Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:

They are done with rate hikes this cycle. The next change in rates is more likely to be down than up.

At least, if Powell & Company truly had a handle on what has been driving inflation for the past few years, that would be their position.

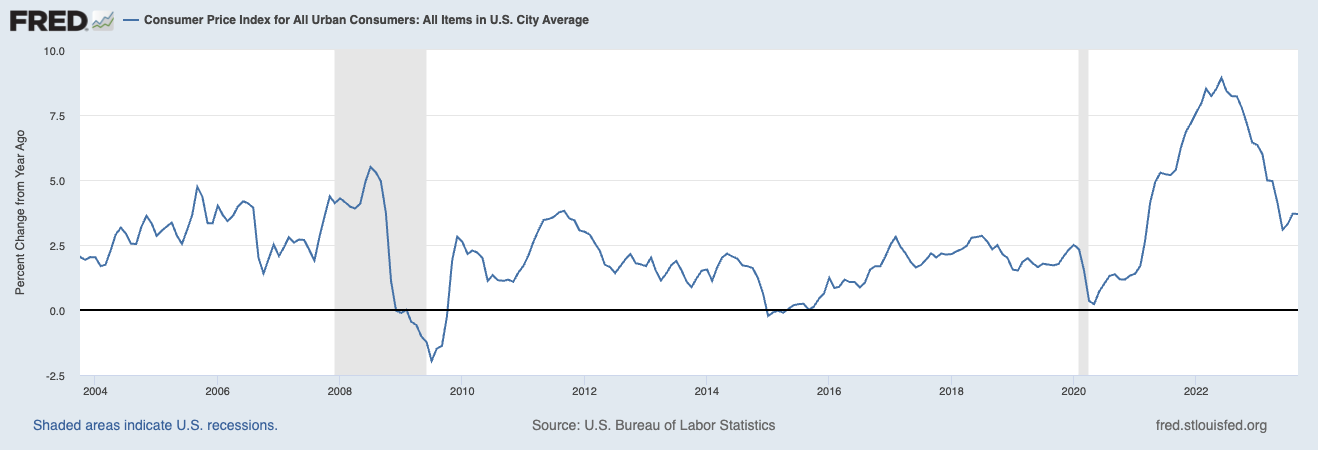

It has been frustrating watching the FOMC come around to eventually making the right decision, but all too often, they are late to the party: Late getting off of emergency footing, late to begin raising rates in response to surging inflation in 2021, late to see this was being driven by fiscal not monetary stimulus of the pandemic, late to recognize the FOMC itself is a driver of housing inflation, and finally, late to recognize inflation had peaked and reversed.

I am not sure if they quite recognize the potential damage they are doing to the economy. I don’t see any indication the FOMC understands that shortages in single-family homes, rental units, semiconductors, automobiles, and Labor won’t be cured by higher rates. In many cases, they will only be exacerbated.

That is especially true in housing, where the Fed is creating new problems and making existing ones even worse:

1. Lack of Single Family Homes: We’ve discussed this before most notably in 2021, but home builders have wildly underbuilt the number of houses relative to population growth following the financial crisis (GFC). That’s 15 years of under-building homes following five years of overbuilding them. Meanwhile, the US population continues to grow and household formation has ticked up dramatically following the pandemic.

As the chart above shows, we are off the lows of 2022, but other than during the pandemic, the Months’ Supply of existing homes for sale is at its lowest level going back 40 years.

There is simply too little supply relative to not just demand but need.

2. Low Mortgage Rate Golden handcuffs: Approximately 60% of homeowners with a mortgage have rates of 4% or lower. This prevents people from moving to a new home, regardless of whether they’re moving up or downsizing. Rates between 7 and 8% simply make the monthly carrying costs too pricey; this is true regardless of the purchase price.

If the Fed wants to see housing prices moderate, an appointment rentals fall, we need a much greater supply of single-family homes. I don’t know why it is so counterintuitive to see that happens with lower mortgage rates. The FOMC obviously should not go back to zero but somewhere in the low 4s% is a much better fed funds rate than where we are today. It shouldn’t take a recession to get there.

3. Owner’s Equivalent Rent: It lags badly versus other measures of rental price changes. (this is why I suspect the Fed believes inflation is worse than it is).

It is also worth noting that during the GFC, Owners’ Equivalent Rent understated inflation era when so many people we’re able to take advantage of low rates and no credit standards to pile into home purchases; today the lack of supply and increased rates has OER overstating rental inflation.

Outside of housing, it’s pretty clear that labor and automobiles are the other sources of increased prices that monetary policy is not reaching. Selective food shortages are problematic; wars in the Middle East and Ukraine are also making oil pricier, and The Fed has no control over those geopolitical events via rate increases.

As noted over the summer, The Fed is on the verge of snatching defeat from the jaws of victory. Let’s hope they figure this out sooner rather than later.

~~~

You can see Powell’s presser today at 2:30.

Previously:

Five Ways the Fed’s Deflation Playbook Could Be Improved (Businessweek, August 18, 2023)

For Lower Inflation, Stop Raising Rates (January 18, 2023)

Inflation Comes Down Despite the Fed (January 12, 2023)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Why Is the Fed Always Late to the Party? (October 7, 2022)

Understanding Investing Regime Change (October 25, 2023)

__________

* …Raising Rates

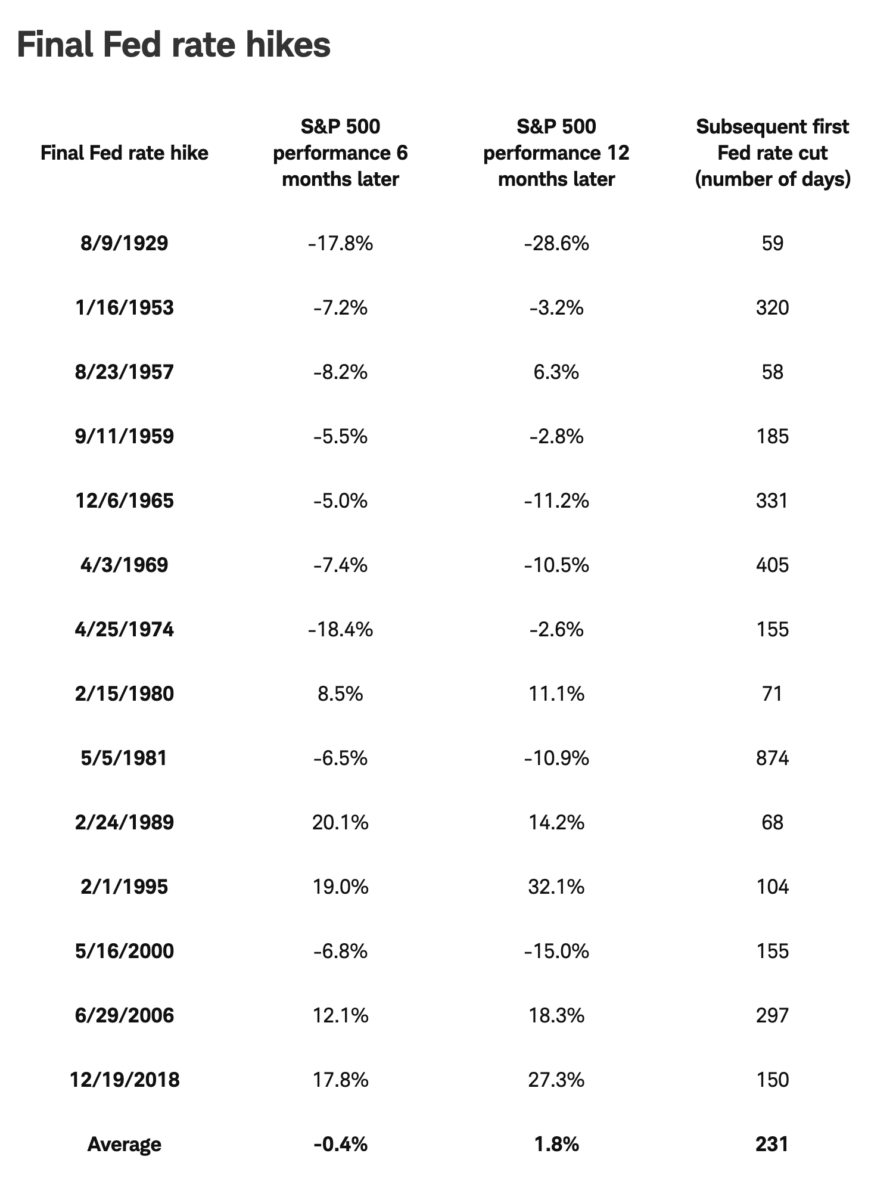

Via Liz Ann Sonders:

Nothing Typical for Stocks After Fed’s Last Hike

Source: Schwab

The post The Fed is Finished* appeared first on The Big Picture.