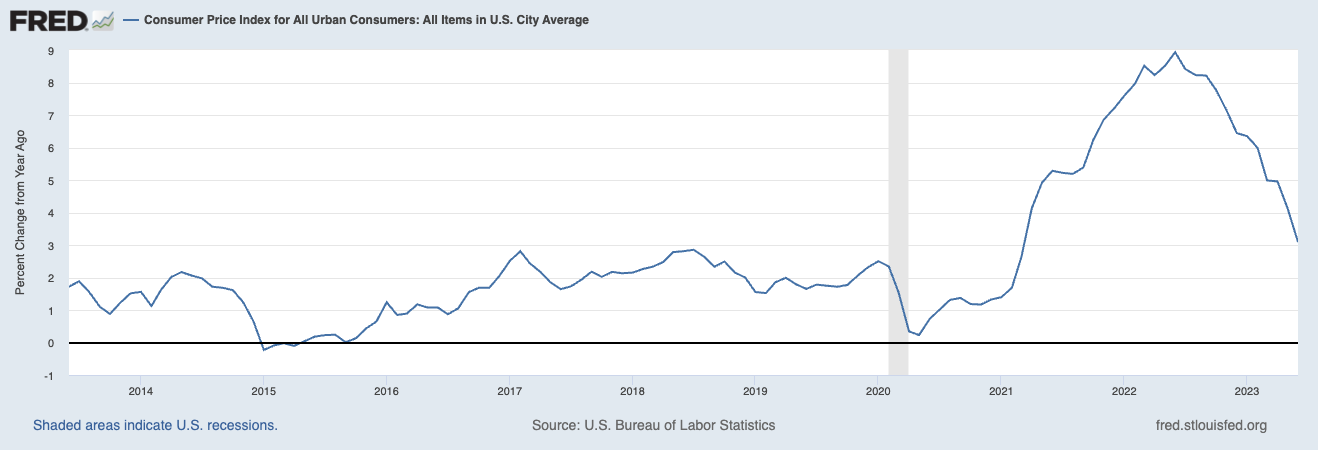

In 2021, some economists predicted that high inflation would be transitory. When inflation soared much higher in 2022, those claims looked foolish. Now that headline inflation has fallen to just over 3%, some are asking whether inflation was transitory after all.

Macroeconomic data never “speaks for itself”. Data only has meaning in the context of a model. In order for transitory inflation to have a useful meaning, we need to consider how nominal and real variables interact.

The average person probably views the concept of “transitory” in terms of a specific period of time—a few months, or perhaps a year. In my view, that’s not a useful way to define the term. Instead, it is more helpful to view transitory inflation as being associated with no change in the growth rate of nominal wages (allowing for composition effects.)

For example, suppose there is a terrorist attack that shuts down the Saudi oil industry for a couple of months. Oil prices would rise and the Fed would probably allow some increase in the overall CPI. When Saudi oil comes back onto the market, oil prices would fall and the CPI would fall back to trend. Nominal wages would be largely unaffected. This is roughly what people have in mind by the term ‘transitory’.

In my view, the most useful definition of transitory is not the period over which the higher inflation persists, rather whether or not it bleeds through to wage inflation. As long as nominal wage growth is stable, all excess inflation is likely to be transitory, whether lasting for 3 months or 3 years. In contrast, if nominal wages start accelerating, then inflation will remain elevated unless a contractionary monetary policy brings wage growth back to normal. Throughout history, that has usually required a period of elevated unemployment (although a “softish landing” is not inconceivable if the disinflation is gradual.)

From this perspective, there is no specific time frame that makes inflation transitory. Any significant amount of elevated wage inflation, no matter how short in duration, constitutes non-transitory inflation. Of course the term “significant” is open to interpretation . Macro data is noisy, and a single month’s data might reflect random shocks, not an overheated labor market. Nonetheless, the criterion here is not the duration of the labor market overheating; the existence of any significant excess nominal wage growth constitutes non-transitory inflation.

During the period of Covid shutdowns, the BLS wage data was thrown off by “composition effects”. Even if every single person got a completely normal wage boost during 2020 (say 3%), the average wage growth would have looked high because lower wage workers were disproportionately laid off.

In a case such as 2020, nominal GDP growth would be an alternative indicator of non-transitory inflation. By late 2021, NGDP was rising above the pre-Covid trend line, and hence by that time inflation was no longer merely transitory.

PS. I’m seeing some optimism that the labor market is normalizing, with pundits pointing to things like lower quit rates and fewer unfilled jobs. I hope these pundits are correct. But keep in mind that the real problem is nominal. We still need to bring nominal wage growth back down to 3%. Various real labor market indicators will eventually normalize (at their “natural rate”) even if nominal wage growth stays permanently elevated. That was Milton Friedman’s great insight in the late 1960s. (Also Edmund Phelps.)