Up to date on June twenty fourth, 2022 by Bob Ciura

Retirees have a distinct set of challenges of their funding planning, than different teams of traders. Buyers in or nearing retirement may need to contemplate revenue alternative as a key element of their funding choices. In spite of everything, retirees now not have an everyday paycheck from working to depend on.

Along with conventional sources of retirement revenue reminiscent of pensions and/or Social Safety, retirees can enhance their ‘retirement paycheck’ revenue with dividend shares. These are firms that pay shareholders common revenue for proudly owning the inventory. Not all shares pay dividends. However the constant funds from dividend shares is usually a useful supply of revenue for retirees.

Shares with low dividend yields will not be as enticing for revenue traders. Because of this we now have created a downloadable record of high-yield dividend shares, labeled as shares with 5%+ dividend yields.

You possibly can obtain our record of excessive dividend shares (together with vital monetary metrics reminiscent of dividend yield and payout ratio) by clicking on the hyperlink beneath:

After all, traders who’re fascinated by buying particular person shares ought to be sure they’ve researched every firm, to make sure it’s financially wholesome with a powerful enterprise mannequin, and future development potential.

To assist with the search, we reached out to 2 authors of fashionable investing web sites in addition to Positive Dividend writers for his or her particular person suggestions. The next record represents these contributors’ favourite retirement dividend shares for the rest of 2022, in no specific order.

This text will talk about 11 high shares to begin your retirement portfolio, with an introduction detailing why revenue traders would possibly wish to put money into high-yield shares.

Desk of Contents

You possibly can immediately bounce to any particular part of the article by clicking on the hyperlinks beneath:

Excessive-Yield Shares Overview

Excessive dividend shares are particularly attention-grabbing proper now, within the local weather of document excessive inventory costs and traditionally low rates of interest. For instance, the typical yield of the S&P 500 Index is simply 1.6% presently, a reasonably unimpressive yield for traders who wish to generate revenue from their inventory portfolio.

Sadly, not all shares with excessive dividend yields ought to be bought. Some shares have excessive dividend yields not as a result of the corporate has elevated the dividend payout, however relatively as a result of the inventory worth has plunged. Inventory costs and dividend yields transfer in wrong way–as a inventory worth declines, the dividend yield rises (and vice-versa).

Subsequently, firms in distressed monetary situation whose share costs are declining quickly, can have a excessive dividend yield. However in some instances, an especially excessive dividend yield is a precursor to a dividend lower or suspension, which is a foul final result that traders wish to keep away from as a lot as doable.

The next 11 shares don’t essentially have the very best dividend yields; as an alternative, they’ve a mixture of excessive yield plus dividend security, a powerful steadiness sheet, and a sustainable payout. Consequently, they enchantment to revenue traders in search of high quality high-yield shares.

Excessive-Yield Retirement Inventory #11: Costco Wholesale (COST)

This greatest dividend inventory choice is from Craig with Retire Earlier than Dad.

Buyers starting to construct a retirement revenue portfolio ought to search for three attributes when shopping for particular person shares.

- Personal companies and perceive.

- Purchase inventory in firms with conservative steadiness sheets.

- Intention for dependable dividend payers with a historical past of dividend development.

One firm that matches this mould is Costco (COST). Costco is a wholesale retailer, working greater than 820 shops worldwide. Costco costs members a membership charge, offering constant and predictable money move and decreasing reliance on product revenue margins. Costco purchases in bulk, permitting it to promote high-quality merchandise to clients at a beautiful worth.

What I like most about Costco is its stock mannequin. As an alternative of filling the shops with each product conceivable like Walmart or Goal, Costco selectively carries solely about 4,000 merchandise in its shops, thereby specializing in high quality and worth whereas retaining a tidy stock. Over the previous decade, Costco has elevated its e-commerce choices and gross sales, however e-commerce was nonetheless lower than 10% of complete gross sales in 2021, leaving a lot room to develop.

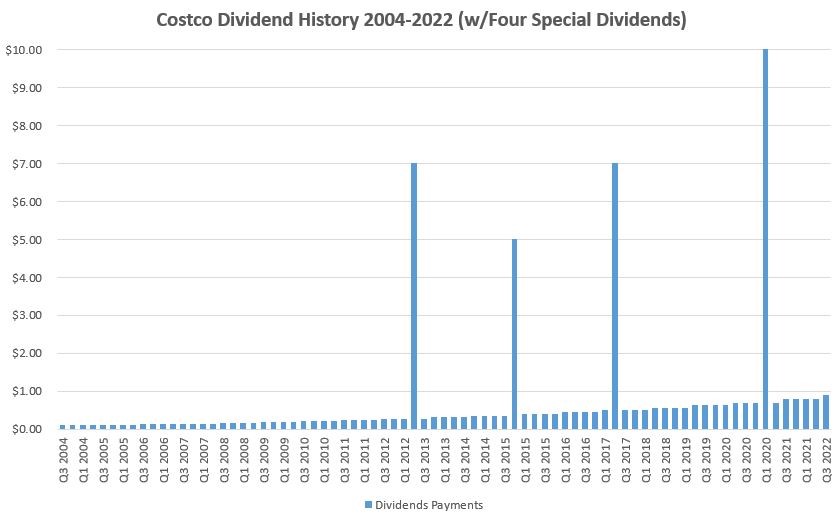

On the finish of the fiscal 12 months 2021 (August 2021), Costco had about $12 billion of money and short-term investments on its steadiness sheet and about $8.5 billion in debt. This conservative ratio ought to defend Costco towards financial fluctuations and hold the dividend solvent. Costco has an 18-year dividend cost and development streak, paying a present yield of solely 0.81%.

Nevertheless, the corporate has elevated its common quarterly dividend by a mean of 12.6% per 12 months for the previous decade and paid 4 particular dividends starting from $5 to $10 per share in that time-frame.

Costco’s dividend yield has averaged between 2% and three% over the previous decade, factoring within the particular dividends.

Costco is a well-recognized enterprise that’s simple to know, has a conservative steadiness sheet, and pays a dependable dividend that grows above even in the present day’s excessive inflation charge.

Costco’s membership mannequin and pricing energy ought to assist it climate financial uncertainty and pay reliable retirement revenue.

Excessive-Yield Retirement Inventory #10: Cisco Programs (CSCO)

This greatest dividend inventory choice is from Prakash Kolli of Dividend Energy.

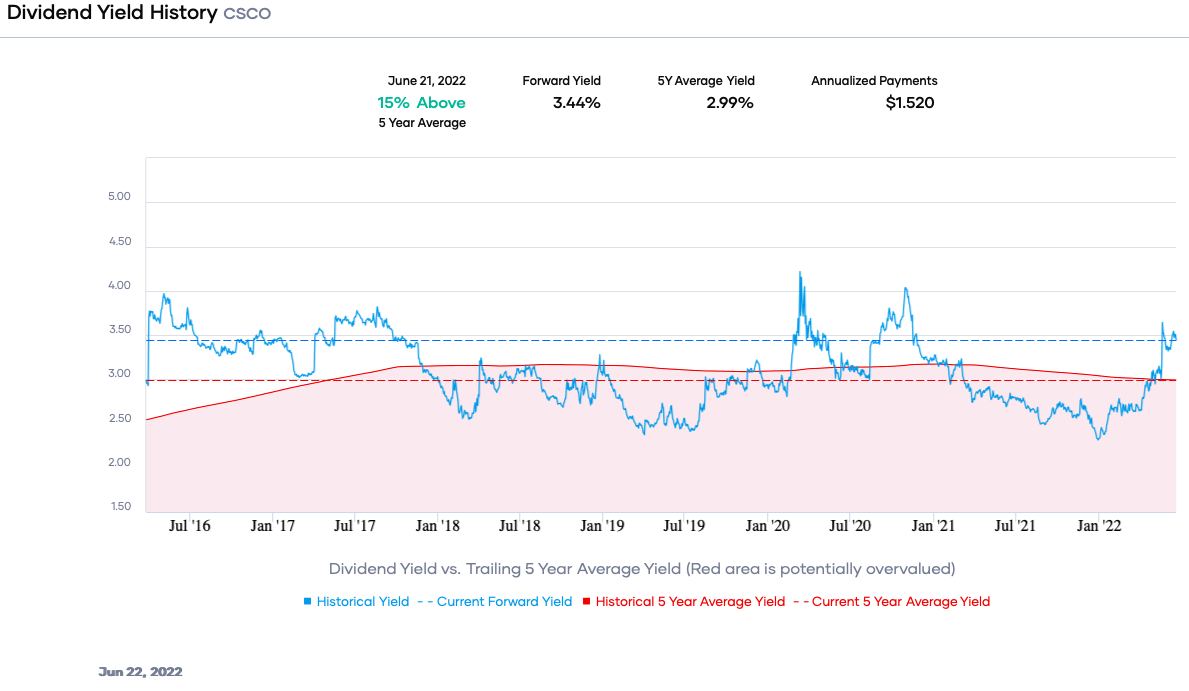

Cisco (CSCO) shouldn’t be a inventory most traders contemplate for retirement revenue. The corporate solely began to pay a dividend in 2011. Nevertheless, the networking big has enticing dividend attributes. The 2022 bear market has punished the inventory worth, and it’s down ~30% year-to-date decreasing the valuation and growing the dividend yield.

Cisco is the market chief in networking tools and software program. The corporate designs, manufactures, and sells Web Protocol (IP) networking and information heart {hardware} and software program applied sciences. Cisco spends prodigiously on R&D to keep up its management by rolling out new and improved merchandise.

The decline in inventory worth has concurrently elevated the dividend yield to the upper finish of its 10-year vary. Consequently, traders are getting a 3.44% yield, greater than the 5-year common of two.99%. The dividend yield can be greater than double the typical of the S&P 500 Index.

Supply: Portfolio Perception

Buyers searching for retirement revenue will just like the yield mixed with constant dividend development for 12 years. The dividend development charge has slowed however remains to be ~8.2% within the trailing 5 years. The comparatively conservative payout ratio of ~46% portends extra future development. The dividend security is enhanced by the online money place on the steadiness sheet.

From a valuation perspective, Cisco is buying and selling at a ahead price-to-earnings (P/E) ratio of roughly 13X, lower than the vary up to now 5-years and inside the vary up to now decade. Consequently, traders searching for retirement revenue to stay off dividends can purchase a market chief yielding nearly 3.5% with a protected dividend. In my view, Cisco is a long-term purchase.

Disclosure: Lengthy CSCO

Writer Bio: Prakash Kolli is the founding father of the Dividend Energy web site. He’s a self-taught investor and blogger on dividend development shares and monetary independence. A few of his writings will be discovered on In search of Alpha, InvestorPlace, Insider Monkey, TalkMarkets, ValueWalk, The Cash Present, Forbes, Yahoo Finance, FXMag, and main monetary blogs. He additionally works as a part-time freelance fairness analyst with a number one publication on dividend shares. He was not too long ago within the high 100 and 1.0% (81st out of over 9,459) of economic bloggers as tracked by TipRanks (an unbiased analyst monitoring web site) for his articles on In search of Alpha.

Disclaimer: The creator shouldn’t be a licensed or registered funding adviser or dealer/vendor. He isn’t offering you with particular person funding recommendation. Please seek the advice of with a licensed funding skilled earlier than you make investments your cash.

Excessive-Yield Retirement Inventory #9: One Gasoline (OGS)

This greatest dividend inventory choice is from Nikolaos Sismanis.

Oklahoma-based ONE Gasoline is without doubt one of the largest publicly traded pure gasoline utilities in america. The corporate gives pure gasoline distribution providers to roughly 2.2 million clients. Particularly, ONE Gasoline holds market shares of 88%, 72%, and 13% in Oklahoma, Kansas, and Texas, respectively.

The three.2%-yielding firm ought to make an amazing addition to any retirement portfolio in its early levels as a result of shares providing each revenue and development prospects. ONE Gasoline’ working money flows are comparatively resilient as a result of pure gasoline consumption ranges being largely predictable, particularly through the winter months.

Additional, as a result of firm’s dominant market share in 2/3 states it operates in, ONE Gasoline ought to proceed to progressively develop its internet revenue, powered by incremental inhabitants/buyer development and base charge will increase as permitted by regulators. Elevated profitability can be being supported by economies of scale kicking in as the corporate expands its distribution community.

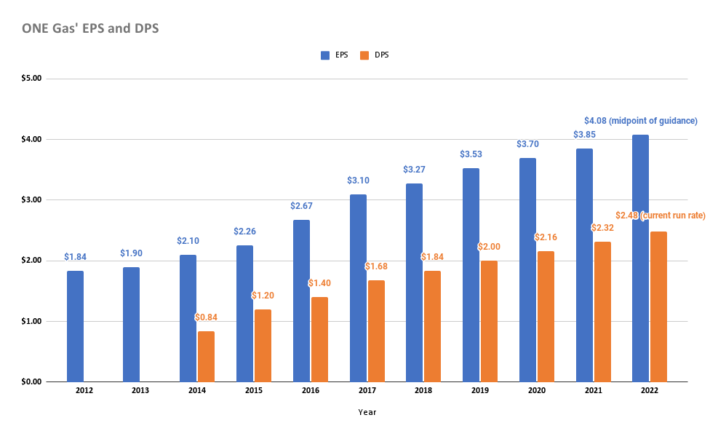

In reality, over the previous seven years, earnings per share have grown on common by 9.3% per 12 months. Following elevated profitability, the corporate has been capable of develop its dividends to shareholders by a compound common development charge of 15.6% over the identical interval. Specifically, dividends have grown yearly since 2014, when ONE Gasoline was spun off from ONEOK. The payout ratio stands at a wholesome 61%, in step with administration’s goal vary of between 55% and 65%.

Supply: SEC filings, Writer

By combining predictable charge will increase (which administration expects to land between 7% and eight% via 2025) and development CAPEX, earnings per share are anticipated to develop between 6% and eight% over the subsequent three years. Accordingly, administration has focused dividend per share development of between 6% and eight% over the identical interval.

Administration’s multi-year outlook is what actually differentiates ONE Gasoline from different firms with regards to serving a retirement portfolio, because it permits for nice investor visibility and lowered ranges of uncertainty.

Excessive-Yield Retirement Inventory #8: Realty Earnings (O)

This greatest dividend inventory choice is from Nate Parsh.

Buyers ought to concentrate on proudly owning the most effective names out there when designing a portfolio that may present revenue for retirement. Corporations which have a dominant trade place are sometimes capable of navigate difficult financial situations. Many of those firms even have lengthy histories of elevating dividends, making their shares good sources of revenue.

Realty Earnings Company (O) possess all of those qualities, making the inventory a powerful candidate for buy.

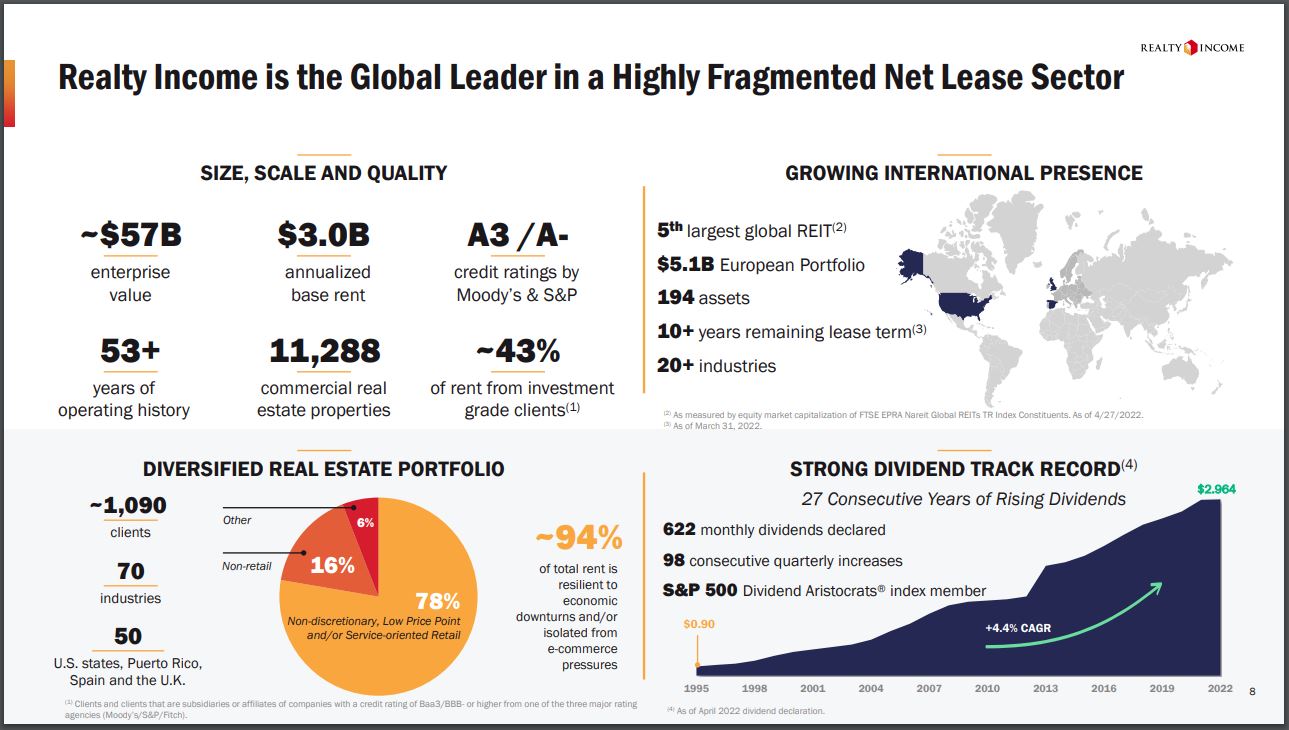

Supply: Investor Presentation

Realty Earnings is a Actual Property Funding Belief, or REIT, that makes a speciality of single-tenant standalone properties, which is a extremely fragmented trade, making it ripe for consolidation. Following a collection of acquisitions, which included spinning off its weaker workplace house unit, the belief has practically 11,300 properties in its portfolio, a footprint that’s largely unmatched by friends.

Realty Earnings operates a extremely diversified enterprise mannequin, which incorporates practically 1,100 purchasers unfold throughout 70 totally different industries. No consumer accounts for greater than 4.1% of the portfolio and no trade contributes greater than 10.2% of annual income. The belief has properties in each U.S. state and not too long ago expanded to the U.Okay. and Spain via a merger with VEREIT.

A powerful enterprise mannequin has enabled Realty Earnings to declare greater than 620 consecutive month-to-month dividends for the reason that belief went public in 1994. The belief has raised its dividend greater than 114 instances during the last 26 consecutive, making Realty Earnings one in every of three REITs that qualify as a Dividend Aristocrat.

The belief’s dividend development streak is more likely to proceed as its projected payout ratio for 2022 is simply 75%, beneath the 10-year common payout ratio of 84%. Shares of Realty Earnings yield 4.6%, practically thrice the typical yield for the S&P 500.

Excessive-Yield Retirement Inventory #7: Parker-Hannifin (PH)

This greatest dividend inventory choice is from Aristofanis Papadatos

Parker-Hannifin (PH) is a diversified industrial producer that makes a speciality of movement and management applied sciences. The corporate was based in 1917 and has grown to a market capitalization of $30 billion with annual revenues of over $14 billion.

Regardless of its industrial nature, Parker-Hannifin operates in a distinct segment market, with merchandise which might be obscure however important to the purchasers of the corporate. Consequently, Parker-Hannifin enjoys a large enterprise moat. That is clearly mirrored within the distinctive dividend development document of the corporate. Parker-Hannifin has raised its dividend for 66 consecutive years and thus it belongs to the best-of-breed group of Dividend Kings.

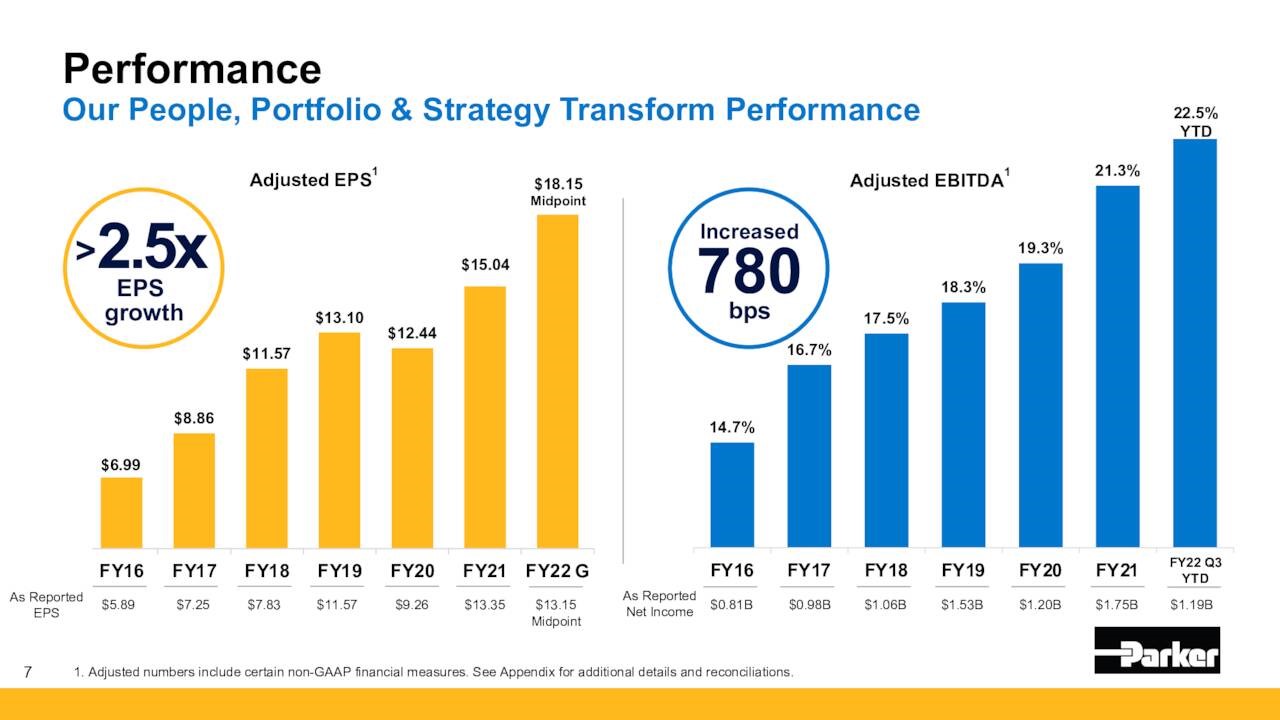

Parker-Hannifin has achieved its admirable dividend development document because of its constant earnings development. Over the last decade, the corporate has greater than doubled its earnings per share, from $7.45 in 2012 to $15.04 in 2021. It has completed such a powerful efficiency primarily because of a collection of acquisitions. It has acquired smaller firms and has integrated their merchandise effectively in its personal portfolio whereas it has additionally loved nice synergies from these acquisitions.

Even higher for the shareholders, enterprise momentum has accelerated in recent times.

Supply: Investor Presentation

Notably the economic producer has exceeded the analysts’ earnings-per-share estimates for greater than 20 consecutive quarters. This can be a testomony to the robust enterprise momentum of the corporate and its dependable development trajectory. As well as, it displays the spectacular resilience of the corporate to the coronavirus disaster.

Furthermore, Parker-Hannifin is presently within the strategy of buying Meggitt, a worldwide chief in aerospace and protection movement and management applied sciences, for $8.8 billion in money. Meggitt affords know-how and merchandise on each main plane platform and has annual revenues of $2.3 billion. Because the deal worth is 29% of the market capitalization of Parker-Hannifin and the revenues of Meggitt are 15% of the revenues of Parker-Hannifin, the transaction is more likely to show a significant development driver for the corporate.

Total, traders ought to relaxation assured that Parker-Hannifin is more likely to stay in its long-term development trajectory, largely because of the acquisition of smaller producers.

Excessive-Yield Retirement Inventory #6: Medical Properties Belief (MPW)

This greatest dividend inventory choice is from Felix Martinez.

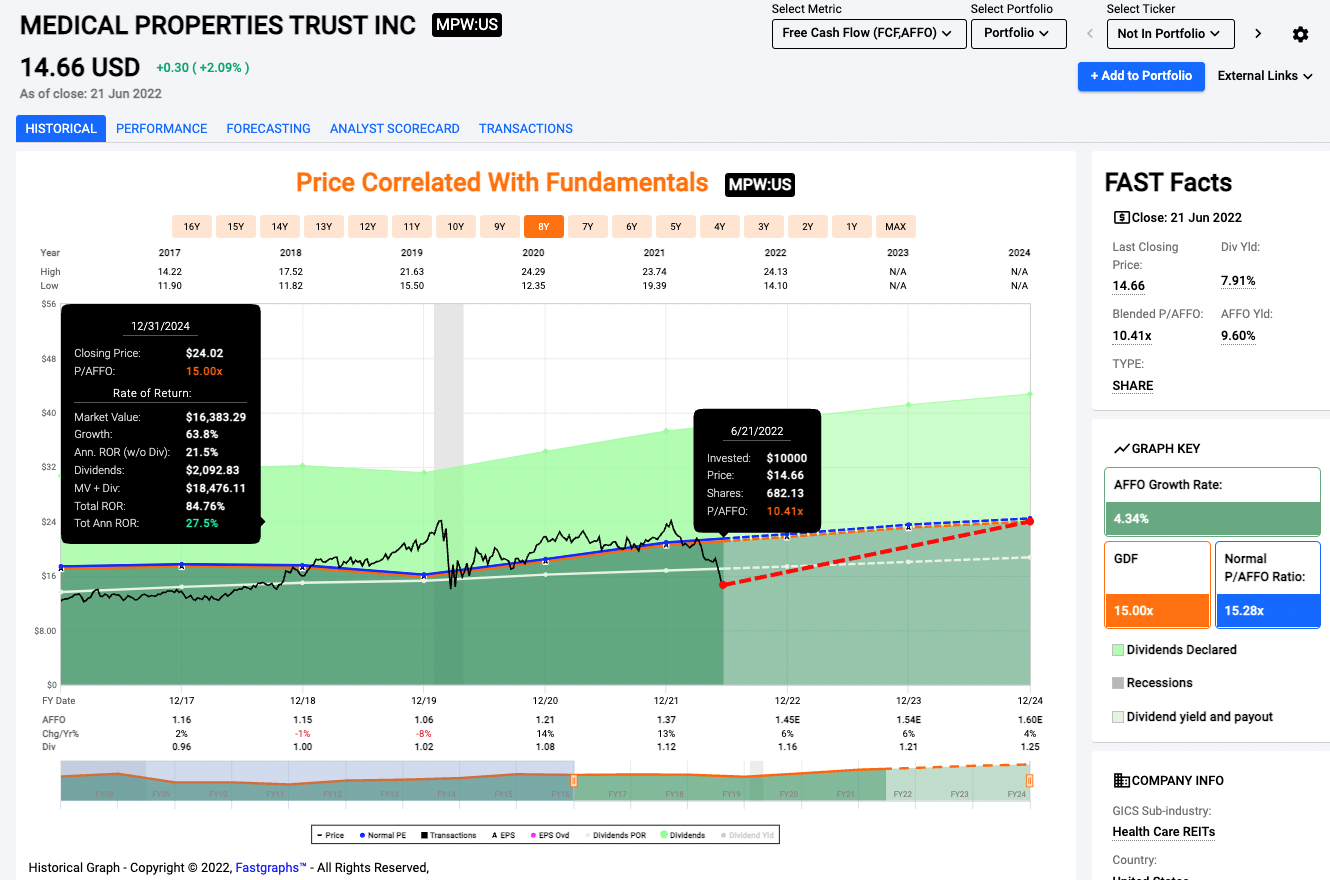

Medical Properties Belief Inc. (MPW) is a self-advised actual property funding belief shaped in 2003 to accumulate and develop net-leased hospital services. Proper now, the corporate is without doubt one of the world’s largest homeowners of hospitals, with roughly 440 services and 46,000 licensed beds in ten nations and throughout 4 continents.

The corporate is a dividend challenger with 9 consecutive years of dividend development. The corporate has a five-year compounded annual dividend development charge of 4.3%. The corporate introduced the latest dividend improve in February 2022, when the corporate introduced a 4% dividend improve. The corporate presently pays a beautiful dividend yield of seven.9%, a lot increased than its five-year common of 5.9%.

Free Money Circulation (FCF) has grown 4.9%/yearly since 2012. Analysts expect FCF development of 5.3% for the subsequent three years. For Fiscal 12 months (FY)2022, analysts anticipate that the corporate will make $1.45 per share in FCF, which is able to improve by 6% in comparison with FY2021. This can present traders with a protected dividend payout ratio, primarily based on the 2022 FCF, of 80%.

One thing to contemplate is the truth that the corporate continued to pay and lift its dividend through the 2020 COVID-19 Pandemic. Whereas most REITs lower or suspended their dividend, MPW elevated them by 3.8% in 2020 and three.7% in 2021.

At the moment, the inventory is attractively valued at 10.4x ahead FCF. If the corporate reverts to its regular P/FCF of 15.3, this may present a good worth of $22.19 per share. Primarily based on in the present day’s worth of $14.65, the inventory is 51% undervalued.

Supply: FastGraphs.com

Excessive-Yield Retirement Inventory #5: 3M Firm (MMM)

This greatest dividend inventory choice is from Quinn Mohammed.

3M is a number one world producer, with operations in over 70 nations. The corporate’s product portfolio is comprised of over 60,000 gadgets, that are offered to clients in additional than 200 nations. These merchandise are used on daily basis in houses, workplace buildings, colleges, hospitals, and extra. 3M has paid dividends to shareholders for over 100 years.

Management offered 2022 steerage and sees natural gross sales development of two% to five%, and earnings-per-share of $10.75 to $11.25. Our 2022 EPS estimate is presently $11.00. So, the corporate is rising, and we estimate annual EPS development of 5.0% over the intermediate time period.

The corporate is presently prioritizing their investments in giant, fast-growing sectors which have favorable components throughout the globe. Some examples are automotive know-how, residence enchancment, private security, healthcare, and electronics.

3M’s know-how and mental property are its most vital aggressive benefits. These distinctive benefits have laid the inspiration for 3M to boost its annual dividend for over 60 years with out fail.

3M has greater than 50 know-how platforms and a workforce of scientists devoted to creating innovation. Innovation has made it doable for 3M to acquire over 100,000 patents all through its historical past, which retains many potential rivals at arm’s size. 3M continues to speculate closely in analysis and improvement and goals to spend round 6% of annual gross sales on R&D.

3M is a Dividend King and has raised its dividend for 64 years straight. Within the final ten years, its dividend has grown at a compound annual charge of practically 10%. 3M pays an annual dividend of $5.96, and on the present share worth, has a excessive yield of 4.6%. Primarily based on our present earnings estimate, 3M sports activities a payout ratio of roughly 54%, which is sort of protected. Moreover, we anticipate the payout ratio to return down in future years.

Though the corporate remained worthwhile through the Nice Monetary Disaster, this doesn’t imply it’s resistant to recessions. Nevertheless, it’s this constant profitability that has afforded 3M the flexibility to proceed growing its dividend via a number of financial cycles. 3M is presently buying and selling effectively beneath our truthful worth estimate and could possibly be an amazing addition to a retirement portfolio.

Excessive-Yield Retirement Inventory #4: Revolutionary Industrial Properties (IIPR)

This greatest dividend inventory choice is from Josh Arnold.

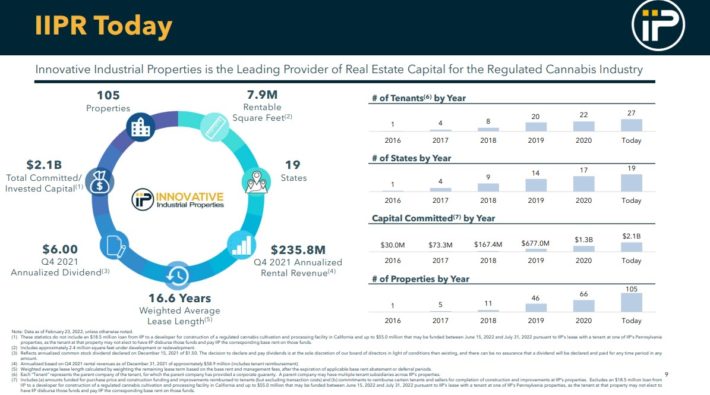

Revolutionary Industrial Properties, Inc. (IIPR) is the one publicly-traded REIT that makes a speciality of serving the burgeoning hashish trade within the US. On condition that, the belief has been afforded a large head begin in what’s an especially fragmented trade, and its portfolio is rising fairly shortly in consequence.

Associated: The Finest Marijuana Shares: Checklist of 100+ Marijuana Business Corporations

We anticipate 18% annual development in FFO-per-share within the years to return, pushed by not solely robust income development, however margins as effectively.

Supply: Investor presentation, web page 8

IIPR has seen its portfolio develop from one property in 2016 to over 100 in the present day, with 28 totally different tenants in 19 states. The belief has been capable of develop to greater than 1 / 4 billion run-rate in income as of the primary quarter of 2022, and we see rather more than that on the horizon.

IIPR’s sale-leaseback mannequin is extremely helpful to tenants as a result of it frees up their capital to put money into their companies, relatively than their actual property. IIPR then collects rental income off of that, and each side are higher for it.

Not solely will we see sizable development forward, however IIPR affords a 6.5% dividend yield in the present day, placing it in elite dividend firm. The belief has raised its dividend greater than 10 instances since 2017.

Lastly, IIPR trades for beneath 13 instances FFO-per-share for this 12 months, which is effectively beneath our estimate of truthful worth at 18 instances. With the present worth of $108 representing simply 71% of truthful worth, we additionally see large potential for a valuation tailwind within the years to return. That mixture of valuation, dividend yield, and FFO development makes IIPR my high inventory decide for this 12 months.

About this greatest dividend inventory choice’s creator: Josh Arnold is an unbiased fairness analyst and a prolific author with regards to dividend shares. His work will be seen right here on Positive Dividend, in addition to different monetary websites reminiscent of In search of Alpha.

Excessive-Yield Retirement Inventory #3: Verizon Communications (VZ)

This greatest dividend inventory choice is from Eli Inkrot of Positive Dividend.

Verizon Communications (VZ) is without doubt one of the largest wi-fi carriers within the nation, with a community masking ~300 million folks and ~98% of the U.S. The safety’s dividend has additionally been masking the money move wants of retirees for a while.

Many would possibly consider the enterprise as a gradual grower, however Verizon has proven some spectacular outcomes as of late:

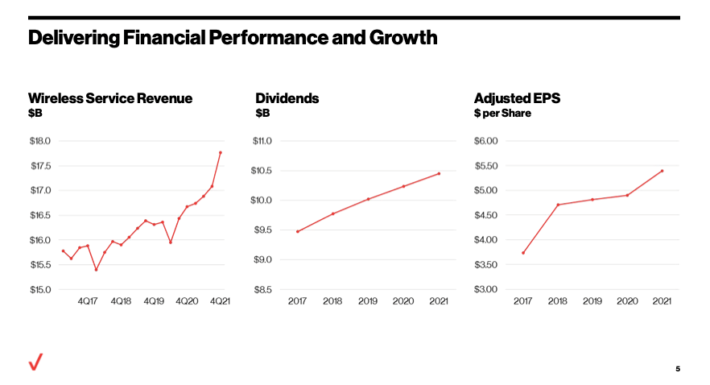

Supply: Verizon Investor Day 2022

Within the 2011 via 2021 interval, Verizon has grown its earnings-per-share by 9.6% yearly. Nevertheless, over that very same interval, the dividend per share grew by a compound annual development charge of simply 2.5%, that means the corporate’s payout ratio declined considerably over this time-frame. Immediately the dividend cost makes up lower than half of earnings, permitting for an ample dividend yield, however it additionally permits the corporate to reinvest in its enterprise, hold a powerful steadiness sheet, and repurchase shares.

Furthermore, whereas earnings and dividends have continued to climb, Verizon’s share worth has languished to a level. This makes in the present day’s worth proposition extra attention-grabbing.

Within the Positive Evaluation Analysis Database, we’re forecasting the potential for 14.6% annualized complete returns over the subsequent 5 years. That is pushed by the 5.1% beginning yield, 4% anticipated development charge and a 7.0% achieve from the opportunity of a valuation tailwind.

Naturally simply because this Is forecast, this doesn’t make it so. All kinds of issues can occur within the funding world. Nevertheless, Verizon has a wide range of constructive qualities for a retirement portfolio together with a excessive and sustainable dividend yield, the likelihood for development as the corporate continues to improve its community, and a beneath common valuation.

Disclosure: I’m lengthy VZ.

About this greatest dividend inventory choice’s creator: Eli Inkrot is President of Premium Providers at Positive Dividend, overseeing the Positive Evaluation Analysis Database, Newsletters and Particular Studies. Beforehand, Eli was an analyst in non-public actual property, VP and Portfolio Supervisor for a cash administration agency, VP for a monetary software program firm and an unbiased fairness analyst. Eli obtained a level in Enterprise and Economics from Otterbein College and a Grasp’s in Finance from the College of Tampa, the place he was named the “most excellent graduate pupil.”

Excessive-Yield Retirement Inventory #2: Johnson & Johnson (JNJ)

This greatest dividend inventory choice is from Bob Ciura of Positive Dividend.

Retirees have a distinct set of priorities than youthful traders. Particularly, retirees are usually extra involved with preservation of capital and producing revenue. Consequently, my greatest inventory decide for a retirement portfolio is healthcare big Johnson & Johnson (JNJ).

J&J has an exemplary dividend historical past. The corporate has elevated its dividend for over 60 consecutive years, giving it one of many longest streaks in all the inventory market.

It has maintained its lengthy historical past of elevating dividends every year, even via recessions, due to a diversified and dominant enterprise mannequin.

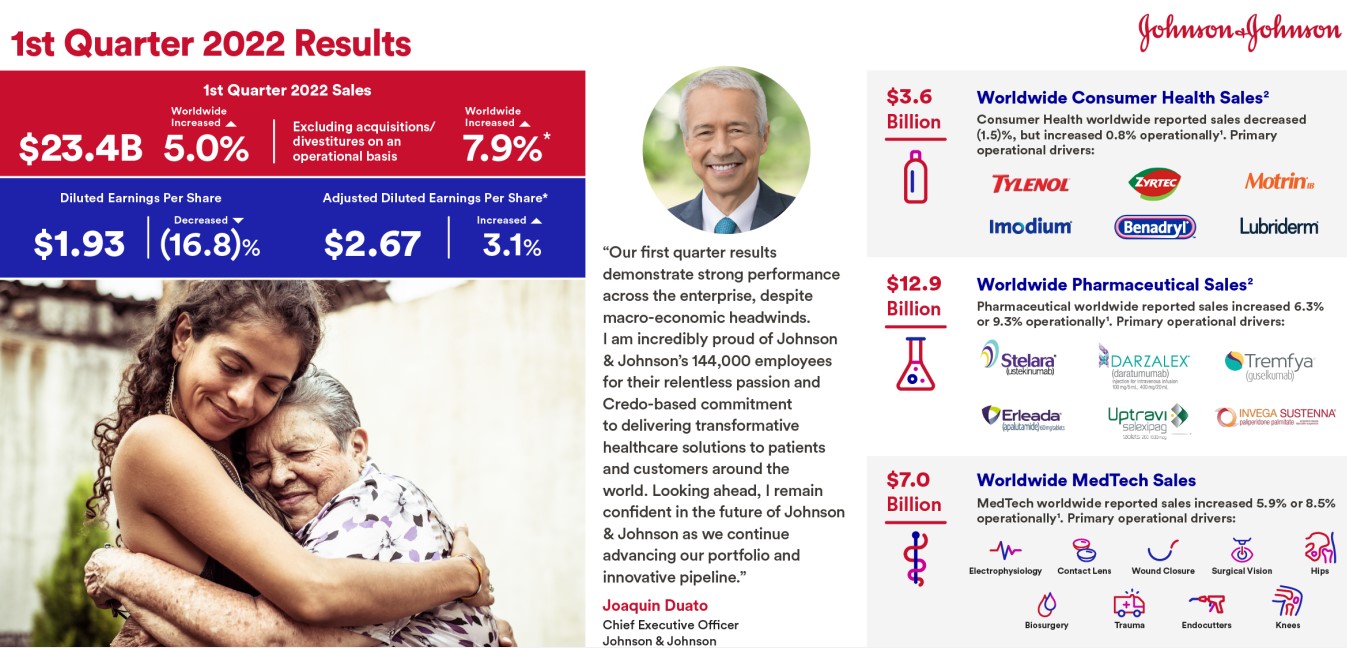

Supply: Investor Presentation

J&J has generated roughly 6% income development and eight% adjusted earnings-per-share development every year, up to now 20 years. It has very giant companies unfold throughout prescribed drugs, medical gadgets, and shopper merchandise.

Associated: Johnson & Johnson’s Shopper Well being Spinoff | What Ought to Buyers Do?

J&J is about to spin off its shopper division, however it can nonetheless stay a worldwide chief in two main healthcare classes. After the spin-off, the corporate will possess 25 particular person platforms or merchandise that every generate at the least $1 billion in annual gross sales.

Its world dominance is an added aggressive benefit. J&J generates over 70% of its annual income from merchandise that maintain the #1 or #2 world market place. The corporate’s trade management gives it with regular profitability and development, even when the economic system enters a recession.

One other margin of security for traders is the corporate’s pristine steadiness sheet. J&J is one in every of solely two U.S. firms (the opposite being Microsoft) that has a ‘AAA’ credit standing from Commonplace & Poor’s.

J&J inventory has a 2.5% dividend yield. Whereas it isn’t the very best yield round, it’s considerably increased than the S&P 500 common yield. And, J&J gives one of many most secure enterprise fashions on this planet, together with dependable dividend will increase every year.

About this greatest dividend inventory choice’s creator: Bob Ciura is President of Content material at Positive Dividend. He has labored at Positive Dividend since October 2016. He oversees all content material for Positive Dividend and its associate websites. Previous to becoming a member of Positive Dividend, Bob was an unbiased fairness analyst publishing his analysis with varied retailers together with The Motley Idiot and In search of Alpha. Bob obtained a Bachelor’s diploma in Finance from DePaul College, and an MBA with a focus in Investments from the College of Notre Dame.

Excessive-Yield Retirement Inventory #1: 3M Firm (MMM)

This greatest dividend inventory choice is from Ben Reynolds of Positive Dividend.

3M (MMM) is a high-quality dividend development inventory with an exemplary monetary historical past. The corporate was based in 1902 and has paid rising dividends for an unimaginable 64 consecutive years.

With a dividend streak of fifty+ years, 3M is a member of the elite Dividend Kings record.

3M is a well-diversified producer. The corporate’s development has been fueled by its heavy concentrate on analysis and improvement. 3M spends 6% of gross sales, which is ~$2 billion yearly, on analysis and improvement.

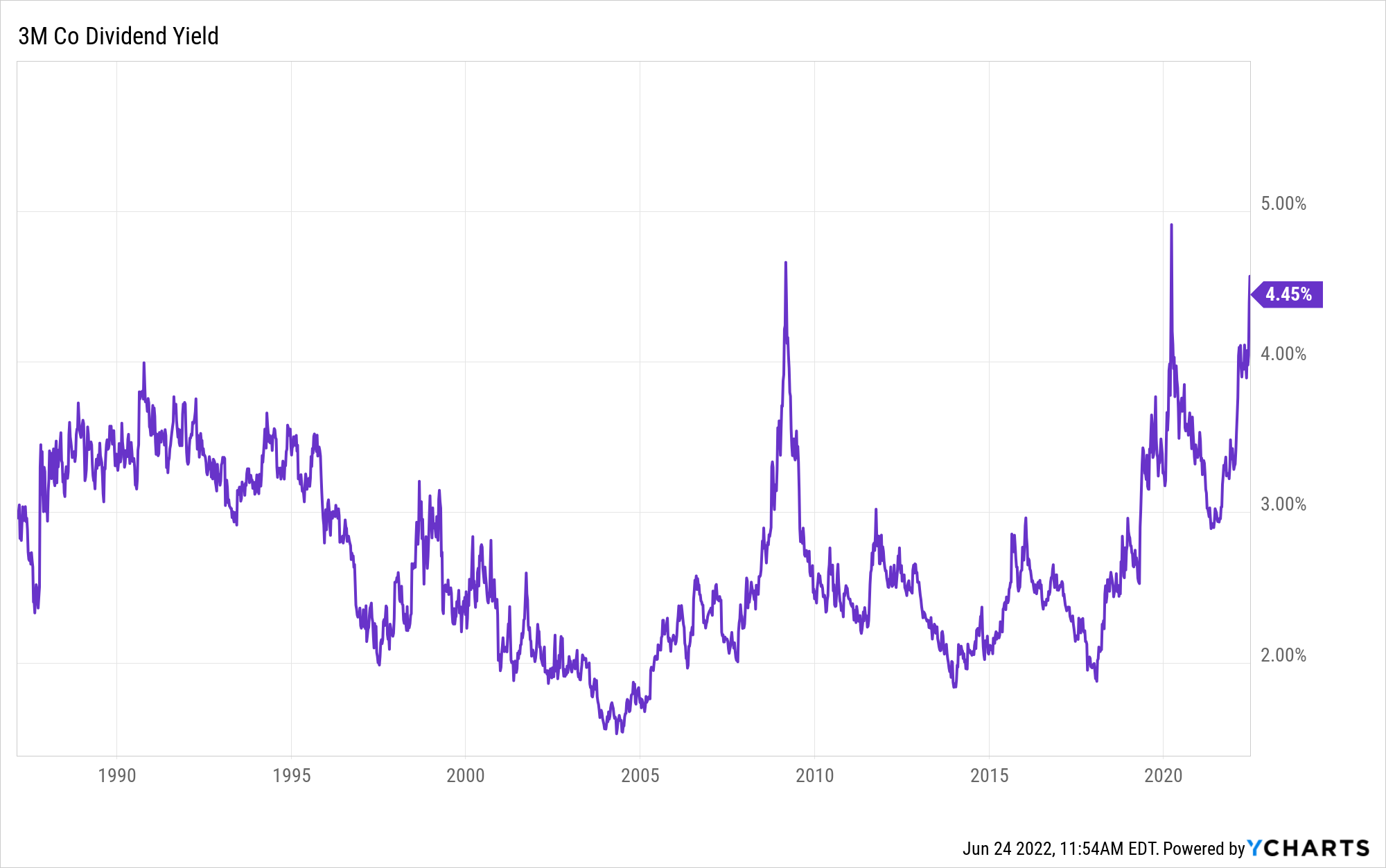

What makes 3M such a compelling retirement funding now’s its elevated dividend yield. The corporate’s inventory presently has a excessive 4.6% dividend yield. This can be a traditionally excessive dividend yield for 3M.

Supply: Ycharts

The one different instances since 1990 that 3M was buying and selling for a dividend yield of 4% or larger was through the Nice Recession and through the COVID-19 crash in 2020.

The first motive 3M is so cheap proper now’s as a result of the corporate is dealing with practically 300,000 lawsuits surrounding claims that its earplugs utilized by fight troops had been faulty. We don’t imagine this authorized state of affairs considerably impacts the corporate’s long-term prospects.

Moreover, 3M has not carried out as much as its ordinary exemplary requirements over the previous few years. In fiscal 2018, the corporate generated earnings-per-share of $10.46. We expect earnings-per-share of $11.00 in fiscal 2022, for tepid development over 4 years.

Regardless of current weak point, there’s a lot to love about 3M as an funding proper now. First, the 4%+ dividend yield is compelling. Moreover, we anticipate average development of round 5% a 12 months going ahead. And with a price-to-earnings ratio of solely 11.8 utilizing our present 12 months anticipated earnings-per-share estimate of $11.00, we anticipate important valuation a number of growth to our truthful worth price-to-earnings ratio estimate of 19.0.

3M is a confirmed high-quality enterprise that rewards shareholders with rising dividends over the long term. The corporate has not carried out as much as its ordinary requirements not too long ago, however it nonetheless has a sturdy aggressive benefit and ample money move producing skill. Close to-term headwinds have created a uncommon probability to purchase into 3M inventory at a 4%+ beginning yield.

About this greatest dividend inventory choice’s creator: Ben Reynolds based Positive Dividend in 2014. Reynolds has lengthy held a ardour for enterprise typically and investing specifically. He graduated Summa Cum Laude with a bachelor’s diploma in Finance and a minor in Chinese language research from The College of Houston. Immediately, Reynolds enjoys watching motion pictures, studying, and exercising (not on the similar time) in his spare time.

Closing Ideas

Excessive yield shares are enticing for traders, notably retirees, as a result of their increased revenue payouts. However traders have to analysis every particular person inventory earlier than shopping for, to verify the dividend payout is sustainable. That is very true in an unsure financial local weather. Many high-yield shares lower or suspended their dividends in 2020 as a result of coronavirus pandemic.

The 11 shares on this article all have management positions of their respective industries, together with sturdy aggressive benefits. In addition they have robust earnings to assist their hefty dividends, which is able to assist safe the dividend even in an financial downturn. Consequently, these are high shares for traders to begin their retirement portfolios.

Different Dividend Lists

The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].