supergenijalac

The Volvo Group: Leader In Its Industry

The Volvo Group (OTCPK:VLVLY, OTCPK:VOLAF), together with Paccar (PCAR) represents the top tier among truck manufacturers. Its strong financials coupled with a valid management team that has been able to lead the company through any economic environment make it the go-to stock for investors who want exposure to truck manufacturing and, more in general, to freight transportation stocks.

The company was among the first ones in the industry to restrict order books during high inflationary pressure in 2022. This enabled the company to protect its margins while spreading out its orders evenly throughout several quarters. Only in October 2023, we saw some initial weakness in order intake that could have an impact on the quarters to come. This is why I was eagerly waiting for Q4. Depending on what it would have reported, investors would have been able to gain some further insights and more appropriately forecast what FY 2024 may look like.

Since Volvo is a Swedish company, it reports in SEK. Currently, the exchange rate is 1USD=10.36SEK. For simplicity’s sake, I will round it to 1USD=10SEK.

Let’s now look at Volvo’s earnings.

The Volvo Group: Beware of FOMO due to recent gains

The last time we went over Volvo Group, we saw a company in good financial shape, whose stock price had already gone up quite a bit and whose order intake was declining. Around that time I switched my rating from buy to hold. My downgrade was not an example of perfect timing, as the stock soon after the report soared and gained more than 20% to then retrace a bit. So, Volvo Group outperformed SPY since October 2023.

In similar situations, one may feel FOMO, thus beginning to chase the stock. But we have to bear in mind how investing is also about temperament. If we miss out on an opportunity, there will be others to grab. But, what matters most is to keep looking at a stock by focusing on the fundamentals of its business compared to the macroeconomic trends with a larger impact on the company.

Volvo’s Quarterly Results

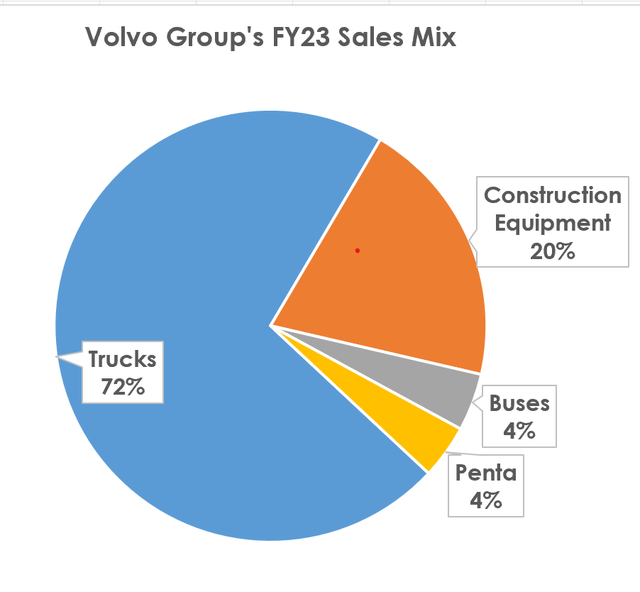

Volvo Group reports its industrial operations results under four segments: trucks, construction equipment, buses, and Volvo Penta plus a fifth item that goes under “group functions & other”. As we can see from the pie chart below, the most important segments are trucks and construction, accounting for $37.3 billion and $10.4 billion in revenue respectively. Together, they make up 92% of Volvo’s industrial operations revenues.

Author, with data from Volvo’s FY23 Report

However, we will see how these two segments are going in different directions, due to industrial and geographical reasons. In fact, while truck sales were up 15% YoY, construction saw a 6% decline. But, before we get to that part, let’s take a quick look at the overall report.

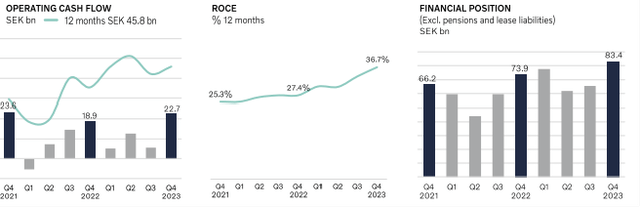

For this quarter, Volvo reported a net sales increase of 8% to $14.8 billion, with an adjusted operating income of $1.84 billion, which is a margin of 12.4%. Volvo generated $2.27 billion in operating cash flow, ending the quarter with a net cash position in Industrial Operations of $8.34 billion. Its ROCE kept moving north and stood at 36.7% versus 27.4% in the same quarter in the prior year. Clearly, this is linked to the clearing up of inventories combined with a more normalized production workflow.

These quarterly results end up a fiscal year which is record-breaking for the company. In fact, for the first time, it reported more than $50 billion in revenue, becoming the first Swedish industrial company to bypass that mark.

Hats off to Volvo. But let’s dig a bit more into its report to have a better understanding of how each of its main segments and regions performed. It will be interesting to see how Volvo can give us some data about the different macroeconomic environments it’s working in.

Volvo’s sales by regions

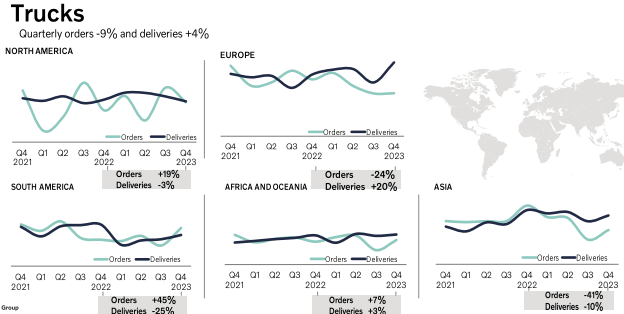

Let’s start with the trucks segment, which delivered 246,272 units (+6% YoY) during the last fiscal year. We can see how overall deliveries performed quite well in Europe (+20% YoY) with a big decline in South America (-25%) and, to a lesser extent, Asia (-10%). Why is that? Europe is easy to interpret: easy comps due to supply chain bottlenecks still unresolved at the end of FY 2022. South America saw Brazil reduce its spending a few quarters ago to resume it recently. Asia can only have one meaning: China is not doing as well as expected, especially when considering big investments with a relationship to industrial production and/or the housing market.

As investors, we need to look forward. So, the most interesting lines in the graphs shown below are the light blue ones which show the order intake by region. North America is doing great: +19% YoY. South America is even better: +45% thanks to strong demand from mining and agriculture. The two sick regions are Asia, with orders down 41% YoY, and Europe, with orders declining by 24%.

The Volvo Group Q4 Earnings Presentation

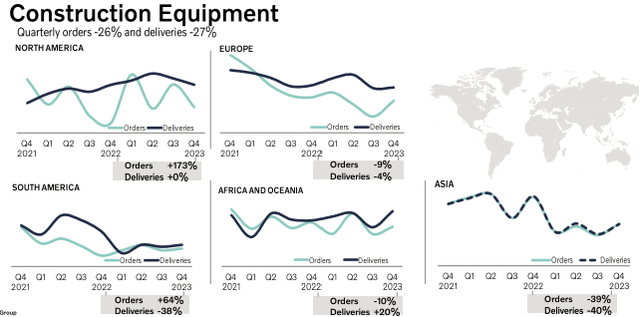

If we move to the segment of Construction Equipment, overall deliveries decreased by 27%, though increased prices were able to almost completely offset the segment’s net revenues, which came in only 4% lower YoY. Let’s pause a moment. We are looking at a company whose pricing power can almost completely offset a 27% decline in deliveries. Now, if we look at the segment’s sales breakdown by region, we see where the issue was: deliveries in North America were flat YoY, while in Europe they declined by 4%. More concerning were South America, with a 38% decline, and Asia, with -40%.

The Volvo Group Q4 Earnings Presentation

Volvo Group’s order intake for the quarter shows something in part unexpected. North America posted a 173% increase. The Infrastructure Act is being deployed. South America sees also a strong rebound with orders up 64% YoY. Europe’s orders are down 9% and Asia’s are down 39%.

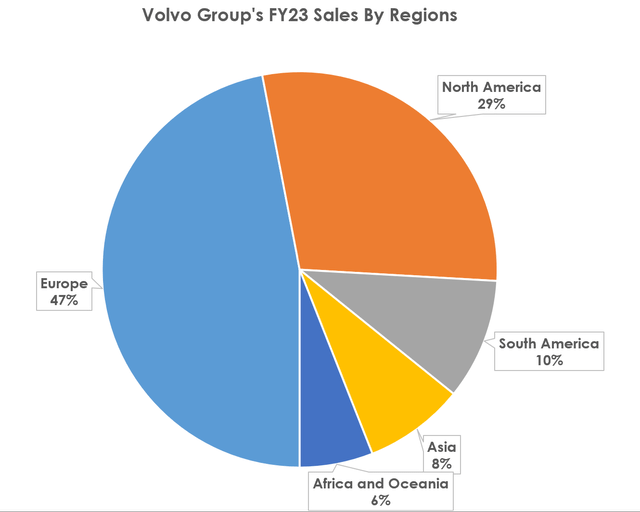

So, the picture is somewhat mixed, particularly when considering the outlook for the upcoming quarters. As we can see from the pie chart below, Europe accounts for 47% of the company’s revenues, with North America having a 29% weight. But what we have seen points out that Europe’s outlook is weak. Even though North America and South America’s sales should perform quite well due to high order intake, it might not be enough to offset the decline in Europe combined with the decline in Asia.

Author, with data from Volvo’s FY23 Report

Volvo Group’s BEV orders and sales

Though fully electric trucks make up only a small portion of Volvo’s sales, we can’t overlook how this newly-born segment performed. Here, too, we see signs of normalization. However, given the very low volumes, the results reported by Volvo might concern those who are extremely bullish on electric vehicles.

In fact, in Q4, Volvo’s electric truck deliveries increased by 127% to 1,285 vehicles, but the company’s order intake for fully electric trucks declined by 7% YoY to 1,090 vehicles. This might only be a temporary slowdown of a trend whose destiny is to go up and up. But it might also be a sign that the market is not as enthusiastic about electric vehicles as first anticipated. Or, more simply, these vehicles are still more costly compared to ICE vehicles. With trucks, in particular, the range a vehicle can go before being recharged is key, and electric trucks still don’t offer a high convenience when considering long-range hauls.

The company is also acquiring the battery business Proterra Powered, a step towards creating “a battery value chain for the group in North America while adding onto the Group’s overall battery capabilities”, as Volvo’s CEO said during the earnings call.

The Volvo Group’s Main Profitability Metrics

At the end of FY23, The Volvo Group’s financial stability is out of question, with $8.34 billion in cash and $13.3 billion in LT debt the company is well balanced. Moreover, its net debt/EBITDA ratio is just below 2x. But if we look at the industrial debt, as said during the earnings call, the company carries none.

A stable and healthy financial position is nurtured by strong operating and profitability metrics. In fact, the Volvo Group earns an A- as its profitability grade. We can understand why that is because, as we see below, the company’s operating cash flow keeps moving up and its ROCE increases at a very healthy pace, being now headed towards the 40% landmark, which would be astounding.

The Volvo Group Q4 Earnings Presentation

The Volvo Group’s Dividend

Boosted by its cash flow generation, The Volvo Group’s Board proposed an ordinary dividend of SEK 7.5 and an extra dividend of SEK 10.50 which equals a dividend yield of 7.1%, considering the price of the stock in Stockholm. For U.S. residents, the withholding tax ranges from 0 to 15%.

The Volvo Group’s Valuation

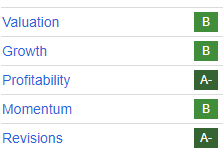

Let’s start with a simple fact: on Seeking Alpha, the stock is very well-rated, with all B’s and A’s. We don’t find this situation that often. It means, for example, that, while momentum is favorable, the valuation remains alluring. At the same time, though the company operates in a highly competitive and mature industry, its growth prospects are interesting. We can’t say much before these grades, as they are deserved.

Seeking Alpha

Looking at the valuation, the stock trades at a fwd PE of 11.7, a fwd EV/EBITDA of 8.8, and a fwd P/FCF of 8.4.

Compared to its two closest peers, Paccar and Daimler Truck (OTCPK:DTRUY), we have the company trading a bit below the former, whose fwd PE is 12.7, fwd EV/EBITDA is 11.8 and fwd P/FCF is 9.8. I think this is deserved for one reason: Paccar’s revenues are a bit more stable and higher margin compared to Volvo because Paccar has developed a larger spare parts business. At the same time, Volvo trades at a premium compared to Daimler Truck for the reason the latter still has to improve its overall profitability and margins.

Compared to its peers, Volvo Group’s valuation makes sense. Moreover, considering orders are declining, I expect the company to face a little margin compression. It is not something that is particularly concerning, but in case this happens, the valuation may become a bit more stretched than what it seems now. This is why I keep the Volvo Group on my watchlist but I would wait for a 15-20% drop to step back into it and take a new position. This is why I keep rating it as hold, which in no way should be seen as a bearish stance on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.