Caiaimage/Robert Daly/iStock via Getty Images

By Ryan McMaken

The Bureau of Labor Statistic (BLS) released new jobs data on Friday. According to the report, seasonally adjusted total nonfarm jobs rose 236,000 jobs (seasonally adjusted) in March, the smallest month-over-month jobs gain since December 2020.

The unemployment rate fell slightly from 3.6 percent to 3.5 percent (month over month). This has changed little since December 2022, and this reflects rising numbers in workforce participation as total employment estimates have increased. In March, the labor participation rate rose very slightly from 62.5 percent, to 62.6 percent, the highest estimate since March 2020.

These numbers suggest slow but continued growth in total employment, but net growth continues to flatten as layoffs throughout much of the economy continue to mount.

For example, in March, Virgin Orbit, Roku, Disney, Bed Bath & Beyond, Glassdoor, Indeed (VORB), Amazon (AMZN), Tyson (TSN), and Lockheed Martin (LMT) all announced layoffs totaling tens of thousands of jobs in aggregate.

This was just in March. Employment bulls may claim these numbers amount to only 1 to 5 percent of all employees in these companies, but this was just in March, and that follows months of other layoff announcements.

To paraphrase one well-known joke about government spending: a thousand jobs here and thousand jobs there, and soon you’re talking about real numbers.

The trend continued in April with jobs extending beyond the tech sector. Walmart (WMT) announced it would cut 2,000 jobs. McDonald’s (MCD) has begun laying off corporate-level employees.

Moreover, the latest cuts aren’t even showing up in the latest employment numbers. Many of these jobs come with severance plans that mean many of these employees won’t even count as unemployed for several more months.

One could also note that many of these layoff announcements are about jobs in tech and other types of services, rather than in retail or hospitality. It does indeed appear to be the case that jobs retention and growth in lower-paid service-industry jobs – plus government jobs – appears to be fueling an outsized portion of jobs growth.

In March, 72,000 of the 236,000 new payroll jobs – both full time and part time – were in “leisure and hospitality.” That’s 30 percent of all new jobs. Of those, 50,000 were specifically in “food services and drinking places.”

47,000 new jobs were government jobs meaning that essentially waiting tables and tending bar amounted to more than a quarter of new private sector jobs in March. New jobs in professional services amounted to only 17 percent of all jobs.

Meanwhile, total nationwide job openings fell to 9.9 million, the lowest since May of 2021. It’s increasingly looking like former tech workers will need to learn how to pour beer if they want to stay employed in 2023.

Food Service Jobs Drive a Lot of Job Growth

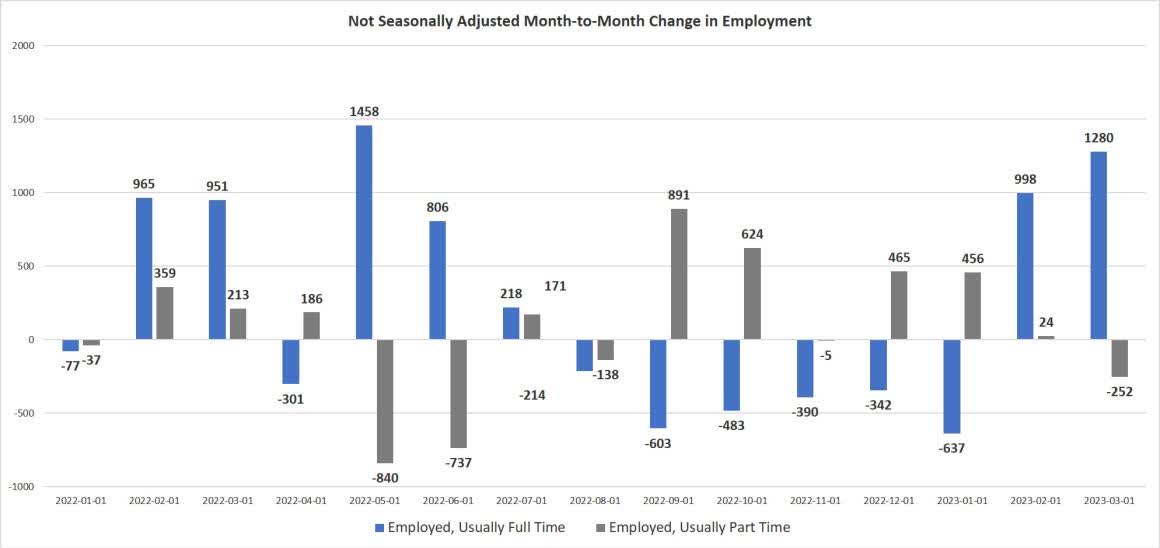

Indeed, it may be that relative strength in food service and hospitality sectors is also helping to drive up full-time work totals. After several months of waning full-time work being eclipsed by new part-time hires, the trend appears to have reversed again, with full-time work against growing faster than part-time.

As I noted last month, the current relative strength in the job market partly reflects the ongoing monetary overhang from years of breakneck growth in money-supply inflation. It is apparent that the $6 trillion in money that was newly created since 2020 is still very much a factor in the present economy.

Even with a historic collapse in the money supply growth since last fall, the economy appears to still be in only the very early phases of an economic bust that is to be expected in the wake of a monetary slowdown.

Although March’s jobs numbers were relatively weak, markets have interpreted them as strong enough to impel the Fed and the Federal Open Market Committee (FOMC) to delay an assumed pivot toward a lower policy rate. The New York Stock Exchange is closed today for Good Friday, but the 10-year Treasury note headed up sharply today to 3.4 percent in the wake of the new jobs numbers.

Will the Fed Pivot?

For at least two years, Fed Chairman Jerome Powell and the Fed have fixated on jobs numbers as the stated driver of FOMC policy. Assuming the FOMC continues to rely on this metric, March’s job growth numbers – while relatively weak – could be strong enough to allow Powell to politically justify ongoing rate hikes of at least 25 basis points in coming months.

This, of course, has been the FOMC’s path for the last several months in spite of the fact that economic indicators outside employment totals have repeatedly pointed to a rapidly weakening economy.

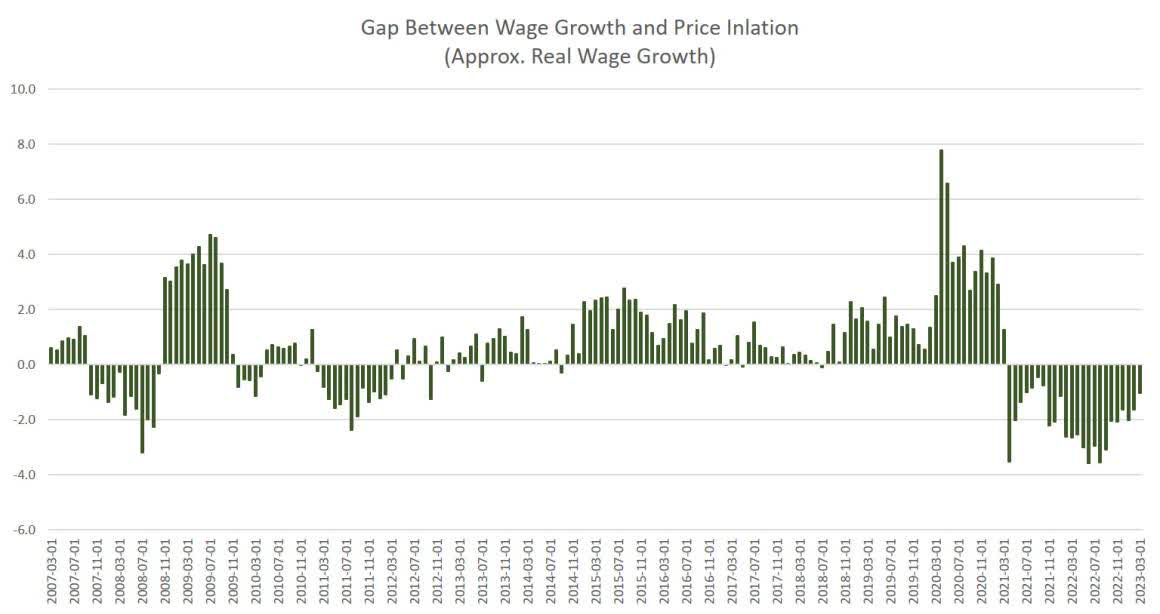

Among these indicators is the fact that as of March, real wages have been negative for two full years, or 24 months. Average hourly earnings in March fell to 4.18 percent, year-over-year.

That’s the smallest increase since June 2021. In real terms, this means negative wage growth in March since, according to the Cleveland Fed’s preliminary CPI number, price inflation grew by 5.2 percent in March.

We might also look to other traditional indicators of upcoming recession such as the US leading indicators index, which remains in recessionary territory. Factory orders continue to head downward.

Meanwhile, as Reuters reported this week, “U.S. manufacturing activity slumped in March to the lowest level in nearly three years as new orders plunged.”

The yield curve is deep into territory that points to recession. Money supply growth late last year went negative for the first time in more than 30 years, and has stayed there.

The fact that Jerome Powell is ignoring all this is actually a good thing. Thanks to more than a decade of “unconventional monetary policy” with unprecedented levels of financial repression and ultra-low interest rates, the degree to which the Fed has created an economy addicted to easy money is remarkable.

Falling home prices, bank failures, and tech layoffs all point to this addiction. To put the economy on a more realistic footing, the Fed will have to allow interest rates to rise even above where they are now.

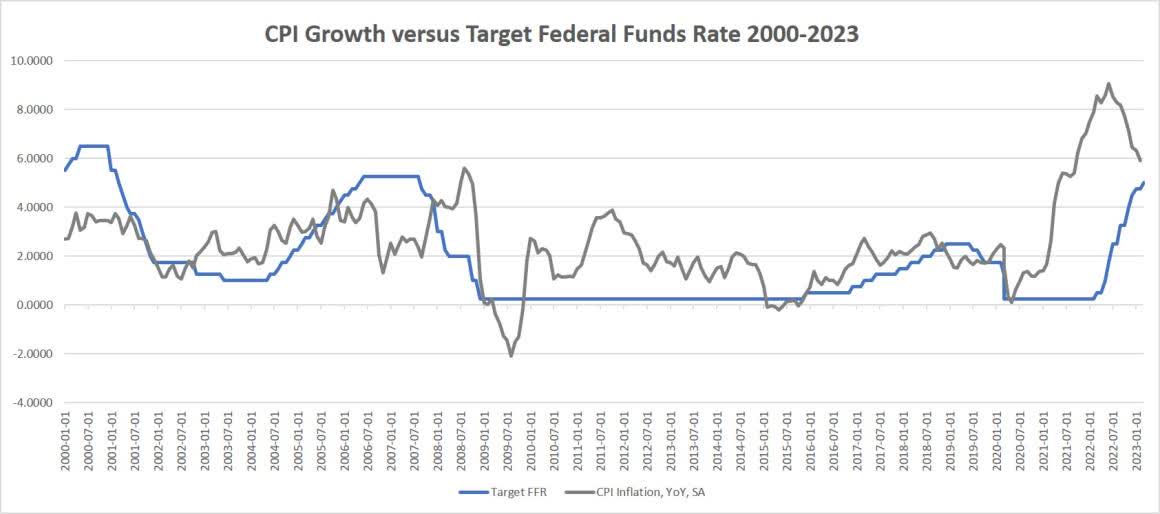

After all, even with the most recent FOMC increase in the target federal funds rate to 5.0 percent, this target rate is still below the official price inflation rate of 5.9 percent.

In the past, the Fed frequently allowed the target rate to rise above CPI inflation in order to rein in inflationary forces. Since 2009, however, the Fed has steadfastly committed itself to driving interest rates well below inflation rates. At the time, this was a new development and part of the Fed’s new extreme easy-money crusade.

Now, even with 6 months of rising rates, interest rates are still quite low in real terms by historical standards. The fact that a target rate of merely five percent is a problem for banks and investors simply illustrates how much damage has been done by 12 years of ultra-low rates in creating an economy crippled by a lack of real savings.

The problem isn’t that the Fed is now allowing rates to rise. The problem is the Fed forced those rates down much too far for much too long.

In any case, jobs totals continue to show that the monetary inflation of the past three years continues to work its way through the economy and there will be no fast readjustment.

Disclosure: No positions.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.