Elite endowments with heavy allocations to different investments are underperforming, shedding floor to easy index methods. Excessive prices, elevated competitors, and outdated perceptions of superiority are taking a toll. Isn’t it time for a reset?

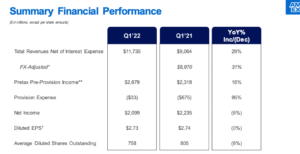

Endowments with massive allocations to different investments have underperformed comparable listed methods. The typical return among the many Ivy League faculties for the reason that International Monetary Disaster of 2008 was 8.3% per 12 months. An listed benchmark comprising 85% shares and 15% bonds, the attribute allocation of the Ivies, achieved 9.8% per 12 months for a similar 16-year interval. The annualized distinction, or alpha, is -1.5% per 12 months. That provides as much as a cumulative alternative value of 20% vis-à-vis indexing. That could be a huge chunk of potential wealth gone lacking.[1]

“Endowments within the On line casino: Even the Whales Lose on the Alts Desk” (Ennis 2024), exhibits that different investments, resembling personal fairness, actual property, and hedge funds, account for the complete margin of underperformance of huge endowments.

Why do some endowments proceed to rely closely on what has confirmed to be a shedding proposition? Endowment managers with massive allocations to different investments endure from what I name the Endowment Syndrome. Its signs embody: (1) denial of aggressive circumstances, (2) willful blindness to value, and (3) vainness.

Aggressive Situations

Different funding markets have been comparatively small and inchoate when David Swensen (Yale) and Jack Meyer (Harvard) labored their magic within the Nineties and early 2000s. Since then, many trillions of {dollars} have poured into different investments, growing mixture belongings below administration greater than tenfold. Greater than 10,000 different asset managers now vie for a chunk of the motion and compete with each other for the most effective offers. Market construction has superior accordingly. Briefly, personal market investing is vastly extra aggressive than it was method again when. Massive endowment managers, nevertheless, principally function as if nothing has modified. They’re in denial of the fact of their markets.

Price

Current research provide an more and more clear image of the price of different investing. Personal fairness has an annual value of at the least 6% of asset worth. Non-core actual property runs 4% to five% per 12 months. Hedge fund managers take 3% to 4% yearly.[2] I estimate that enormous endowments, with 60%-plus in alts, incur a complete working value of at the least 3% per 12 months.

Now hear this:A 3% expense ratio for a diversified portfolio working in aggressive markets is an not possible burden. Endowments, which don’t report their prices and don’t even focus on them so far as I can inform, appear to function in see-no-evil mode relating to value.

Vainness

There exists a notion that the managers of the belongings of upper schooling are distinctive. A dozen or so faculties cultivated the concept that their funding places of work have been elite, just like the establishments themselves. Others drafted on the leaders, comfortable to be drawn right into a particular class of funding execs. Not way back, a veteran observer of institutional investing averred:

- Endowment funds have lengthy been regarded as the best-managed asset swimming pools within the institutional funding world, using essentially the most succesful folks and allocating belongings to managers, standard and different, who can and do actually deal with the long term.

- Endowments appear notably effectively suited to [beating the market]. They pay effectively, attracting gifted and steady staffs. They exist in shut proximity to enterprise faculties and economics departments, many with Nobel Prize-winning college. Managers from all around the world name on them, concerning them as supremely fascinating shoppers.[3]

That’s heady stuff. No marvel many endowment managers consider it’s incumbent upon them –both by legacy or lore — to be distinctive buyers, or at the least to behave like they’re. Finally, although, the phantasm of superiority will give strategy to the fact that competitors and price are the dominant forces. [4]

The Awakening

The awakening might come from increased up, when trustees conclude the established order is untenable.[5] That might be an unlucky denouement for endowment managers. It may end in job loss and broken reputations. Nevertheless it doesn’t need to play out that method.

As an alternative, endowment managers can start to gracefully work their method out of this dilemma. They might, with out fanfare, arrange an listed funding account with a stock-bond allocation of, say, 85%-15%. They might then funnel money from reward additions, account liquidations, and distributions to the listed account as institutional money stream wants allow. In some unspecified time in the future, they might declare a pragmatic method to asset allocation, whereby they periodically alter their asset allocation in favor of whichever technique — energetic or passive — performs finest.

Or, as Senator James E. Watson of Indiana was fond of claiming, “In case you can’t lick ‘em, jine ‘em.” To which, I might add, “And do it as quietly as you please.”

References

Ben-David, Itzhak and Birru, Justin and Rossi, Andrea. 2020. “The Efficiency of Hedge Fund Efficiency. NBER Working Paper No. w27454, Out there at SSRN: https://ssrn.com/summary=3637756.

Bollinger, Mitchell A., and Joseph L. Pagliari. (2019). “One other Take a look at Personal Actual Property Returns by Technique.” The Journal of Portfolio Administration, 45(7), 95–112.

Ennis, Richard M. 2022. “Are Endowment Managers Higher than the Relaxation?” The Journal of Investing, 31 (6) 7-12.

—— . 2024. “Endowments within the On line casino: Even the Whales Lose on the Alts Desk.” The Journal of Investing, 33 (3) 7-14.

Lim, Wayne. 2024. “Accessing Personal Markets: What Does It Price? Monetary Analysts Journal, 80:4, 27-52.

Phalippou, Ludovic, and Oliver Gottschalg. 2009. “The Efficiency of Personal Fairness Funds.” Evaluation of Monetary Research 22 (4): 1747–1776.

Siegel, Laurence B. 2021. “Don’t Give Up the Ship: The Way forward for the Endowment Mannequin.” The Journal of Portfolio Administration (Funding Fashions), 47 (5)144-149.

[1] I corrected 2022-2024 fund returns for distortions attributable to lags in reported NAVs. I did this by utilizing regression statistics for the prior 13 years mixed with market returns for the ultimate three. (The corrected returns have been really 45 bps per 12 months larger than the reported sequence.) I created the benchmark by regressing the Ivy League common return sequence on three market indexes. The indexes and their approximate weights are Russell 3000 shares (75%), MSCI ACWI Ex-US (10%), and Bloomberg US Combination bonds (15%). The benchmark is predicated on returns for 2009-2021.

[2] See Ben-David et al. (2020), Bollinger and Pagliari (2019), Lim (2024), and Phalippou and Gottschalg (2009).

[3] See Siegel (2021).

[4] My analysis persistently exhibits that enormous endowments obtain decrease risk-adjusted returns than public pension funds, which spend a lot much less on energetic funding administration, and different investments, specifically. See Ennis (2022).

[5] I estimate that Harvard pays its cash managers greater than it takes in in tuition, with nothing to indicate for it.