There is a thought-provoking discussion on short selling over at Russell Clark; check it out (including audio) to get an overview of his perspective.

I don’t really disagree with any of it but I do (did) see the world of short-selling from a different seat. Allow me to share a few thoughts about shorting as a trading strategy; I include specifics at the end.

It’s been more than a decade since I have been short stocks (although I was dying to short TSLA in late 2021 after it was added to the SPX1). Heading into the GFC, the firm I worked at was short AIG, LEH, CIT, and similar names. I got into a wonderful argument with Charlie Gasparino over Lehman Brothers, and was thrilled when he went on CNBC and asked, “Who are you gonna believe Dick Fuld or David Einhorn? Dick Fuld or Barry Ritholtz?” It was literally the nicest thing anyone ever said about me on TV, even if unintentionally so. I sent him a thank you email afterward (should have sent flowers); he laughed, and we have remained on civil terms since.

The world of shorting has changed dramatically since the GFC, and so my caveat is that all of my experiences shorting stocks are wildly out of date.2 I learned a lot playing on the short side back then, and while we made some lucrative trades in the pre-QE/ZIRP era, those trades did not come without scars.

I came to recognize some inherent challenges to the entire process of short-selling stocks:

-Identifying a fundmental problem not in prices already is difficult;

-Borrows are subject to getting called away at the worst times;

-The media cheerleads most of time (except when panicking)

-Getting a borrow on a stock can be hard and/or expensive;

-Stocks can only fall 100% but can go up much more (%);

-Expected catalysts often disappoint;

-Timing is notoriously tricky;

-Markets go up over time.

Other than that, shorting is easy!

Consider the chart of Enron (above) via Professor Douglas O. Linder’s Famous Trials. He notes that from 1996 to 2001, Enron was the darling of Wall Street; from 1999 to 2001, Enron executives and directors sold over $1.1 billion of shares. CEO Jeff Skilling abruptly resigned on August 14, 2001 (“personal reasons”); he was replaced by Ken Lay, who was also selling shares but urging employees to buy via a company-wide e-mail. On October 16, 2001, Enron reported a giant Q3 loss of $618 million. On December 2, 2001, Enron filed for bankruptcy.

I left something out of the chronology: Enron was the subject of several research reports from analysts and short sellers for years prior; Bethany McLean’s big piece in Fortune, “Is Enron Overpriced?” came out March 5, 2001. Even after the newsflow turned against the company, I watched people who were short the stock get crushed with every rally, price surge, and run higher. It was painful being short even as sellers pressured the company’s stock price lower over a full year on the way to zero.

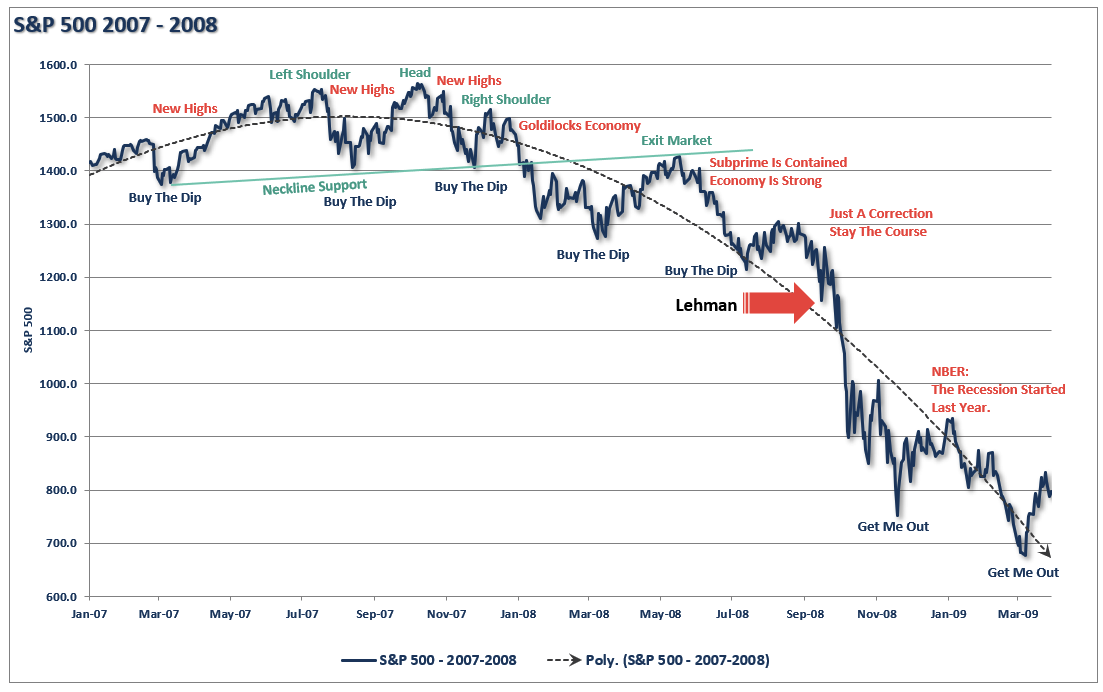

If Enron was tough, what about Lehman Brothers?

LEH might have been even more difficult to stay short: The chart below, via Investing.com, shows all of the many painful squeezes upward in the bank. The news flow focused on lots of potential saviors of LEH, you always felt like most of your gains were about to be snatched away by overnight news that a deal was cut to save the company.3 It was the most painful trip to zero imaginable.

I got an education in short-selling in an unpleasant and expensive way; here is what I learned:

1. Always marry a put to any shorted stock (slightly in the money, and deep out of the money); if the bet works out, the option will generate a much greater ROI than the equity portion of the trade itself. (Note the option stays even if the stock is called away);

2. Pre-define your losses in advance: Figure out (while you are still objective) exactly how much capital you are willing to burn in the trade.

3. Decide what will lead you to admit error and close the trade; how will you know that your thesis is wrong?

4. Put all of this in writing so your memory does not mislead you as circumstances change;

5. Keep your position to yourself — you don’t want to get squeezed;

6. Never crow or celebrate a short that is working out, as it means there is blood in the street, or at the very least, lots of people are losing money and more than a few people are losing their jobs.

7. Last, brace yourself for some wild times.

These days, I am much more an investor than a trader, and more willing to ride the markets up and down than to try to time them or bet against them.

Previously:

MiB: Bethany McLean, Enron, and Wall Street’s Promotion Machine (March 22, 2016)

Exonerating the Shorts (March 28, 2010)

Banning Short Selling (July 4, 2009)

The Backward Business of Short Selling (March 1, 2006)

Sources:

The Three Profit Centres of Short Selling – Update

Russell Clark, October 6 2023

https://www.russell-clark.com/p/the-three-profit-centres-of-short-833?r=2gv2#details

The Three Profit Centres of Short Selling Part II

Russell Clark, November 15, 2022

https://www.russell-clark.com/p/the-three-profit-centres-of-short

__________

1. I won’t bet against companies RWM clients are long, either individually or as part of broad holdings in Canvas, our direct indexing strategy.

2. Paul Graham: “When experts are wrong, it’s often because they’re experts on an earlier version of the world.” Whatever small expertise in shorting I had back in the day, that version of the world no longer exists…

3. People forget that Lehman Brothers CEO Dick Fuld rejected a deal from Warren Buffett’s Berkshire Hathaway as too expensive — which could be the single worst decision by any bank CEO ever. Goldman Sachs took Buffett’s pricey deal and lived to fight another day. Lehman sleeps with the fishes…