Authored by Bradley Peak through CoinTelegraph.com,

What’s NexFundAI, the FBI’s crypto entice?

NexFundAI, launched by the US FBI in Could 2024, is an Ethereum-based crypto token created as a part of a covert sting operation, Operation Token Mirrors.

The NexFundAI token was designed to behave as bait, concentrating on people and organizations engaged in fraudulent cryptocurrency actions, notably pump-and-dump schemes. In these scams, manipulators artificially inflate a token’s worth, attracting unsuspecting traders, solely to dump their holdings as soon as the worth peaks, leaving traders with losses.

NexFundAI mimicked the look and conduct of a reputable cryptocurrency, permitting the US Federal Bureau of Investigation to draw market manipulators. Fraudsters had been lured into participating with the token, performing unlawful actions like wash buying and selling, the place a number of trades are performed by the identical occasion to create a misunderstanding of buying and selling quantity. This tactic inflates the token’s worth and deceives traders into considering there’s a rising demand.

In the long run, NexFundAI helped the FBI gather arduous proof towards 18 people and implicated corporations like Gotbit and ZM Quant, who had been concerned in orchestrating sham trades throughout greater than 60 crypto tokens. By July 2024, the FBI had constructed a case sturdy sufficient to file expenses, resulting in the arrests of key figures in these schemes.

Do you know? Over $25 million in belongings had been seized because of the NexFundAI sting, and the investigation helped reveal new strategies scammers had been utilizing to control crypto markets.

The evolution of crypto sting operations

Crypto sting operations advanced from conventional bodily setups to classy digital stings, with the FBI leveraging blockchain monitoring and concentrating on scams like Silk Street, Ponzi schemes and preliminary coin providing (ICO) fraud for the reason that rise of Bitcoin within the early 2010s.

Within the early days of economic crime enforcement, brokers would pose as consumers, traders or intermediaries to catch criminals within the act, usually involving wire transfers or money. As expertise superior, cybercrime emerged, shifting the main focus of sting operations from bodily money to digital belongings.

This shift started in earnest with the rise of Bitcoin within the early 2010s, which launched a brand new type of untraceable, decentralized digital forex. Criminals shortly adopted crypto for cash laundering, scams and hacks.

The FBI responded with its first main crypto sting operations concentrating on on-line black markets like Silk Street in 2013, which relied on Bitcoin BTC$68,139 for unlawful transactions. These early efforts revealed the potential for digital stings, the place regulation enforcement might monitor blockchain transactions in real-time.

As crypto crime grew, so did the scope of sting operations. One of many notable examples was Operation Phish Phry within the late 2000s, concentrating on on-line hackers.

But it surely wasn’t till the 2010s that regulation enforcement centered extra closely on crypto scams, reminiscent of Ponzi schemes and hacking rings. Operation Cryptosweep in 2018 marked a serious effort, concentrating on over 200 ICO scams that defrauded traders worldwide. Regulation enforcement businesses within the US and Canada coordinated to crack down on fraudulent ICOs, recovering thousands and thousands of {dollars} in stolen funds.

Equally, the FBI’s involvement in catching Ponzi schemes just like the Bitconnect fraud in 2018 showcased how digital stings might expose main crypto crimes.

Do you know? Within the cryptocurrency world, one of many largest digital stings was Operation Silk Street, which focused the unlawful on-line market Silk Street in 2013. The operation resulted within the arrest of Ross Ulbricht, the positioning’s founder, and the seizure of thousands and thousands of {dollars} in Bitcoin.

How the FBI used NexFundAI to show crypto fraud

Showing reputable, full with a web site, branding and tokenomics, the NexFundAI token attracted market manipulators, together with corporations specializing in wash buying and selling and pump-and-dump schemes.

NexFundAI was arrange as a typical Ethereum-based token, full with a web site, branding and tokenomics that seemed no totally different from any reputable crypto undertaking. The FBI made certain that NexFundAI had all the weather needed to draw the eye of manipulators — an lively on-line presence, engaging prospects and, most significantly, a way of legitimacy. By making a facade of authenticity, the FBI was capable of trick market makers into considering this token had the potential for enormous earnings.

To additional strengthen the bait, the FBI engaged with market-making corporations that specialised in manipulating costs. These corporations usually carry out wash buying and selling and pump-and-dump schemes to inflate token costs artificially. NexFundAI supplied a great playground for these manipulators to reveal their fraudulent techniques, all beneath the shut watch of regulation enforcement.

By mimicking how actual crypto initiatives function, the FBI successfully created a “honey pot,” luring these corporations into fraudulent actions with out realizing they had been being watched.

As soon as the market manipulators began interacting with NexFundAI, the FBI was capable of collect proof in real-time. As famous, corporations like Gotbit and ZM Quant, who had a historical past of inflating buying and selling volumes via sham trades, had been caught within the act, very similar to flies in a honeypot.

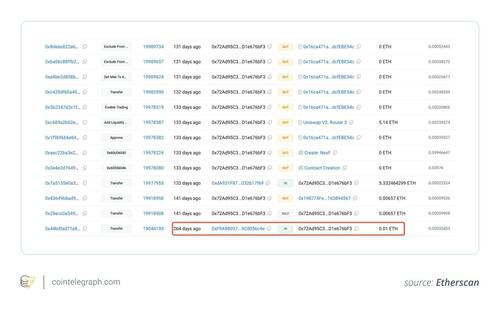

Additionally, onchain knowledge reveals {that a} pockets, which as soon as manipulated SAITAMA to rake in over $11 million, funded the NexFundAI deployer with simply 0.01 Ether ETH$2,642.12. The pockets spent $7,300 to purchase 875.8 trillion SAITAMA, offered 687.66 trillion for $8.85 million, and deposited 737 trillion ($2.75 million) into OKX and Gate.io. And after shopping for again with $253,000, this single pockets profited over $11 million from SAITAMA.

Wash buying and selling, which entails making trades between accounts managed by the identical occasion to create the phantasm of liquidity, was one of many key fraudulent actions noticed. These trades mislead traders into considering the token is in excessive demand, driving up its worth earlier than the manipulators dump their holdings for revenue.

The FBI intently tracked the token’s buying and selling exercise and recorded the fraudulent trades, making certain they’d stable proof of manipulation. This wasn’t simply restricted to market exercise; the FBI additionally gathered digital communications, contracts and cost data from the corporations concerned.

The operation revealed simply how coordinated these frauds had been. Along with wash buying and selling, the FBI recognized worth manipulation methods, together with intentionally timing giant purchases and gross sales to affect market sentiment. By means of NexFundAI, the FBI not solely noticed fraud but additionally immediately participated within the market-making course of, recording each transfer the fraudsters made.

Do you know? One of many largest wash buying and selling indecents in historical past concerned BitForex, which in 2019 was discovered to have 95% of its buying and selling quantity attributed to clean buying and selling, as reported by blockchain transparency initiatives. Such a synthetic quantity manipulation affected billions of {dollars} in buying and selling, deceptive traders concerning the precise market demand.

NexFundAI: Combating fireplace with fireplace

NexFundAI has confirmed itself within the battle towards crypto fraud as a profitable tactic in exposing unhealthy actors.

By creating its personal token, the FBI was capable of acquire a novel insider’s perspective by observing fraudulent actions from inside the very system criminals sought to take advantage of. As an alternative of merely monitoring transactions from the skin, as in earlier operations, the FBI grew to become a participant within the crypto world.

The success of Operation Token Mirrors might have long-lasting implications for the way regulation enforcement operates within the crypto area. The operation demonstrated that creating undercover tokens and initiatives might grow to be a robust software to unmask crypto criminals. As fraudsters develop more and more subtle, operations like these provide a solution to infiltrate their schemes immediately, moderately than simply monitoring them from the sidelines.

This technique might make scammers and market manipulators extra cautious sooner or later, as they are going to now not know if the token they’re manipulating is a part of an FBI sting. It provides a brand new layer of unpredictability to the already unstable crypto market. Fraudsters might hesitate to have interaction in blatant market manipulation, figuring out that regulation enforcement could possibly be watching — and even collaborating — of their actions.

Moreover, this operation units a precedent for future digital stings. Regulation enforcement businesses worldwide might undertake comparable methods, creating their very own tokens to trace felony conduct. This sort of proactive method alerts a brand new period in crypto enforcement, the place fraud detection turns into extra about participation and fewer about passive remark.

Tips on how to spot a entice token

If something appears off — whether or not it’s unrealistic guarantees, hidden group members or unexplained market exercise — it’s value reconsidering your involvement. NexFundAI proves that even essentially the most legitimate-looking tokens could be traps designed to take advantage of unsuspecting traders.

Having the ability to spot entice tokens is essential as a result of they’re usually designed to draw investments via pump-and-dump schemes. These tokens would possibly seem like they characterize reputable initiatives, typically backed by giant investments or sudden worth jumps, making you need to make investments shortly.

After all, regulation enforcement makes use of entice tokens like NexFundAI to catch unhealthy actors, not real traders. However whether or not it’s a entice token created by regulation enforcement or a rip-off arrange by unhealthy actors, falling for these schemes can result in enormous losses. You threat dropping your total funding in the event you don’t spot the warning indicators in time.

Listed here are some basic crimson flags for you to concentrate on:

Sudden worth spikes with out clear fundamentals: One of many clearest indicators of a possible rip-off or entice token is fast worth will increase with none real-world information or undertaking improvement to assist the rise. Pump-and-dump schemes usually comply with this sample, the place manipulators drive up the worth to lure traders earlier than promoting off their holdings and crashing the market. If a token’s worth skyrockets in a single day with no clear cause, it’s a crimson flag.

Low liquidity paired with excessive volumes: One other telltale signal is when a token exhibits unusually excessive buying and selling volumes, however the liquidity — the benefit with which belongings could be purchased or offered — stays low. This will point out wash buying and selling, the place the identical entity is shopping for and promoting the token repeatedly to create the phantasm of exercise. If the token appears tough to commerce or withdraw, that’s one other warning signal.

Presence of wash buying and selling: Look out for patterns that counsel wash buying and selling, like a excessive variety of trades occurring in fast succession or very small worth actions between trades. Wash trades artificially enhance the looks of demand, deceptive traders into considering there’s extra curiosity within the token than there actually is. Instruments like blockchain explorers or specialised websites that monitor suspicious buying and selling exercise might help you notice these patterns.

Lack of transparency: Be cautious of initiatives that aren’t upfront about their group, expertise or improvement targets. Fraudulent tokens usually conceal behind anonymity or obscure guarantees. Respectable initiatives sometimes have clear, clear roadmaps, lively developer communities and accessible groups.

Lastly, earlier than investing in any token, test for regulatory warnings and confirm the legitimacy of the undertaking. Entities just like the US Securities and Trade Fee or equal our bodies in different nations usually concern warnings about identified scams and fraudulent initiatives. These advisories are designed to guard traders from getting concerned in shady operations. You may as well use public instruments and databases, such because the SEC’s EDGAR database, to confirm whether or not the token has been flagged as fraudulent or concerned in a authorized dispute.