ING Economics, a top financial and economic analysis think tank, released a report last week that boldly predicted that federal interest rates will likely be cut six times in 2024. ‘’We are currently forecasting 150bp of rate cuts in 2024 with a further 100bp in early 2025’’, the report said. This is a big claim, especially after the consistent rate rises we’ve been seeing over the past year, with rates currently standing at 5.25%-5.50%.

What Are the Factors Behind the Prediction?

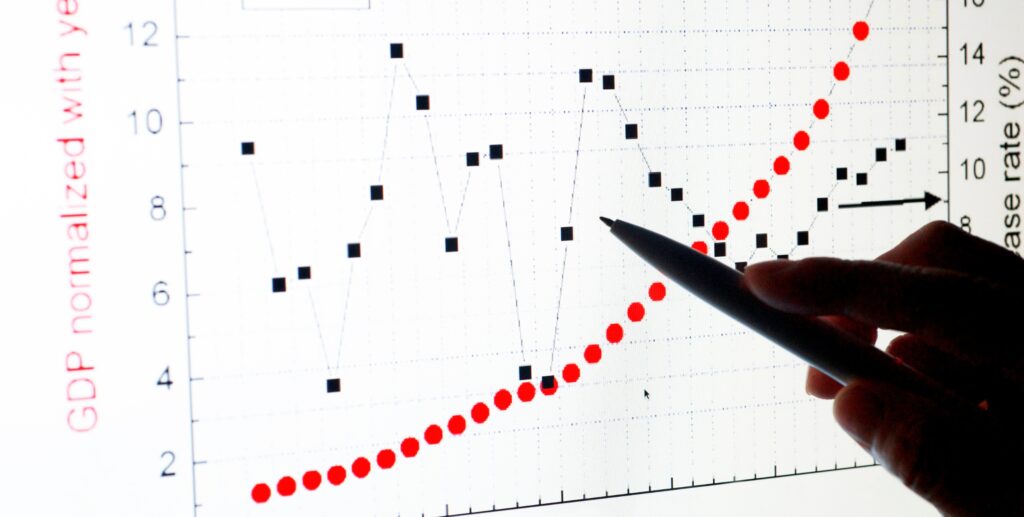

Broadly speaking, ING defines the current economic climate as ‘’cooling,’’ which is exactly what the Fed needed to stop hiking the rates. Three main parameters all point to an economic slowdown. The first is a cooling labor market. ING is careful to point out that the job market is ‘’cooling, not collapsing.’’ Based on the most recent job market data, both initial and continuing jobless claims are rising, with continuing jobless claims showing a surge, up 32,000 to 1.865 million.

It’s not that companies are firing workers. They’re just not hiring new ones. All of this is ‘’evidence of a cooling, but not collapsing, labor market,’’ as per the report.

The second factor that gives ING the confidence to make the prediction is the gradual easing of inflation pressures. ING metrics are showing that inflation has slowed from 3.7% to 3.5%, with signs that the economy is on track to reach the target inflation rate of 2%, which is the target the Fed has been working toward with its fiscal tightening policies.

Finally, consumer spending is slowing down in real terms. ING data suggests that although consumer spending is still buoyant, it is being propped up by debt and the usage of savings. The key takeaway is that people’s real incomes are stagnating, with credit card delinquencies on the rise. The end of student loan repayment relief is also contributing to financial pressures, contributing to slower economic activity overall.

All of these factors combined are fueling ING’s confidence in predicting a repeated slashing to interest rates beginning in the second quarter of 2024. ING’s chief international economist, James Knightley, wrote, “We have modest growth and cooling inflation and a cooling labor market—exactly what the Fed wants to see. This should confirm no need for any further Fed policy tightening, but the outlook is looking less and less favorable.”

What Are Other Top Economists Saying About 2024 Rates?

The general expectation shared by economists and markets is that rates will decrease, but not before the summer of 2024. The CME Fed Watch Tool is currently predicting that rates could start decreasing in June.

Some expert economists and financiers are more optimistic in their forecasts. The billionaire and founder of Pershing Square Management, Bill Ackman, told Bloomberg that he expects the Fed to start cutting rates as early as March. Ackman sees ‘’a real risk of a hard landing’’ if inflation keeps going down while rates remain elevated. Investment bank UBS is even bolder in its forecast, predicting a 2.75% rate drop in the first quarter. The bank predicts that the Fed will cut rates drastically in order to prepare for a looming recession in the second quarter.

The Fed itself has been markedly cautious in its statements, saying over and over again that it’s too early to start predicting rate decreases. In fact, the Fed hasn’t even definitively signaled that it’s done raising rates, let alone committing to reducing them. Atlanta Federal Reserve President Raphael Bostic told CNBC back in late October that he doesn’t foresee a rate cut until ‘’late 2024’’. Bostic said: “There’s still a lot of momentum in the economy. My outlook says that inflation is going to come down but it’s not going to like fall off a cliff.”

In a nutshell, Bostic doesn’t think there will be a recession. Any rate cuts will be modest, and they will come later in the year rather than sooner. The cautious note may well be wise given that repeated recession forecasts so far have not materialized, with inflation only just beginning to come down. We’re not even sure that the all-important target rate of 2% will be reached in 2024. So, it’s likely too early to tell whether the optimistic ING prediction will come true.

The Impact on Housing

The general consensus is that with lower rates, demand will return to the housing market in greater numbers. There’s also a theory swirling around that the “lock-in” effect that’s been plaguing the market ever since rates started increasing will unlock as rates fall. Sellers will feel less inclined to cling to their historically low rates of 3% and cash their homes in for a 5.5% rate.

Whether this comes to fruition is still a debate, but many, especially investors, are looking forward to a lower-rate environment.

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.