Antoine Bertheau, Edoardo Maria Acabbi, Cristina Barceló, Andreas Gulyas, Stefano Lombardi, Raffaele Saggio 11 March 2022

Think about one Italian and one Danish employee who’ve comparable expertise and work in an identical business. Think about they out of the blue lose their jobs due to a collective dismissal or a agency closure. Are the implications of job loss totally different for the 2 staff? Do they share comparable revenue and employment restoration paths? And if these penalties are totally different, what are the underlying causes?

Finding out the implications of job loss may also help us perceive the extent to which labour markets effectively reallocate unemployed staff to new jobs (Jacobson et al. 1993). The literature on the implications of job loss is huge and has proven that totally different teams of staff expertise wildly totally different long-run restoration paths (Gulyas and Pytka 2020, Carrington and Fallick 2017).1 Nonetheless, the present empirical proof doesn’t present a solution to the questions posed above. Evaluating the price of job loss throughout totally different international locations can make clear which labour markets perform higher than others and why. Nevertheless, it stays tough to make significant cross-country comparisons of the implications of job loss from current research as a result of variations in pattern choice and methodology.

In a latest paper (Bertheau et al. 2022), we overcome these comparability points by constructing a harmonized dataset that mixes administrative information from the next seven international locations which might be characterised by various labour market establishments: Austria, Denmark, France, Italy, Portugal, Spain, and Sweden.2 We analyse the labour market outcomes of staff fired as a result of collective dismissals or agency closures (’mass layoffs’) for every nation in our pattern. We evaluate their labour market outcomes with these of staff who’re comparable alongside key observable dimensions however who don’t lose their jobs throughout a mass layoff in the identical interval. Mass layoffs enable us to seize precise involuntary job separations quite than voluntary quits or particular person firings.

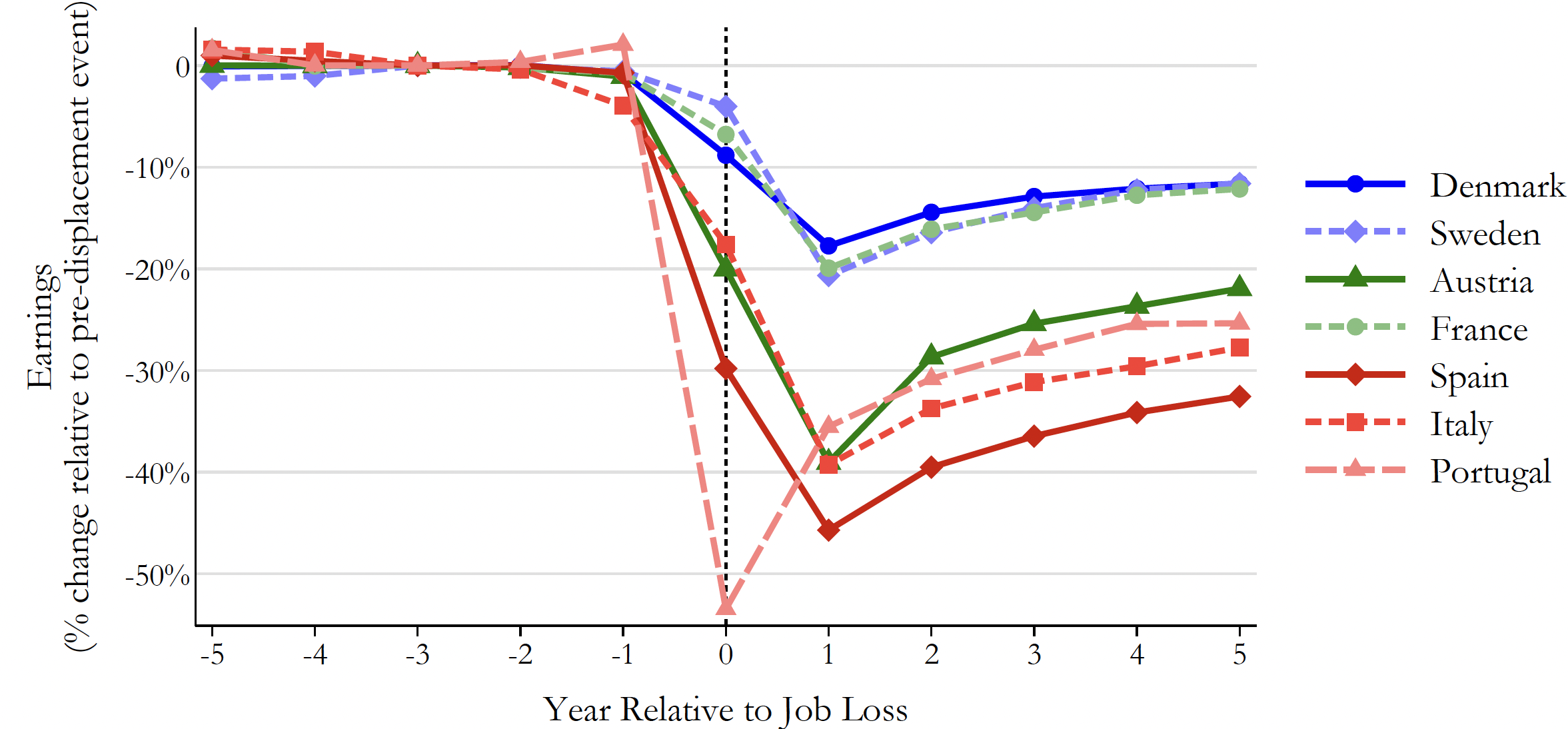

Determine 1 exhibits losses in earnings (excluding authorities transfers) as a result of mass layoffs. Every dot within the graph represents the typical distinction in labour earnings between the 2 teams of staff (those that had been laid off throughout a mass layoff and those that weren’t), as much as 5 years earlier than and after the job loss occasion. To make sure the comparability of outcomes throughout international locations, Determine 1 experiences portions within the proportion change from the typical pre-mass layoffs earnings within the pattern. The primary takeaway from Determine 1 is that shedding a job has very totally different implications throughout Europe. Northern European staff (Danish and Swedish) expertise by far the bottom earnings losses: 5 years after job loss, earnings are about 10% decrease than earlier than the mass layoffs. In contrast, the earnings drop of laid off staff from Southern Europe (Italy, Portugal, and Spain) is about 30%. Austrian staff expertise earnings losses in between these of the Scandinavian and Southern European international locations, whereas French staff expertise losses much like these of Scandinavian staff.

Determine 1 Job loss results on earnings

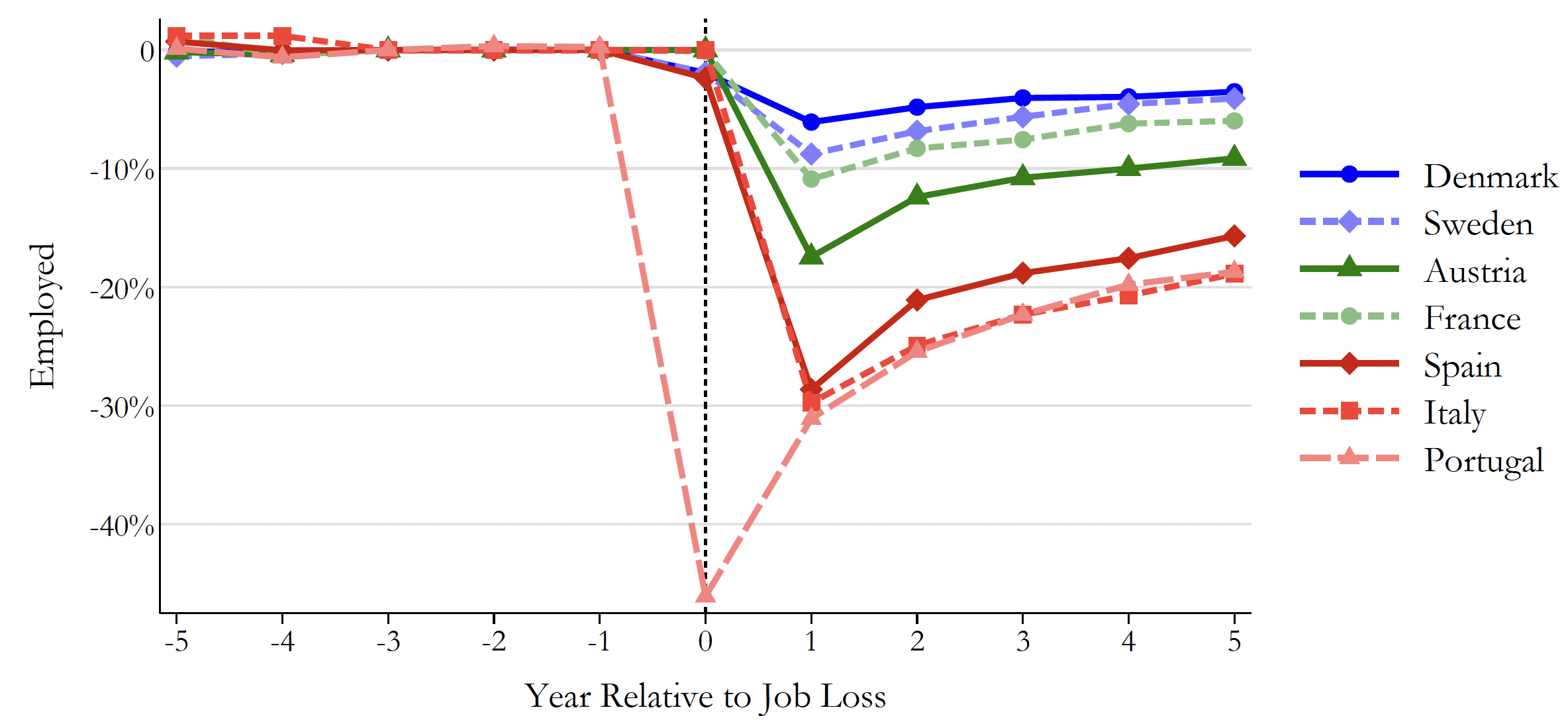

To what extent are the differential earnings losses pushed by variations in employment or in wages? On the one hand, Determine 2 exhibits that a big a part of these cross-country variations in earnings losses is because of variations within the likelihood of discovering a brand new job. Round 20% of laid off staff from Spain, Portugal, and Italy are unable to discover a job 5 years after shedding their job. This quantity is simply round 5% in Sweden and Denmark and round 10% in France and Austria. Then again, as we present in our paper, variations in wages are much less dispersed and are clustered between 5% and 10% 5 years after job loss for many international locations (see Bertheau et al. 2022 for particulars). Our evaluation additional exhibits {that a} appreciable share of the wage declines after job loss is defined by transitions of laid off staff to worse-paying corporations: this share ranges from round 40% for Spain to greater than 95% for Portugal.

Determine 2 Job loss results on the likelihood of receiving constructive yearly earnings

When making an attempt to know the sources of the massive cross-country variations in revenue losses, a pure query is whether or not these are pushed by variations in employee and employer traits throughout international locations. In our latest paper, we present that the differential job loss results noticed throughout the European international locations usually are not pushed by cross-country variations in gender, job tenure, age, the unemployment fee, yr of job loss, or different worker-level or earlier employer traits.

Provided that neither wage losses nor variations in employee or employer traits seem to elucidate the massive cross-country variations in earnings losses, we then give attention to labour market establishments. As famous by Boeri (2011), institutional options – such because the strictness of employment safety, the generosity of unemployment advantages, and the scope of lively labour market programmes – are likely to range considerably throughout the international locations in our pattern.

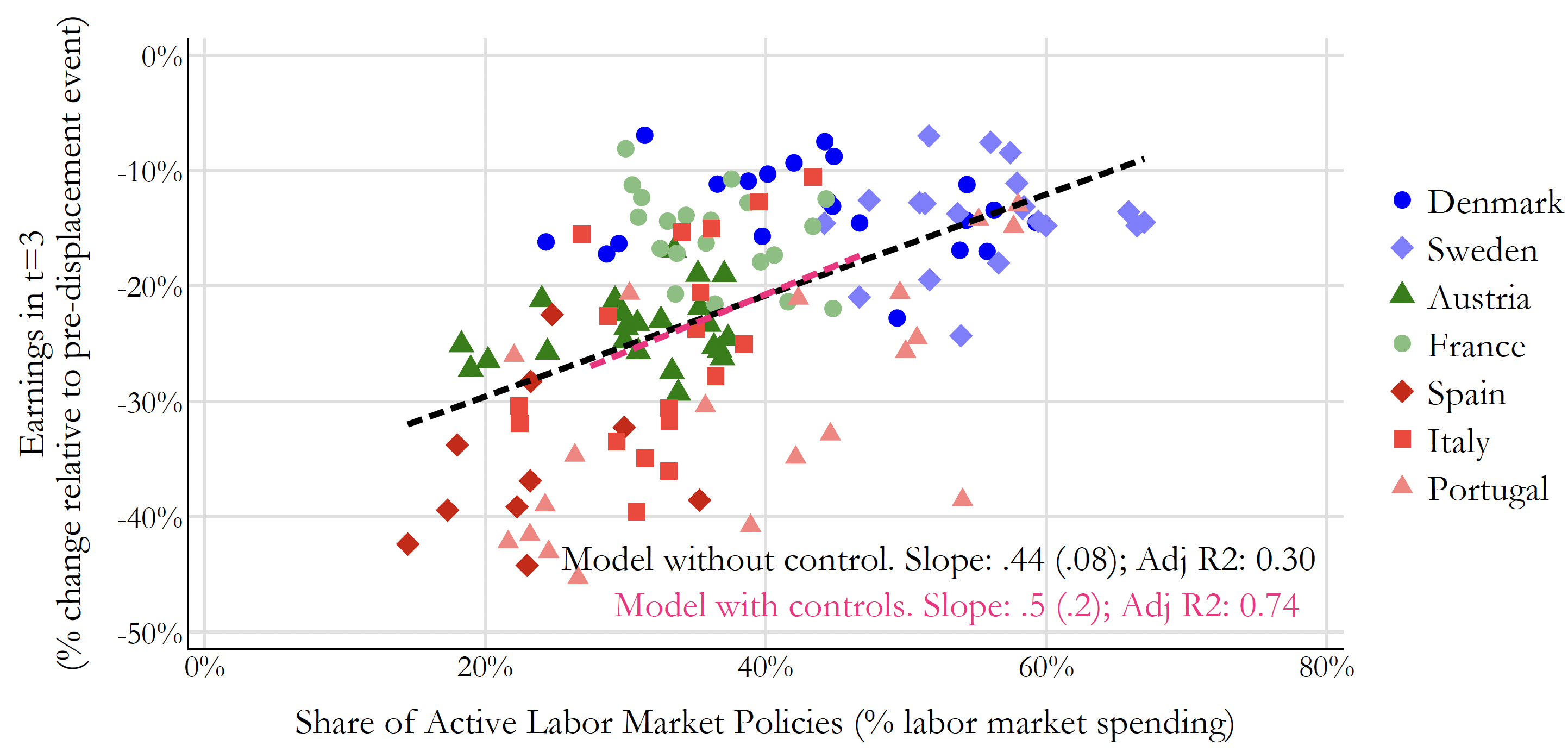

Determine 3 experiences the beforehand estimated job loss results on earnings plotted in opposition to spending on lively labour market insurance policies (as a share of whole spending on labour market applications). The determine highlights that lively labour market insurance policies, equivalent to coaching programmes, are extremely predictive of earnings losses. In international locations that use extra coaching insurance policies, we discover decrease earnings losses three years after job loss. This end result seems to be sturdy even when controlling for a variety of worker-level demographic and labour market traits, employer options and calendar time tendencies. Moreover, the outcomes are sturdy throughout and inside international locations. In contrast, not one of the different labour market establishments that we analyse in our paper (equivalent to whole spending in labour market insurance policies, employment safety, and union protection) seems to be robustly predictive of the persistent earnings drop that follows job loss.

Determine 3 Earnings losses and spending on lively labour market insurance policies.

Be aware: Relationship between the estimated earnings losses three years after job loss and spending on lively labour market insurance policies. The regression coefficient obtained when controlling for nation and yr fastened results, employee and employer traits, macroeconomic controls and labour market establishments is printed in pink, normal errors in parentheses (see Bertheau et al. 2022, for additional particulars).

All in all, the significantly totally different earnings trajectories that comply with job loss represent a hanging end result that raises the query of what could be accomplished to mitigate everlasting earnings and employment losses. Our outcomes reveal that labour markets perform higher in some international locations than others and that labour market establishments have the potential to mitigate these variations.

Editors’ word: An Italian model of this column is on the market on Lavoce.

References

Autor, D, D Dorn, G Hanson, and Ok Majlesi (2020). “Importing political polarization? The electoral penalties of rising commerce publicity”, American Financial Assessment 110(10):3139-3183.

Bennett, P and A Ouazad (2016), “The connection between job displacement and crime”, VoxEU.org, 29 October.

Bertheau, A, E Acabbi, C Barceló, A Gulyas, S Lombardi, and R Saggio (2022), “The unequal value of job loss throughout international locations”, NBER working paper 29727.

Boeri, T (2011), “Institutional reforms and dualism in European labor markets”, Handbook of Labor Economics 4B: 1173-1236.

Carrington, J and B Fallick (2017), “Why do earnings fall with job displacement?”, Industrial Relations: A Journal of Financial system and Society 56(4): 688-722.

Gulyas, A and Ok Pytka (2021), “Understanding the sources of earnings losses after job displacement: A machine-learning strategy”, Working paper.

Jacobson, L S, R J LaLonde, and D G Sullivan (1993), “Earnings losses of displaced staff”, The American Financial Assessment 83(4):685-709.

Kleven, H, C Landais, J Posch, A Steinhauer, and J Zweimüller (2019a), “Youngster penalties throughout international locations: Proof and explanations,” VoxEU.org, 14 Might.

Kleven, H, C Landais, J Posch, A Steinhauer, and J Zweimüller (2019b), “Youngster penalties throughout international locations: Proof and explanations”, American Financial Affiliation: Papers and Proceedings 109: 122-126.

Sullivan, D and T Von Wachter (2009), “Job displacement and mortality: An evaluation utilizing administrative knowledge”, The Quarterly Journal of Economics 124(3): 1265–1306.

Endnotes

1 A greater understanding of the implications of job loss has implications that transcend the labour market outcomes. A lot of causal research have discovered detrimental results of job loss on staff’ well being and chance of committing against the law, in addition to on the rise of maximum political discourse (Sullivan and Von Watcher 2009, Bennett and Ouazad 2016, Autor et al. 2020).

2 This strategy is analogous to the one employed in a distinct setting by Kleven et al. (2019a, 2019b). They examine how males’s and girls’s earnings are in another way affected by the delivery of a kid and present that the magnitude of the kid penalty for girls differs extensively throughout international locations.