The U.S. Federal Reserve is arguably the most powerful force in global markets.

Fed Chair Jay Powell knows this … which is why his Federal Open Market Committee (FOMC) press conferences have turned into something of a theatrical act.

He’s become adept at creating confusion between what he’s doing, what he’s saying he’s doing and what he’ll actually do. But really, his goal is simple.

At the highest level, the Fed’s mandate is to keep things “goldilocks.” If the economy and/or inflation are running too “hot,” the Fed has tools to put the brakes on. On the other hand, when things run cold, the Fed has other levers to pull.

These levers effectively inject billions of dollars of cash into the financial system … cash that eventually finds its way to bank balance sheets, corporate coffers and investors’ brokerage and 401(k) accounts.

In a word, “liquidity” is how the Fed moves financial markets.

When the Fed is adding liquidity to the financial system, the value of so-called risk assets, namely stocks, tends to go up. When the Fed is draining liquidity out of the financial system, risk assets tend to suffer.

The federal funds rate is the liquidity “lever” everyone knows about. When you hear on the local news or CNBC about the Fed “raising interest rates by 0.25%,” the Fed’s intent is to drain liquidity out of the financial system.

Higher interest rates make would-be borrowers less interested in taking out a loan. When fewer loans are made, less cash is “created” … so, less cash is spent or invested in financial assets, like stocks and bonds. That’s how higher interest rates have a “cooling” effect on the economy and financial markets.

But this is just one of several methods the Fed and the government have to manipulate the economy.

While everyone’s laser-focused on the rate hike pause, you should know about a few other “hidden” forces that may be not so bullish for the stock market overall…

The Fed’s “Secret” Rate Hike

Bullish investors, eager to dive headlong back into stocks, were cheering the Fed’s Wednesday decision to not hike interest rates. It’s understandable.

The last 18 months have taught investors: “higher rates = bad for stocks.” So, the logic is that a pause in the Fed’s rate-hike campaign is good for stocks.

But that conclusion is not so simple or complete — for three distinct reasons:

1. Time. The more time interest rates remain at their current levels, the more liquidity is drained out of the financial system.

As more time passes, an increasing number of borrowers must refinance their debts as they come due. A corporation that borrowed money (i.e., sold a bond) at 2% in 2020 will now have to pay closer to 5%.

This means a greater share of its revenues will go to servicing that debt, which means tighter profit margins and cash flows … less investment in future growth … and lesser return of capital to shareholders.

In short, the more borrowers who have to pay 5% on a loan (or bond) … the less liquidity there is slushing around the financial system. This situation will worsen with time, even if the Fed is completely done hiking rates (and it’s probably not).

2. The Banking Crisis. Just as investors had grown increasingly wary of the Fed’s continual and aggressive rate hikes, Jay Powell got a “gift” from the March banking crisis: tighter lending standards.

Tighter lending standards make it harder for borrowers to get a loan, even if they’re willing to pay a higher interest rate. This has the same effect as an additional rate hike would have had if the FOMC hadn’t agreed to a pause this month.

This in a way was the Fed’s “secret” rate hike — an economy-cooling move it didn’t have to take credit for. But it wasn’t the only one…

3. The Treasury General Account (TGA). On June 1, Congress succeeded in raising the debt ceiling. Since failure to raise the debt ceiling would lead to the government’s default on U.S. Treasury bonds (at least in theory), everyone breathed a sigh of relief once it was raised.

But, ironically, that event could actually be bad for investors. And the reason why comes back to the U.S. Treasury.

The U.S. Treasury is responsible for paying the government’s bills. It cuts checks to government employees and contractors, Social Security recipients, bondholders … anyone the government owes money to.

When it writes those checks, it adds liquidity to the financial system. It flows to banks, corporations and consumers who spend and lend and invest it.

Typically, the Treasury is able to sell newly-issued Treasury bonds (created out of thin air) to bring cash back into the Treasury’s bank account. But during the debt-ceiling impasse, the Treasury wasn’t allowed to issue more bonds. So it had to draw from the cash hoard it built up in its bank account, the Treasury General Account.

The TGA was flush with $550 billion at the end of January, when the government first hit the debt ceiling. But that balance was drawn down to less than a piddly $50 billion by the time Congress finally reached a deal.

That’s too low a balance for the Treasury to maintain, so now that the debt ceiling has been raised, it’s free to begin building the TGA balance back up to healthy levels. The stated plan is to raise it by $425 billion by the end of June, and to $600 billion by the end of September.

Realize, this is bad for liquidity, which is bad for markets. The Treasury will issue new debt … buyers of that debt will hand the Treasury their cash … and the Treasury will then sock that cash away, stuffing more than half a trillion dollars into its bank account and out of the financial system.

In short, banks, businesses, consumers and investors will all feel the pinch as the Treasury sucks out that $600 billion (or more).

It’s another “secret” liquidity-tightening lever the Fed knows about, but doesn’t have to take credit for (more so, the blame for).

So, what’s a Fed-befuddled investor supposed to do about all this?

This probably isn’t where you thought I was going with this…

But I think most investors are best-served ignoring it completely.

When you realize the complexity of the Fed’s actions — both the widely-reported and “secret” ones — it becomes clear that being a Fed-watcher is a fool’s errand for most folks.

The Best Move: Ignore the Fed

Personally, I can’t help but keep aware of the inner workings of the Fed. I’m an investment writer … it’s kind of my thing.

But I don’t use it to invest. Instead, I use a far simpler strategy.

In my Green Zone Fortunes service, we leverage my six-factor stock rating model to identify stocks that are poised to beat the market by at least 3-to-1.

We recently locked in profits of over 100% on a utility contractor, and 224% on a little-known industrial company that builds warehouses and data centers for the likes of Amazon and Google.

Neither company ran into speedbumps because of Fed lever-pulling. Matter of fact, most of the gains from both positions came in the last year and change, during the blistering rate-hiking campaign.

We’re finding great stocks just like these every single month. Our latest recommendation, on a little-known homebuilder, is up nearly 20% in less than a month!

You can learn more about a Green Zone Fortunes subscription right here.

If you’re the type to tune into the Fed’s 2:30 p.m. press conferences … might I suggest tuning out next time.

The Fed’s powers extend far beyond what’s talked about there and are well out of your control anyway.

Focus instead on finding profitable companies trading in a bullish trend, and you’ll have little problem outperforming even the most dedicated Fed-watcher.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets

We’re in the business of trading and investing. But as every experienced trader knows, you don’t have to be 100% invested at all times.

Even famed “buy and hold” investors, like Warren Buffett, often keep a large chunk of their portfolio in cash, waiting for the right investment to come along.

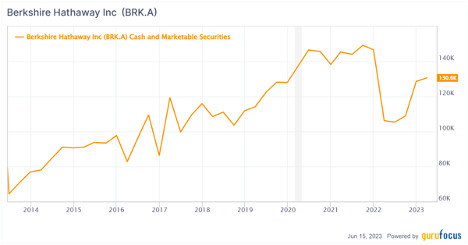

Think I’m lying? Buffett’s Berkshire Hathaway currently has over $130 billion in cash and short-term marketable securities.

And while the total dollar amount will tend to grow as Berkshire itself grows, the cash balance will also fluctuate from year to year, depending on how Buffett sizes up his investment options.

You and I don’t have Buffett’s bankroll. But we do have good investing options for our uninvested cash.

Let’s take a look at some of those options.

The Safest Short-Term Investments

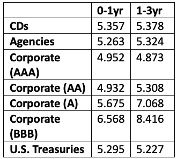

I logged in to my TD Ameritrade account to get a quote on the current yields on offer. For the moment, I’m limiting this to bonds and certificate of deposits (CDs) with three years or less to maturity.

With the yield curve inverted (short-term rates are currently higher than long-term rates), we’re not getting compensated for holding longer-term bonds. So there is no real reason to consider buying them.

Here’s what I saw:

For maximum liquidity and safety, you simply can’t beat U.S. T-bills right now. A 5.3% yield with no credit risk and extremely low sensitivity to rising yields is unbeatable for large dollar amounts over $250,000.

But if you have less than $250,000 in cash, you can get a slightly better yield with a CD. And for any amount under $250,000, a CD in an FDIC-insured bank is as safe as a T-bill. Uncle Sam guarantees it.

Selling a CD early can be problematic if you buy it directly from a bank. But if you buy a CD via your brokerage account, you can generally sell them on the secondary market if you need the cash in a pinch.

There is absolutely no value in buying short-term corporate bonds at current prices.

In the upside-down world of today’s bond market, the yields are actually lower (or only marginally higher) than comparable Treasurys.

A-rated and BBB-rated bonds start getting interesting if you’re willing to go out three years, as some of the yields top 8%. But for the cash you’re simply wanting to park somewhere safe while you’re waiting for your next big trade, T-bills and CDs are the way to go right now.

But if you’re ready for your next big trade, Adam O’Dell recommends a very cost-effective opportunity in an often overlooked sector of the market.

His latest research is focused on a handful of high-quality stocks — currently trading at $5 or less.

There are about 2,000 of these stocks that are essentially “invisible” on Wall Street, due to an arbitrary SEC rule. But we have the opportunity to take advantage of these trades. Adam’s ratings analysis has pinpointed the very best of them.

So if you want to learn more, go here to watch Adam’s webinar, The $5 Stock Summit.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

(Ft. image from Yahoo Finance: Fed Chair Jerome Powell.)