Perhaps you wished to know how one can spend money on actual property again in early 2020. You took a while to coach your self by listening to podcasts and studying books. Then you definitely went and acquired preapproved, discovered your self an agent, and had been prepared to begin hitting the pavement, trying to find your first actual property deal. Whilst you had been in your hunt for worthwhile homes, the world began to close down. Everybody was compelled inside, the actual property market locked up, and also you thought “possibly I ought to wait this one out.”

Now, it’s 2022, and the housing market is arguably probably the most aggressive it has been in a long time. You missed your shot, proper? Now you’ll be able to by no means spend money on actual property…or so that you suppose. Dave Meyer, On The Market Host and VP of Knowledge and Analytics at BiggerPockets, is right here with Henry Washington, Jamil Damji, and Kathy Fettke to argue that it is best to nonetheless be investing in actual property. Even with rising rates of interest, excessive dwelling costs, and fierce competitors, our skilled panel agrees: there’s no higher time to take a position than proper now.

So, in the event you’ve been feeling like your passive earnings desires are slowly slipping away, we encourage you to not solely hearken to this episode however take the steps outlined in at the moment’s present. Dave and our panel of skilled friends offer you the whole lot you want to make a sensible, worthwhile, assured entry into actual property investing. You simply have to take step one.

Dave:

Welcome everybody to OnTheMarket. On at the moment’s episode, we’re going to go deep into an important matter, how one can get began in actual property investing in 2022. We’re going to cowl headlines that deal with the difficult and complicated financial circumstances we’re going through, we’ll speak about methods and techniques that new buyers can make use of to get an incredible deal proper now, and we are going to assist one in all our viewers members stroll via their first deal.

Welcome everybody again to OnTheMarket at the moment. I’ve my good buddies, Jamil Damji, Henry, Washington, and Kathy Fettke becoming a member of me at the moment, and since we’re going to be speaking about first offers and stepping into actual property for the primary time quite a bit in at the moment’s present, earlier than we get began, Henry, are you able to inform me in 30 seconds what your first deal was?

Henry:

My first deal was a rental property. Discovered it from phrase to mouth, simply because I used to be telling individuals I used to be an investor, regardless that I had no clue how one can truly be one and someone heard that and stated, “I have to promote this home in 30 days. Can you purchase it?” And I stated, “Yep,” and I had no thought what to do. Actually downloaded a contract off BiggerPocket, signed a contract and discovered a manner to purchase it. Growth.

Dave:

I like it. What about you Kathy?

Kathy:

Ooh, 30 seconds. Okay, my dad was distressed, he had invested in an condo in Marin County and the sponsors bought it and he didn’t know, he was on trip. So backside line, he was about to retire and discovered he was about to need to pay all these again taxes from the sale of that property he invested in for years.

I used to be like, “Dad, what do you want?” And he goes, “I simply want a brand new property, a alternative property.” So Wealthy and I, we had been simply getting married that 12 months, ended up discovering an enormous home that met the 1031 alternate, and we stated, “Dad, we are going to care for this for you, all particulars.” What we didn’t know on the time, however know now’s that we ended up inheriting that home after which all of the again taxes had been gone. In order that was how we did it. We turned it right into a fourplex and we shared partitions. We home hacked and that’s how we did it.

Dave:

All proper, Jamil, what’s your first deal?

Jamil:

Wholesale. I used to be strolling for {dollars}, drained landlord, had a purchaser in my again pocket that I knew would pay a selected sum of money, locked it up, $50,000 lower than that, wholesaled it, $47,000 revenue after paying the attorneys and title charges. First deal, life altering.

Dave:

I like it. Everybody simply maintain that in thoughts as you’re listening to this episode, there are plenty of other ways to get into actual property and we’re going to speak about among the greatest methods which you could get in, even on this uncommon financial local weather. Earlier than we try this, we do have to get to our, between the headline section and I’ve some actually good headlines that I believe assist paint the image for the financial local weather new buyers are discovering themselves in proper now. So we’re going to play the sport. It’s simply known as fast take, Tremendous easy, I’m going to learn a headline, offer you some background info and would love only a fast opinion from every of you about what this implies for buyers new and skilled alike.

The primary story is that the inventory market continues to underperform this 12 months. During the last couple years we’ve gotten actually used to the inventory market simply going up and up and up. As of now, we’re seeing that the Dow Jones is down 6% 12 months up to now and that’s the greatest index proper now. The S&P is down 10% and the NASDAQ, which could be very tech heavy, is down 17% 12 months up to now, and it doesn’t appear to be issues are getting any higher to me, however would like to get your opinion. Kathy, let’s begin with you.

Kathy:

Nicely, the individuals I hearken to and I don’t make investments quite a bit in shares, just a bit bit, however the individuals I hearken to say that you just wish to be in inflationary shares, so power, meals, issues like that. So the inventory markets like plenty of issues, not all shares are good and never all shares are dangerous. There are totally different corporations which are performing properly on this atmosphere.

What didn’t assist final week is that the fed chief, Jerome Powell talked about on the IMF that they had been going to be extra aggressive. I believe he stated, “We’re going to maneuver a bit of extra shortly,” and when Jerome Powell speaks buyers hear, and it actually impacts the inventory market, which might be way more unstable.

Dave:

All proper, Henry, what do you suppose?

Henry:

Yeah man, the inventory market is, proper, flawed or detached, it’s an funding car that individuals have used for many years and a long time to construct wealth. So the inventory market tends to react negatively to worry, and plenty of issues that drive worry are uncertainty, and boy, the final two to a few years has been the definition of uncertainty. The issues which have occurred in our world are issues that nobody might have predicted and unpredictability drives uncertainty, which drives worry, which you’re seeing the market reply to that worry. However in the event you take a look at the inventory market as a complete, it’s just like actual property.

Everyone knows in the event you purchase actual property now and also you maintain it for the following 50 years or name it 10 to twenty years, the trajectory line goes to be rising over time. So in the event you’re making an attempt to generate profits within the quick time period by shopping for one thing which may be low proper now, hoping it goes again to its pre pandemic highs, then yeah, that’s a chance, intestine in the event you’re shopping for high quality corporations, who’re producing high quality services or products that you just belief and consider in and also you maintain them for a protracted time frame, I believe that’s, that’s a method to play it “secure.”

So proper now it’s going to be a bit of unstable as a result of the world’s unstable. As issues stabilize… hopefully issues stabilize on the earth, the inventory market will fall a swimsuit. So in the event you’re making an attempt to purchase low, promote excessive briefly time period proper now, most likely not the marketplace for you.

Dave:

All proper. Jamil, wrap us up right here.

Jamil:

By no means been a fan of the inventory market and regardless that, as Henry stated, it tends to go up over time, for me, I’m genetically engineered to commerce. I really like the joy of being in issues and buying and selling. So shares are very very similar to playing for me. I do higher in Vegas than I do within the inventory market, simply saying that. So for me, I’m I’m not placing my cash within the inventory market, I don’t have my cash within the inventory market, I by no means will put my cash within the inventory market. So, “Pfft,” that’s what I believe.

Dave:

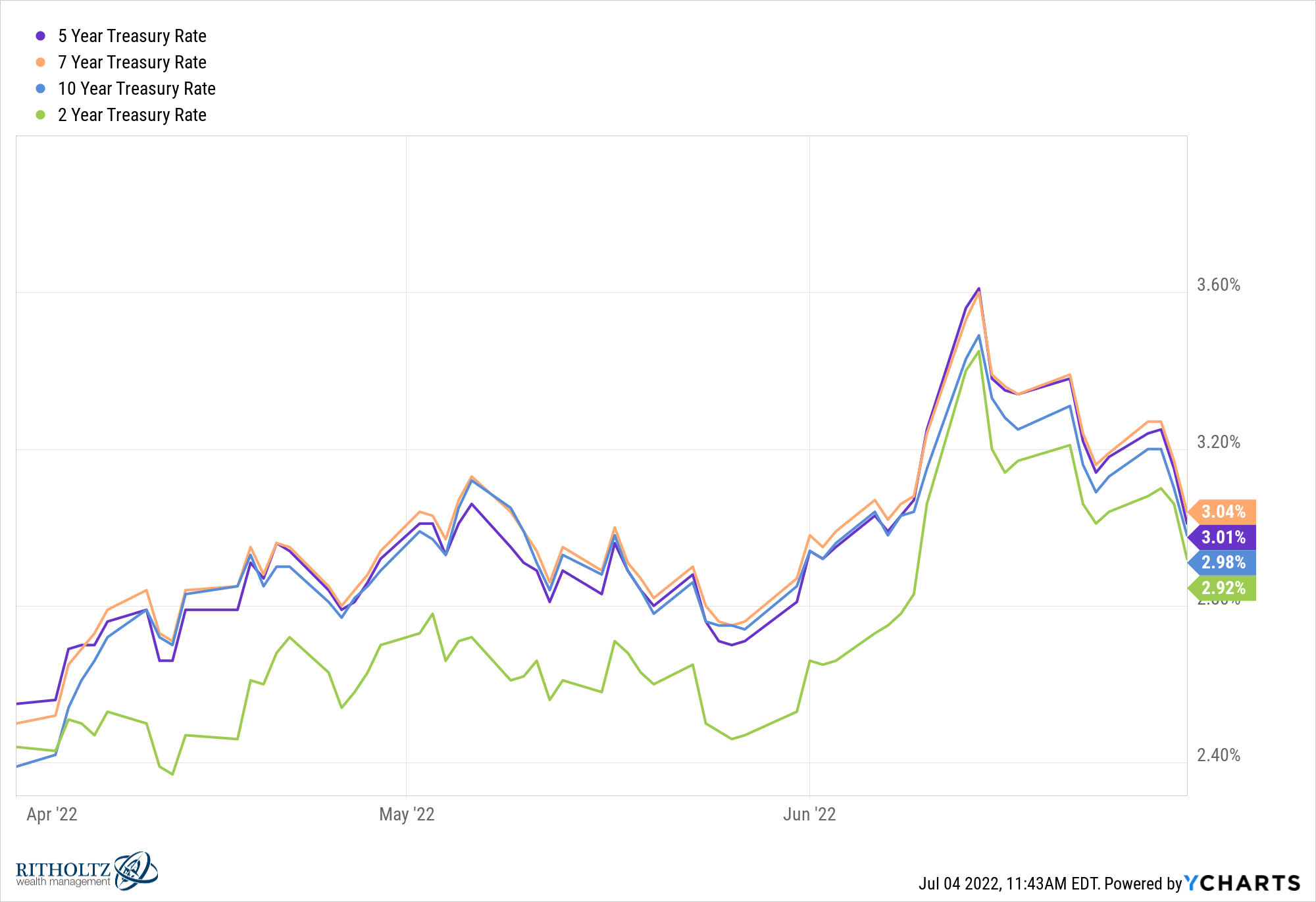

All proper. Nicely, I do spend money on the inventory market and simply proceed to do greenback value averaging index funds. I don’t do something fancy, however one factor I do wish to level out about what’s going on proper now, as a result of it’s associated to actual property, is that we’re all seeing bond yields begin to rise and I do know bond yields are the least attractive, most boring factor on the earth, however they management a lot of what’s going on within the economic system. Proper now bond yields are pushing up mortgage charges and that may most likely put downward strain on housing costs. It does a really related factor within the inventory market simply so individuals are conscious, as a result of it offers buyers an alternative choice to speculative shares and issues. So we noticed that over the pandemic, lots of people didn’t wish to spend money on bonds as a result of the yields had been so low, so that they had been pouring cash into the inventory market. Now bonds are beginning, progressively, to look extra enticing and you might begin seeing individuals pulling cash out of the inventory market and into the bond market as a substitute as a result of it’s a comparatively secure funding. So one thing simply to think about for everybody listening to that.

For the second story and headline, I wish to speak about at the moment and we’re solely going to do two at the moment, is in regards to the housing market and what’s going on proper now. March numbers are beginning to come out and simply so everybody is aware of, we get this information like a month in arrears, so we’re nonetheless speaking about March information, however it is vitally related. The numbers got here in and we noticed 17% 12 months over 12 months worth progress, 17% hire progress, however stock stays in any respect time lows on a seasonally adjusted foundation. So that’s actually, actually attention-grabbing and I believe the info level that stood out to me probably the most is that dwelling purchaser mortgage funds, so the common quantity a brand new individual in the event you went to purchase a home is paying for his or her mortgage proper now, was up 38% over the 12 months earlier than and that is because of, after all, the rising costs, however quickly rising rates of interest. That quantity type of boggled my thoughts Jamil, let’s begin with you. What do you concentrate on all this information from the March housing market?

Jamil:

It is sensible. I’m seeing it in my enterprise. We now have super quantity, the urge for food has not gone away. The secondary dwelling patrons are nonetheless very, very a lot actively shopping for. You noticed a small… a bit of blip from retail dwelling patrons, as they paused, they gave pause for a second as charges began to extend, the secondary dwelling patrons got here in, devoured up the whole lot.

The first dwelling patrons, your college lecturers, your nurses, these individuals had been ready hoping that there might need been a chance. By no means occurred. So that they soar again in. Now after all, funds are up. Issues aren’t reasonably priced. We’re not seeing one thing wholesome right here, nevertheless it’s what I’ve been predicting. I believe the secondary dwelling purchaser is robust. I believe that they’re ready for this chance for charges to go up to allow them to are available in and seize increasingly stock off the market and it’s not going to get any higher,

Dave:

Kathy.

Kathy:

Nicely, we’re trying on the outcomes of low rates of interest. You may have low rates of interest for an prolonged time frame, that enables extra individuals to afford to purchase and the pure result’s larger dwelling costs. So it’s nothing sudden. What’s actually tough is these costs are up and now rates of interest are going up as a result of they should to sluggish it down. So proper now is perhaps probably the most costly time to purchase. That’s not stopping individuals although. Gross sales are down barely this previous month, however there are nonetheless loads of patrons on the market who can afford. That’s actually what it comes right down to.

We now have, truly all of us, a private pal, I can’t say who, who’s shopping for a extremely costly dwelling in Austin, shifting out of a excessive priced space. So that you’ve nonetheless acquired motion occurring, individuals who have made an incredible sum of money over the previous 12 months, individuals who did choose the fitting shares and the fitting actual property and the fitting occupation , have accomplished rather well and are loaded. The buyer might be the strongest ever. The FICO scores that we’ve seen have been the best over 740 or no matter. This isn’t the subprime disaster in any respect.

So costs are excessive, however nonetheless reasonably priced for some individuals, however for once more, such as you stated, the daycare employees… That is one thing I wished to say final time. I’ve buddies who’re daycare employees in Seattle. They’re not experiencing the wage will increase that tech individuals are and they should care for these youngsters. The place are they going to dwell? So there’s a separation that’s occurring and it’s very regarding for employees who aren’t seeing the form of wage will increase.

Dave:

All proper, Henry, what do you concentrate on these numbers?

Henry:

Sure. That is what we’ve been speaking about, proper? The important thing issues that you just stated that I honed in are provide and demand. So we’ve nonetheless acquired low stock. That’s at all times going to convey extra patrons. Sure, there’s larger rates of interest. That simply means a subsection of patrons get priced out. It doesn’t matter what the rates of interest are, there’s going to be a subsection of patrons that get priced out, that subsection will get bigger the upper the rates of interest go, however there’s nonetheless loads of individuals who wish to purchase.

The opposite quantity that caught my eye there was hire progress at 17%. Meaning rents are larger now too. So individuals who might have thought, “You recognize what? I don’t wish to purchase proper now, as a result of I can simply hire and avoid wasting money,” after which growth, their hire goes up or they transfer and so they’re paying new market rents at their new place. They begin doing the mathematics and reevaluating and going, “Nicely, possibly I’m okay paying a pair hundred {dollars} a month extra. At the least I get to personal, even when I’m I’m paying the next quantity than I’d be accustomed to paying, no less than I get the opposite advantages of possession.”

So, yeah, man, individuals are nonetheless going to purchase. If the demand is there and the provision will not be, that’s why I really like this enterprise.

Jamil:

I ponder if we’re going to have a child growth, of all these single individuals which are paying all this costly hire, getting collectively and shifting in with one another simply because they want to have the ability to afford issues and now they’re simply having extra infants due to inflation.

Henry:

Get that tax credit score.

Dave:

Oh, you suppose that decreased affordability goes to result in a inhabitants surge in its face? You by no means know.

Kathy:

As a result of infants aren’t costly in any respect.

Dave:

Yeah. Superb level. Kathy.

Jamil:

It’s simply kicking the can down the street, Kathy, that’s how we dwell.

Kathy:

Ah.

Dave:

All proper. Thanks all for these very fast takes. We’re going to get all into how one can make investments on this complicated financial time, proper after this.

Okay. Welcome again to OnTheMarket. For our due diligence part at the moment, we’re going to be speaking about how one can make sense of this very difficult marketplace for new buyers or possibly it’s not very difficult. We’ll speak about this, however earlier than we get into it and I ask you all of your opinions, I’d like to simply set the stage for this dialog and inform the story I maintain listening to from lots of people about their expertise and the place they’re getting caught in investing. Principally the story goes like this. You’re a tough working grownup. You’re making an attempt to get forward. Perhaps you might have a full-time job, you might need some children and also you need a good life. You’re not asking for an excessive amount of, you’re searching for a life the place you don’t have monetary stress and also you need freedom over your time and also you’re making an attempt to do properly.

You make good monetary selections, however everyone knows it’s fairly robust. Financial savings accounts are just about ineffective. Wage progress has not been actually important because the Nineteen Seventies and life is pricey shit. You may have medical payments, you might have scholar debt, you might have all these items occurring, after which possibly in the future, hopefully, you uncover BiggerPockets or one other investing useful resource and also you’re like, “Sure, that is it. I want to take a position. That is the important thing to what I would like,” and I don’t know if possibly this for you was 5 years in the past, possibly it was throughout the pandemic. As Henry has talked quite a bit about, you selected to coach your self financially, no matter it’s. Perhaps you bought to really feel enthusiastic about investing After which unexpectedly it’s 2020 And also you see now this virus that’s shutting down the world economic system and also you’re disinfecting your mail and also you’re making an attempt to make bread and it tastes like shit, and also you go to Zoom, birthdays and puzzles, and also you’re bored and it’s simply terrible. There’s like homicide hornets occurring. Australia catches hearth, the whole lot is horrible, however you retain your resolve and also you’re making an attempt to decide to investing. You’re like, “As soon as the pandemic’s over, that’s after I’m going to take a position.”

However then housing costs take off, they’re at an all time excessive and it’s tremendous onerous to get a deal. Inflation makes the whole lot much more (beep) costly. The fed proclaims they’re elevating rates of interest, everybody’s freaking out. Economists are beginning to predict recessions and if all this wasn’t dangerous sufficient, some (beep) go and begin the primary floor warfare in Europe because the Forties, inflicting untold struggling and an enormous humanitarian disaster.

So it’s an ideal time to take a position, proper? Is that this a narrative that resonates with you guys? Do you are feeling like that is the perfect… remains to be a superb time, regardless of all of those challenges to take a position? Henry, I’m going to open the ground to you.

Henry:

Once more, sure.

Dave:

Ought to we simply finish the podcast now? was it just-

Henry:

Proper.

Dave:

… [inaudible 00:16:40]

Henry:

Two credit? Look man, sure, all of that craziness and uncertainty and scariness occurred and craziness continues to occur, however what we talked about within the final section can also be occurring, which is actual property is proving itself to be an outstanding car, nonetheless to construct wealth. And sure, it’s scary, however for these of us who had been in earlier than all of the craziness and I wager in the event you ask individuals who’ve gotten in, even after the craziness occurred, the nice majority of them are in a greater monetary place at the moment than they had been in earlier than they acquired began as a result of values are rising, as a result of demand is so excessive and provide is so low and sure, there’s been a ton of cash on the market and that’s what’s inflicting individuals to exit and purchase, purchase, purchase, as a result of they wish to shield that cash by placing it into an asset that they really feel goes to extend in worth over time and historical past says with actual property, that that’s true.

So sure, it has been loopy and it’s going to… who is aware of what’s going to occur. If I’ve discovered one factor it’s that I do know nothing about what’s going to occur within the political atmosphere or within the well being, well being disaster atmosphere. Like, I don’t know, are we going to put on masks once more? Who is aware of. Are we going to get locked up? Who is aware of. However I do know that actual property has confirmed itself to be an outstanding funding car, particularly for these of us who’ve educated ourselves after which taken motion on the schooling to purchase high quality property as usually as they will.

Dave:

Completely with you, however the worry is actual, proper?

Henry:

Sure.

Dave:

I don’t really feel prefer it’s as apparent because it was, in 2014, it was quite a bit simpler to discover a deal and financing that made sense to you. Kathy, do you suppose the fears respectable and the way do you recover from that worry?

Kathy:

There are such a lot of issues to be afraid of and I might inform you that what’s occurring at the moment is nothing new. Once I was younger and that was a short while in the past, we had been fearful that two guys had been going to push a button and blow up the world and we needed to learn to drop and roll. Do not forget that? Cease, drop, and roll to not get blown up. That’s how I used to be raised. I purchased my first home proper earlier than Y2K. Everybody thought the world was going to finish. There’s at all times one thing. My background, my diploma is in broadcasting. I labored in ABC and CNN and Fox earlier than when it was simply common information, and I can inform you that was our enterprise mannequin was to scare you. I hate to say it, but when the headline didn’t draw viewers, then we didn’t have advertisers, so it at all times got here right down to scaring you.

So simply know that and there’s extra headlines now. Again then there have been 5. There have been 5 information stations, that was it and that’s the place you might get afraid. However now it’s in all places. It’s in your cellphone, it’s in your laptop. You simply attempt to search to buy and one thing comes up. So we’re being bombarded by it. I can inform you after I was terrified and I made Wealthy change outdoors earlier than he got here in our home and wash the whole lot down, I used to be most likely probably the most scared individual in March of 2020 as a result of I’ve bronchial asthma and I didn’t wish to die in aisle of a hospital.

So I perceive and I bear in mind Wealthy simply took me and he regarded to me within the eye, Wealthy is my husband, and simply stated, “You’re going to be okay. You’re going to be okay.” And it’s like, “Yeah,” as a result of I’m, and only a shift of perception system that you just’re going to be okay and cease trying on the information, simply cease. Concentrate on what you wish to create and put all of your power there as a result of the world is at all times in turmoil, it at all times has been. It is a horrible warfare that’s occurring, however there have been wars, there’s at all times wars. For some motive, this one we’re extra upset about possibly as a result of we’ve been to those locations or they appear to be us or no matter. There’s been wars in Africa, there’s at all times humanitarian disaster that’s horrible.

Whenever you construct wealth, you’ll be able to donate to those organizations and you’ll assist greater than in the event you don’t. So specializing in changing into profitable is admittedly vital and simply let all that stuff go and know which you could generate profits in any market, in any cycle. The one motive you’re afraid, the one motive, is since you haven’t accomplished it and possibly you haven’t discovered sufficient.

So discover a mentor or learn extra books, hearken to extra podcasts and take the step. That is what I advised my daughter when she stated, “Mother, I’m too younger to purchase a home at age 24.” I stated, “Who’s your mama? No, you’re not.” So go simply step one, simply do step one, as a result of she was about to go purchase a automobile. I stated, “Oh my gosh, the eight hours, you’re going to spend making an attempt to purchase a fricking automobile and now throw your debt to earnings ratios fully off, simply spend that point, spend one hour, one hour, with a mortgage dealer. That’s all I ask. In any case I’ve given you for twenty-four years, simply do that for me.

And he or she did it. She went and he or she talked to the mortgage dealer. She got here again and he or she’s like, “They stated, I qualify for a $300,000 dwelling.” She was two years out of school with making $26,000 a 12 months. This isn’t a rich individual. So she was shocked and it was simply taking that step studying a bit of bit extra. Then she’s like, “Mother, I don’t know how one can get a mortgage.” Nicely, all of it’s terrifying.

When my pal purchased her first home earlier than I used to be in actual property, I used to be like, “Oh, that’s too overwhelming for me,” and it’s, it’s quite a bit, however if you do it, if you undergo the method, you study a lot. So it won’t be the perfect deal on the earth, the primary deal you do, however you’ll study a lot and it is perhaps the perfect deal.

Within the case of my daughter, she discovered a $250,000 home in Chico, California. It was cheaper and I’m speaking California. It was cheaper than what she was paying for hire after which the fires occurred, the large Paradise fires. I’m positive you heard about that, was identical to the neighboring city. Impulsively she was getting individuals determined for a spot to dwell and he or she was in a position to hire her place out. The insurance coverage paid for all of it, $3,500 when her mortgage was 1400 a month. She was making $2,000 cashflow at age 24. She’s like, “Okay, mother, I get it now.” She wouldn’t have recognized that. She wouldn’t have recognized that if she didn’t simply take that first step.

So I at all times inform individuals simply discuss to a mortgage dealer simply to seek out out what does it take? What’s the method? What do you want to do? Do you want to repair your credit score? Okay, they’ll inform you that. That’s step one.

Henry:

Ah, Kathy’s voice telling me it’s going to be okay, the following time I’m burdened out-

Jamil:

It makes you are feeling good.

Henry:

… I’m calling you so you’ll be able to discuss me down. I really feel nice proper now.

Kathy:

Yay.

Dave:

Our subsequent information drop goes to be an audio recording of Kathy simply reassuring individuals that’s going to be okay.

Kathy:

It’s going to be okay.

Jamil:

It’s a guided meditation by Kathy Fettke.

Dave:

I’d hearken to that.

Jamil:

You’re going to be okay.

Henry:

I’m subscribing proper now.

Dave:

Now. I do wish to transfer this into sensible suggestions and methods for investing as a brand new investor, however Jamil, I want to hear your perspective on this. From a mindset perspective, how do you advise individuals that you just work together with about stepping into at the moment’s market?

Jamil:

Nicely, I respect you asking the query as a result of I agree with each of Henry and Kathy, you get what you’re searching for and are you investing in worry or are you investing in alternative and chance? And that’s really what we are able to at all times be doing. So shifting perspective, shifting focus will discover you a actuality that you just’re looking for. So in case you are being crippled by the information, in the event you’re being crippled by negativity, in the event you’re being crippled by your personal unconscious thoughts telling you that issues are going to be tougher for you, than you might be ingesting the flawed info. I promise you’re ingesting the flawed info. It is advisable make investments your thoughts and alternative and chance.

Look, life is difficult for individuals proper now who made life onerous and I’m sorry, in case your scenario proper now’s tough, you need to take a look at the alternatives that acquired you there. That’s simply what is going on in actuality. You may focus your consideration, you’ll be able to focus your momentum in a trajectory that’s going to get you throughout the road. That takes time, that takes dedication, that takes adjusting your power every day, however the product of that, in the event you look three years down the street from you simply making that funding into the way in which that you just suppose, the way in which that you just really feel and the way in which that you just function, and you then see what your life seems like in three years, it’s going to be totally different.

Dave:

That is nice recommendation to all of you. Thanks for sharing this as a result of I do suppose there may be cheap worry and it’s onerous to recover from it, however recommendation from individuals like all of you who’ve accomplished this earlier than and have gotten to a proper mindset to pursue your monetary objectives is tremendous beneficial.

Let’s change gears right here and speak about nuts and bolts. How do you go about investing proper now in the event you’re new on this financial local weather? So Jamil, is that to you wholesaling or how would you advise somebody in the event that they needed to focus in on one technique, what would you inform them to do?

Jamil:

Nicely, let’s take a look at the parameters we’re working with proper now. We’re working with rising rates of interest, so it’s tougher and tougher to qualify for a property as a result of the charges are excessive and you could not have a job proper now that’s going to have the ability to get you that certified mortgage. In order that might be tough for individuals in preserving them from taking motion. You’re retail stock out on on the earth on the MLS it’s very sparse and never plenty of it pencils out. So it’s like, “Wow, how do I even… I can’t soar into that, it doesn’t pencil. I’m going to have detrimental money circulation. I’m not going to take motion.”

In order that’s, what’s crippling lots of people proper now as a result of if you’re actual property from a rental perspective, you need to have some cash earlier than you can begin doing these items in a good way that’s truly going to maneuver the needle in your life. Why wholesaling is such an unimaginable software, you spend money on schooling and understanding and studying how one can underwrite property. When you perceive what a deal is now you recognize what to do now you recognize, “Okay, I’ve acquired a chance right here. There’s fairness on this alternative. There’s a lot potential right here. I can go dump a bit of that potential for a big sum of money.”

Look, guys, anybody listening to this, how a lot would $10,000 change your life proper now versus an additional $200 a month? How a lot would $40,000 change your life proper now versus an additional $500 a month? I’m not saying that an additional $200 or $500 a month isn’t good, however an additional $10,000 or $40,000 is a lot better. Okay? So understanding wholesaling can get you giant chunks of cash, which you’ll then use to spend money on shopping for and constructing a rental portfolio, however first we want cash and also you’re going to get cash by studying how one can wholesale.

In truth, Dave, I’m so adamant on individuals understanding and studying how one can perceive worth, I put collectively this algorithm, they’re the appraisal guidelines. I went and I spoke to appraisers throughout the nation. I took programs on appraising. I perceive how one can perceive worth. It’s the one factor I really feel like I’m actually good at aside from combing my hair within the morning. I’m superb at understanding worth. I made these appraisal guidelines and I’m completely satisfied to offer it away to everyone listening to this podcast. You could find these appraisal guidelines, you’ll be able to learn to underwrite and spot a deal after which when you’ll be able to spot a deal, convey it to me, convey it to one in all my 106 franchises throughout the nation. Allow us to purchase it from you, pay you $10,000 to $40,000 or much more, after which exit and begin a greater life.

Kathy:

Ooh, that’s a deal.

Dave:

Yeah. Thanks for providing that. I assume that’s a knowledge drop. We’ll have to get the air horn in the course of the episode this time. Thanks for sharing that.

Jamil:

In fact.

Dave:

Earlier than we transfer on, although, I do wish to convey out one different query about wholesaling as a result of to me, and I’ve by no means wholesaled a deal, to be sincere, is it a comparatively low danger manner for brand spanking new individuals who is perhaps afraid and wish to type of dip their toe in an actual property investing to become involved?

Jamil:

Completely as a result of look, you might be buying and selling devices if you’re wholesaling, you’re buying and selling a contract. You’re solely promoting a proper to purchase. Now that proper to purchase doesn’t imply that you need to truly purchase this factor proper now and I’m not telling you to go on the market and unethically tie up individuals and misinform individuals and put individuals in dangerous conditions, however let’s be sincere, we’re in a list crunch, there’s nonetheless 15 million vacant gross homes on the market in the USA. Okay? That stock crunch doesn’t exist on this market of misery, on this world of misery the place all of those actually crummy homes that retail patrons can’t purchase as a result of they’re, unfinanceable, that’s the place we commerce in wholesale. That’s the place the potential lies.

So sure, you’re not placing your self in a dangerous scenario as a result of once more, these properties require due diligence, they require time, they require consultants to come back in, take them and make them vertical and beautify them once more and put them again into the retail house. You, my pal, who’s listening to this, fascinated about stepping into wholesale, are offering these individuals the chance to do this. You’re including worth to {the marketplace}, you might be serving a function.

So by studying how one can wholesale, by studying how one can underwrite, you take a primary step into actual property investing with out having to purchase a home, with out having to get a mortgage. Consider that. All you’re doing is knowing how one can underwrite after which buying and selling that thoughts and that contract for a revenue. What a phenomenal factor.

Dave:

All proper. Thanks for explaining that. I believe it’s an excellent useful matter for our listeners to think about if they aren’t prepared to drag the set off, however let’s speak about pulling the set off. If you’re prepared to purchase otherwise you wish to do that together with actual property, Kathy, what would your technique suggestion be for anybody who’s making an attempt to make their first funding proper now?

Kathy:

I truly outlined this in my guide. It’s tremendous clear to know the place you’re going. What’s it you’re making an attempt to attain? So know the place you’re going, and you then’ve acquired to know the place you might be. So if I used to be to say… let’s say you wished to be in Phoenix. All of us 4 are coming from totally different locations, it’s going to be a special method to get there.

So the way in which that you just do that’s actually simply sit down and determine, “What am I making an attempt to do? Why would I purchase a bit of property? Why would I wholesale? What am I making an attempt to get to?” And is it you’re making an attempt to extend cashflow? Are you making an attempt to take a position for the longer term? Do you might have plenty of time? Do you don’t have any time? These are all issues which are actually vital to have a look at first.

So the place are you desirous to be and the place are you now? The largest mistake or a really large mistake is individuals don’t know how a lot cash they make generally or how a lot they’re spending in taxes or how a lot they’re spending on dinners and no matter. Consciousness is step one. You hear this quite a bit in motivational seminars and it’s actually true, consciousness is step one. The place are you? And to simply perceive your funds. Do you might have a tax downside? Are you paying manner an excessive amount of in taxes? You’re going to unravel that otherwise than someone who doesn’t have a job and is paying no taxes and must make money circulation. So getting these issues actually clear, what’s it you’re making an attempt to attain and the place are you now? After which what’s your path going to be?

It’s going to be totally different for everybody. That’s why it’s onerous for me to offer a straight reply right here however in the event you don’t have any cash, then you’re going to most likely… To begin with, you’re going to need to get actually educated. Like Jamil stated, ensure you are one hell of an underwriter, as a result of in the event you discover the deal and it’s a superb deal, you’re going to seek out the cash, that’s not going to be an issue.

In case you have cash and no time, possibly you simply want to actually perceive why are you wanting to purchase actual property. Is it for tax advantages? Or possibly you spend money on someone else’s passive earnings mission, possibly a syndication the place you get these tax advantages, however you don’t need to do something, you get the money circulation and tax advantages otherwise you simply purchase a extremely already like a model new rental property that doesn’t want any of your time and power, nevertheless it’s in a progress market and also you’ve acquired nice property administration in place.

So once more, it’s going to be totally different for everyone, however beginning out, realizing what you need after which the place you might be.

Dave:

So do you suppose then that given… I completely agree with the whole lot you’re saying, that’s glorious recommendation as a result of your technique is inherently private, it needs to be replicate your personal private objectives, however do you consider that any and all actual property methods are nonetheless potential and advisable to first time buyers in such a financial local weather?

Kathy:

Oh my gosh, sure, after all. In fact, after all. Sure. Sure, nevertheless it’s simply not going to be the identical technique as possibly final 12 months or the final 10 years, however there’s at all times, at all times alternative. I can’t emphasize that sufficient. Proper now, we’re truly actually excited. Like, “Oh, lastly, there’s extra stock.” We’ve been on this stock starve market and it’s not likely a lot better, nevertheless it’s a bit of tiny bit higher.

So for the primary time in years, we’re truly in a position to get some properties at public sale in Tampa. That has not occurred for years. So for the primary time we’re having a property tour and going to have a look at foreclosed properties. Once more, that sounds, that sounds dangerous. It’s not like we’re hoping individuals will lose their properties, under no circumstances, however there have been some people who had been in a position to benefit from the foreclosures moratoriums who had been already late on their mortgages earlier than COVID, so it wasn’t actually COVID associated and so they’re simply coming via the pipeline. However the auctions had been simply shut down. So there’s extra stock coming Available on the market, which suggests there’s extra alternative coming.

Dave:

Nice recommendation. Thanks, Kathy. Henry, what’s your technique tip for brand spanking new buyers in 2022?

Henry:

Sure. Look, Kathy’s 100% proper, you bought to know what you wish to do. Look, I inform individuals, you need to determine you’re going to spend money on actual property. Decide and really make that call in your thoughts and in your coronary heart as a result of if you determine you’re going to do one thing, the Universe will get out of your manner, and also you begin to see choices for the way that may be potential. Whenever you simply say, “Hey, I believe actual property’s an incredible hedge. I’d wish to attempt to personal a property. We’ll see the way it goes.” Your mind doesn’t begin working for you. Your mind simply begins going via what it usually goes via, the issues it already is aware of after which if you run right into a roadblock like stock scarcity or rising rates of interest, otherwise you don’t have the down cost cash, all these roadblocks that pop up, you then cease. You simply say, “Oh, properly, it’s too onerous. I can’t. I can’t on this market, it’s too onerous,” however that might not be true in any respect.

Kathy simply stated there’s a bunch of various methods you may get into actual property investing and that’s nonetheless true even on this market, however you need to decide in your thoughts that, “I’ll purchase an funding property within the subsequent 60, 90, 120, six months,” no matter, choose your timeframe and simply write it down 5 instances a day, “I’ll purchase an funding property,” as a result of what you do if you do that’s you open up your thoughts to the chances of how one can get within the sport. Too many individuals wish to know the how earlier than they take any motion and that’s not the way in which issues work. Like you’ll be able to’t have each step lined out for you. And it simply says, “Okay.” You open Zillow, and you then search and you then discover a home and you then go, “That’s the one,” and you then name the financial institution and so they’re like, “Right here’s all the cash,” and you then purchase a property and you then get a tenant after which it money flows. Yay. Actual property. That’s not the way it works, y’all.

It’s a must to determine, you’re going to spend money on actual property and if you try this, it’s just like the purple truck idea. It’s such as you wish to purchase this beautiful purple truck and also you exit and you purchase it as a result of no person has this truck and also you’re going to be tremendous cool man with the cool purple truck after which each different truck you see after you purchase that truck is a purple truck. There’s no extra purple vehicles at the moment than there was yesterday, it’s simply that your mind is open to the concept that they exist.

So in the event you inform your self and making a decision that you just’re going to take a position, you’ll begin to hear issues in dialog, you’ll begin to hear issues in podcasts, you’ll begin to hear among the nice knowledge that Kathy and Jamil and Dave are dropping proper now and be like, “Oh, that’s it. That’s how I can do that.” This info was on the market earlier than. Your mind simply wasn’t open to receiving it and placing it into motion. So the the 1st step is the choice you need to make and you bought to make it in your thoughts and in your coronary heart and know that it doesn’t matter what comes up, “I’m going to determine how one can get this accomplished.” That’s the 1st step.

Step two is simply consider your scenario. Consider the place you might be. Kathy touched on this. Consider the place you might be and what you need. I can inform you one thing. A whole lot of you wish to purchase a rental property and also you don’t understand you’re dwelling in it. Tons of you reside in a property that will be an outstanding rental. Three mattress, two bathtub, 1500 sq. foot, first home. That’s an incredible home. It’s superb that you just purchased that home, nevertheless it is perhaps a unbelievable rental. Perhaps it’s a unbelievable Airbnb. It’s a must to know the market that you just’re in.

So you might probably transfer out of that property, hire it out after which use a program like an FHA program to purchase a duplex. You recognize you should buy as much as 4 models with an FHA mortgage and you’ll dwell in a kind of models and you’ll hire the opposite models or you’ll be able to dwell in a kind of models and you’ll Airbnb the opposite models or you’ll be able to dwell in a kind of models and you’ll hire out the rooms in your aspect and the opposite aspect,

I’m not saying this home hacking technique works for everyone in any scenario. What I’m saying is it could possibly most likely work for lots of people, nevertheless it’s going to require you to get a bit of uncomfortable, however wealth is in-built uncomfortable zones. If wealth was comfy, everyone can be rich. It’s going to take you getting a bit of uncomfortable. I’ve heard individuals say, “Hey, I wish to purchase rental property. How do I get within the sport?” And I say, “It is best to home hack.” “Nicely, I don’t wish to share partitions.” Nicely, that’s a foolish factor to cease you from constructing wealth. Or they are saying, “Nicely, my spouse gained’t wish to share partitions.” Nonetheless, it’s a foolish factor to cease you from constructing wealth.

Does the technique work for everyone? No it doesn’t, however take into consideration this. In case you dwell in a home which you could presently hire out and you then go purchase a duplex, let’s simply name it a duplex and you reside in a single aspect and also you hire the opposite aspect and the opposite aspect covers your mortgage. So let’s say proper now you’re paying $1,000 a month, I do know that’s most likely low on your mortgage. $1,000 a month, in the event you dwell there for 12 months. Let’s say you simply maintain paying that, however you pay it to your self. After 12 months, you’ve acquired $12,000 saved up. After two years, you’ve acquired $24,000 saved up. Then you’ll be able to go take that $24,000, you should buy no matter dream home you’re trying to purchase. You’ve acquired $24,000 to make use of as a down cost. You progress into that and you then hire out the unit that you just’re dwelling in and the hire from the unit you’re dwelling in, pays for half your mortgage at your new dream home.

You will get to your objectives sooner in the event you simply take a look at the scenario you might have and see how one can leverage it to succeed in your objectives. Sure, it is perhaps a bit of uncomfortable, however ask your self, “Am I dwelling in my first rental or can I simply go purchase a duplex and dwell in my rental after which have two doorways?” I don’t know, man. I believe it’s an outstanding method to get… I did it. And it’s how I dwell within the dream home that I’ve proper now and it modified my life endlessly.

This market is loopy and it’s going to proceed to be loopy for a short while. So simply take a look at the scenario that you’ve got and the instruments that you’ve got at your disposal and be a bit of artistic with the way you attempt to discover that first deal. Is it a wholesale? Perhaps. Is it a home hack? Perhaps. You’re going to need to get artistic and also you’re most likely going to need to get a bit of uncomfortable and you want to be okay with that.

Dave:

That was very properly stated, Henry. I’m impressed to go begin home hacking once more, regardless that I’ve accomplished that a couple of instances at this level, however I’m glad that you just introduced that up as a result of I believe that when when individuals ask me what’s the simplest method to get into actual property investing? I say the identical factor. I at all times say home hacking as a result of there are simply so many benefits. So I agree with Jamil that wholesaling is admittedly good, particularly in the event you don’t have cash saved up, it’s an incredible studying expertise, however if you wish to truly purchase the home, home hacking, tremendous nice alternative. As Henry stated, you’ll be able to benefit from an FHA mortgage and put as little as 3% down and in a rising rate of interest atmosphere, you get proprietor occupied financing, and I believe that’s tremendous vital as a result of during the last couple of years, the unfold between an proprietor occupied mortgage and an investor mortgage was not that a lot. I don’t know precisely what it was, nevertheless it was not as nice because it already is now. Now we’re seeing it it’s no less than some extent, so meaning as an proprietor occupant your offers, like you’ll be able to underwrite a deal higher than somebody who will not be proprietor occupying one thing. In order that is a bonus which you could have over different individuals within the market.

The opposite factor is, as somebody who has accomplished this and was an terrible landlord after I was home hacking, is that it’s an incredible studying expertise. You’ll study extra about property administration by home hacking than you’ll by shopping for out of state and shopping for down the street for years. You’ll study a lot dwelling in a property that it’ll set you up for long run success in actual property, for my part.

So I’m with you Henry. I do know it’s a bit of uncomfortable, however once more, as somebody who’s accomplished this, it’s actually not that uncomfortable.

Henry:

It’s not that it’s uncomfortable.

Dave:

It’s’ actually not. What’s so dangerous about sharing partitions? Like I’ve lived in flats. I dwell in an condo proper now, I share partitions with individuals proper now, it’s actually not that dangerous, it’s a fairly regular factor to do. So in the event you might try this and construct wealth on the similar time, I’m all for it.

So that you guys all have given actually glorious enter and recommendation on first issues you might do. We’ve talked about home hacking, expertise like studying to underwrite and Jamil, very generously is freely giving that underwriting doc. We’ve talked about assessing your scenario. Kathy talked about simply speaking to a mortgage lender. What an incredible piece of recommendation. Simply go determine what you qualify, cease fascinated about like what if, you might discover out for positive what you qualify for. Earlier than we go, are there some other sensible suggestions, particular person items of recommendation that individuals might do proper now at the moment to get them that subsequent step ahead in direction of their first deal?

Henry:

100%. I believe you simply hit it, is simply too many instances we let what we expect goes to occur cease us from the motion that we wish to take. I’ve heard individuals say on a regular basis, “I wish to purchase a rental property, however my debt to earnings isn’t good, so I can’t qualify proper now.” “Oh, okay, properly which mortgage lender advised you that?” “I haven’t talked to 1 but.” “Oh, okay.” Or, “I can’t purchase a home proper now as a result of I can’t home hack. I can’t qualify for a duplex. They value far more than a single household dwelling. There’s simply no manner I can afford that.” “Oh, okay. The financial institution advised you that?” “Nicely, no. I simply know they’re costlier.” “Nicely, yeah in the event that they’re occupied with tenants that they will use the rents that that place is making to qualify you for extra as a result of that’s earnings for you.” “Oh, I had no thought.”

I believe plenty of the instances we have now to cease convincing ourselves that we are able to’t do one thing earlier than we simply go get the solutions for ourselves. So take the step. The sensible step is go discuss to a financial institution, go discuss to an actual property agent, go discuss to the professionals in your discipline and inform them your objectives, “I wish to purchase a rental property within the subsequent six months. What’s it that I have to do with a view to get that accomplished?” and allow them to provide the sensible recommendation and allow them to inform you precisely what you’ll be able to and may’t do and cease telling your self what you’ll be able to’t do primarily based on what someone on the web stated or one in all your mates stated that attempted to purchase a home a couple of months in the past and acquired beat out. Simply go determine it out for your self. You’ll be shocked at what you’ll be able to most likely accomplish in the event you stopped saying no to your self.

Dave:

I’m feeling so impressed. I’m able to go do my first deal yet again. I want I might return a time and go home hack. Kathy or Jamil, both of you might have any final ideas or recommendation for first time buyers?

Jamil:

Completely. So a motto of mine is squat up. Squat up, go discover a group, discover individuals which are doing it. Similar to Henry simply stated, there are individuals dwelling what you are attempting to dwell and so they’re good. Guess what? Most profitable individuals acquired there as a result of they’re not dicks. Actually. You may go and get recommendation from individuals, you might be pleasant with individuals, you’ll be able to inform individuals, “I’m new, I’m desirous to study,” and also you’d be shocked at simply how many individuals are keen to supply mentorship or provide stewardship and simply be part of your life, part of your journey, as a result of they’re simply genuinely good individuals and so they wish to see others succeed. Group, squatting up, getting with different individuals which are doing what you’re making an attempt to perform. You can’t be not be left behind in case you are forcing your self into the pack, that’s simply what it’s. Go do it, go try this factor.

Kathy:

Yeah. Completely. If you’re being detrimental, being a downer, seeing all the explanations you’ll be able to’t, that is the one manner I can say it, you haven’t arrived but. You haven’t adopted an abundance mindset. And if you’re round buyers all they’re doing is speaking about alternative. And I’ve been doing this for 25 years and there’s been quite a bit that’s occurred in 25 years, plenty of detrimental stuff on the market, and but it was 25 years in the past that I discovered this, that profitable individuals have a special mindset, they see issues otherwise.

So in case you are seeing all the explanations you’ll be able to’t, you haven’t arrived but. That’s all I can say, there’s work so that you can do in altering your mind and altering your mindset to seeing what’s out there. And the way in which you do that’s via studying and by doing it and by hanging round people who find themselves the place you wish to be, as a result of that’s if you go, “Oh my gosh, they really do suppose otherwise.” It’s true. So go get it. Go shift it.

Dave:

Wonderful recommendation from all of you and in the event you’re questioning, “The place might I discover all of those people who find themselves concerned about actual property investing?” Nicely, BiggerPockets occurs to be a free web site the place 2.5 million people who find themselves concerned about actual property investing are speaking about actual property each single day, they’re going on boards, there are extremely skilled individuals answering discussion board questions fully without cost and we even have an incredible software. You may go to biggerpockets.com/agent and discover an investor pleasant agent in any market that you just’re contemplating. These are simple, sensible methods so that you can construct your community, to construct your crew, to squat up, as Jamil stated, and get you on that path to that first deal.

Thanks. Jamil, Henry, Kathy for this recommendation, I’m personally simply feeling impressed regardless that my first deal was fairly a very long time in the past. We’re going to get into some… one of many members of our viewers, of our group, requested a query about their first deal and we’re going to assist them suppose via among the challenges they’ve for this primary deal, proper after this break

For our crowdSource part at the moment, we’re going to be serving to a member of the OnTheMarket group. I believe this can be a milestone for us.

Henry:

We now have one now?

Dave:

… Our first episode we had been saying this was the CrowdSource that we imagined, this theoretical crowd that was going be interacting with us and speaking to us and it exists now.

Kathy:

Woo.

Dave:

And for anybody listening to this who needs to work together with us, Instagram is at all times a superb place to do it the place all of us have particular person accounts. You could find these within the present notes or BiggerPockets like we had been simply speaking about. I posted a query on the BiggerPockets boards, asking individuals a couple of potential deal that they had been contemplating doing. And I acquired this response from Nico Dandini, who lives in Boston, however is trying to do a deal in Kansas Metropolis, Missouri.

The deal is listed for $72,000, and hire is estimated to be $850 per thirty days. So already in my thoughts, I’m considering that beats the 1% rule, that child’s going to money, that’s actually good. What Nico likes about this deal is the worth. He has 14,000 saved up for a rental property, however he lives in a suburb of Boston. It’s a fairly costly market, so the cheaper out-of-state markets are enticing to him and he thinks it seems like, for probably the most half, it’s in good situation, however doesn’t have any expertise working with a contractor.

So his large query and what he needs the assistance from the three of you about is, “The present worth and the worth reduce by $6,000 on April eighth makes me surprise if there’s one thing actually dangerous I’m lacking. Within the Boston space. Homes are going for tens of 1000’s over asking worth with out contingencies inside per week of being listed. Why did the worth get reduce? Why has it been available on the market for 20 days? What’s flawed with it? What am I lacking? Additionally, if I don’t have sufficient money to purchase and rehab, I might purchase it with no rehab, however given how the worth is low and it was lately reduce, one thing tells me I have to rehab one thing that I can’t select from the photographs on Zillow.”

All proper, Henry, I really like your chuckling. Let’s provide the first crack at this one.

Henry:

All proper. I’ve acquired some tremendous loopy recommendation for… It’s Nico Was that his title, Mr. Nico?

Dave:

Nico, sure.

Henry:

Right here’s some tremendous loopy recommendation. Numbers sound good. Sure, you’re over the 1% rule, that’s superior and I like your intestine response to the worth reduce. It is best to belief your intestine. In case you odor like one thing’s up, there could also be one thing up, that’s good instinct. Right here’s what I’d do. If that is one thing you’re severely contemplating, which is investing in a market like Kansas Metropolis, which is outdoors of your space, in the event you’re really critical about it, line up this property, so contact an actual property agent or whoever you want to with a view to line up a exhibiting, line up another showings of comparable properties in that neighborhood, after which some properties in an adjoining neighborhood. After which right here’s the kicker. Go there.

Kathy:

Whoa. Sure.

Dave:

Revolutionary.

Henry:

So purchase a airplane ticket. As a result of I hear this quite a bit. Individuals wish to make investments out of state, they discover what seems like a superb deal numbers smart and I simply interviewed someone on the opposite BiggerPocket present who did a primary deal out of state, who didn’t go see the property and is paying the worth for that. So if you concentrate on the price of a airplane ticket, sure, airplane ticket prices are on the rise proper now, let’s say it prices you between flight and a lodge, let’s say it value you $1,000. Let’s say it prices you $2000, let’s go loopy. Let’s say it value you $2000 and you then go there and also you study this property has a lot misery that the photographs did it no justice. Perhaps they had been previous photos. Perhaps you uncovered that {the electrical} is simply horrible or that there’s an enormous plumbing problem. Who is aware of what might be flawed which you could’t see with photos and also you spent $2,000 and now you didn’t purchase a property. Man, you wasted $2,000. What did that $2,000 prevent in sunken prices in a property that was going to be a cash pit?

Cease trying on the worth of getting on a airplane and going to see one thing as what might probably be a misplaced {dollars} and take a look at them as what number of 1000’s might that prevent in the event you simply go put eyes on it your self. Nobody goes to care extra about your funding than you and you’ll construct an incredible crew of trainers on the bottom who may help you do all these items nearly and that’s superior, however you’re nonetheless placing your belief in someone who doesn’t have the pores and skin within the sport that you just’re going to need to put within the sport.

Dave:

That is nice recommendation and also you may keep away from a nasty deal, which is as vital, if no more vital than discovering a superb deal, however in dropping that deal, you may also study the neighborhood higher or discover a block that you just discover actually attention-grabbing and construct a relationship with a neighborhood investor. There’s so many different advantages from it even when that one deal doesn’t work out.

Henry:

That’s proper.

Dave:

I simply did this myself and I hadn’t accomplished it in years and I simply felt actually invigorated by it. It was actually enjoyable, actually informative and I simply love this recommendation, however please end your thought, Henry, sorry to interrupt.

Henry:

It’s additionally going to be simpler to construct your core 4 and construct your crew if you go get on the bottom and go meet these individuals in individual, they’ll take you extra severely than simply some man who known as them from out of state and who needs to pour cash into their group. Present them that you just’re critical. Present them that you just not solely wish to make investments, however you care about their group as properly and it’s going to assist construct your crew and like I stated, this might be an incredible deal, however go determine it out for your self as a result of no person else goes to care such as you.

Kathy:

Don’t be a sucker from a excessive priced market who thinks the whole lot that isn’t Boston costs or California costs is an efficient deal. That is basic. Once I began investing, it’s like I had an enormous D on my brow of simply dummy as a result of, “Oh, you’re from California. Every part seems like a deal for you.” It might not be and to me, the most important problem I noticed with this query is the truth that you don’t know the situation of the property. You could find out the situation of the property with out visiting, though I at all times advocate actually realizing your market, realizing the road degree. One road is totally different than one other road, it actually issues. However even in the event you didn’t go, you might get three or 4 inspections and even one inspection from a licensed inspector who can inform you what’s flawed with the property and the way a lot cash you’re going to need to put into it.

So the truth that you don’t know, after all, that’s like I stated, worry comes from not realizing. In case you don’t know the situation of the property, don’t purchase it as a result of that might value you $40,000, you don’t know till you discover out. Is there a basis problem? That shall be costly. A roof? It’s going to be costly. So yeah, simply discover out, possibly save your self the journey first and simply pay the $400 for an inspection report and if it wants plenty of work, don’t get it.

Then the second factor can also be ensure, I discussed this earlier than, discuss to a property supervisor as a result of they’re a bit of bit extra sincere. They don’t have anything to realize by you shopping for a crappy property as a result of then they need to handle a crappy property, no person needs to do this. So at all times discuss to a property supervisor or a number of to guarantee that they’d confirm these rents and that they like that neighborhood. You may search for crime statistics, however once more, getting on a airplane and going is at all times a good suggestion as properly, as a result of you’ll be able to discuss to neighbors. You may go to the native Starbucks and say, “What do you concentrate on this neighborhood?” So yeah, simply the not realizing is what causes plenty of worry.

Dave:

All proper, Jamil, take us away.

Jamil:

I really like each of these solutions. I’m going to offer you some recommendation that’s not going to require you having to go to the city fairly but. How I’d do it’s I’d go and spend money on… In case you’re doing this full time, you ought to be investing in some form of a useful resource or a software like batch leads that may present you the place properties are buying and selling for, for money worth. Like the place are buyers shopping for properties in that space for money? In order that’s my first information level I wish to take a look at.

The second factor I wish to do is that if I really feel like this truly is an efficient potential and because you do have the cash to buy this property, you’re a respectable purchaser. I’d lock that property up with a pleasant due diligence interval. Then, as a substitute of touring, I’d ship that deal out with a $5,000 markup on it to different buyers within the space and I’d see, might I wholesale this property? What are the patrons telling me about this property? Allow them to go and do the be just right for you. Allow them to go be your due diligence. Allow them to go convey the contractors, allow them to go do the inspections and inform you why you’re both out to lunch or why you might have a superb deal.

Now, when you’ve got a superb deal, you may determine to take the $5,000 wholesale price and promote the contract to a different investor and allow them to do it and now you made $5,000, or you could determine, “Hey, all of the patrons need this property. I’m going to maintain it for myself.” That saved you a airplane ticket and might need made you $5,000 or acquired you a property.

Kathy:

What’s smarty pants?

Dave:

It is a good method to wrap up the present as a result of we wished to begin the present in a manner that confirmed how there’s other ways to get to your first deal and this can be a good method to wrap it up, that Nico or anybody else on the market listening, there’s so many alternative methods to get in. You might wholesale, you might go go to, you might purchase information. There’s so many alternative methods which you could method this. The secret’s actually to take motion and hopefully this dialog has been actually useful to all of you listening and helps encourage you to go on the market and take motion.

Henry Jamil, Kathy, this has been a lot enjoyable. As at all times, you might have impressed me and I can’t wait to speak to you all once more actual quickly on the following episode of OnTheMarket. We’ll see y’all quickly.

OnTheMarket is created by Dave Meyer and Kalin Bennett. Produced by Kalin Bennett, edited by Joel Esparza, copywriting by Nate Winetrout. Particular because of Lisa Schoyer, Eric Nutsen, Danielle Daley and Nathan Winston. The content material on the present OnTheMarket are opinions solely. All listeners ought to independently confirm information factors, opinions, and funding methods.