Generally, the info is so overwhelming that little commentary is required.

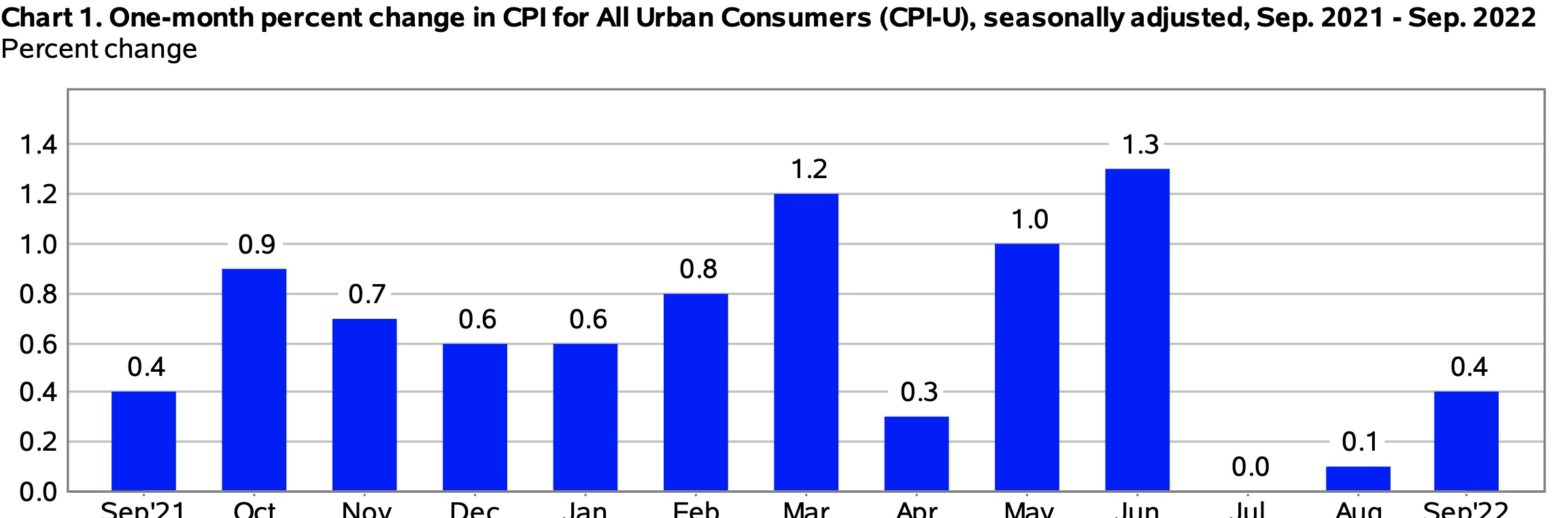

From SPIVA, right here is the info on large-cap fund efficiency in america, exhibiting the share of all large-cap funds that over and underperformed the S&P 500 over varied time frames:

1 Yr: 65.24% of funds underperformed the S&P 500; 34.76% outperformed the S&P 500

3 Years: 84.96% underperformed; 15.04% outperformed

5 Years: 76.26% underperformed; 23.74% outperformed

10 Years: 84.34% underperformed; 15.66% outperformed

15 Years: 89.50% underperformed; 10.50% outperformed

After 15 years, the percentages are about 1 in 10 that you’ve got picked an lively fund that has outperformed its benchmark over that interval. (All information as of Dec 31, 2024) And, if we exit to twenty+ years, virtually no one web of charges has crushed their benchmark.

And it’s not simply the U.S. SPIVA reviews comparable information for Europe, Japan, Canada, Mexico, Brazil, Chile, Center East, S. Africa, and Australia.

The possibilities make it clear {that a} broad index must be the core of your portfolio; if you wish to put your individual spin on it, be at liberty to attempt. However the important thing takeaway stays this:

Portfolios can not obtain Alpha if they aren’t no less than getting out with Beta.

~~~

Do you want assist along with your belongings? RWM works with purchasers by setting up a long-term monetary plan, marrying it to an acceptable degree of threat in a broadly diversified portfolio constructed round a core index, after which making use of one of the best know-how we are able to discover to generate web after-tax returns with modest threat and volatility.

Attain out to us at [email protected] for extra data…

Sources:

Extra Than 80% of Lively Managers in Public Markets Underperform Their Index

Torsten Sløk,

Apollo, Could 29, 2025

United States Proportion of All Massive-Cap funds vs S&P 500

SPIVA Analysis