Data updated daily

Constituents updated annually

One of the challenges that self-directed retired investors face is constructing an investment portfolio that generates a similar amount of dividend income each month.

This challenge becomes much more manageable if investors have access to a database of stocks that pay dividends in each calendar month.

That’s where Sure Dividend comes in. We maintain a list of stocks that pay dividends in July, available for download below:

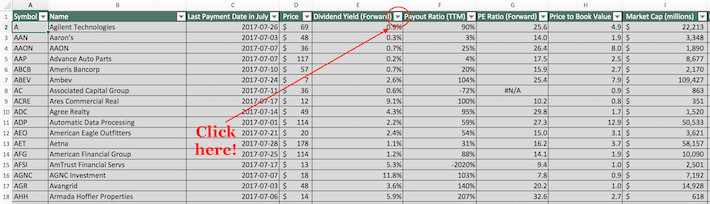

The database of stocks that pay dividends in July available for download above contains the following information for each stock in the database:

- Last payment date in the month of July

- Dividend yield

- Dividend payout rartio

- Price-to-earnings ratio

- Price-to-book ratio

- Return on equity

- Market capitalization

- Beta

Keep reading this article to learn more about how you can use our list of stock that pay dividends in July to help make better portfolio management decisions.

Note: Constituents for the spreadsheet and table above are from the Wilshire 5000 index, with data provided by Ycharts and updated annually. Securities outside the Wilshire 5000 index are not included in the spreadsheet and table.

How To Use The List of Stocks That Pay Dividends in July to Find Investment Ideas

Having an Excel document that contains the name, ticker, and financial information for every stock that pays dividends in July can be quite useful.

This document becomes even more powerful when combined with a working knowledge of Microsoft Excel.

With that in mind, this tutorial will demonstrate how you can apply two useful investing screens to our database of stocks that pay dividends in July.

The first screen that we’ll implement will search for stocks with high dividend yields and large market capitalizations. More specifically, we’ll screen for stocks with yields above 3% and market capitalizations above $10 billion.

Screen 1: Dividend Yields Above 3%, Market Capitalizations Above $10 Billion

Step 1: Download your free list of stocks that pay dividends in July by clicking here.

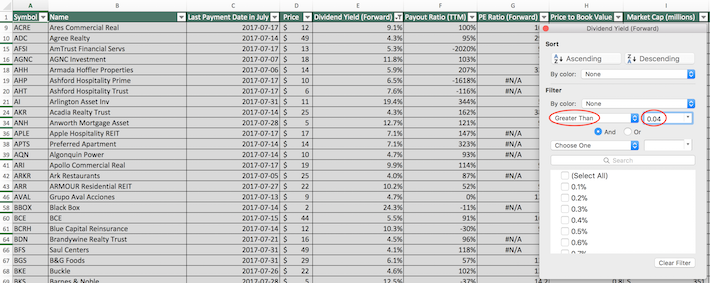

Step 2: Click the filter icon at the top of the dividend yield column, as shown below.

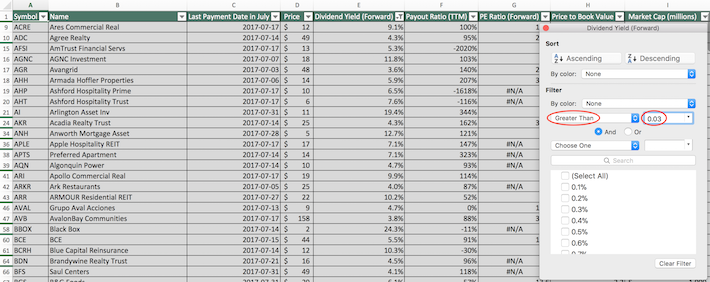

Step 3: Change the filter setting to “Greater Than” and input 0.03 into the field beside it, as shown below. This will filter for stocks that pay dividends in July with dividend yields above 3%.

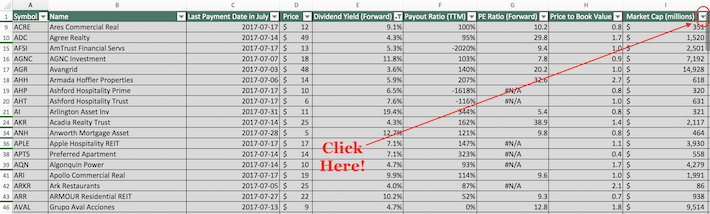

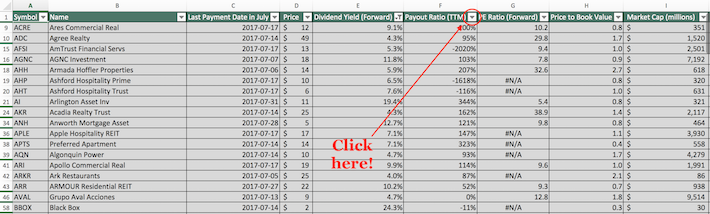

Step 4: Close out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button in the bottom right corner). Next, click the filter icon at the top of the market capitalization column, as shown below.

Step 5: Change the filter setting to “Greater Than” and input 10000 into the field beside it. Since market capitalization is measured in millions of dollars in this spreadsheet, this is equivalent to filtering for stocks with market capitalizations above $10 billion.

The remaining stocks in this spreadsheet are stocks that pay dividends in July with dividend yields above 3% and market capitalizations above $10 billion.

The next screen that we’ll demonstrate is for stocks with dividend yields above 4% and payout ratios below 100%. This screen is useful for investors who need dividend yield now but do not want to risk investing in companies with payout ratios above 100%.

Screen 2: Dividend Yields Above 4%, Payout Ratios Below 100%

Step 1: Download your free list of stocks that pay dividends in July by clicking here.

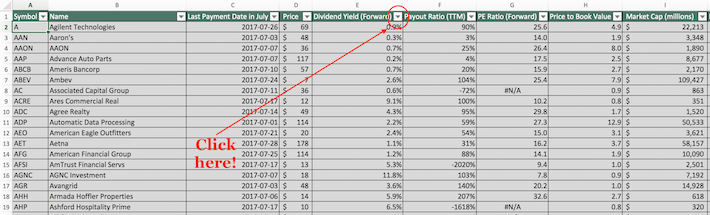

Step 2: Click on the filter icon at the top of the dividend yield column, as shown below.

Step 3: Change the filter setting to “Greater Than” and input 0.04 into the field beside it. This will filter for stocks that pay dividends in July with dividend yields above 4%.

Step 4: Close out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button in the bottom right corner). Next, click on the filter icon at the top of the payout ratio column, as shown below.

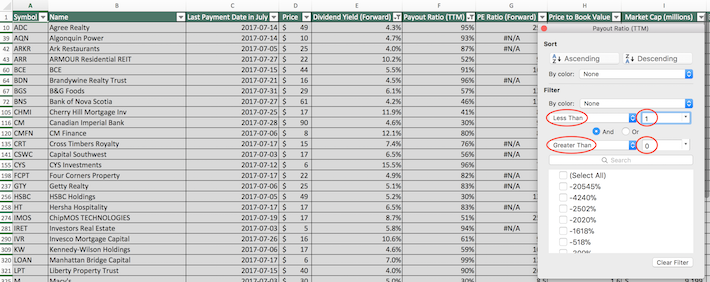

Step 5: Chance the primary filter setting to “Less Than” and input 1 into the field beside it. This will filter for stocks that pay dividends in July with payout ratios below 100%.

Additionally, change the secondary filter setting to “Greater Than” and input 0 into the field beside it. This will filter out stocks that have negative payout ratios – which is even worse than stocks with payout ratios above 100%.

The remaining stocks in this spreadsheet are stocks that pay dividends in July with dividend yields above 4% and payout ratios between 0% and 100%.

You now have a solid understanding of how to use our database of stocks that pay dividends in July to find investment ideas.

To conclude this article, we will introduce several other useful investing databases that you can use to improve your long-term investing outcomes.

Final Thoughts: Other Useful Investing Resources

July is not a particularly special month of the year when it comes to dividend income. This article (and the associated database) is part of a comprehensive suite of dividend calendar solutions. You can access similar databases for the other 11 calendar months below:

Diversifying your dividend income by calendar month is very important for retirees and other income-oriented investors.

Another important component of diversification is having investments in every major sector of the stock market.

With that in mind, Sure Dividend maintains databases of the following stock market industries, which are available for download below:

Diversification aside, our research suggests that the best place to find compelling investment opportunities is among stocks with long histories of steadily increasing their dividend payments.

The following databases are useful resources if this approach sounds appealing to you:

- The Dividend Aristocrats: the Dividend Aristocrats are a group of elite S&P 500 dividend stocks with 25+ years of consecutive dividend increases

- The Dividend Achievers: the requirement to be a Dividend Achiever is 10+ years of consecutive dividend increases, which results in a universe of stocks that is less inclusive but more diversified than the Dividend Aristocrats

- The Dividend Kings: considered to be the best-of-the-best when it comes to dividend growth stocks, the Dividend Kings are a group of companies with 50+ years of consecutive dividend increases

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].