The S&P 500 could soar another 18% by year-end, according to Oppenheimer.

That’s because the economy is strong and the Fed is likely to end its rate hike cycle.

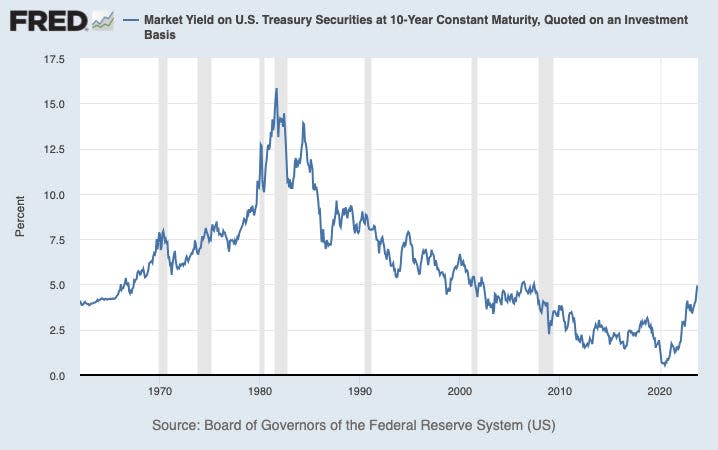

While 5% Treasury yields have sparked concern among investors, that’s normal compared to previous eras.

The S&P 500 is due for a monster rally by the end of the year, as the Federal Reserve looks poised to dial back its war on inflation, according to Oppenheimer’s chief investment strategist John Stoltzfus.

In an interview with CNBC on Thursday, Stoltzfus reiterated his S&P 500 price target of 4,900 by the end of the year. That points to the benchmark index skyrocketing 18% in just over two months, a forecast that’s predicated on the Fed likely ending its rate hike cycle.

“You’ve got to remember that when we raised that target, we were expecting that the Fed would continue be vigilant against inflation but would remain sensitive to the effects of its policy on the economy. And it has remained so,” he said.

Central bankers have hiked interest rates aggressively since March 2022 to tame inflation, with the fed funds rate now at 5.25%-5.5%. That has sparked fears that the Fed could push the US into a recession with its aggressive policy, though the economy has stayed impressively resilient so far, with GDP growing 4.9% in the third quarter.

Corporate earnings also look to have held up, despite some disappointing results this week from the largest tech firms. Of the 17% of S&P 500 companies that reported third-quarter earnings last week, 73% have beaten analysts’ estimates, according to FactSet data.

And though stocks have sold off in recent weeks, that’s largely due to fears stemming from higher Treasury yields, with the 10-year US Treasury yield recently topping 5% for the first time since 2007. But yields around 5% are actually fairly normal relative to history, Stoltzfus said:

“From a historical perspective, 4%-5% is really what the 10-year yield usually would be like during normal periods,” he added, noting that interest rates were unusually low for the past 15 years.

The Fed has warned that rates could stay higher-for-longer as it continues to monitor inflation and the strength of the economy. Still, markets are expecting interest rate cuts by mid-next year, with investors pricing in an 80% chance that rates could be lower than their current level by July 2024, according to the CME FedWatch tool. That could be bullish for stocks, considering that rate hikes weighed the S&P 500 down heavily in 2022.

Stoltzfus has been one of Wall Street’s most bullish forecasters, despite concerns brewing in markets over surging bond yields and the potential of a recession on the horizon. In 2022, he predicted the S&P 500 would surge to 5,330, but then slashed that target several times as the year went on.

Read the original article on Business Insider