cemagraphics

The velocity with which financial situations have modified over the previous two and a half years has made positioning vital for traders. An financial slowdown now seems assured, whether or not that is gentle or a deeper recession will decide sector efficiency going ahead. Development shares have performed comparatively properly in current weeks as investor consideration has shifted from inflation to recession, however as Snap’s (SNAP) earnings have proven, firms which might be delicate to financial situations stay in danger.

Enterprise and Market Cycles

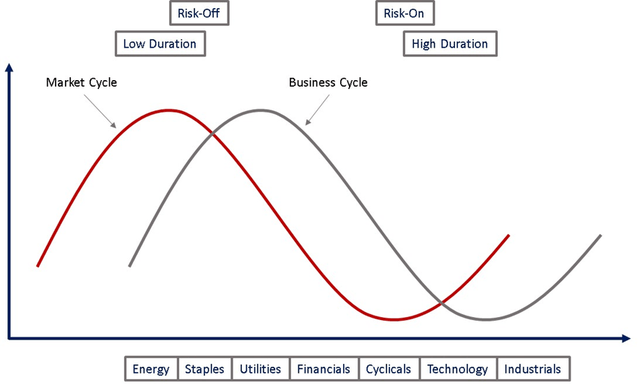

Monetary markets and the financial system are sometimes cyclical, resulting in variation in efficiency between sectors over time. Whereas a common framework can information positioning, not all cycles are the identical, that means the underlying reason for an financial increase and bust should be understood with the intention to decide positioning throughout sectors.

Determine 1: Instance Market and Enterprise Cycle with Potential Sector and Issue Positioning (Created by writer)

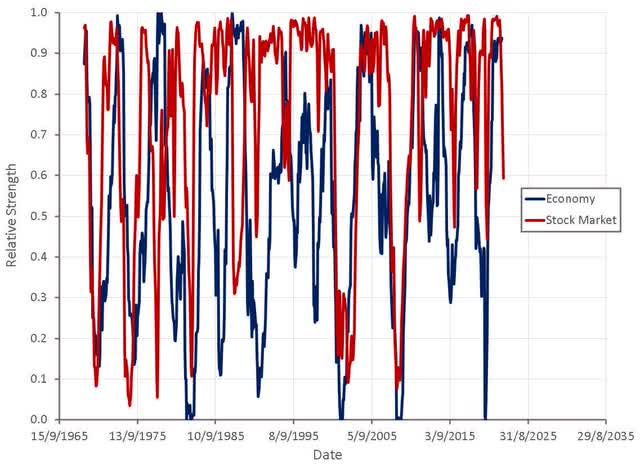

The inventory market usually leads financial indicators like unemployment and GDP progress. That is seemingly the case for the time being as many shares are already down considerably, and a spread of main financial indicators (housing, manufacturing, sentiment) are exhibiting weak point. Company income are but to be considerably impacted, however it’s seemingly that within the coming months, progress and profitably expectations will probably be lowered. This, together with labor market weak point, will seemingly be required earlier than markets start to backside.

Determine 2: Relative Energy of US Financial system and Inventory Market (Created by writer utilizing knowledge from The Federal Reserve)

Provided that the present cycle has been pushed by a mix of low-interest charges and big fiscal stimulus, an prolonged interval of weak point in sectors that benefited from extreme shopper spending is probably going. Inflation pushed by provide shocks can also restrict the extent to which central banks can help weakening economies.

Sector Efficiency

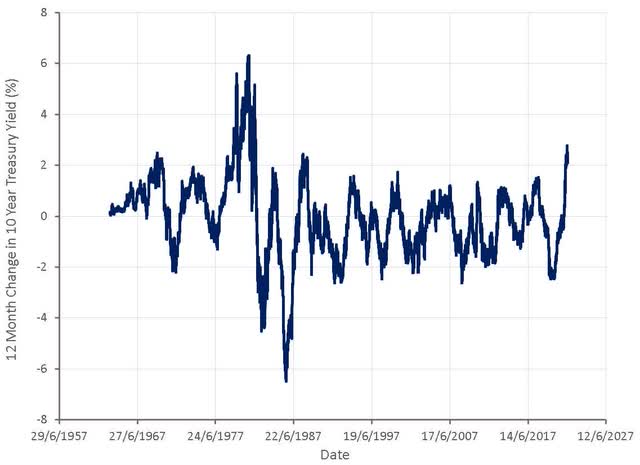

Every business has its personal vary of worth drivers, which causes relative efficiency between sectors to range by the enterprise cycle. The present cycle is uncommon as a result of a enterprise cycle, which generally takes round 8 years, has been compressed right into a 2-year interval. On account of this, and the velocity with which rates of interest are shifting, the efficiency of some sectors could differ from what is anticipated. For instance, financials are performing poorly once they usually would have been anticipated to do properly. It additionally seems that commodity companies will solely take pleasure in a brief window of favorable situations. Tech shares can also start to outperform comparatively early within the bear market as a result of extent to which inflationary fears have negatively impacted them.

Determine 3: 12 Month Change in 10-12 months Treasury Yield (Created by writer utilizing knowledge from The Federal Reserve)

Extra defensive sectors have carried out comparatively properly in current months, as have sectors which might be much less impacted by rising rates of interest. It will most likely change within the coming months, although, as expectations of decrease long-term charges lead traders to hunt larger publicity to high-duration shares. With company income set to say no, traders are additionally prone to keep away from publicity to extra cyclical sectors.

- Vitality: prone to proceed performing poorly as expectations of a recession enhance

- Staples: could proceed to carry out comparatively properly on account of defensive nature

- Cyclicals: prone to proceed performing poorly as expectations of a recession enhance

- Know-how: deteriorating financial situations will probably be weighed towards expectations of decrease rates of interest. Companies with comparatively low publicity to financial situations ought to do properly

Issue Efficiency

Shares can be considered when it comes to their publicity to danger components, reasonably than simply their sector or business. Extra defensive shares are prone to do properly in direction of the top of a bull market as traders sit up for a possible deterioration in financial situations and search to cut back danger publicity. Conversely, close to the top of a bear market, traders search publicity to extra cyclical shares which might be prone to do properly as financial situations rebound. In an setting the place charges are rising, low-duration shares are prone to carry out higher as their valuations are much less impacted by larger charges. Conversely, high-duration shares are prone to do properly when charges are falling as their valuations are positively impacted.

Massive-cap shares have carried out comparatively properly this 12 months. Massive-cap shares usually outperform throughout bear markets, which can be on account of traders viewing bigger shares as safer. Small-cap shares seem attractively valued relative to large-cap shares, however it isn’t clear when sentiment will shift.

Worth shares have outperformed progress shares in current months. Worth shares are inclined to outperform throughout bear markets, and the final 12 months have seen some of the excessive intervals of outperformance previously few many years. That is seemingly due partly to a big preliminary discrepancy in valuations between progress and worth shares, and the velocity with which rates of interest have elevated. It’s possible that when fears of upper charges recede, progress shares outperform considerably.

Worthwhile shares have outperformed unprofitable shares in 2022. Extra worthwhile shares typically have a decrease period and are higher positioned to handle a downturn. Consequently, worthwhile shares ought to outperform throughout market downturns. A distinction needs to be made between companies which might be unprofitable as a result of they’ve poor unit economics and companies which might be unprofitable solely as a result of they’re small and/or rising quickly. Many companies with engaging economics have been indiscriminately offered off, and these current a big alternative.

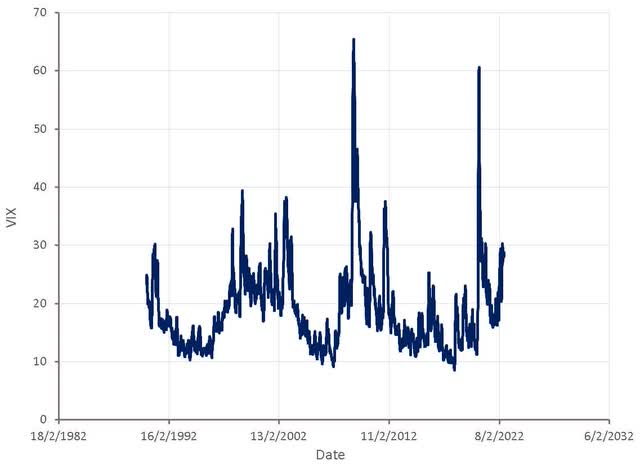

Volatility

Many traders predict the VIX index to spike considerably earlier than fairness markets backside. Whereas that is doable, it isn’t obligatory. Massive spikes within the VIX index are usually related to panic, like the worldwide monetary disaster or the COVID pandemic. In a standard downturn, there isn’t any purpose for this degree of panic, and markets could backside with out VIX shifting considerably larger.

Determine 8: VIX Index (Created by writer utilizing knowledge from The Federal Reserve)

Conclusion

Monetary markets are already declining, and a recession seems imminent. Markets are unlikely to stabilize till central banks ease financial coverage and main financial indicators backside. Longer period bonds could do properly if expectations of a recession enhance. Excessive-duration shares that aren’t uncovered to financial situations (i.e., biotech) may outperform going ahead if long-term charges transfer decrease. Commodities and cyclicals are prone to underperform going ahead as financial situations weaken and their profitability is negatively impacted.