This article is an on-site version of our Trade Secrets newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday

Welcome to Trade Secrets, and thanks to Andy Bounds for standing in for me last week. Here’s his account of the waning “Brussels Effect”, the EU’s ability to project its rules and norms abroad — and indeed sometimes within its own single market. This week I’m looking at an argument that definitely needs some airtime: whether the EU (and perhaps by extension other rich economies) is overdoing rather than underdoing it in its green subsidy race with the US. I also look at the UK’s trade and geopolitical relationship with the US, in which it’s either a lapdog or a bulldog or perhaps a bit of both. Sticking with the green theme, Charted waters is on climate change’s impact on palm oil prices.

Get in touch. Email me at [email protected]

No need to flash EU cash

The whole world’s got Joe Biden green investment subsidy envy right now. (Except China, obviously, which has been at it for years.) If it’s not about latching on to the US taxpayers’ teat directly through the US president’s Inflation Reduction Act — see today’s second piece on the UK joining the queue at that particular feeding station — then it’s about governments shelling out their own cash.

The EU is the most salient worrier in this regard. There’s lots of discussion about how it can match the US but less debate about whether and why. What market failure exactly is this investment intending to correct?

I don’t have a very strong view myself, but there’s an interesting new paper out on EU subsidies from John Springford and Sander Tordoir at the Centre for European Reform urging restraint. They make a few key points:

The EU is already pretty competitive in global green tech exports — less so than China but much more so than the US. The EU has been importing green goods because domestic demand has been growing so quickly, but markets are maturing: the authors reckon the EU should be supplying enough EV batteries to meet its domestic demand by 2030.

Relatedly, the distance effect (that is, far-flung economies trade less) in green goods exports is asserting itself. EVs and particularly their batteries are heavy: it makes sense to produce them close to the consumer. EVs for Europeans will mainly be made in Europe.

Finally, if you’re going to subsidise, better to do it with very immature technologies to build an early advantage, such as green hydrogen, not established sectors such as EVs.

At the same time, the authors make a few caveats and suggestions of intervention. Wind power is one area China appears to be dominating despite the distance effect, and it might be worth using subsidies to avoid strategic dependence — similar to the way that EU handouts to Airbus and US to Boeing promoted competition. Another, rather more contentious, is taking some kind of reciprocal action where a market such as Chinese EVs is closed to European exports.

I’d flag another big issue, which I’ve written about before. EVs in particular are likely to be one of the first big consumer goods where a substantial amount of European-based production is owned by Chinese companies. (Note all that courting of Chinese investment into EV battery plants.) Is it really going to be plain sailing economically or politically if much of the intellectual property and profits for European EV production are retained by Chinese companies? I suspect not, but it might well take the mother of all battles over foreign direct investment, perhaps using the EU’s new foreign subsidy regulation, to stop them.

Britain: existing strengths, new weaknesses

Britain’s Rishi Sunak was in the US last week doing the traditional UK prime minister thing of signing a declaration with the word “Atlantic” in it (here’s the previous one, featuring some character called Boris Johnson) including a critical minerals agreement, which will give British companies access to certain tax credits under the IRA.

You can read opposing views here and here about whether this visit underlined Britain’s economic weakness after Brexit or showcased its geopolitical freedom outside the EU.

The first, pessimistic view is fairly obviously right as far as trade and regulation go. Sunak has announced the UK will in the autumn be hosting a global summit on regulating artificial intelligence, but Washington and Brussels are already discussing AI rules in their bilateral Trade and Technology Council without consulting London. The UK has failed to create its own similar bilateral council with the US.

However, I think the second point about geopolitics is also often true — except that Brexit is basically irrelevant. Support for Ukraine, the Aukus deal, Five Eyes intelligence-sharing: Biden’s declaration of geopolitical comity with the UK isn’t just pleasantry. But British military and foreign policy independence and alignment with the US existed well before Brexit — both for good (supporting Ukraine’s military after Russian president Vladimir Putin’s 2014 annexation of Crimea) and ill (joining in the 2003 invasion of Iraq). The EU’s national security and military capability still isn’t yet developed enough to make it a serious constraint on its member states, so leaving it made little difference.

More generally, although le tout monde (including me) is banging on about trade being all about geopolitics these days, the connections are still often weak.

For example: the EU may be regarded in Washington as a relatively unreliable US ally over Ukraine. But it’s clearly America’s friend for the purposes of the likes of IRA tax credits, which it’s getting faster than the UK. Simple commercial interest dictates the US doesn’t unnecessarily annoy one of its biggest trading partners.

Similarly, the Biden administration’s foreign policy alignment with Britain — now that the Northern Ireland issue is somewhat sorted — isn’t going to get Sunak the preferential trade deal he’s stopped even bothering to ask for, because PTAs are toxic in Washington at the moment. Brexit hasn’t enhanced the UK’s foreign policy influence with the US or elsewhere, but nor has it entirely destroyed it.

Charted waters

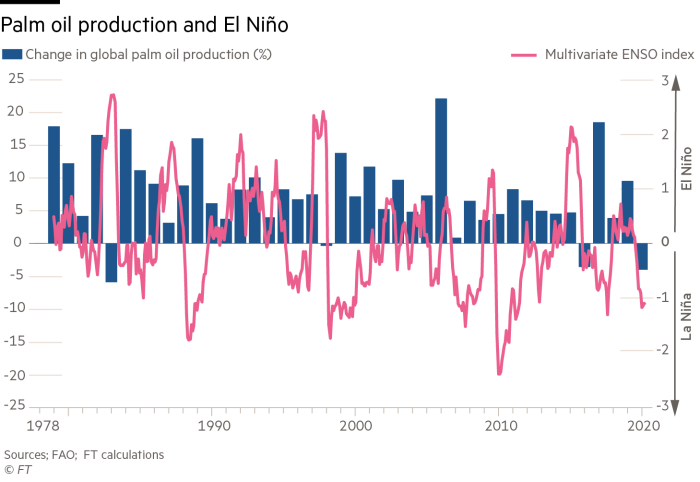

The cost of living crisis has been blamed on many factors, not least Russia’s invasion of Ukraine and the supply chain snarl-ups post Covid-19. Another factor has been the shifting Pacific currents of El Niño, marked by higher southern temperatures, droughts and gyrations in agricultural commodity prices as a recent Lex note explains.

Vegetable oil prices are most affected by El Niños, a 2016 study from Sydney university found. Data from Refinitiv shows commodity prices peaking a year after El Niño. Palm oil prices are most highly correlated (see the chart below), largely owing to drought conditions in Indonesia and Malaysia.

Other commodities have also been affected. Orange juice prices are already near record highs in part due to cold weather and hurricanes. Sugar prices are soaring because of elevated rainfall levels in India. Any good news? Well, the current La Niña period is fading. But if the next one is bad, as some weather prophets are forecasting, emerging markets on the equator will be hit hard. (Jonathan Moules)

Trade links

The South China Morning Post describes how the European Commission’s ambitious plans for “de-risking” its trade with China are encountering opposition from member states. I’m not saying I told you so. I’m not, I’m not.

The Wall Street Journal says Brazil’s attempts to reverse deindustrialisation (see here for how Lula is trying to court Chinese manufacturing investment) aren’t working, not least because its protectionist moves to protect local industry have had the opposite effect. (Incredible, I know).

Namibia is the latest country to try to force more of the supply chain for processing raw materials in-country, in its case by banning the export of unprocessed critical minerals including rare earths and lithium.

The Turkish lira fell rapidly last week following Recep Tayyip Erdoğan’s re-election as president. His new economic team (the FT’s profile of the central bank governor is here) have apparently stopped trying to defend it, amid talk of a more orthodox monetary policy.

Trade Secrets is edited by Jonathan Moules

Recommended newsletters for you

Swamp Notes — Expert insight on the intersection of money and power in US politics. Sign up here

Britain after Brexit — Keep up to date with the latest developments as the UK economy adjusts to life outside the EU. Sign up here