LIgorko/iStock by way of Getty Pictures

The market humbles us all. In some unspecified time in the future, each investor experiences draw back related to a number of corporations that they personal shares of. The identical particularly holds true as you begin analyzing different corporations and designating them as enticing or not, even when you do not personal inventory in these particular person companies. Generally it may be troublesome to inform the distinction between being flawed and requiring extra persistence. At this level, traders in The Timken Firm (NYSE:TKR) is perhaps questioning which applies to them. As the overall market declined, shares of Timken have adopted go well with. On the finish of the day, the value will transfer the place it must. However for individuals who are involved a couple of everlasting loss in worth, the perfect factor that may be achieved is to take a look at the basics and derive a conclusion from that course of. By doing this, you possibly can see that, regardless of the ache related to the broader economic system, Timken continues to be rising and creating money circulation for its traders. Add on high of this, shares of the corporate nonetheless look low-cost. For all of those causes, I’ve determined to retain my ‘purchase’ score on the enterprise, even in gentle of current declines.

The image nonetheless appears to be like nice

The final time I wrote an article about Timken was in February of this yr. At the moment, I referred to as the corporate a compelling long-term prospect that provided good upside potential. This was based mostly on my understanding of the corporate’s historic efficiency. Nonetheless, it was additionally based mostly on the value that shares had been buying and selling for. As a result of these info, I ended up writing the enterprise a ‘purchase’ prospect, indicating my perception that it might, over an prolonged timeframe, outperform the broader market. Since then, the corporate has skilled some downward strain. The S&P 500 is presently down 16.2%. By comparability, shares of Timken have declined by an virtually equivalent 16.3%.

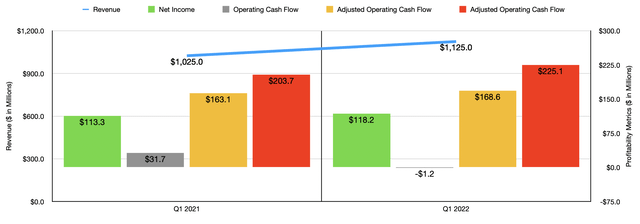

Writer – SEC EDGAR Knowledge

What’s fascinating is that this efficiency comes at the same time as the basics for the corporate proceed to enhance. In my prior article, we had information protecting the agency’s total 2021 fiscal yr. Now, we’ve got information protecting one extra quarter. Throughout that quarter, income got here in at practically $1.13 billion. That works out to a 9.8% improve over the $1.03 billion generated the identical time one yr earlier. Administration attributed this improve to sturdy natural development that included optimistic pricing for the corporate’s merchandise. The agency was hit some by overseas foreign money fluctuations. However past that, administration has not offered a lot in the best way of particulars. The one factor administration has mentioned is that demand for its merchandise has remained strong and that pricing actions have contributed to a few of this improve.

As income has risen, so too has profitability. Web earnings within the newest quarter got here in at $118.2 million. That is barely increased than the $113.3 million generated the identical time one yr earlier. Apparently, working money circulation for the corporate did endure, declining from $31.7 million within the first quarter of 2021 to unfavorable $1.2 million the identical time this yr. But when we modify for modifications in working capital, this quantity would have really elevated, climbing from $163.1 million to $168.6 million. Over that very same window of time, EBITDA for the corporate additionally improved, rising from $203.7 million to $225.1 million.

Along with posting continued development, administration additionally introduced the completion of a small acquisition. This acquisition was of an organization referred to as Spinea. Based on administration, this enterprise focuses on producing cycloidal discount gears and actuators. It makes for a great bolt-on transaction for a enterprise that’s well-known for producing quite a lot of industrial merchandise like bearings, energy transmission merchandise, and different associated applied sciences. Sadly, administration didn’t disclose how a lot was paid for the deal. However they did say that the enterprise ought to be answerable for about $40 million in income yearly.

With regards to the 2022 fiscal yr, administration mentioned that income ought to improve by about 8%. This is able to take gross sales up from $4.13 billion to roughly $4.46 billion, marking the best yr for income within the firm’s historical past. Earnings per share ought to be between $4.85 and $5.25. On the midpoint, this is able to translate to web earnings of $374.4 million. That is a modest 1.4% rise over the $369.1 million reported for the agency’s 2021 fiscal yr. Given inflation and provide chain points, this is able to translate to the corporate’s web revenue margin declining barely, in the end dropping from the 8.93% it is all in 2021 to eight.39% this yr. although this may occasionally not sound like a lot, based mostly on 2022 estimated income, it’ll translate to $24.1 million in decrease gross sales than if margins remained elevated. No steering was given when it got here to different profitability metrics. But when we assume that they might improve on the identical charge that earnings ought to, we will anticipate adjusted working money circulation of $546.1 million and EBITDA of $711 million.

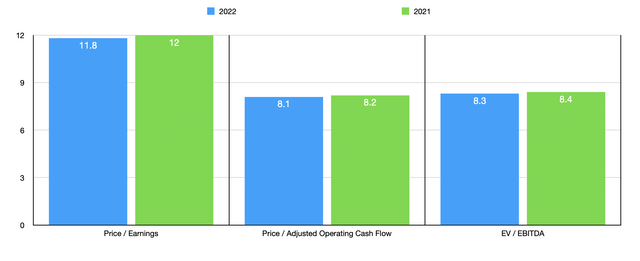

Writer – SEC EDGAR Knowledge

Taking this information, it turns into simple to cost the corporate. Utilizing our 2022 estimates, the agency is buying and selling at a price-to-earnings a number of of 11.8. The value to adjusted working money circulation a number of is even decrease at 8.1, whereas the EV to EBITDA a number of ought to be 8.3. These numbers are marginally higher than the multiples skilled in 2021. These are 12, 8.2, and eight.4, respectively. Because the desk above illustrates, shares within the enterprise have additionally gotten a bit cheaper in comparison with once I final wrote concerning the agency. To place the pricing of the corporate into perspective, I made a decision to match it to the identical 5 companies that I in contrast it to in my final article. On a price-to-earnings foundation, these corporations ranged from a low of 5.4 to a excessive of 51.5. Utilizing the value to working money circulation strategy, the vary was from 7.6 to 300.9. And utilizing the EV to EBITDA strategy, the vary was from 3.6 to 21.7. In all three circumstances, solely one of many 5 corporations was cheaper than our prospect.

| Firm | Value / Earnings | Value / Working Money Stream | EV / EBITDA |

| The Timken Firm | 12.0 | 8.2 | 8.4 |

| Parker-Hannifin (PH) | 19.5 | 14.7 | 13.5 |

| Dover Company (DOV) | 16.0 | 18.6 | 11.6 |

| Standex Worldwide (SXI) | 17.5 | 13.5 | 9.5 |

| Mueller Industries (MLI) | 5.4 | 7.6 | 3.6 |

| Welbilt (WBT) | 51.5 | 300.9 | 21.7 |

Takeaway

Primarily based on the information offered, it appears to be like to me as if Timken continues to get more healthy. That could be a troublesome factor for a corporation that’s already top quality to do. Sure, its web revenue margin would possibly contract some this yr. However on the entire, the enterprise is rising and money flows are rising properly. Add on high of this how low-cost shares are on each an absolute foundation and relative to comparable gamers, and I can not assist however to be bullish sufficient on the corporate to retain my ‘purchase’ score on it for now.