown up, and just one is still operational, but not currently transporting gas, the price of EU natural gas will be volatile.

This brings up the issue of EU inflation. The price spikes in the fall were truly horrific. Shortages of supply and severe weather are two examples of the type of inflation that have little to do with monetary policy, which poses quite the dilemma for the European Central Bank.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.