Guest contribution by Investro

The current recession is causing massive price declines in the stock market, mainly in the tech sector. While dollar-cost averaging may be a wise choice during an economic downturn, there are also stocks that keep their value during tough times and pay notable dividends.

You have surely heard about Coca-Cola, which pays almost 3% yearly dividends. However, more is needed to cover high inflation. There are companies paying dividends high enough to cover inflation and even give you a return. You just maybe haven’t heard about them, until now.

Rio Tinto Group (RIO)

Rio Tinto Group is an Anglo-Australian multinational company that is the world’s second-largest metals and mining corporation, a little behind BHP. The company was founded in 1873 and has approximately 50,000 employees. Its stock is listed on the New York Stock Exchange (NYSE) with a $104.8 billion market cap.

Related article: These 3 stocks are safe-haven amid recessions

For decades, the stock has been performing well. The only thing that hit the company really hard was the 2008 financial crisis, which caused a massive price decline. However, this was also caused by exponential growth, taking the stock to sky-high levels.RIO is now down about 50% from its all-time high (ATH) level from 2008, offering fair pricing.

Price chart of Rio Tinto Group, source: finance.yahoo

The price/book ratio (P/B) 2.07, price/earnings ratio (P/E) 5.96, and other valuation measures also show good numbers, signaling the uptrend may continue in 2023.The company’s current dividend yield is around 11%, with a solid dividend history. The payout is likely to change in the future, but investors of RIO receive dividends semi-annually.

Rio Tinto is a profitable company with large revenues that totaled almost $65 billion last year. It may shrink due to an ongoing economic decline, but dividends are expected to remain. If the current recession continues throughout the next year, owning RIO may be a wise choice because the company’s payout ratio is pretty high.

Annual revenues of Rio Tinto Group, source: finance.yahoo

Maersk (MAERSK-A.CO)

Danish shipping company Maersk is involved in both ocean and land-based freight transportation, as well as related services, including supply chain management and port operation. Maersk was the world’s biggest container shipping line and vessel operator for several decades. It was founded in 1904, and it has almost 100,000 employees globally.

Their stock is available on more stock exchanges, including a Danish and American stock exchanges. MAERSK stock declined by more than 35% from its ATH, causing the company to be undervalued. P/B is currently 0.62 and P/E only 1.26, while the company has a $39 billion market cap.

Price chart of Maersk, source: finance.yahoo

The company’s dividend history is less bright than the one of Rio Tinto, but investors can expect from 7.68% to 15.52% dividend in the following season. This should cover inflation and bring a little return as well. As Maersk is one of the world’s leaders in the industry, it is fair to expect it will keep its position in the future, rewarding its loyal shareholders.

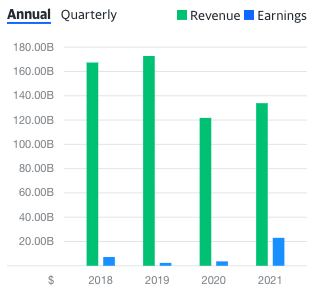

Maersk has long-term profitability and rising revenues that even grew higher in 2021. Revenue and earnings exploded in 2021, drawing attention to the company as its stock also rose by hundreds of percent since the COVID crash. Further growth is expected even during a recession because of all the mentioned signals.

Annual revenues of Maersk, source: finance.yahoo

Mercedez-Benz (MBG.DE)

No need to introduce Mercedes. Most people know it only as a car brand, but it is also listed on the stock market. This well-known car maker was established in 1926 and reportedly has over 173,000 employees worldwide. Despite the company’s colossal revenues, Mercedes did not break its ATH level from late 1990s.

Also read: How are these 3 unicorn companies doing since IPO?

For the third time in a row, Mercedes stock retreated when it reached the zone of 90€ – 100€, namely in 1998, 2015 and 2021. As stocks rise in the long run, it is anticipated this stock will do too, as it is one of the biggest automobile manufacturers in the world. MBG is listed on the German stock exchange, being a part of the most popular European index DAX 40.

Price chart of Mercedes, source: finance.yahoo

MBG is currently down approximately 27% from its latest peak in 2021 and could fall even more, but Mercedes plans to pay a nice dividend to its holders. The automobile company is considered undervalued with its 70€ billion market cap because of its enormous long-term revenue and earnings. For four years in a row, the company had revenue of at least 120€ billion.

Annual revenues of Mercedes, source: finance.yahoo

While 2021 was a great year for the company, 2022 is also solid, with more than 10€ billion in profits and more than 109€ billion in revenue for the first three quarters. It has a 0.85 P/B and 5.37 P/E, showing it might be a good time to buy as a long-term investment. Mercedes stock has been paying out dividends quarterly since 1999.

The best part is that shareholders receive approximately a 10% yearly dividend, but they receive it quarterly. There have been some instances when the company had to cut the dividend payout in worse years, but it’s a smart choice for those willing to hold for years despite the low payout ratio.

Bottom Line

This article provided three companies from different sectors, which should give you diversification through not just quantity, but also sector-wise. They also provide a bit of geographical diversification, since these companies are not from one country or economy. The dividend-oriented portfolio is great for investors who want less stress on their investment journey. Dividend stocks tend to be less volatile and offer “certain profit” through regular payouts.

However, it is important to consider the overall market risk. Therefore, investors need to diversify even with dividend stocks. That is why you should not rely on investing in just one or two stocks,but at least five to seven. Of course, other great companies also pay high dividends and are considered low risk, but these are few of the best at the moment.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].