Odu Mazza

When I graduated from college my net worth was negative $50,000 and that’s because I took out student loans so that I could afford to attend a private college in South Carolina.

Armed with a business degree and a real estate license (I got my license when I was 19) I was motivated to go to work so that I could pay off my student loan and buy my first house.

By the time I was 28 years old, my net worth was over $1 million, mostly equity from real estate projects that I had developed, and of course I took on enhanced leverage which increased my risk considerably.

By the time I was 35 my net worth had increased substantially, and so did my appetite for the use of leverage. My business partner and I owned shopping centers, free-standing properties, and land. I also was a franchisee in a multi-unit business and lived in a $2 million home.

Simply put I was living the easy life.

No Silver Spoon for Me

Growing up, I was raised by a single mother who worked multiple jobs, and while she always provided for the basic necessities in life, our family was certainly not wealthy.

My first job was a paper boy where I learned the importance of customer service. If the paper was not delivered, I did not get paid.

My next job was as a bag boy (or courtesy clerk as I called myself) and I learned how to win over customers. I knew many of the shoppers on a first name basis, and they would always provide me with tips when I brought groceries to their car.

At an early age in life, I knew that I wanted to be rich, and my mother instilled in me the work ethic that I have today (over 3,600 Seeking Alpha articles in 12 years).

I Lost It All

By the time I was 40, I thought I had life figured out, and I never imagined that the next few years would be some of the toughest years of my life.

Fancy vacations, private schools, and trophy cars were all part of the so-called American Dream.

But when 2008 hit…

Things got nasty.

The Great Recession was what I refer to as my “Great Reset” and during that time I was forced to downsize my lifestyle considerably. Not to bore you with the details here, but I saw my nest egg fall off the cliff. All the king’s horses and all the king’s men could not put humpty together again.

One of these days I’ll write a book that will explain in detail my life and the lessons that I learned before, during, and after the Great Recession.

However, one of the greatest things about all of that adversity is that I landed on this really cool website known as Seeking Alpha.

And 12 years later I have become the most-followed writer with over 108,000 followers and over 15,000 subscribers (across platforms).

“Adversity is bitter, but its uses may be sweet. Our loss was great, but in the end we could count great compensations.” Benjamin Graham

I’m Back in the 7-Figure Club

Thanks in large part to hard work, determination, and perseverance, I’m now back in the 7-figure club, and I’m not looking back.

I recognize that we’re likely headed into another recession, yet this time I’m preparing for it, in hopes that I can use my skillset as an intelligent REIT investor to move me even closer to the 8-figure club.

The seven-figure club may seem exclusive, but it’s hardly small.

According to Spectrem, there are now more than 13.6 million U.S. households worth $1 million or more (not including the value of their primary residence) and that’s more than 10% of households in the U.S.

So, the U.S. is definitely the country with the most millionaires and only about 20% of Americans inherited their riches.

The rest of them are self-made, first-generation millionaires. According to “The Millionaire Next Door: The Surprising Secrets of America’s Wealthy” by Thomas J Stanley, most millionaires have to work for the money and don’t get rich once a relative dies.

Okay, I’m sure you thinking to yourself, how many billionaires are in the U.S.?

According to a census report in 2020, there are 788 billionaires (in the US) with a combined net worth of $3.431 trillion, in contrast, the U.S. had 404 billionaires in 2010. I’m glad to say that I have met at least six of these billionaires and I’m looking forward to meeting more of them in the future (hopefully one in March).

Millionaire Moves

Most millionaires keep a low profile and don’t live in big mansions or drive Bentleys. Heck, even billionaire Buffett still lives in the same house in Omaha that he bought for $31,500 in 1958.

fancypantshomes.com

Buffett went on to say that real estate is a valuable asset “for a great many people. If you know you’re going to live in a given area, or think it’s very likely, for a considerable period of time and you’ve got a family, the home is terrific.”

As I said earlier, I used to own a $2 million home and downsized to a much smaller home that I purchased in 2010.

Most millionaires credit their success not for being smart investors but for saving early and often. My goal is to sock away 50% of my disposable income and that’s becoming increasingly easier for me as my children leave the home.

What I’m Doing Different

Believe me, once you become a multi-millionaire and then lose it all, you become driven, because during that chaos, you develop a more serious concern for money, and that’s when I was transformed for a risk taker to a more conservative investor.

In fact, it’s this extreme conservatism that provides me with an advantage when I pick stocks because I completely grasp the margin of safety concept. As Benjamin Graham defined it, the margin of safety constitutes a “favorable difference between price on the one hand and indicated or appraised value on the other.”

I no longer swing for the fences like I did in my 20’s and 30s’, instead I embrace rising stock dividends. There’s a reason that millionaires are fond of dividends…

The Case for Dividend Growth

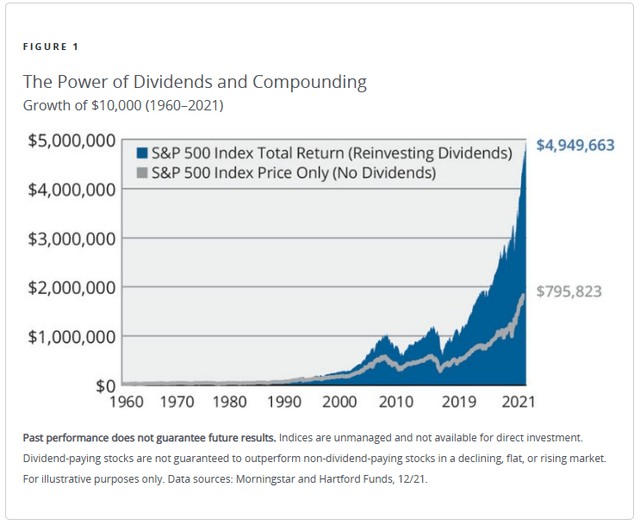

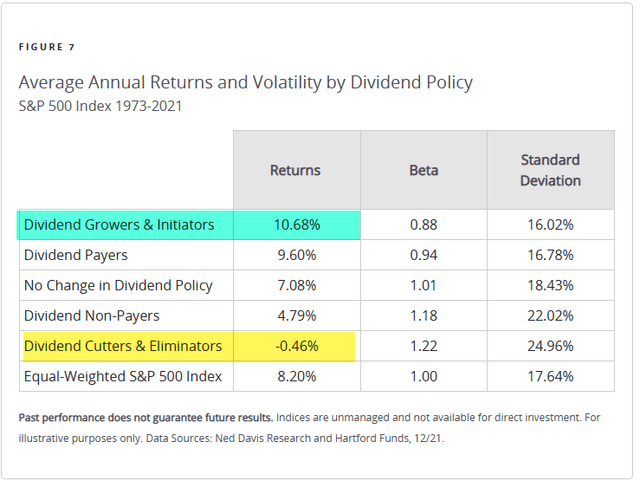

Dividends have historically accounted for a sizeable portion of equity returns. Going back to 1960, 84% of the total return of the S&P 500 Index can be attributed to reinvested dividends and the power of compounding, as illustrated below:

hartfordfunds

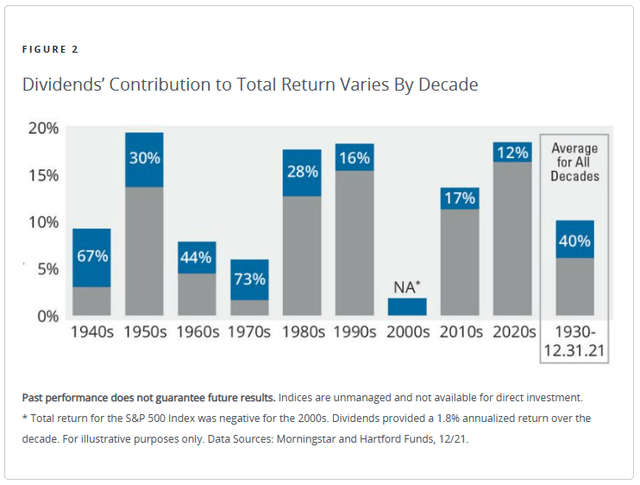

Looking at average stock performance over a longer time frame provides a more granular perspective. From 1930–2021, dividend income’s contribution to the total return of the S&P 500 Index averaged 40%. Looking at S&P 500 Index performance on a decade-by-decade basis shows how dividends’ contribution varied greatly from decade to decade.

hartfordfunds

Dividend payers have outperformed non-payers by a wide-margin, ad have done so with less volatility.

As seen below, dividend cutters and eliminators (e.g., companies that completely eliminated their dividends) were more volatile (as measured by beta and standard deviation) and fared worse than companies that maintained their dividend policy.

Alternatively, companies that grew or initiated a dividend have experienced the highest returns relative to other stocks since 1973—with significantly less volatility.

hartfordfunds

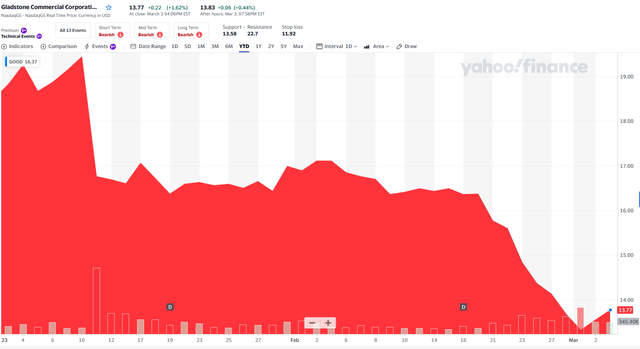

Now you can see why I’m frequently insisting on avoiding sucker yield stocks like two REITs I referenced last week – Annaly Capital (NLY) and Granite Point Mortgage (GPMT). Whenever a dividend gets closer to the so-called danger zone, we always let our members at iREIT on Alpha know.

The best way to measure whether a company will be able to pay a consistent dividend is through the payout ratio – calculated by dividing the yearly dividend per share by the earnings per share (or Adjusted Funds from Operations for REITs).

A high payout ratio means that a company is using a significant percentage of its earnings to pay a dividend, which leaves them with less money to invest in future growth of the business.

Fortunately, we were able to steer investors away from Gladstone Commercial (GOOD) before the latest cut:

Yahoo Finance

The 8-Figure Club

Dividend payers often underperform coming out of a downturn, buy eventually regain the lead. If we look at other bear markets, dividend payers generally lagged the broad indices after stock prices bottomed.

One of the clearest indications that a company is confident in its future stream of cash flows is when it raises its dividend. In the past, dividends have played an important role in offsetting the effect of inflation.

Dividend growers have had a strong record of total returns during inflationary periods, largely due to the strong relationship between dividend growth and pricing power – the ability to pass along rising costs by raising prices, without losing customers.

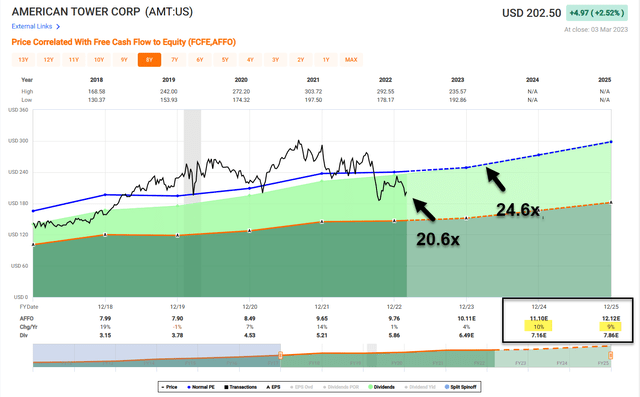

Within the REIT sector, we’re buying more American Tower (AMT) that’s trading at a 17% discount to our Buy Below target. The company has a well-covered dividend (65% payout ratio) and is forecasted by analysts to grow by low double-digits in 2024 and 2025.

FAST Graphs

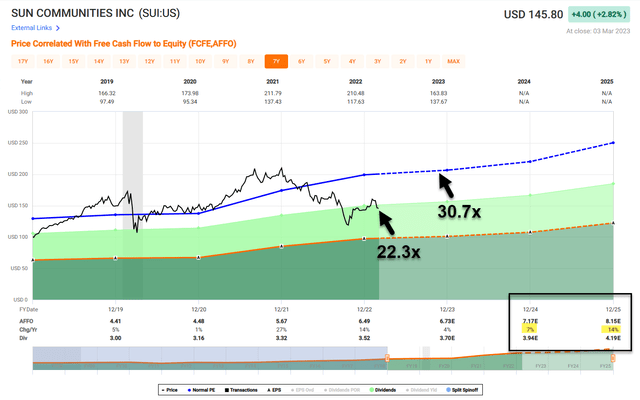

We’re also hot on Sun Communities (SUI) that owns manufactured housing, RV parks, and marinas in terrific locations. I recently visited the Safe Harbor property in Fort Lauderdale, and we believe the “future is bright” for SUN, and analysts agree (consensus growth is 7% in 2024 and 14% in 2025).

FAST Graphs

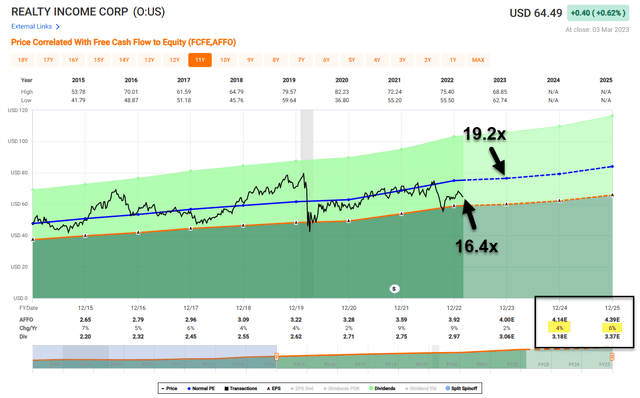

Of course, as most readers know, part of millionaire mindset has to do with net lease investing and my largest holding, Realty Income (O). Later in the week I plan to write a deep dive on “the monthly dividend company” as I continue to own and recommend shares in this dividend growth dynamo.

FAST Graphs

The Millionaire Mindset

When I was younger, I took excessive risks, always believing that the gravy train would never end. I rarely said no to anything, and I never imagined (in my wildest dreams) that the Great Recession would cause me and so many other to suffer.

But there’s always a silver lining and my rags-to-riches story has reshaped my life and my outlook on money – both how I earn it and how I spend it. I now grasp the danger of risking hard earned capital and while this was one tough lesson, it taught me how to be smarter by insisting on quality and value.

Looking back in my rearview mirror, I can say that the Great Recession reshaped my life, to achieve financial success and an appreciation of value through the pain of adversity, and as Ben Graham observed “its uses may be sweet”.

Happy SWAN Investing!