Lena Anayi, Nicholas Bloom, Philip Bunn, Paul Mizen, Gregory Thwaites, Ivan Yotzov 16 April 2022

Editors’ observe: This column is a part of the Vox debate on the financial penalties of struggle.

The Russia/Ukraine battle has despatched shockwaves all through the world economic system. Commodity costs, together with vitality, have elevated sharply as uncertainty about provide disruptions has grown (Bachmann et al. 2022, Chepeliev et al. 2022). As well as, sanctions and commerce restrictions have been imposed on Russian banks, companies, and people (Berner et al. 2022). Lastly, the battle has sparked a large refugee disaster, with over 4 million Ukrainians fleeing their nation (on the time of writing).1 All of that is more likely to contribute in the direction of better uncertainty within the economic system, amongst companies, households, and monetary markets.

On this column, we current early proof on the affect of the battle in Ukraine on financial uncertainty utilizing each day mixture indices in addition to firm-level measures from the Choice Maker Panel survey. Our focus is on forward-looking uncertainty measures which might be obtainable in close to real-time. The struggle is more likely to have elevated financial uncertainty round each anticipated demand and inflation in addition to creating considerations about provide chain disruptions.

Mixture uncertainty measures

Indices primarily based on monetary markets and information/social media can present info on financial uncertainty in near actual time. Determine 1 presents the evolution of 4 measures of financial uncertainty since 2019: the US Financial Coverage Uncertainty (EPU) index, the UK EPU index, the VIX index, and a Twitter-based financial uncertainty index.2 All 4 measures are normalised by their respective common values in 2019 to ease comparability.

Though the collection are noisy, all 4 metrics present that uncertainty elevated after the Russian invasion of Ukraine in late February. The Vix and Twitter indices have since begun to fall again, however all collection have not too long ago reached their highest ranges for the reason that starting of 2021, when the Delta variant of Covid-19 was spreading the world over. However, present uncertainty remains to be beneath the height noticed in April 2020 by a number of orders of magnitude.

Determine 1 Day by day uncertainty indices, January 2019 – March 2022

Agency-level uncertainty

One other strategy is to evaluate perceptions of uncertainty amongst corporations. Specializing in the UK, we analyse the evolution of firm-level uncertainty utilizing knowledge from the Choice Maker Panel (DMP). The DMP is a consultant month-to-month survey of chief govt officers and chief monetary officers throughout the UK, with round 3,000 responses every month. It’s used to review enterprise tendencies throughout the nation and to advise policymakers, together with on the impacts of uncertainty round Brexit (Bloom et al. 2018, 2020) and Covid-19 (Altig et al. 2020, Bunn et al. 2021). Companies are requested about their realised and anticipated values for gross sales, employment, and costs. As well as, corporations are requested concerning the distribution of anticipated outcomes. This permits us to calculate an ordinary deviation of anticipated year-ahead development for every agency. We take the typical throughout corporations to assemble measures of ‘subjective’ uncertainty for gross sales, costs, and employment.

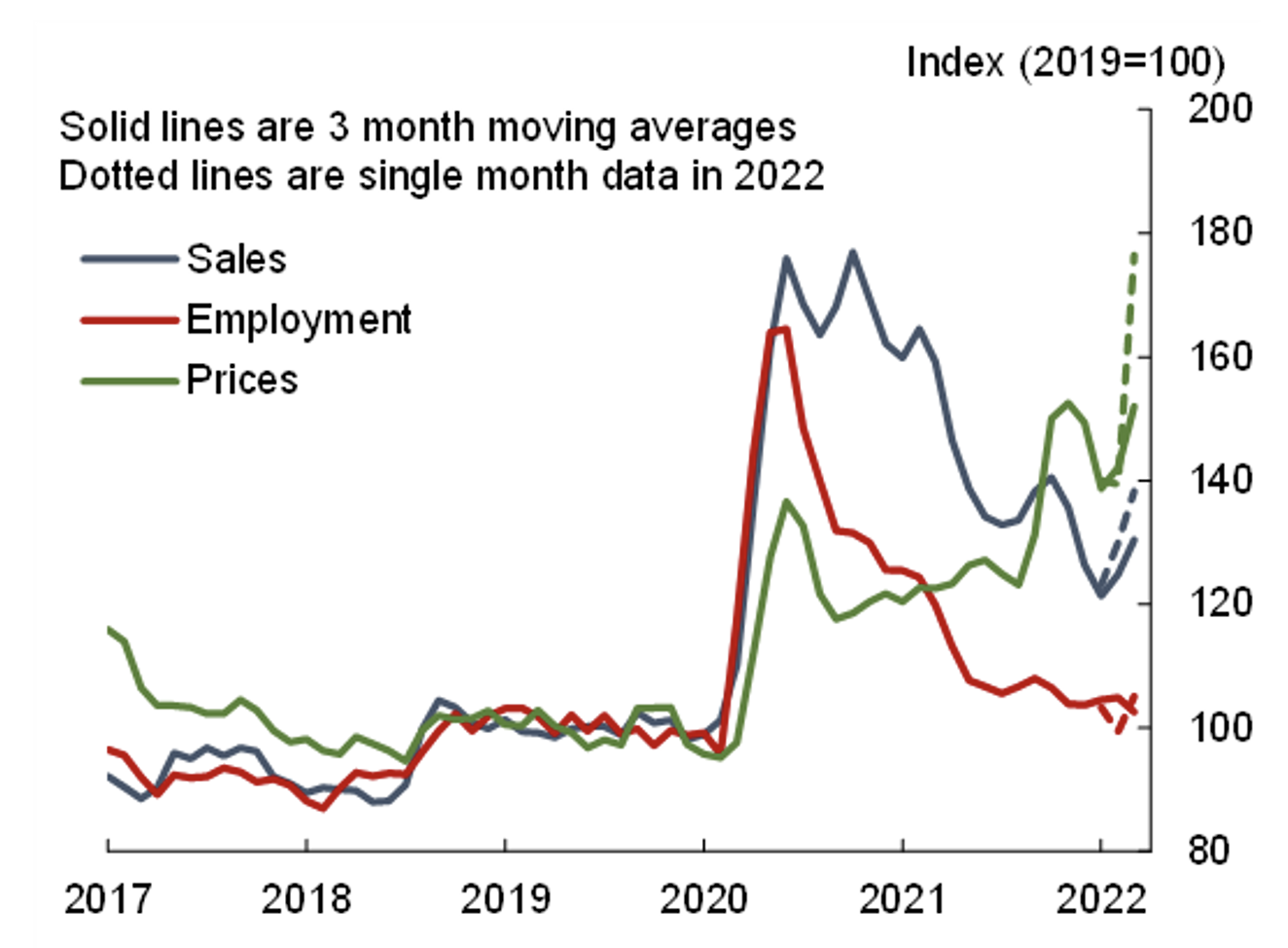

The struggle in Ukraine has raised uncertainty about future gross sales and significantly inflation (Determine 2). Between January 2022 and March 2022, uncertainty about gross sales elevated from simply over 120% of its 2019 common to virtually 140%. Nevertheless, value uncertainty elevated from 140% to round 175% in March 2022, its highest stage for the reason that DMP survey started in 2016. In the meantime, employment uncertainty solely elevated modestly. This can be a totally different sample to that seen throughout Covid-19, and it highlights how uncertainty referring to the Ukraine struggle is especially associated to inflation, given the massive related actions in vitality and different commodity costs.

Determine 2 Agency-level measures of subjective uncertainty

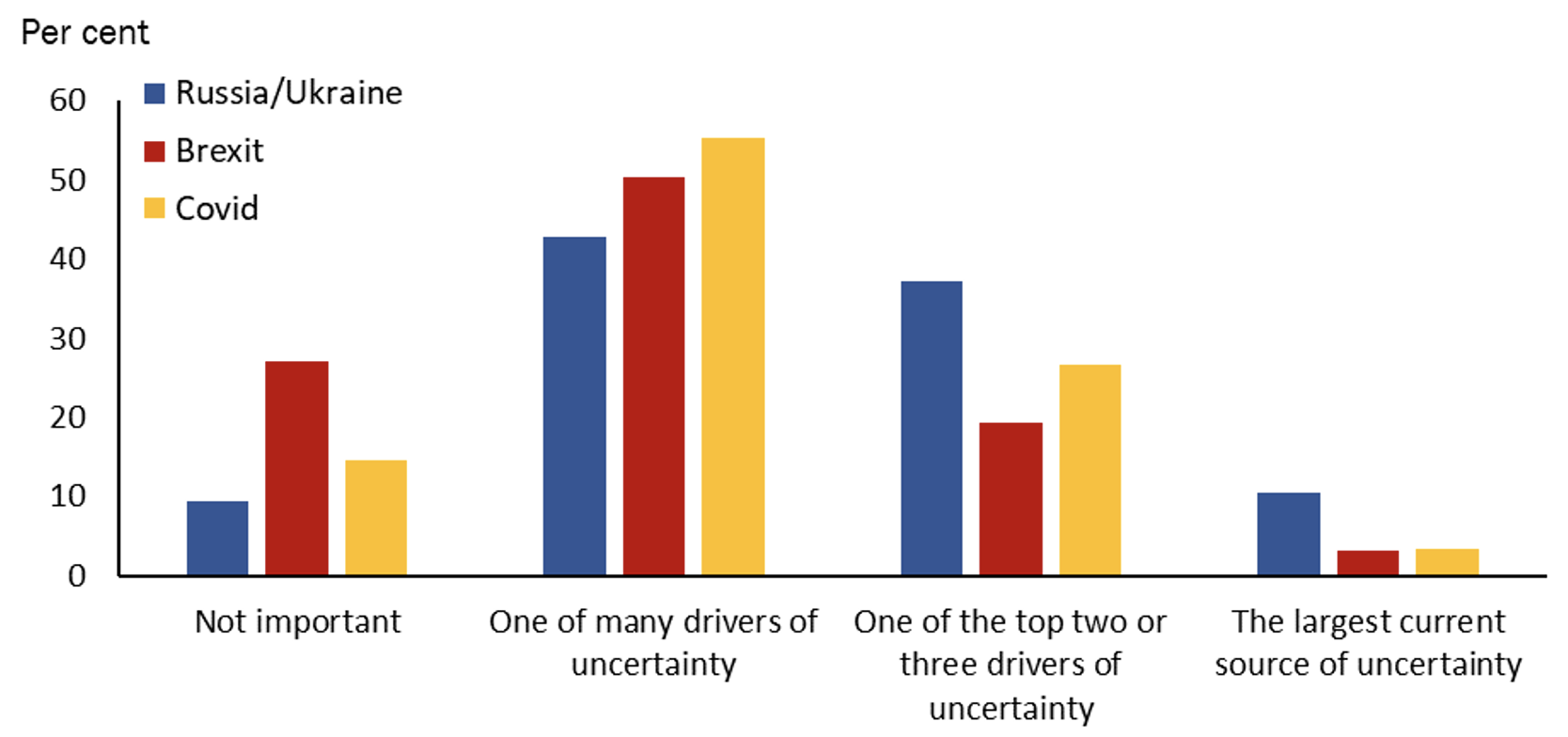

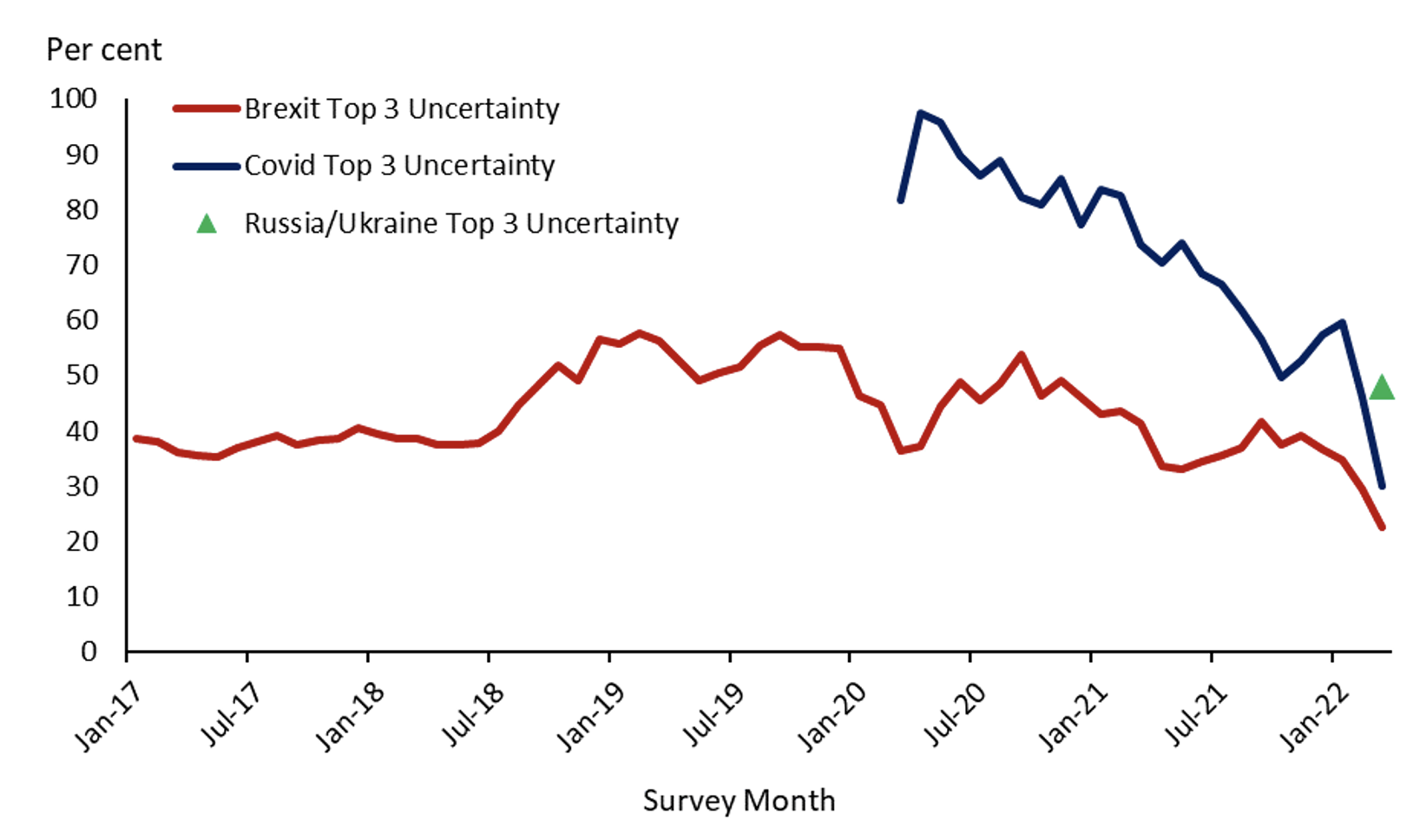

Along with these subjective uncertainty indices, the DMP additionally asks concerning the significance of particular components (e.g. Brexit, Covid-19) for enterprise uncertainty. In March 2022, a brand new query was launched asking concerning the Russia/Ukraine battle as a supply of uncertainty. Determine 3 exhibits the outcomes, together with a comparability to the relative significance of Brexit and Covid within the newest knowledge. Of the three components, the struggle in Ukraine was the most important supply of uncertainty for UK corporations in March: 48% of respondents thought-about the struggle as a top-three supply of uncertainty, in contrast with 30% for Covid and 22% for Brexit. Nevertheless, it is usually vital to place these numbers in context. Each Covid-19 and Brexit uncertainty have been on a downward pattern in latest months (however a small enhance in Covid uncertainty as a result of Omicron wave) (Determine 4). The present stage of uncertainty relating to the battle in Ukraine is beneath the peaks of Covid uncertainty (97% reported as a top-three supply in April 2020) and Brexit uncertainty (57% reported as a top-three supply in February 2019) seen up to now, supporting the proof from mixture tendencies offered in Figures 1 and a pair of.

Determine 3 Brexit, Covid-19, and Russia/Ukraine uncertainty, March 2022

Determine 4 Brexit, Covid-19, and Russia/Ukraine uncertainty

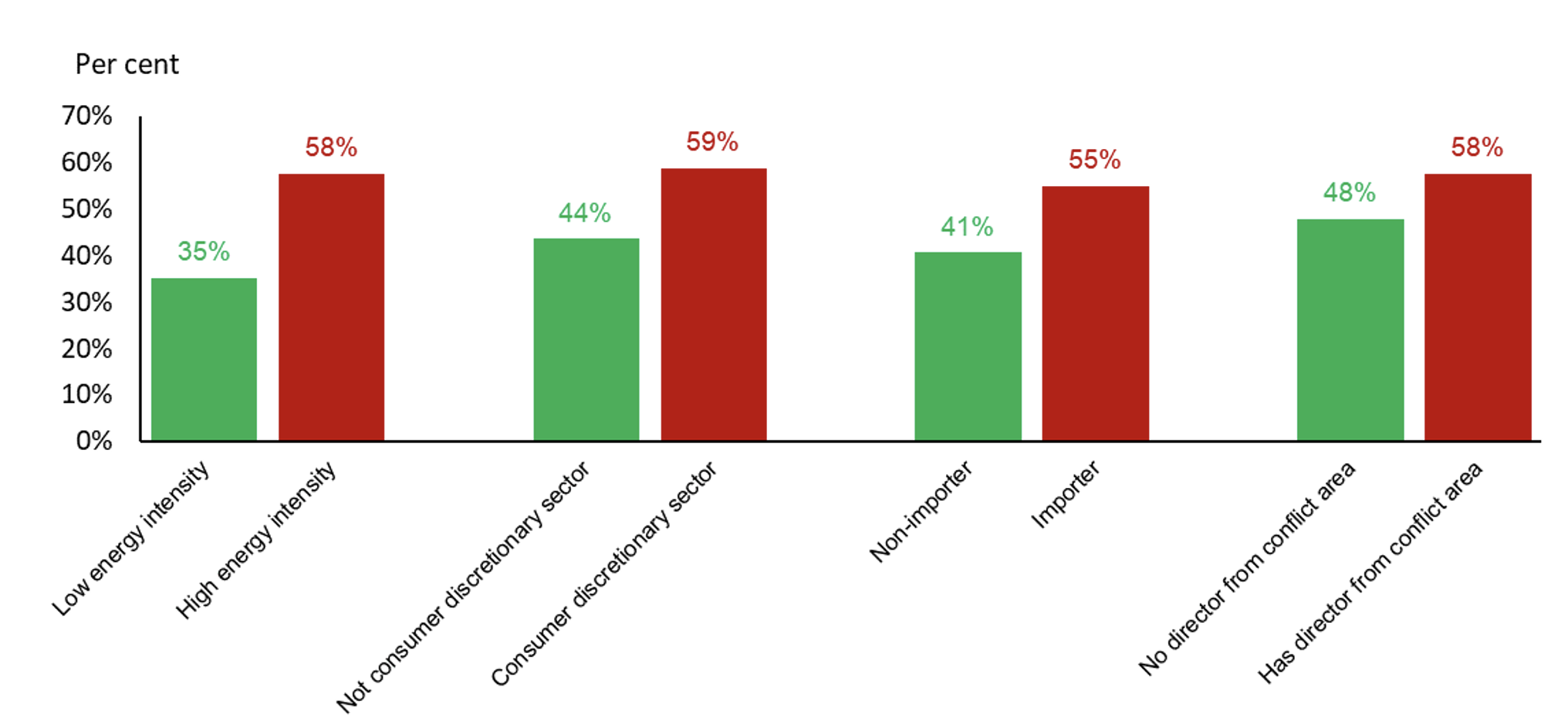

These relative ranges of uncertainty could also be pushed by the heterogeneous nature of the Russia/Ukraine shock. As an illustration, corporations in energy-intensive industries at the moment report greater uncertainty (Determine 5). Utilizing knowledge from the ONS Enter-output provide and use tables,3 we discover that 58% of corporations in industries with above-average vitality use reported that the Russia/Ukraine battle was a top-three supply of uncertainty, in contrast with solely 35% of corporations with below-average vitality depth. Second, corporations in sectors oriented in the direction of discretionary consumption (e.g. clothes, holidays, alcohol) reported greater uncertainty (59% versus 44%).4 Companies in additional discretionary industries could also be extra involved concerning the results of an actual incomes squeeze that leads shoppers to focus extra on important expenditures. Likewise, importers usually tend to have reported the battle as a top-three supply of uncertainty in contrast with non-importers (55% versus 41%). These corporations could count on to be extra affected by provide disruptions, for instance. Lastly, we use firm knowledge from the Fame database to establish the nationality of administrators throughout UK corporations. There are round 1% of all UK corporations which have at the least one director from the battle area.5 Matching this to the DMP dataset, we see that 58% of corporations with a director from the battle area reported the Russia/Ukraine battle as a top-three supply of uncertainty in contrast with 48% of corporations with no director from the area.

In sum, these measures of publicity are neither mutually unique nor exhaustive, however they present that the battle is affecting uncertainty for a spread of UK companies, and throughout numerous totally different channels: vitality use, demand, commerce, and possession. Going ahead, will probably be vital to observe how enterprise publicity to the battle develops in addition to the impacts on agency anticipated and realised outcomes.

Determine 5 Proportion of corporations reporting Russia/Ukraine as a prime three supply of uncertainty

Conclusions

The struggle in Ukraine is already affecting the world economic system. Day by day measures of uncertainty have elevated, however by a lot lower than throughout the Covid pandemic. Measures of subjective uncertainty derived from agency surveys have additionally elevated, significantly relating to inflation. Early proof from the UK means that 48% of companies thought-about the battle a ‘top-three’ supply of uncertainty in March, though that stage remains to be beneath the height uncertainty seen as a consequence of Covid-19 and Brexit up to now. Moreover, this uncertainty is pushed by a number of components, together with vitality utilization, import publicity, discretionary spending, and direct hyperlinks of firm administrators to the battle area. The implications of this uncertainty for companies are nonetheless unclear, though the implications of a protracted battle will doubtless have opposed results on a number of financial outcomes.

References

Altig, D E, S Baker, J M Barrero, N Bloom, P Bunn, S Chen, S Davis, J Leather-based, B Meyer, E Mihaylov, P Mizen, N Parker, T Renault, P Smietanka and G Thwaites (2020), “Financial uncertainty within the wake of the Covid-19 pandemic”, VoxEU.org, 24 July.

Bachmann, R, D Baqaee, C Bayer, M Kuhn, A Löschel, B Moll, A Peichl, Okay Pittel and M Schularick (2022), “What if Germany is reduce off from Russian vitality”, VoxEU.org, 25 March.

Berner, R, S Cecchetti and Okay Schoenholtz (2022), “Russian sanctions: Some questions and solutions”, VoxEU.org, 21 March.

Bloom, N, S Chen and P Mizen (2018), “Rising Brexit uncertainty has diminished funding and employment”, VoxEU.org, 16 November.

Bloom, N, P Bunn, S Chen, P Mizen and P Smietanka (2020), “Brexit uncertainty has fallen for the reason that UK normal election”, VoxEU.org, 25 February.

Bunn, P, D E Altig, L Anayi, J M Barrero, N Bloom, S Davis, B Meyer, E Mihaylov, P Mizen and G Thwaites (2021), “Covid-19 uncertainty: A story of two tails”, VoxEU.org, 16 November.

Chepeliev, M, T Hertel and D van der Mensbrugghe (2022), “Chopping Russia’s fossil gas exports: Quick-term ache for long-term acquire”, VoxEU.org, 9 March.

Endnotes

1 Supply: https://data2.unhcr.org/en/conditions/ukraine

2 The US Financial Coverage Uncertainty (EPU) index and the UK EPU index are two newspaper-based measures which rely the variety of occurrences of key phrases associated to (i) economic system, (ii) coverage, and (iii) uncertainty matters in main nationwide newspapers. The VIX index is a measure of 30-day anticipated volatility of the US inventory market primarily based on possibility costs. Lastly, the Twitter-based financial uncertainty index relies on the variety of tweets mentioning each ‘economic system’ and ‘uncertainty’ key phrases. Sources: http://policyuncertainty.com/ and https://www.cboe.com/tradable_products/vix/vix_historical_data/

3 Supply: https://www.ons.gov.uk/economic system/nationalaccounts/supplyandusetables/datasets/inputoutputsupplyandusetables

4 The excellence between discretionary and non-discretionary industries relies on work finished by the Australian Bureau of Statistics, which offer a classification for separating items/providers within the CPI inflation basket into these of a discretionary (i.e. important) and non-discretionary (i.e. non-compulsory) nature. The classification may be accessed right here. The identical classification has been utilized by the Workplace for Nationwide Statistics within the UK.

5 The ‘battle area’ is outlined as Russia, Ukraine, Belarus, in addition to Poland, Hungary, Slovakia, Moldova, and Romania. There are roughly 164,000 UK corporations which have at the least one director from the battle area. Round 1% of our pattern with responses to this query has a director from the battle area, matching the statistic for the universe of UK corporations.