Spreadsheet data updated daily

The end goal of many dividend growth investors is to create a high-quality portfolio of dividend stocks that generates sufficient passive income to cover their living expenses.

One of the challenges of this goal is generating a dividend income stream that does not vary much on a month-to-month basis. Having access to a list of dividend stocks sorted by payment dates helps greatly in eliminating this challenge.

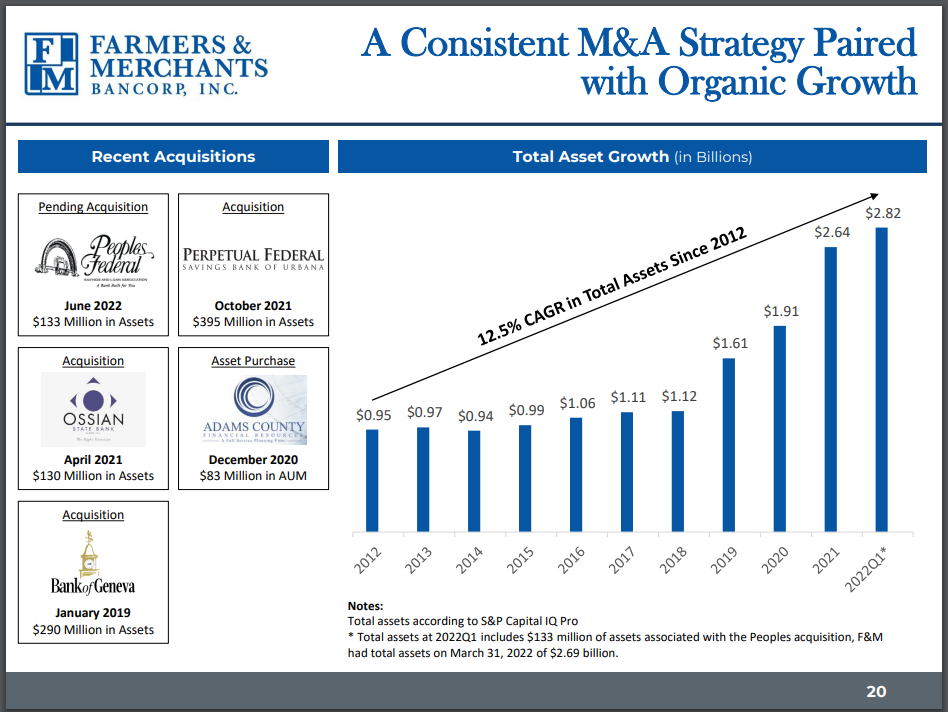

With that in mind, Sure Dividend maintains databases of dividend stocks sorted by the calendar month of their payment dates. You can download our free list of stocks that pay dividends in October below:

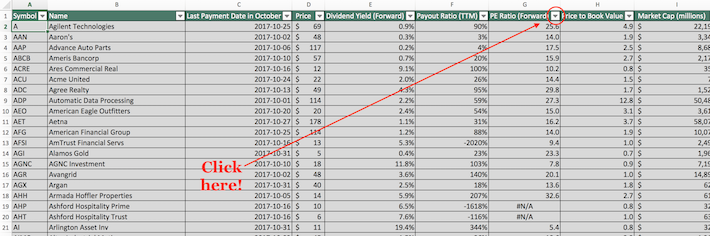

The list of stocks that pay dividends in October available for download above contains the following metrics for every stock in the index:

- Last dividend payment date in the month of October

- Stock price

- Dividend yield

- Dividend payout ratio

- Market capitalization

- Beta

- Price-to-earnings ratio

- Price-to-book ratio

- Returns on equity

Keep reading this article to learn more about using our list of stocks to find compelling investment ideas.

Note: Constituents for the spreadsheet and table above are from the Wilshire 5000 index, with data provided by Ycharts and updated annually. Securities outside the Wilshire 5000 index are not included in the spreadsheet and table.

How to Use The List of Stocks That Pay Dividends in October to Find Investment Ideas

Having an Excel document that contains the names and financial information of stocks that pay dividends in October can be very useful for the self-directed investor.

This document becomes even more powerful when combined with a rudimentary knowledge of Microsoft Excel (or other spreadsheet software).

With that in mind, this tutorial will demonstrate how to use Microsoft Excel to apply two insightful investing screens to the list of stocks that pay dividends in October.

The first screen that we’ll implement is for stocks with large market capitalizations and low betas. More specifically, we’ll filter for stocks that pay dividends in October with market capitalizations above $20 billion and 3-year betas below 1.

Screen 1: Market Capitalizations Above $20 Billion, Beta Below 1.0

Step 1: Download your free list of stocks that pay dividends in October by clicking here.

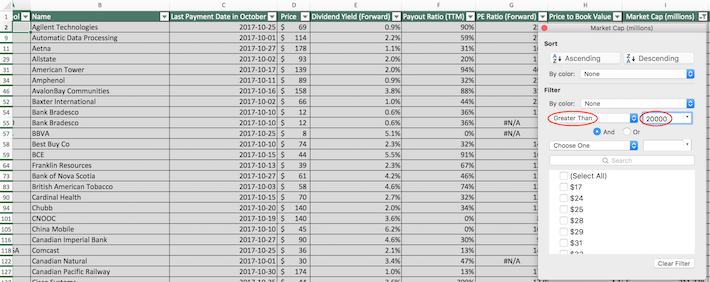

Step 2: Click the filter icon at the top of the market capitalization column, as shown below.

Step 3: Change the filter setting to “Greater Than” and input 20000 into the field beside it, as shown below. Since market capitalization is measured in millions of dollars in this spreadsheet, this will filter for stocks that pay dividends in October with market capitalizations above $20 billion.

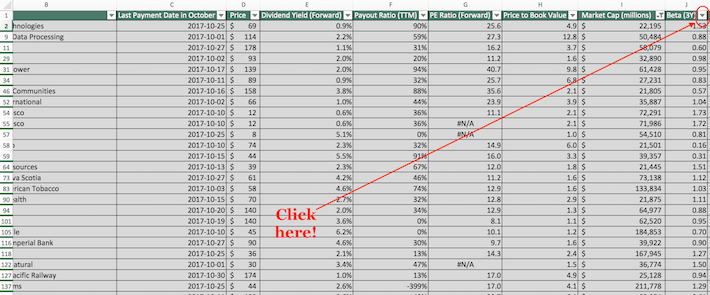

Step 4: Close out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button in the bottom right corner). Next, click the filter icon at the top of the beta column, as shown below.

Step 5: Change the filter setting to “Less Than” and input 1 into the field beside it. This will filter for stocks that pay dividends in October with betas below 1.

The remaining stocks in this spreadsheet are stocks that pay dividends in October with market capitalizations above $20 billion and betas below 1.

The next screen that we’ll implement is for pure value stocks. More specifically, we’ll filter for stocks with price-to-earnings ratios below 10 and price-to-book ratios below 1.

Screen 2: Price-to-Earnings Ratios Below 10 and Price-to-Book Ratios Below 1

Step 1: Download your free list of stocks that pay dividends in October by clicking here.

Step 2: Click the filter icon at the top of the price-to-earnings ratio column, as shown below.

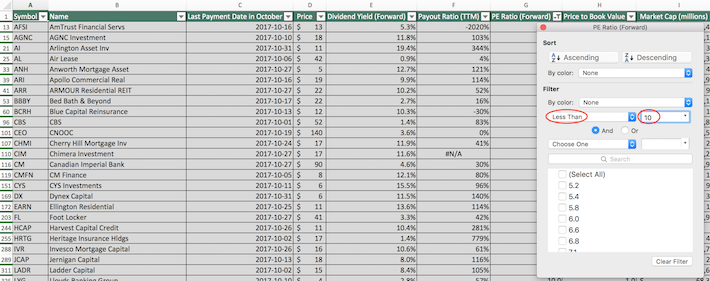

Step 3: Change the filter setting to “Less Than” and input 10 into the field beside it. This will filter for stocks that pay dividends in October with price-to-earnings ratios less 10.

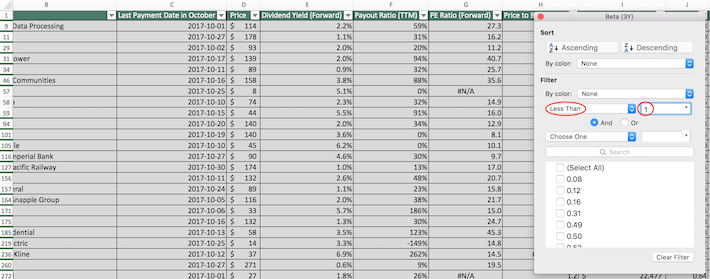

Step 4: Close out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button in the bottom right corner). Next, click the filter icon at the top of the price-to-book ratio column, as shown below.

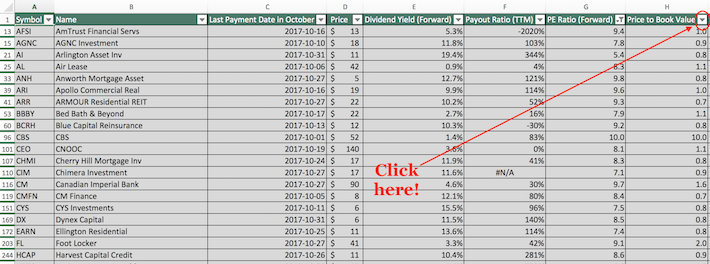

Step 5: Change the filter setting to “Less Than” and input 1 into the field beside it. This will filter for stocks that pay dividends in October with price-to-book ratios below 1.

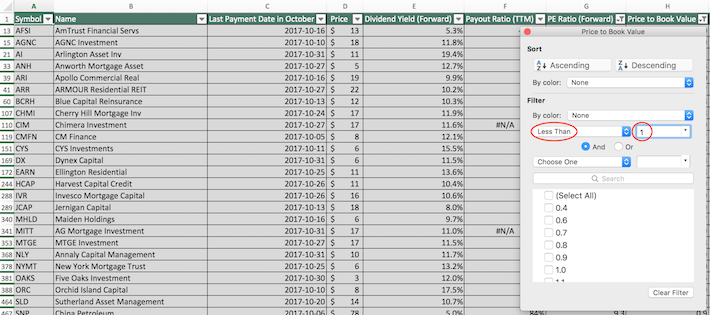

The remaining stocks that appear in this spreadsheet are stocks that pay dividends in October with price-to-earnings ratios below 10 and price-to-book ratios below 1.

You now have a solid understanding of how to use our list of stocks that pay dividends in October to find investment ideas.

To conclude this article, we will introduce several additional investing resources that you can use to find your next compelling investment opportunity.

Final Thoughts: Other Useful Investing Resources

Having a list of stocks that pay dividends in October is useful for the investor who is looking to generate a reliable stream of dividend income.

With that said, this document’s utility is increased mightily when combined with similar databases for the other 11 months of the year. You can access these databases below:

A similar diversification approach needs to be applied to sector diversification. For obvious reasons, an investor who owns 500 energy businesses is not appropriately diversified.

For this reason, Sure Dividend maintains databases for every stock market sector. You can download these databases at the links below:

Once your portfolio is appropriately diversified, an investor should attempt to invest in the best opportunities available.

We believe the best opportunities for most investors lie within stocks that have consistently increased their dividends for many, many year. Based on this belief, we maintain the following databases:

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases

- The Dividend Kings: considered to be the best-of-the-best when it comes to dividend growth, the Dividend Kings are an exclusive group of dividend stocks with 50+ years of consecutive dividend increases

In fact, we publish two detailed and comprehensive monthly newsletters that discuss these types of dividend growth stocks. You can read about our flagship newsletters below:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].