The Magnificent 7 have been stealing the headlines for the previous few years.

And rightly so.

The efficiency of those firms is off the charts.

Skilled cash managers have a tough time simply beating the market by a smidgen.

In reality, 90% of them can’t even outperform the S&P 500 index!

That’s why the Magnificent 7’s efficiency is a jaw-dropper.

During the last 5 years, Magazine 7 shares have returned 775% on common in comparison with the S&P 500’s 104% return … greater than 7X!

There’s one factor that’s widespread to the Magazine 7 that I haven’t heard anybody speak a lot about…

And it’s this: They’re all managed by their founders — or had been for a really very long time.

That made all of the distinction.

Did you personal any of the Magazine 7 shares? And if that’s the case, how had been your returns? Let me know right here.

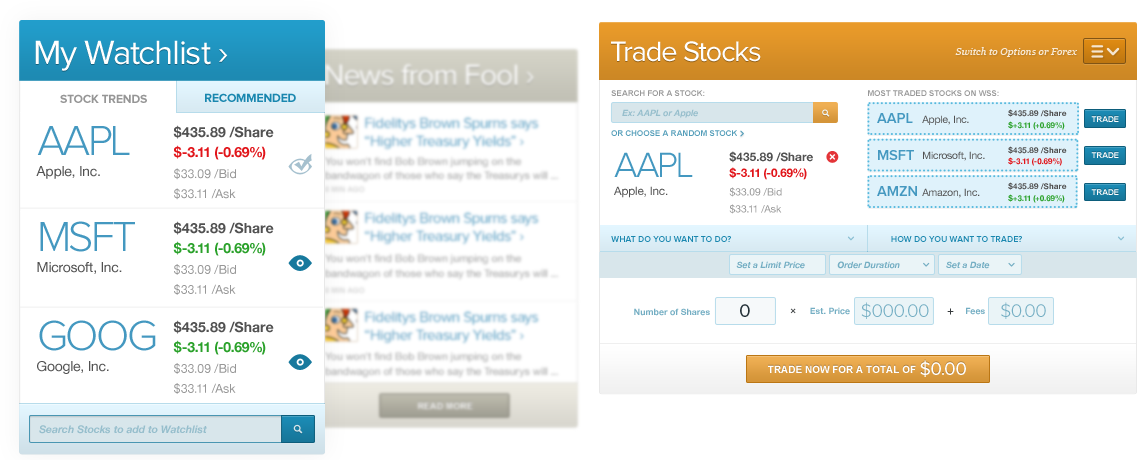

What Drives the Magazine 7 and How Can YOU Make investments?

If you happen to’re trying to make huge returns within the inventory market, investing in founder-led firms can actually stack the chances in your favor.

In reality, a 2014 examine by professors at Purdue’s Krannert College of Administration discovered that over a 15-year interval, founder-led firms beat the market by over 3X.

Bain & Firm developed a database of all public firms within the world inventory markets and tracked their efficiency over 25 years.

They concluded that the probably the most worthwhile firms over the long run … had been founder-led.

It’s not too exhausting to determine why that’s.

Corporations led by the founder are extra modern, create extra beneficial innovations and are extra keen to take dangers to develop.

Founder-led firms…

- Have a transparent function and check out new issues.

- Care quite a bit about their prospects and take note of small particulars.

- Have attentive house owners who take duty and make choices shortly.

And that’s why founder-led firms prime our guidelines of ones that make it into our portfolio.

A fantastic instance of that is Herb Kelleher and Southwest Airways.

He had the founder’s mentality by the bucket-load, and because of this, Southwest Airways (LUV) turned one of the vital profitable airways in historical past.

Its inventory is up an enormous 16,160% since 1980.

So, anybody who invested $1,000 into Southwest Airways in January 1980 and held onto it, is sitting on greater than $160,000 at this time.

Corporations which can be managed by their founders have massively outperformed.

That’s why it’s one of many 5 key traits of what makes a particular class of shares with the potential to 10X…

No. 1 Small-Cap Inventory with Excessive Development Forward

One of many founder-led small-cap shares I really useful to a gaggle of my readers has been on a curler coaster experience since we added it to the portfolio in 2022.

After it reported earnings final week, the inventory value jumped 50% in someday…

(Click on right here to unlock the title of my small-cap inventory.)

That’s nice! However over the previous few years, when the inventory value fell, I used to be not involved.

That’s as a result of we give attention to the enterprise, not the whims and short-term actions of Mr. Market.

A decrease inventory value is a chance to purchase extra shares of a enterprise with sturdy fundamentals.

My prime small-cap has a powerful enterprise. So, we ignored the gyrations.

To sensible buyers like us … Mr. Market’s mispricings are golden alternatives to revenue.

When no-knowing buyers dump shares with out understanding the enterprise … the benefit swings to us.

That’s as a result of we will make clever choices as a substitute of following emotional merchants who know the value of the whole lot and the worth of nothing.

Now’s that second for us.

The way in which I see it, this small-cap inventory continues to be within the early innings.

Because the firm continues to be very small, with a market cap of simply $1 billion, the potential for progress is big. It may develop into the following trillion-dollar Magnificent 7 inventory…

Mr. Market continues to be providing us an impressive alternative to purchase this inventory at a fantastic value…

Proper now, we’re seeing a uncommon “market rotation.” Cash is flowing out of enormous caps and into small-cap shares.

I don’t know how lengthy it will final.

So don’t procrastinate. As my father used to say, “Procrastination is the thief of all earnings.”

I’ll share the total story with you right here and present you find out how to unlock the corporate title and ticker of my No. 1 small-cap inventory.

Regards,

Charles Mizrahi

Founder, Alpha Investor