Strong demographics have fueled the U.S. demand for housing over the last several years. As millennials, now the largest generation alive in the country, hit their peak home-buying age, demand for home purchases and rental units has surged. This demographic strength has been one of the several variables that have pushed up home prices since prior to the pre-pandemic period.

But demographics isn’t everything when it comes to demand—economics matters too. And with persistently high inflation, and a great deal of economic uncertainty, there is the risk that demand for housing could slow in the coming years. What happens to demand over the coming years will have big implications for real estate investors.

As such, in this article, I’m going to break down recent demand trends, provide a forecast for national demand over the coming years, and give a list of the top and bottom 10 markets for housing demand growth.

Measuring Demand

There are several ways to measure demand for housing. We typically look at total sales volume, mortgage purchase applications, and some conglomerate metrics like inventory and months of supply to measure the balance between supply and demand. In the rental market, we typically use a metric known as “absorption”, which measures the total number of occupied rental units in a given market. To combine these different markets into one useful metric, I like to track the total number of households and the growth rate of that number.

Sponsored

If you’re unfamiliar with the formal definition of a “household,” the census website states, “A household (or “ordinary household”) in the sense of the census survey describes all the persons sharing the same main residence, without these persons necessarily being blood-related.”

In other words, any housing unit occupied as a primary residence is a household. If you live with your parents, that’s a household. Live with a partner and your kids? That’s a household. If you live with one or more roommates, even though you’re not blood relatives—it’s still a household.

This definition makes sense because it helps us measure the total demand for primary residence housing units. If you add up all of the households in the U.S., that should, in theory, be equal to the total demand for primary residences in the country as well (this analysis doesn’t include demand for second homes or short-term rentals).

Over time, the total number of households tends to grow because the population is growing. The birth rate in the U.S. has slowed considerably, but it will take decades for that to be reflected in household formation numbers. In fact, right now, we’re at a high point for household growth.

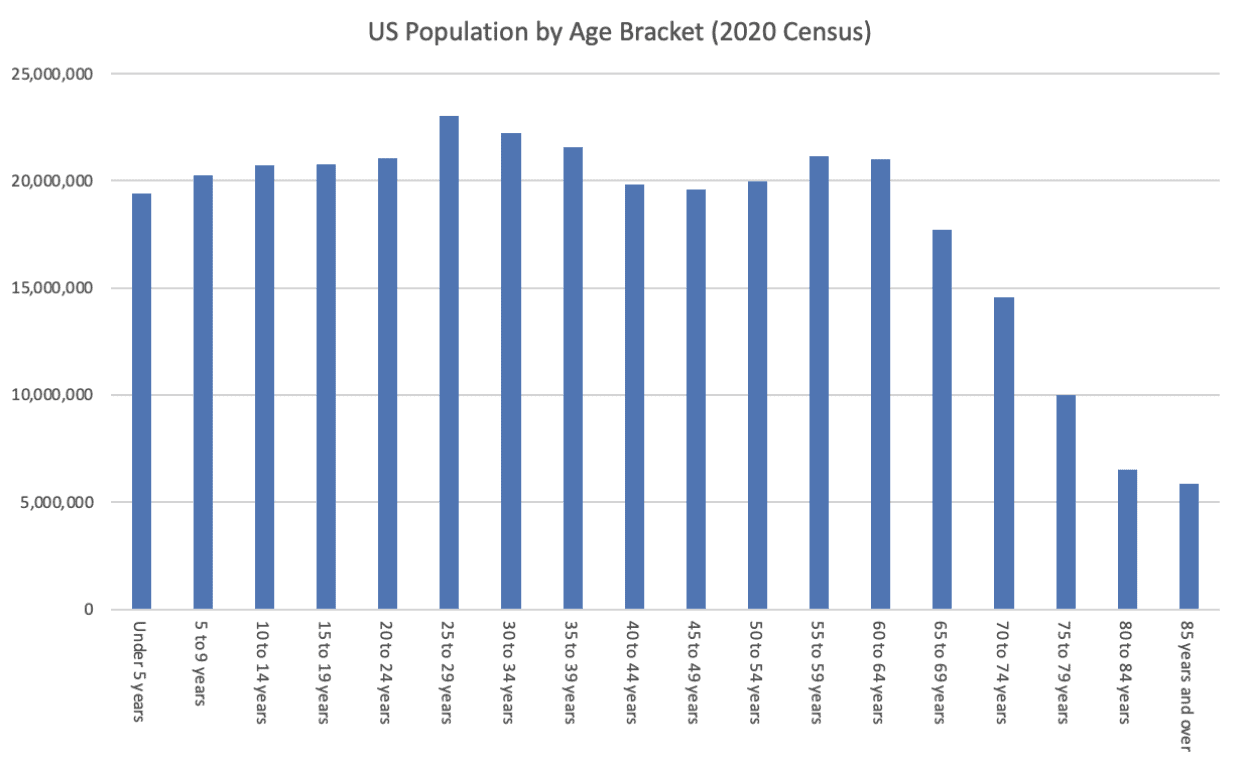

According to the 2020 U.S. Census, the biggest age brackets in the U.S. are 25-29-year-olds, followed by 30-34-year-olds. This population distribution aligns closely with the age at which most people start their own household, which is typically when a person reaches their late 20s or early 30s. This demographic reality has driven strong demand for rental units and housing for several years.

But as I said at the beginning of the article, population is not the only factor that impacts household formation. It is possible for household formation to slow, even with a strong demographic. And the opposite is true as well—household formation can speed up even if the population trends aren’t particularly strong. Economics plays a large factor in household formation. People won’t take the financial leap to form a household unless their financial situation supports it. And right now, as we all know, the economic picture is cloudy at best.

For the last several years, rent growth and home price growth have made housing generally unaffordable in the U.S. The U.S. is now “rent burdened” for the first time, and housing affordability has hit multi-decade lows. All of this is happening at a time when inflation is eating into the spending power of all Americans, and there is fear of further economic pain in the future. Basically, it’s not a great time to start a household if you don’t have to, and the data supports it.

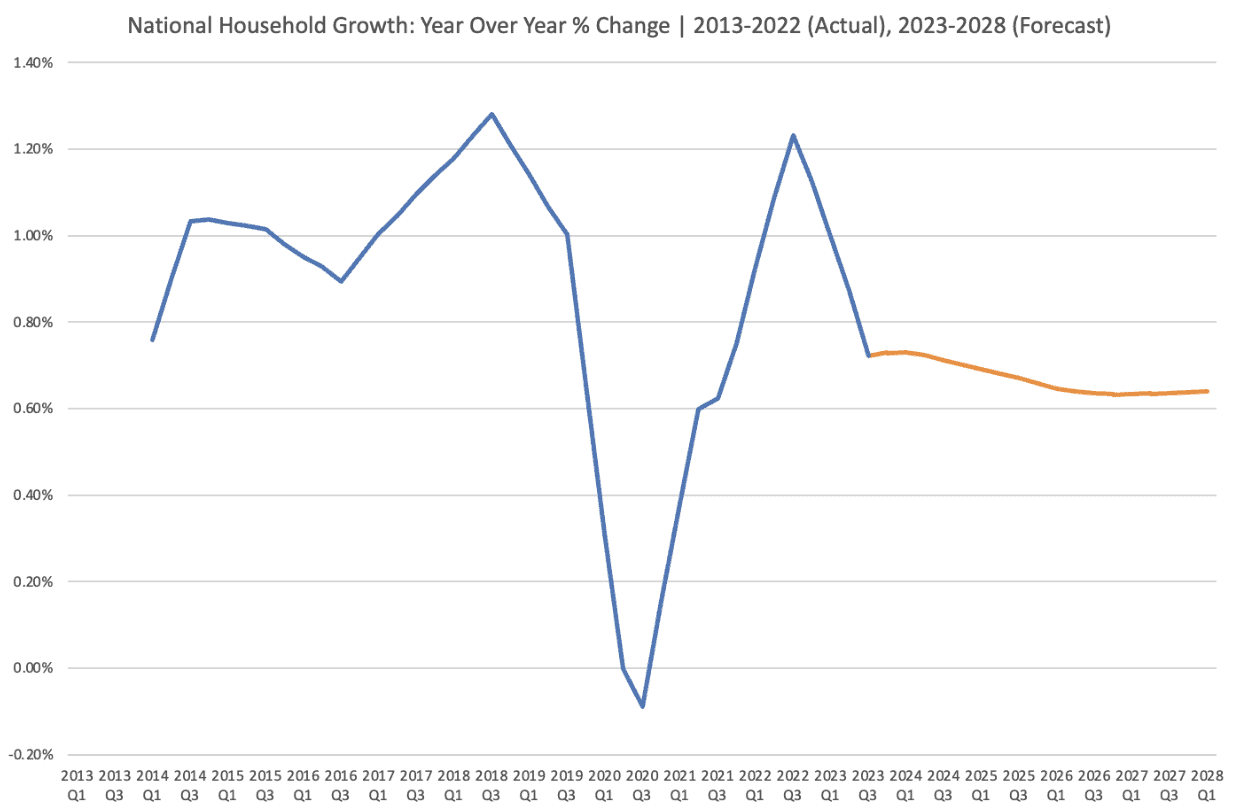

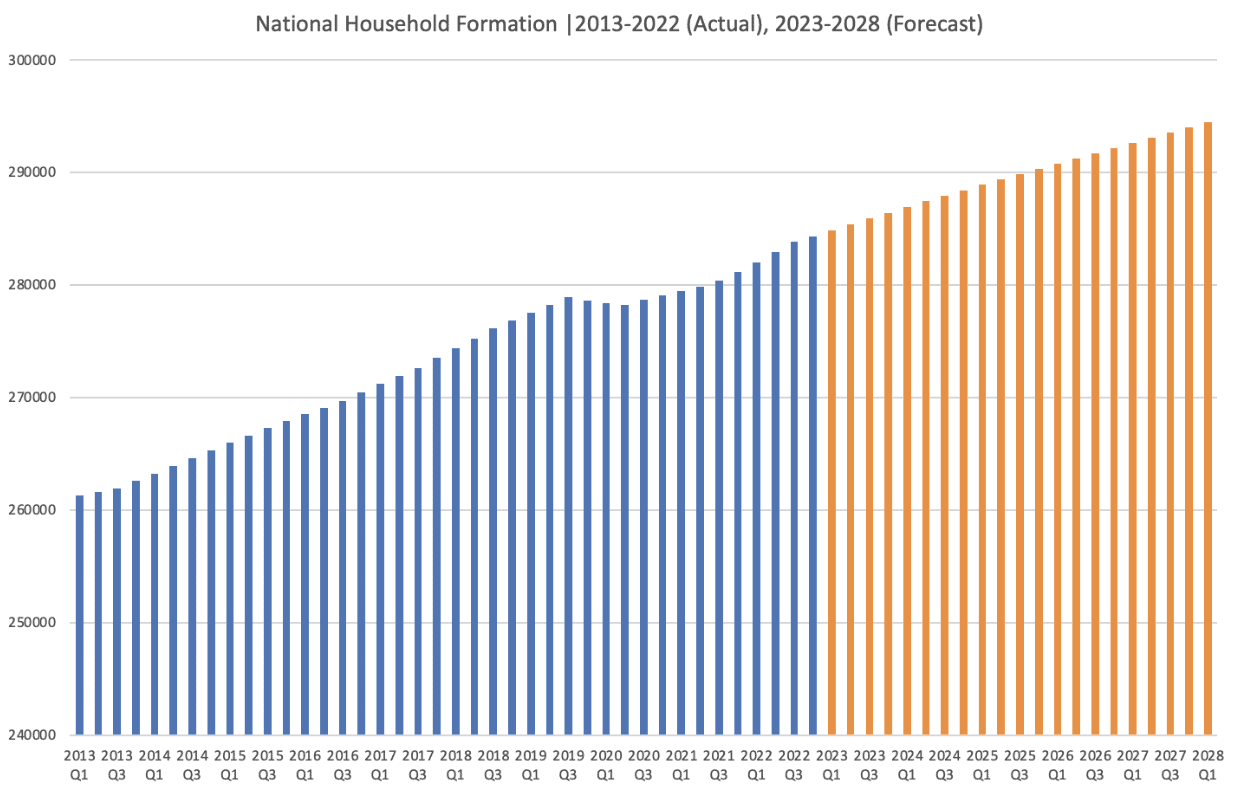

As shown by this data from CoStar, household formation has been on a wild ride over the last few years (as has basically all housing market data). Following a brief period of negative growth during the beginning of the pandemic, housing formation rapidly recovered—leading to strong demand for houses and rental units. But the frenzy peaked in Q3 of 2022 and has come down sharply. CoStar provides a forecast (shown in orange) of where they expect household formation to be over the coming years, and it’s markedly lower than pre-pandemic. Personally, I think there is some more downside risk in the short-term than is seen in this forecast, but I think the 5-year average is probably about right, given demographic trends.

This slowdown in demand will, of course, impact real estate investors, as it will likely lead to slower appreciation and rent growth in the coming years. But, it’s important to recognize that demand is still increasing, and most experts believe we are still under-supplied for housing in the U.S., meaning demand can slow down, but the market may not reach equilibrium anytime soon because supply is low.

The data shown above is on a national level, and as we all know, real estate is local. Using CoStar’s historical data and 5-year forecast, I found the 10 markets with the strongest forecasted demand and 10 markets with the weakest forecasted demand over the coming years. I filtered only for markets with greater than 100,000 households because a lot of the smaller markets are less recognizable (and probably less interesting to all of you reading this).

Top 10 Markets for Forecasted Demand

| City | Last 5-Year CAGR | 5-Year Forecast CAGR |

|---|---|---|

| Provo, Utah | 4.3% | 2.1% |

| Austin, Texas | 4.8% | 2% |

| Lakeland, Florida | 2.1% | 1.8% |

| Boise, Idaho | 3.8% | 1.8% |

| Ogden, Utah | 2.6% | 1.7% |

| Myrtle Beach, South Carolina | 2.6% | 1.6% |

| Houston, Texas | 2.5% | 1.6% |

| Orlando, Florida | 1.6% | 1.5% |

| Charlotte, North Carolina | 2.5% | 1.5% |

| Dallas-Fort Worth, Texas | 2.3% | 1.5% |

Bottom 10 Markets for Forecasted Demand

| City | Last 5-Year CAGR | 5-Year Forecast CAGR |

|---|---|---|

| Charleston, West Virginia | -1.5% | -1.2% |

| Flint, Michigan | 0.2% | -0.5% |

| Youngstown, Ohio | -0.1% | -0.4% |

| Erie, Pennsylvania | 0.1% | -0.4% |

| Binghamton, New York | 0.6% | -0.3% |

| Rockford, Illinois | -0.2% | -0.3% |

| Peoria, Illinois | -0.3% | -0.3% |

| Huntington, West Virginia | -0.8% | -0.3% |

| Canton, Ohio | 0.3% | -0.2% |

| Utica, New York | -0.1% | -0.2% |

These lists are not comprehensive but should give you a sense of the range of outcomes projected over the coming years. For the top markets, like Provo, Utah, and Austin, Texas, the total number of households is expected to grow by 2% per year for each of the next five years. On the side of the equation, we have Charleston, West Virginia, which is projected to decline by 1.2% per year for each of the next five years.

Conclusion

For investors who are considering what market to invest in, I highly recommend you study the household formation patterns in your city. Population growth is a good start, but if you really want to understand what’s happening with the demand for housing, look at household formation. The Census Bureau has free data you can analyze to see historical performance, and you can Google projections for your city to help you get a sense of what might be coming in your area.

Find an Agent in Minutes

Match with an investor-friendly agent who can help you find, analyze, and close your next deal.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.