imaginima

The Silicon Valley Bank Failure

Late last week, Silicon Valley Bank (SIVB), the 16th largest bank in the U.S., was seized by regulators after it could not accommodate a flood of client withdrawal requests. There is now much hyperbole about what happened and lots of fear mongering on social media about what comes next. Some people are, recklessly in our opinion, drawing comparisons between this episode and the start of the 2008-2009 Global Financial Crisis (GFC). In this note, we discuss our views on these issues.

An intelligent take on what happened and its repercussions is in this Financial Times article. To summarize: SVB had many institutional deposits from start-up technology firms. Most of these were above the $250,000 FDIC insurance limit. In 2020 and 2021, when interest rates were much lower, SVB invested many of its deposits into long-dated U.S. Treasuries. This year, these Treasuries fell in price as interest rates went up. Many of the start-ups who were investing in SVB were in touch with the same small group of venture capital (VC) firms who provide funding and advice to start-ups.

At some point, for whatever reason, the idea spread through this tight-knit community that SVB may not have enough funds to cover customer withdrawals. When ideas like this spread through a bank’s depositor base, this leads to what economist refer to as a bank run. (Interestingly, this year’s Nobel Prize in economics was given out for exactly this line of research.) Retail bank runs, of the kind that happened around the Great Depression, no longer take place in the U.S. because of the advent of FDIC depositor insurance. But since this insurance did not cover the larger deposits of SVB’s institutional customers, the latter, likely coordinated by advice from a small group of VC firms, pulled their money which led to a 1930s-style bank run on SVB.

The crucial question is whether this set of events at SVB has repercussions for the broader banking system. First, other regional banks, with heavy VC-funded start-up depositor bases, are likely to receive extreme scrutiny from their depositors and regulators. However, if these banks were more prudent in their asset-liability management — that is, if they invested in shorter-dated securities compared to SVB — then their depositors will likely react in a more temperate way. Second, regulators are now working to calm the situation and it is likely their efforts will succeed in assuaging the concerns of depositors in other SVB-like regional banks. Finally, and perhaps most importantly, the largest banks in the U.S. do not face the same issues as SVB. According to the FT article, SVB was an extreme outlier in the number of deposits it had above the $250,000 FDIC limit. Other large banks have many fewer such accounts. Furthermore, SVB was again an outlier in how many of its assets were invested in long-term Treasury bonds. Other banks have been more prudent in their asset-liability management.

A closer look at SVB

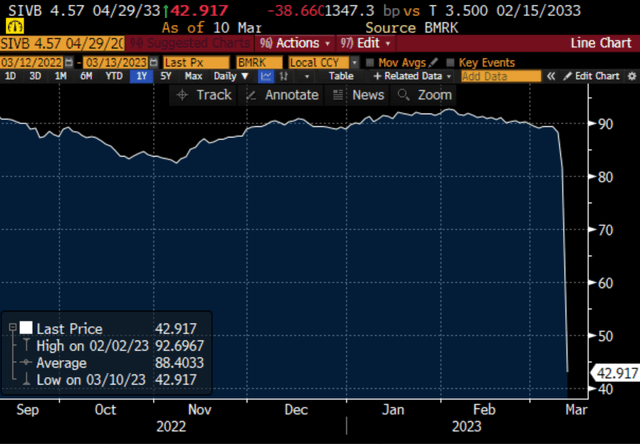

According to the FDIC, when a bank fails, the order of precedence for pay-outs is: insured depositors, uninsured depositors, general creditors (like senior unsecured bonds), and then equity. SVB’s equity will essentially go to zero. But Silicon Valley Bank also has bonds:

Bloomberg

These bonds will only see a payout if insured and uninsured depositors are paid in full. As of Friday, the senior unsecured bonds of SVB were trading in the low 40s.

Bloomberg

We’ll see where they open up on Monday, but as of Friday’s close, the bond market was saying that there are enough assets here to fully cover all depositors, insured and uninsured, and then still have some assets left over to pay bond holders. Even the preferred bonds, which are junior to the senior unsecured, were trading above zero (around $5-$6). So there seems to be ample capital to repay depositors, which calls into question all the doomsday scenarios about system-wide bank runs.

Summing it up

Our general view is that a systemic bank run in the U.S. is highly unlikely, though some regional banks, especially ones that look like SVB, are more at risk. Regulators are looking into it, and we suspect they will come up with workable solutions for depositors in the set of exposed banks. This episode is also likely to (1) dampen inflationary pressures in the market as firms and customers temporarily pull back on spending, and (2) cause the Fed to slow down its tightening cycle. It appears the SVB collapse is providing a tightening in financial conditions all by itself.