Propelled by altering assessments of what can and what needs to be executed, fiscal coverage follows a winding path between actuality and ambition, often marked by sudden realisations of what’s sustainable and what’s not. Within the late Nineteen Nineties and early 2000s, when the advance of fiscal guidelines was in full swing, the mainstream had converged on the understanding that numerical limits needed to be imposed on budgetary aggregates to maintain public funds on a sustainable path. The consensus even discovered a really highly effective picture rooted in an historical European legend (Debrun et al. 2008): Ulysses tying his palms to the mast of his ship, lest he fall for the bewitching songs of sirens and sink his vessel collectively together with his pals.

20 years on, the controversy on the way forward for the EU’s fiscal guidelines takes place in opposition to a really completely different narrative. We needed to be taught that not all leaders are able to have their palms tied in relation to fiscal coverage. To be clear, the vast majority of observers and policymakers nonetheless profess a devotion to guidelines as means to make sure sustainability, however an vital camp sees both restricted dangers of sinking the ship and/or attaches greater significance to stabilising the ship in uneven waters; and waters have certainly been uneven within the final 15 years.

To be extra concrete, a rising variety of pundits and politicians are taking concern with the debt rule of the Stability and Development Pact (SGP). The rule requires member states to scale back the space between the debt-to-GDP ratio and the 60% reference worth by on common 1/20 per 12 months over the earlier three years. Underneath present circumstances, the argument goes, the implied annual adjustment is just too demanding each from an financial and political perspective. In different phrases: tying oneself to the mast would sink the ship. So, why was the rule launched within the first place and why has it not labored to this point?

The EU’s debt rule: A sudden anti-hero?

The EU’s debt rule was launched in 2011 as a part of a broader reform package deal. The secular slowdown of financial development had led to the realisation that maintaining finances deficits beneath 3% of GDP would not be ample to make sure an ample tempo of debt discount. On the time of the reform, the prevailing thought was guidelines and their implementation had been too unfastened and wanted to be tightened to guard in opposition to the fiscal imbalances that had gathered within the good years previous to the International Disaster and painfully unwound after 2007. Naturally, some international locations had been much less satisfied concerning the specifics of the debt rule however the basic sense that stronger guidelines had been wanted prevailed.1

In hindsight, the SGP reform introducing the debt rule was predicated on a sanguine view of issues. First, the ambition to avert previous errors, particularly these made within the run-up to the International Disaster, by bettering public funds throughout financial good instances, was extreme. The deep-seated asymmetry of launching a fiscal enlargement on the slightest prospect of an financial slowdown, whereas overlooking alternatives for consolidation, turned out to be stronger in a number of international locations (Larch et al. 2021). Second, the SGP reform geared toward strengthening enforcement. It launched a full set of escalating sanctions for non-compliance. Nevertheless, imposing sanctions turned out to be daunting in a multilateral setup – the Council by no means discovered the required majority to superb members who discovered themselves in dire straits. Third, whereas accepting the secular slowdown in financial development, the reform assumed the tempo of financial enlargement would rebound throughout all EU member states after the International Disaster.

And certainly, the tempo of financial enlargement did decide up markedly however in some euro space international locations lower than in others. Within the single foreign money space as an entire, common nominal GDP development moved from round 0.5% in 2009-2013 (the disaster years), to three.2% in 2014-2019 (the restoration part). In Italy, in contrast, nominal development averaged only one.8% within the restoration part, when its implicit price of curiosity on authorities debt stood shut to three%. Had the nation loved the identical curiosity rate-growth differential because the euro space as an entire (-0.75%), the common main finances stability wanted to adjust to the debt rule as of the 12 months of its introduction would have been lower than 2% of GDP, just about in step with the common main stability recorded in Italy in 1999-2019.

Nevertheless, precise numbers referred to as for a mean main stability of near 4% of GDP, ranges that Italy (and Belgium too) had sustained previous to the introduction of the euro within the Nineteen Nineties, however which had been deemed laborious to attain after the International Disaster. Consequently, the Fee and the Council had agreed to minimize the debt rule properly earlier than the Covid-19 pandemic pushed authorities debt ranges to new highs. The main focus of EU fiscal surveillance shifted in the direction of making ample progress in the direction of a secure budgetary place no matter debt developments.2 Since this shift was determined whereas the restoration from the International Disaster was in full swing, the cyclical enchancment of nominal finances balances supplied a deceivingly rosy image of fiscal efficiency simply earlier than a brand new main shock struck; an unlucky sample noticed earlier than. Determine 1, which attracts on the newest replace of our compliance tracker, illustrates the purpose.3

Determine 1 Numerical compliance with the principles of the Stability and Development Pact

Notes: ‘Deficit rule’: A rustic is taken into account compliant if, (i) the finances stability of the final authorities is equal or bigger than -3% of GDP or, (ii) in case the -3% of GDP threshold is breached, the deviation stays small (most 0.5% of GDP) and restricted to 1 12 months. ‘Debt rule’: A rustic is taken into account compliant if the debt-to-GDP ratio is beneath 60% of GDP or if the surplus above 60% of GDP has declined by 1/20 on common over the previous three years. ‘Structural stability rule’: A rustic is taken into account compliant if the structural finances stability of the final authorities is at or above the medium-term goal (MTO) or, the annual enchancment of the structural finances stability is equal or larger than 0.5% of GDP. ‘Expenditure benchmark rule’: A rustic is taken into account criticism if the annual price of development of main authorities expenditure, internet of discretionary income measures and one-offs, is at or beneath the ten-year common of the nominal price of potential output development minus the convergence margin crucial to make sure an adjustment of the structural finances deficit of the final authorities in step with the structural stability rule.

Supply: Compliance tracker of the European Fiscal Board Secretariat

Usually are not all fiscal guidelines anti-heroes in the long term?

To permit governments to mount a forceful response to the financial fallout of the Covid-19 pandemic, the EU determined in 2020 to de facto droop all fiscal guidelines by activating the extreme financial downturn clause. Nevertheless, the prospect of returning to the present algorithm meets little enthusiasm in sure quarters. There was a basic sense of frustration with the EU fiscal guidelines for fairly a while (Beetsma and Larch 2018), however member states are more and more polarised about what needs to be executed subsequent.

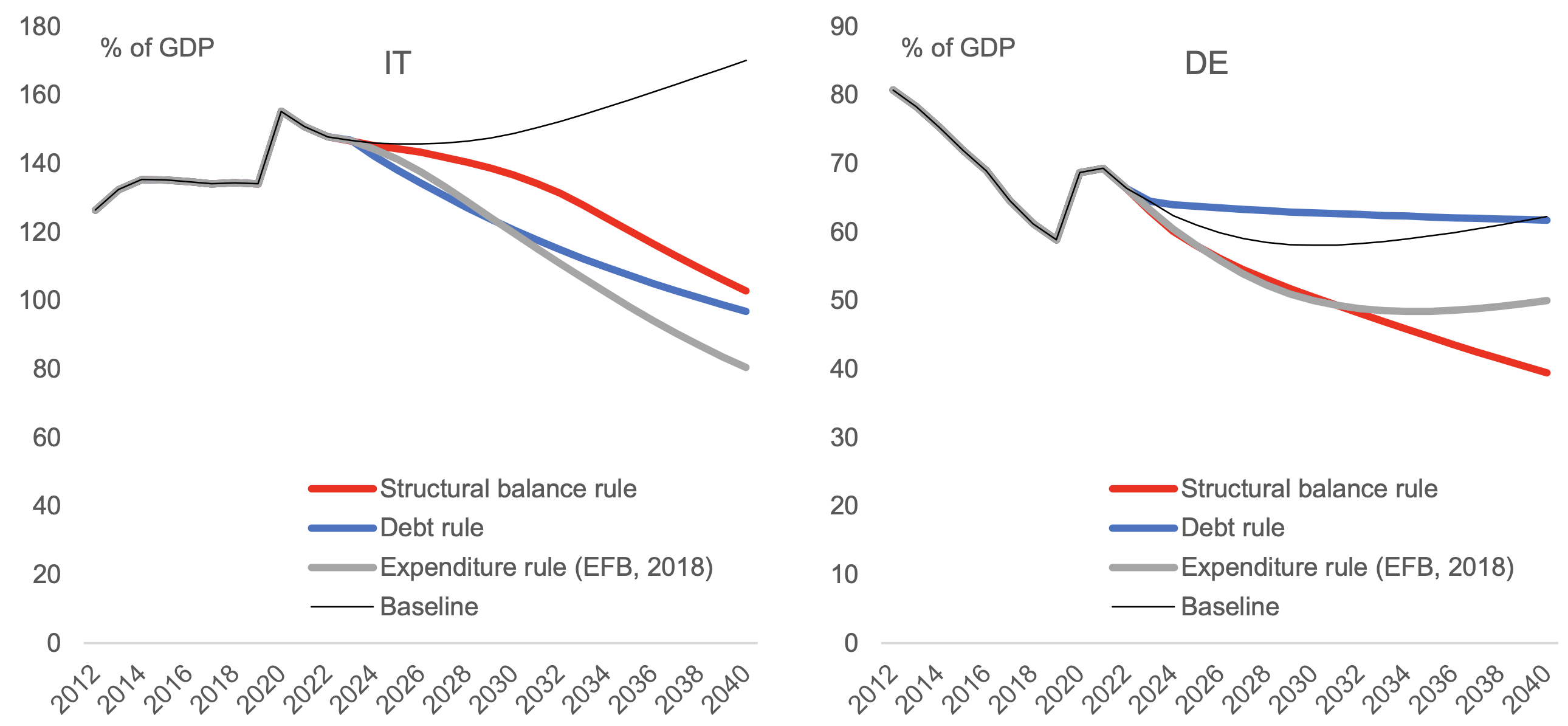

As probabilities for a swift and radical reform of the EU’s fiscal guidelines will not be bettering, rising criticism is being levelled in opposition to the rule imposing the hardest constraint on fiscal coverage: the debt rule. If utilized to the letter, the rule would certainly require a frontloaded profile of fiscal adjustment, particularly for international locations with very excessive debt ranges and low charges of financial development. Determine 2 exhibits simulation outcomes for Italy and Germany. Utilizing the long-term macroeconomic projections of the Fee obtainable on the time of writing, the Italian authorities must flip a present structural main deficit of greater than 2% of GDP right into a surplus of 2¼% of GDP in 2023 and hold working such surpluses for the subsequent ten years.4 By means of comparability, our simulations additionally current the adjustment implied by two different fiscal guidelines: the SGP’s structural finances stability rule and an expenditure rule proposed by the European Fiscal Board since 2018. These or comparable simulations are taken as irrefutable proof of how unrealistic the debt rule can be for sure international locations.

Determine 2 Debt simulations for Italy and Germany

a) Authorities debt ratios

b) Cumulative adjustment effort (cumulative adjustment in structural main stability relative to the baseline)

Notes: The ‘baseline’ state of affairs assumes no change within the structural main stability after 2022. The ‘structural stability rule’ state of affairs assumes an annual adjustment of the structural stability of 0.5% of GDP from 2023 till the nation’s Medium-Time period Goal (MTO) is reached. The ‘debt rule’ state of affairs assumes an adjustment of the structural main stability from 2023 that’s in keeping with the EU debt rule from 2025. The ‘expenditure rule (EFB 2018)’ follows a recursive strategy: the expansion price of main expenditure is re-estimated and glued each three years with the intention to scale back authorities debt to 60% of GDP within the successive 15 years.

Supply: European Fee, personal calculations.

Nevertheless, an instantaneous and strict return to the debt rule can be an unlikely proposition anyway. Since 2020, the EU has intentionally accepted growing debt ratios by asking member states to run expansionary fiscal insurance policies in response to the Covid-19 pandemic. As a consequence of its backward-looking nature – the discount of 1/20 is to be achieved on common over the previous three years – an instantaneous and strict utility of the debt rule would quantity to an overt inconsistency in coverage recommendation. A phasing-in association can be crucial.

Extra importantly, Determine 2 highlights some extent that normally falls by the wayside because of the short-term focus of the controversy. If the last word goal is to attain a given debt goal over a given time period, the general adjustment effort is broadly the identical throughout various fiscal guidelines. The SGP’s debt rule is extra demanding within the preliminary part however turns comparatively gentle additional down the street. In distinction, the SGP’s structural finances stability rule and the European Fiscal Board’s expenditure benchmark indicate much less demanding changes within the first few years however very demanding fiscal positions in a while; within the case of the European Fiscal Board’s expenditure benchmark, in lower than 5 years from now.

Therefore, the actual debate on fiscal guidelines is about compliance over time. It comes as no shock that the debt rule has turn into more and more unpopular, whereas the fan group of expenditure benchmarks has grown. The prospect of doing much less now and leaving the laborious bit for later is interesting. However what concerning the well-documented tendency in some international locations to systematically shift changes into the longer term? Will the expenditure rule fall out of favour too as soon as its back-loaded adjustment profile begins biting? The expenditure benchmark has many benefits; to sidestep a given debt discount just isn’t one in every of them.

Within the present framework of multilateral EU surveillance, the effectiveness of fiscal guidelines finally hinges on the dedication of nationwide policymakers to stay to an agreed fiscal trajectory over an prolonged time period. Some argue possession will mechanically enhance as adjustment necessities turn into extra reasonable. That is properly doable; the proof of the pudding continues to be within the consuming.

Within the Odyssey, it’s Ulysses himself who decides to be tied to the mast and makes his crew put wax of their ears to avert catastrophe. Afterward in the identical legend, the end result is completely different. When confronted with a brand new temptation, Ulysses’ males fall for the beguiling phrases of the enchantress Circe simply to search out themselves remodeled into animals. Ulysses limits harm by accepting recommendation from Hermes. Allow us to assume, coverage steering collectively generated on the EU degree may be this type of recommendation in these difficult instances for nationwide public funds.

Authors’ be aware: The views expressed on this column don’t essentially replicate the official place of the establishments with which the authors are affiliated or for which they work.

References

Beetsma, R and M Larch (2018), “Danger discount and danger sharing in EU fiscal policymaking: The position of higher fiscal guidelines”, VoxEU.org, 10 Might.

Debrun, X, L Moulin, A Turrini, J Ayuso-i-Casals and M S Kumar (2008), “Tied to the mast? Nationwide fiscal guidelines within the European Union”, Financial Coverage 23(54): 298–362.

European Fiscal Board (2018), Annual Report, Brussels.

Larch, M, D Kumps and A Cugnasca (2021), “Fiscal stabilisation in actual time: An train in danger administration”, Financial Modelling 99 (105494).

Endnotes

1 As a matter of truth, the introduction of the debt rule required unanimity.

2 The European Fiscal Board highlighted the brand new observe in successive Annual Reviews beginning in 2018.

3 See https://ec.europa.eu/data/business-economy-euro/economic-and-fiscal-policy-coordination/european-fiscal-board-efb/compliance-tracker_en

4 The preliminary effort and the first surpluses can be considerably larger in an more and more possible state of affairs the place yields on authorities bonds improve and exceed the projected price of financial development.