DNY59

Because this subject can easily lead down many avenues of discussion (and disagreements), I’m going to make it short for my own sanity and well-being.

Stocks are Really Bonds in Disguise

By survey, few people know how a stock is actually valued – and there is a simple test. Can you write down the exact formula to calculate the price of a 3% treasury bond that will mature in 18 years if current rates are 5%? If you can, then you know how stocks are priced; if not, you don’t. That’s because stocks follow the same pricing formula as bonds.

Bond prices have been in a bear market for almost two years now and we believe the stock market is on the verge of reminding people why stocks are really bonds in disguise. Warren Buffett explained this bond market disguise twenty years ago in this short, two-minute video.

If stocks are really bonds with a fuzzy, undefined coupon, as Buffett says, when will stocks start acting like bonds?

Why Stocks Will Follow Bonds Lower

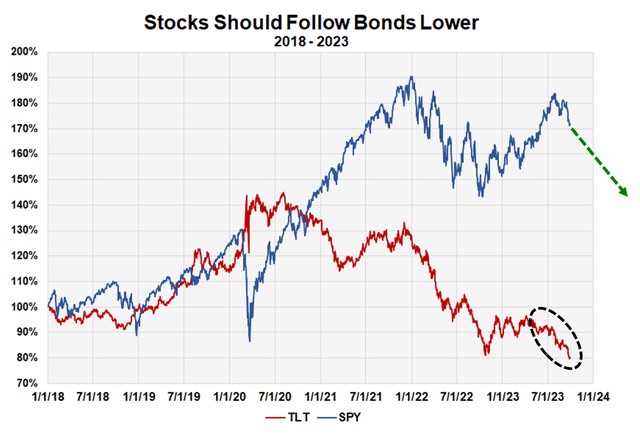

This five-year chart diagrams the price changes of the S&P 500 against the price changes of a 20-year treasury bond as represented by iShares ETF TLT. It shows what we expect the stock market to do, and why.

The green arrow shows that we expect the stock market to return to the lows of last October, and the black Oval highlights the reason why – that long-term bond prices are hitting new lows because long-term rates are hitting new highs.

The stock market can ignore bond prices for a while but sooner or later the bond nature of stocks must show itself and the two act together. It’s our opinion we’re at that “show and tell” moment now.

Comparing Stock Prices to Bond Prices (The Sentiment King)

Making It A Little Clearer – I Think

While Buffett does mention interest rates in the video when he says “discount rate”, he avoids discussing in detail what happens to values when the discount rate is changed in the calculation. The mathematical formula he refers to is really just the sum of a long series of similar fractions. The fractions are similar in that yearly cash flows (bond coupons or earnings) go into the numerators and powers of risk-free interest rates go into all the denominators.

Ninety percent of the time investors focus only on the numerators (future cash flows). That’s essentially what most of the articles at SA do; look at factors that might determine or modify the numerators. Only a few concentrate on how the denominators are changing.

At critical times, however, the focus suddenly shifts and investors look at the changing values of the denominators (interest rates) and its effect on the value of all the fractions. We think we’re at a critical moment now.

Sentiment

While the Sentiment King focuses almost exclusively on market sentiment and metrics of investor expectations, we know the limitations and recognize when an economic issue becomes dominant. We believe we have that now.

The rise in long-term rates to new highs over the last two weeks has changed the picture. We think most investors are underestimating its importance. The current levels of market sentiment allow for another major market decline, which we believe is now highly likely. If it happens though, it should happen very quickly; the market won’t meander down to last year’s lows.

The Low Unemployment Argument

One of the arguments I hear constantly these days is how can we have a recession and another bear market with a 3.5% unemployment rate? The trouble with this argument is it puts the cart before the horse.

Unemployment is classified as a lagging economic indicator; it’s one of the last indicators to rise in a recession. It’s therefore not predictive of anything. The stock market and interest rates are, however, as they’re two of the 10 leading economic indicators. Their actions precede the economy. This just means if the stock market and industrial production decline, then unemployment will rise. The cart doesn’t direct the horse; it just follows where the horse goes.