Through SchiffGold.com,

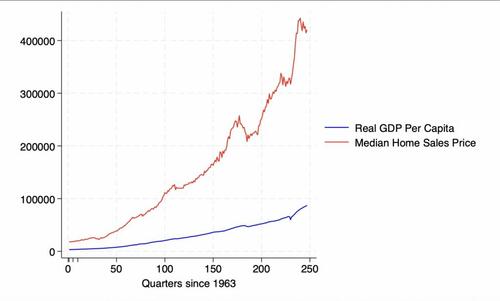

Whereas residence costs improve in worth exponentially, many fear as as to whether they’ll at some point personal a house.

For years the American dream consisted of residence possession and monetary independence. The rising worth of properties makes it appear as if solely a choose group of elites can afford them.

The graph under reveals median worth of residence gross sales exponentially outpacing actual GDP per capita, not even making an allowance for that particular person buying energy trails far behind actual GDP.

The urgency of need for a homeownership creates perverse, long-term incentives for each residence consumers and builders.

Quite than constructing properties which might be meant to final, development corporations, lured by excessive current demand, will construct properties from low-cost supplies and use strategies that prioritize pace.

The drastic lower within the dimension of a 2×4 because the Nineteen Twenties paints a vivid image of the decline in residence high quality.

The materials high quality in addition to the design high quality of properties has shot by way of the ground as a result of homebuyers aren’t in a position to see the complete dangers of their funding. As a result of properties embody the restricted useful resource of land in addition to a standard sturdy construction, they’ve traditionally been a stable funding. Homes that have been constructed over 100 years in the past are sometimes nonetheless sizzling commodities and so they appear to consistently admire. Properties was once constructed with the concept they’d final an extended time frame and be repaired as they wanted it. Whereas every home is totally different, the general public nonetheless mentally locations them into one asset class when they’re deciding whether or not to purchase a house or not. Particular corporations earn belief by way of years of repeated efficiency, and it will be straightforward to assume that properties as an asset operate the identical method. Elementary variations in sturdiness will stratify homes into totally different classes of funding as consumers see how newly constructed properties disintegrate.

Simply as corporations make the most of totally different revenue maximizing methods, so additionally do residence builders attempt distinctive approaches. Some builders plan for long-term success by creating properties that can bolster their repute far into the long run, however many residence builders lately have deliberate for his or her funding to peak shortly after they construct it, relying on housing scarcity and purchaser indifference to maintain residence costs basically excessive. Whereas it is a good technique for maximizing revenue within the present market, folks will slowly begin to turn into extra important of recent builds as they see their younger properties disintegrate.

Two limiting elements for homebuilders of the previous have been extra scrutinizing consumers and a smaller number of supplies. With decrease demand for properties, sellers didn’t have the identical negotiating energy that they’ve been given because the housing scarcity after World Conflict II. Homebuyers have been additionally extra prone to have had expertise in development, or no less than some information of workmanship. Their extra educated minds would allow them to see indicators of quick and low-cost development extra simply than the fashionable eye. Properties have been typically purchased with the concept of retaining them within the household for an prolonged time frame, in order that they have been extra rigorously examined for high quality. The second limitation to the wiles of builders up to now was that they didn’t have entry to the identical low-cost supplies which might be at present out there. Whereas homebuilding supplies are on no account low-cost, they’re far cheaper than the logs and stone used to style properties of the previous. Cheaper transportation prices together with cheaper strategies of manufacturing have allowed the constructing supplies of all kinds to lower in worth. Whereas some would have thought that this might have made high-quality homes extra accessible, it appears to have solely stirred up exponential cravings for bargains amongst homebuilders. They attempt to use far much less framing and ever smaller 2x4s to make up for a scarcity of extra secure and sturdy supplies.

Moreover, trendy conveniences have shifted many prices away from constructing corporations and in direction of residents. Properties in sizzling locations that will have been constructed with thick, cooling partitions are actually absolutely reliant on air con. Pre-fabricated components additionally cut back producer price and in the end shift prices to long-term owners. pre-built items are far more troublesome to restore and they’re much extra prone to crumble if a single weak hyperlink is damaged. Homes which might be easy may be repaired merely, and that always pays off the upper price of extra substantial pure supplies. Whereas shortly constructed homes clear up the housing downside for now, they’ll simply exacerbate the issue 30 years from now when builders who may’ve been constructing new homes should waste time rebuilding the place their outdated ones have been demolished.

Whereas their work could also be questionable, builders can’t bear the blame for responding to the self-centered nature of their goal market. The American shopper doesn’t take into consideration their kids as they used to. A home changing into nugatory in 50 years doesn’t weigh closely of their thoughts of 1 who cares just for offers as we speak. Constructing a home that may final is objectively dearer, but it surely was once anticipated, and it pays off in the long term.