welcomeinside/iStock via Getty Images

In the years I’ve followed the oil market, I have never seen the Saudis this determined to push oil prices up. This includes the “whatever it takes” moment we saw in 2017 when the previous Saudi energy minister, Khalid Al-Falih, started targeting US inventories, and the price war of 2020 when the Saudis went out to crush the Russians for not agreeing to a production cut.

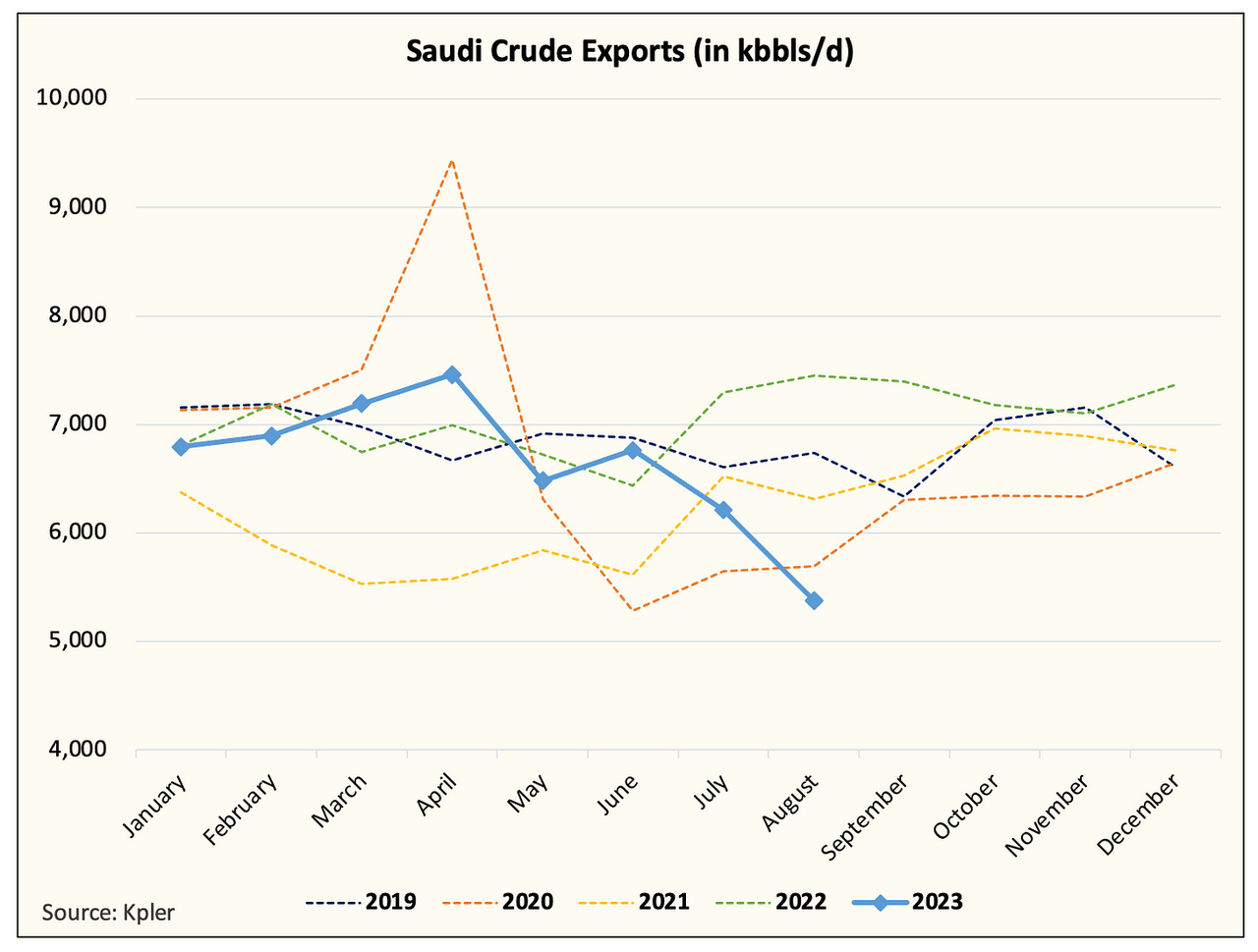

Kpler

Saudi crude exports for the first 24 days of August are averaging at the lowest level since June 2020. At ~5.3 million b/d, Saudis will have reduced crude exports by ~1 million b/d since July. Now we don’t expect this figure to be final. Crude exports for the upcoming week are showing a rebound, so final figures could be closer to 5.6 to 5.8 million b/d.

But that doesn’t change the point of this article, this is crazy, and I’ve never seen the Saudis this determined.

Those of you who follow us closely will know that our base case view is for the Saudis to extend the voluntary cut into year-end. We explained that it’s because of the logistical timing issue of when exports hit physical inventories and the impact on market sentiment. But with the latest Saudi crude export figure, I can’t help but wonder if the cut will likely be extended into Q1 of 2024.

Let me explain.

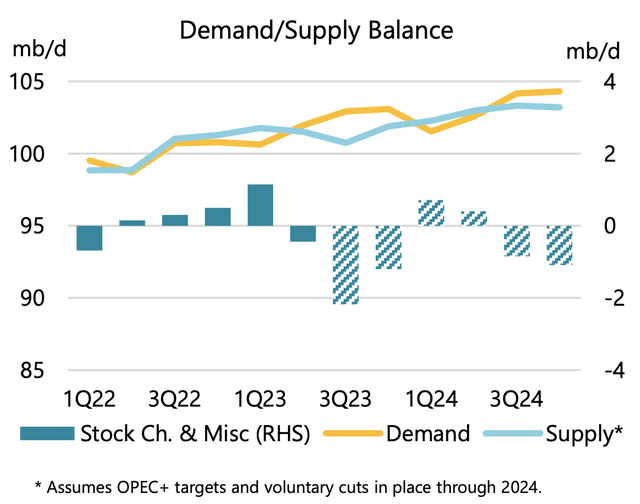

IEA

Here is IEA’s assumption for global oil supply & demand balance into the end of 2024. Out of all of the IEA reports we’ve read to date, the August OMR was the most balanced (surprising).

Now you will notice that both Q1 and Q2 of 2024 show stockbuilds. Keep in mind that the IEA is not assuming the voluntary cut of ~1 million b/d into its balance in 2024. Instead, it is assuming that the Saudis will continue its original ~500k b/d voluntary cut.

In my view, the Saudis played this one beautifully. By keeping it on a month-to-month basis, it deters speculators from bidding up the long end of the curve and keeps the market at bay. The month-to-month action also prevents speculators from front-running prices, which prevents any potential risk of demand destruction amidst a weakening global economy. Instead, the voluntary cut does the sole purpose it was meant to do, reduce global inventories.

So now imagine this scenario, as we approach the end of October, oil continues to trade in the range of $80 to $90. While global oil inventories have drained materially, sentiment remains weak, and speculators believe the impending recession will hurt oil demand. Saudis are now deciding whether to extend to the end of December, but as they look at global oil supply & demand balances, Q1 shows a build. All of the efforts of the voluntary cut up to that point would be pointless if storage gets to build back up again.

With the voluntary cut already in place, what’s to stop the Saudis from slowly unwinding the cut? Perhaps it’s best to after Q1 to slowly unwind the ~1 million b/d cut as to avoid any inventory build-up. In addition, with Russia cooperating (finally), and if the Russians extend their voluntary cut into year-end, then it’s physically very difficult for Russia to increase production during the heart of winter. All of these things suggest to me that it is better than 50% chance that the Saudis extend this voluntary cut (in some form or shape) into the end of Q1 and possibly Q2 of 2024.

Now this is not the consensus view and many of the oil analysts expect the Saudis to unwind the voluntary cut once the storage draw has materialized, but we digress. We think the ultimate goal for the Saudis is price stability, so if that implicitly implies a lower overall storage level to achieve this, then the Saudis will keep the voluntary cut until they see fit.

This means that Brent would have to easily average over $90 for many months before the Saudis contemplate a reduction. We just don’t see that when the consensus expects a build in Q1.

This is crazy…

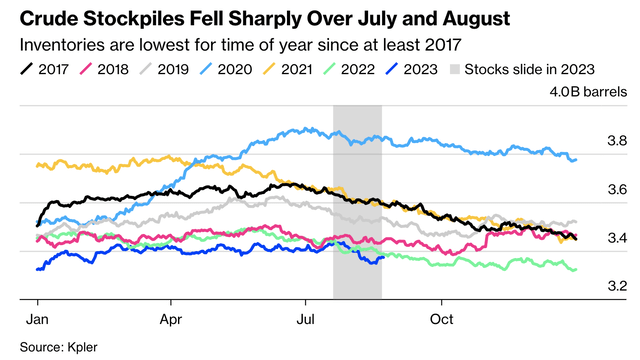

Kpler

In the years I’ve followed the Saudis, this is the most determined I’ve ever seen them. If we are right and the Saudis continue to extend, then the market will get a rude awakening. Global onshore crude inventories are already starting to accelerate to the downside and there’s more to come. Perhaps, like the article we published on Monday, it is really just that straightforward. Perhaps, it is not. We will know with time.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.