You’ve got to see this chart…

It shows the largest 100 stocks in the Nasdaq…

Mega-cap growth and tech stocks, like META, Apple and Microsoft. [1:40]

They are about to break out.

The Index is already up 28% from where it was in October 2022. And when big-cap growth stocks take off, the small-caps are soon to follow.

All the signs point to a HUGE bull market for these stocks.

The driving forces for it are artificial intelligence and robotics automation, and microchip technology.

So in today’s video, you’ll find out why this is the biggest trend of the year. Don’t miss the opportunity to invest today:

(Or read the transcript here.)

🚨 Want to know what stocks I recommend buying for the small-cap bull market? Details here.

Hot Topics in Today’s Video:

- Market News: Are the Federal Reserve’s rate hikes actually making a difference? This chart forecast shows the (potential) path of least resistance for large-cap growth stocks. [0:50]

- Tech News: It’s a breakthrough for science, folks! Microsoft is betting on nuclear — by that we mean fusion power. The tech giant thinks Helion Energy is on the brink of figuring this out. [6:55]

- Mega Trend: Wendy’s is working with Google to implement an AI chatbot to take your order in the drive-thru. At this rate, artificial intelligence and robotics (with the help of microchip technology) could increase U.S. productivity by 1.5% over this decade. [9:30]

- For details about the one microchip company I believe could soar more than 1,000% over the next five years … click here.

Can You Spot the AI?

In yesterday’s Banyan Edge podcast, Amber asked if you could tell which one of these dogs is real and which on was created as an AI image?

I sent her my guess. Which one do you think?

Share your guess here.

See you soon,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Remember last year, when Ian said it was time for America to “fire China?”

Well, about that…

It looks like that’s exactly what is happening.

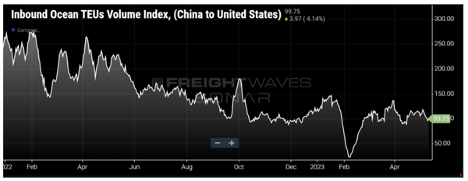

New data from FreightWaves, a research firm specializing in supply chain data, shows shipping container volumes to the United States continuing to trend lower.

(Note: TEU stands for “twenty-foot equivalent unit,” a standard shipping container measuring about 20”x 8”x 8”.)

Volumes are now less than half what they were a year ago. And the de-coupling of the Chinese and American economies is showing no sign of slowing down.

Now, it’s important to remember that global trade flows are complex. Not everything we see here is directly explained by U.S. companies leaving China or rerouting their supply chains.

There are other factors at play here too, such as a weakening economy. U.S. retailers have been bracing for recession for months now, working down their inventory gluts and rightsizing for the post-COVID economy.

So there are really two trends at play here:

- A short-term slowdown in shipping due to economic weakness.

- A longer-term reorganization of supply chains, that’s moving the U.S. and China in different directions.

What Does This Mean for Inflation?

Here’s where it gets interesting.

Shorter-term trends are actually deflationary. China’s capacity glut should actually put downward pressure on prices. It should also help the Fed get at least a little closer to its goal of pushing inflation back to 2%.

But then there’s the longer-term issue…

“Firing China” and bringing production closer to home involves a lot of investment today that won’t see any immediate benefit for months, or even years. That’s inflationary.

But it’s also one of the greatest opportunities of our lifetimes. American industry is already pouring billions of dollars into labor-saving artificial intelligence and automation. This tech is doing the work that was previously being offshored, for even cheaper costs.

And it’s not just factory work that is going high tech.

Service jobs are also in the crosshairs. And historically, this has been the least scalable and the most vulnerable to labor shortages.

Like Amber and I mentioned in yesterday’s podcast episode, Wendy’s is partnering with Google to replace the drive-thru window with a chatbot.

We’re just getting started here, and this new revolution will likely prove to be more disruptive that the internet 30 years ago, or even the original Industrial Revolution.

To navigate a world that is changing this quickly, you need a guy like Ian in your corner.

His specialty is the ever-evolving world of growth and technology. And if he sees a bull market coming for mid- and small-cap tech, then it’s time to take advantage of a great investing opportunity.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge