The Hidden Politics Behind the Nippon-U.S. Metal Deal

September 10, 2024 | Tags: BEACON

In line with reporting by Reuters, the Committee on Overseas Funding within the U.S. (CFIUS) has blocked the $14.9 billion takeover of U.S. Metal (USS) by Nippon Metal (Nippon) as a result of “penalties to nationwide safety” and a “continued lack of viable industrial manufacturing capabilities.” As a result of the US defends Japan’s sovereignty, it’s tough to think about the latter undermining US nationwide safety. Furthermore, Nippon has agreed to no “layoffs or plant closures or idling of U.S. Metal amenities.” Home politics might inspire this determination, particularly serving to Democrats in contested races, notably Vice President Harris.

If the client had been Chinese language, stopping the deal on nationwide safety grounds may need extra benefit for the reason that two international locations are rivals engaged in varied disputes. Nonetheless, since its defeat in WWII, Japan has been a US vassal, with solely a small self-defense power, partly as a result of constitutional constrictions to keep away from warfare. Underneath strain from US hawks, Japan has authorized a file army funds of $56.7 billion. Nonetheless, with out US safety, Japan couldn’t defend itself towards China. Due to this fact, undermining US safety could be tantamount to committing hari-kari.

Prior to now, Japan has been allowed to purchase belongings with far better strategic significance. For instance, Toshiba bought Westinghouse Electrical, a number one supplier of nuclear gas and companies to utilities globally, in 2006, when the nuclear energy market was taking off. In that deal, CFIUS granted regulatory approval lower than 4 months after the sale settlement was signed.

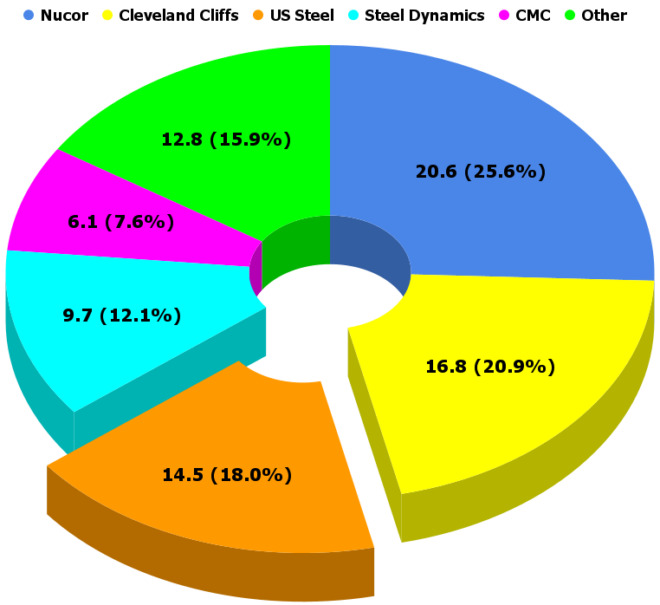

Competitors is one other attainable concern. Final yr, steelmaker Cleveland Cliffs provided $8.3 billion for USS. The union supported that bid, however the firm rejected it. Automakers wrote to Congress, complaining that the mixed firm would management 65-90% of automotive metal. This isn’t the case with the Nippon bid.

USS is a big participant within the home market, but it surely doesn’t have a monopoly or perhaps a 50% market share, which might result in FTC and authorized motion. Nonetheless, implementing antitrust legal guidelines seems selective and influenced by politics, as seen in Google’s 88% US market share. This selective enforcement may be used to forestall the acquisition of USS.

Determine 1: US Metal Is Quantity #3 Domestically

2022 US Metal manufacturing, million metric tons and (market share %)

Supply: World Metal Affiliation, CMC SEC Fillings

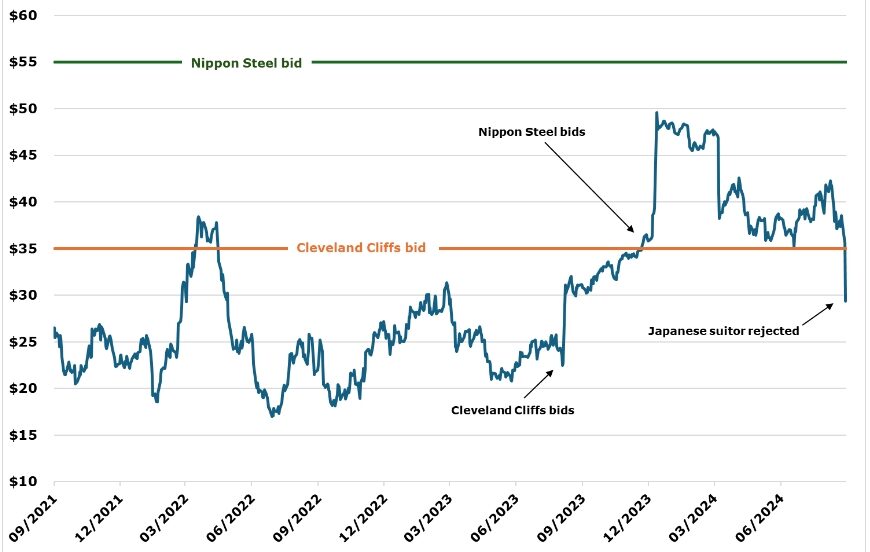

Misplaced on this dialogue is the explanation for the deal: to assist arrest USS’s decline and stave off attainable plant closings and chapter. Metal costs have steadily declined since COVID-19 closures and provide chain disruptions. Given the cooling Chinese language financial system, notably the development sector, this development seems to be set to proceed.

The mixed firm would have a complete annual capability of 88 million tons, the second most on this planet, though nonetheless dwarfed by China as a complete (over 1 billion tons). As such, the corporate ought to profit from economies of scale. Moreover, Nippon has promised to share know-how and make investments billions in current amenities. Given these elements and the 40% premium to market worth the day the deal was introduced, USS shareholders authorized the merger with 99% of shares voted.

Determine 2: US Metal Inventory Buying and selling Has Been a Bit Unstable

US Metal frequent shares, closing worth

Supply: NASDAQ

For Nippon, the US, which has 94.5 million tons of obvious metal use even post-COVID 2022, represents a profitable market. The present “inexperienced” drive to affect the whole lot might generate extra demand for metal as wealth transfers from taxpayers to favored industries outcome within the proliferation of EVs and wind generators.

The following administration might finish large subsidies for these inefficient merchandise that usually are not demanded by the market. Funds could possibly be directed to extra productive makes use of, comparable to much-needed infrastructure, which has a major, long-term multiplier impact on the US financial system. This, too, would increase metal demand.

Thus, if the acquisition makes financial sense, has been authorized by shareholders and administration, and poses no aggressive or nationwide safety danger, why would the Bidden/Harris White Home block it?

The reply might lie in partisan politics.

Pennsylvania, residence to USS headquarters and amenities, is a important battleground state. In Ohio, the place USS has a major footprint, incumbent Democratic Senator Brown is in a good battle, maybe prompting him to pen a letter to Treasury Secretary Yellen and others concerning the “the clear and current threats {that a} Nippon Metal acquisition poses.”

The unions are against the deal, fearing that Nippon will fireplace staff and adversely influence staff’ pensions, though the Japanese have explicitly promised to not, and there exist authorized and different cures to deal with such points. Blocking the acquisition might garner votes from the union members for Vice President Harris. Historically, the Democrats had been the get together of the working class, however this has modified over the previous few a long time.

Holding such a core trade in American palms can be very patriotic. Because of this, most Republicans additionally favor blocking the deal. President Trump calls for top tariffs to guard US firms and restrict international possession.

Nonetheless, blocking the deal can backfire: If the deal falls aside, USS might be compelled to shut metal mills and fireplace staff. (Predictably, that is exactly what USS administration threatened after rumors of political roadblocks to the deal surfaced. Simply as predictably, Cleveland Cliffs provided to purchase these amenities, possibly on the a lot cheaper price it provided.) This would devastate the native financial system and will bitter voters on politicians who lobbied for it.

Worse nonetheless is its potential to dent the US’ standing on this planet. We rose to financial prominence by way of aggressive home markets and, extra lately, by globalism. We now have been the champion of free markets and the enemy of protectionism. It will be very hypocritical to announce one algorithm for us and one other for everybody else, notably if this deal units a precedent.

We’ve seen this film earlier than. Within the Eighties, there was widespread concern that Japan would purchase America and that Japanese managers would boss US staff round. After the 1985 Plaza Accord, the greenback’s worth towards the yen fell sharply. The Japanese went on an aggressive shopping for spree, snapping up metal mills, film studios, and actual property, together with New York’s iconic Rockefeller Heart. On the finish of the last decade, the Financial institution of Japan raised charges, sending its financial system right into a tailspin and popping the asset bubbles.

Then, as now, fears of international domination had been unfounded. Though imperfect, open markets are nonetheless the perfect path to nationwide prosperity.

The submit The Hidden Politics Behind the Nippon-U.S. Metal Deal appeared first on The Beacon.

Learn Extra…